How to get URL link on X (Twitter) App

source: web.archive.org/web/2013030406…

source: web.archive.org/web/2013030406…

https://twitter.com/zerohedge/status/1852816738372473305

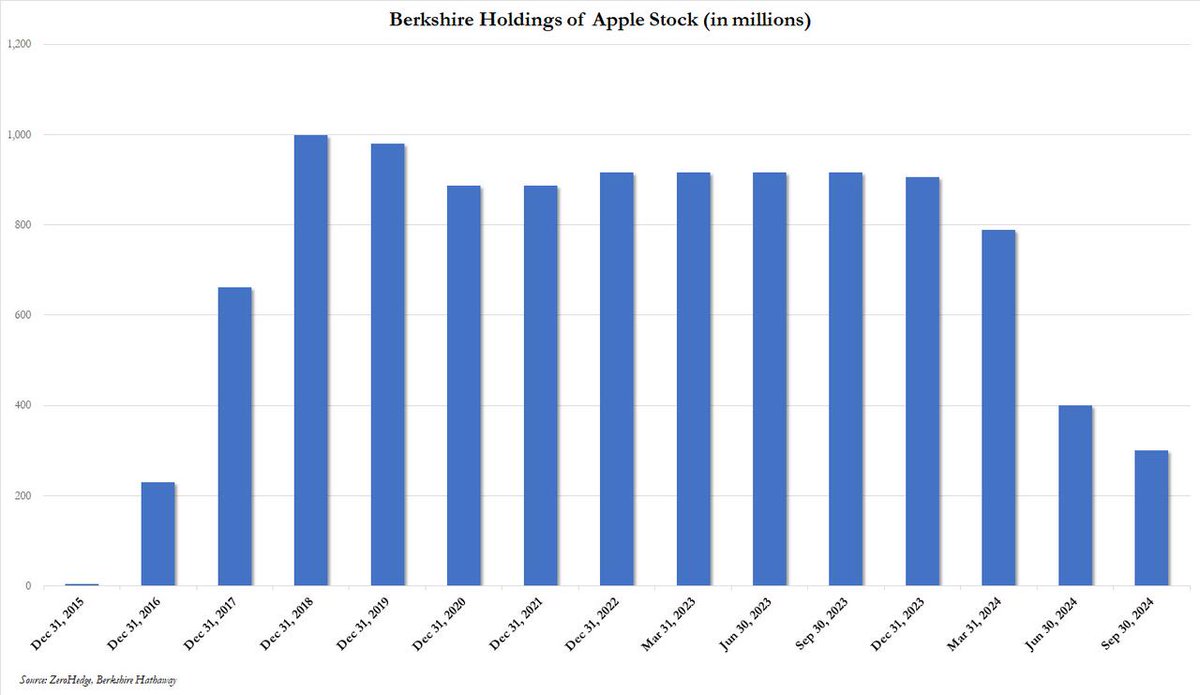

... after selling another 25% of his AAPL stake (100 million shares) in Q3, taking his AAPL shares down from 900 million shares at the start of the year to just 300 million.

... after selling another 25% of his AAPL stake (100 million shares) in Q3, taking his AAPL shares down from 900 million shares at the start of the year to just 300 million.

https://twitter.com/mcuban/status/1839457365994918171First, while the violent crime rate did fluctuate under Trump, it ended 2020 - the year BLM riots sparked calls to defund the police - at 16.4%, the lowest on record. This was unchanged during Biden's first year, then jumped to a 10 year high and pulled back slightly in 2023.

Small banks account for 70% of total CRE loans

Small banks account for 70% of total CRE loans

Other banks, mostly small regional banks, have seen their reserve exposure slide thanks to QT, and are increasingly reliant on depositors for funding. 88% of SIVB's total liabilities were deposits. Meanwhile, loan/deposit creation has collapsed due to imminent recession.

Other banks, mostly small regional banks, have seen their reserve exposure slide thanks to QT, and are increasingly reliant on depositors for funding. 88% of SIVB's total liabilities were deposits. Meanwhile, loan/deposit creation has collapsed due to imminent recession.