Economist, tax policy/inequality. Editor of @JPubEcon. Professional skeptic. Anti-illiberal.

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/RepThomasMassie/status/1857394368094597519Tariffs are inefficient taxes. They distort trade and make you lose gains from comparative advantage. They distort production because they are to the large extent taxes on intermediate inputs. They have narrow base so require high tax rates to raise meaningful revenue

https://twitter.com/wwwojtekk/status/1637288818393989121The raw wage gap (no controls) is a mix of preferences, choices, market conditions, and - potentially - discrimination. You can "eliminate" almost all of it by controlling for individual and job characteristics /2

https://twitter.com/BrankoMilan/status/1628067431645159425

Let me be the first one to say that the end of communism has massively increased prosperity. Also, not bad times for peace

Let me be the first one to say that the end of communism has massively increased prosperity. Also, not bad times for peace

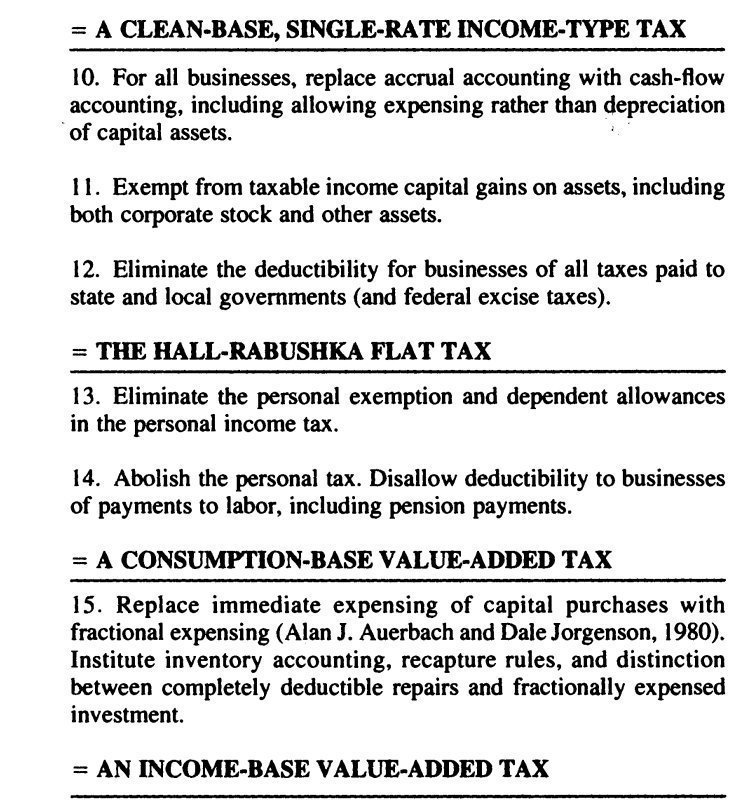

The rest of the table 👇. Any time I look at it, it seems crazier than what I remembered

The rest of the table 👇. Any time I look at it, it seems crazier than what I remembered

https://twitter.com/marcobreso/status/1501201298762485761

The mayor of Przemyśl offered that Salvini can join him to visit the refugees as long as he is wearing that t-shirt.

The mayor of Przemyśl offered that Salvini can join him to visit the refugees as long as he is wearing that t-shirt.

I'll add that, once you include Ukraine, "Eastern Europe" is about same number of people as Russia and higher gdp

I'll add that, once you include Ukraine, "Eastern Europe" is about same number of people as Russia and higher gdp

https://twitter.com/wwwojtekk/status/1499486566582001673So, when Putin objected to Ukrainian association agreement with the EU, he really objected to Ukrainian development.

https://twitter.com/decustecu/status/1499199987401564163?t=aJEXHm0FvqiHkgBMfqyxJw&s=19You'll note that he is unwavering in his commitment to ignore the right of Ukrainians to live in a liberal democracy

https://twitter.com/weaseljug/status/1490513777900638209

https://twitter.com/FloridaFloGrown/status/1492118459362197504

Yes, base rates for kids are still low but they are growing (and driven by unvaccinated places).

Yes, base rates for kids are still low but they are growing (and driven by unvaccinated places). https://twitter.com/FT__Dan/status/1387531815464751108It could be coincidence - around the same time everyone was becoming eligible so the run up and the decline could be related to that. Maybe supply, but J&J was fairly small anyway.

https://twitter.com/SecretaryPete/status/1384291175851384840Talk about corporate welfare

https://twitter.com/wwwojtekk/status/11895473998506598401/29 Let’s start with (national) income identity:

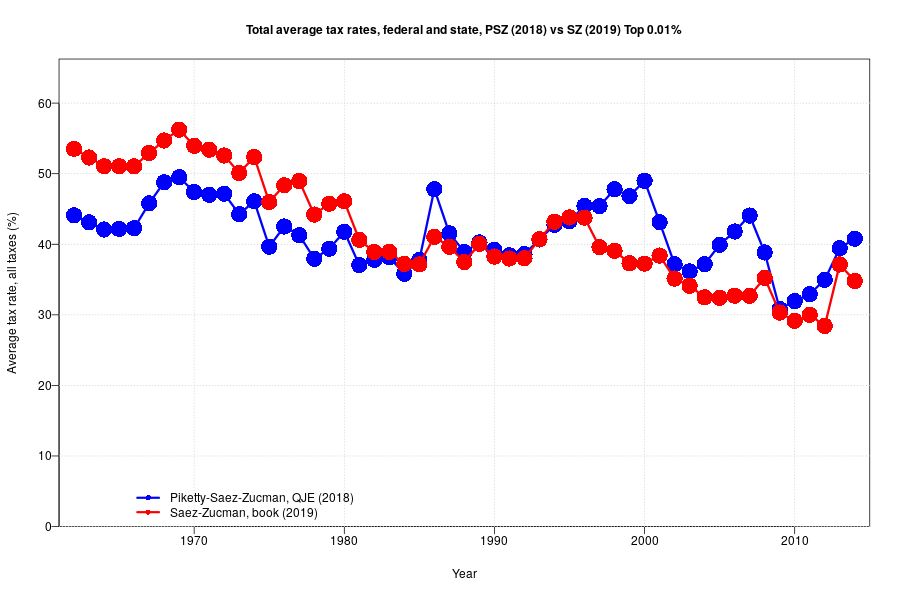

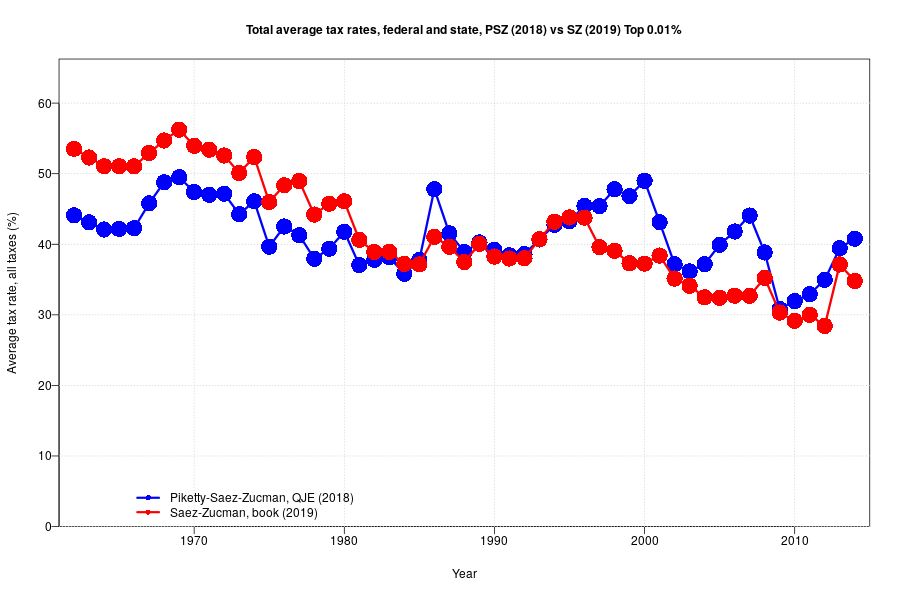

Just to make sure it is not missed: these are very different patterns. Between 1962 and 2014, the QJE series shows 3.3pp drop. The book one shows 18.7pp drop. Volatility differs to.

Just to make sure it is not missed: these are very different patterns. Between 1962 and 2014, the QJE series shows 3.3pp drop. The book one shows 18.7pp drop. Volatility differs to.

https://twitter.com/wwwojtekk/status/1182769865683279872

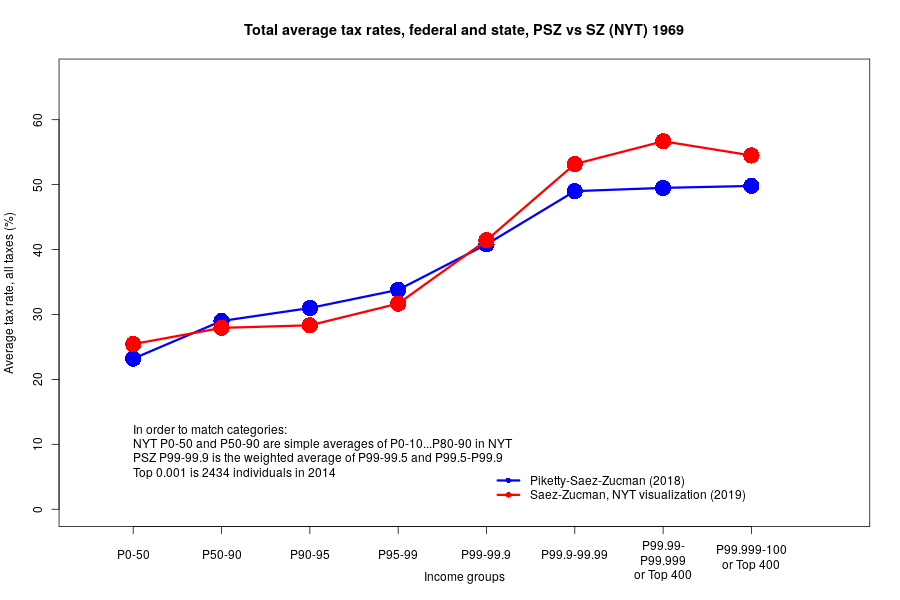

https://twitter.com/wwwojtekk/status/1182695438077562881To illustrate - compare 1969, 1984, 1999, 2014