Writing about Business, Investments and Geography | Don't DM for sponsored tweets

2 subscribers

How to get URL link on X (Twitter) App

Tata Finance was established in 1984 (3 years before Bajaj Finance)

Tata Finance was established in 1984 (3 years before Bajaj Finance)

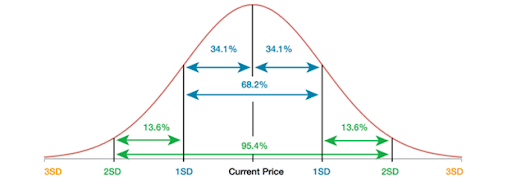

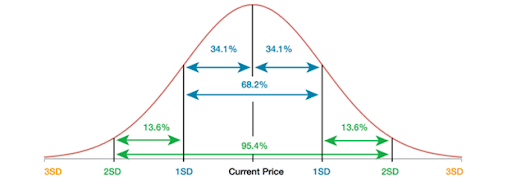

Bollinger Band comprises of 20 period moving average of the price in the middle

Bollinger Band comprises of 20 period moving average of the price in the middle

1959 - A Velumani was born in a very poor family in a small village in Tamil Nadu. The family barely managed to earn 50 Rs per week

1959 - A Velumani was born in a very poor family in a small village in Tamil Nadu. The family barely managed to earn 50 Rs per weekhttps://twitter.com/zhr_jafri/status/1287087120046202882?s=19

1981- Sandeep Engineer joined Cadila Pharma as a project engineer. His salary was around 850 Rs/month.

1981- Sandeep Engineer joined Cadila Pharma as a project engineer. His salary was around 850 Rs/month.

1999 - Nitish, a fresh commerce graduate started Nazara Technologies. Nazara started developing online games like Housie

1999 - Nitish, a fresh commerce graduate started Nazara Technologies. Nazara started developing online games like Housie

2014 - Sanil Jain and Siddharth Singh from NMIMS, Mumbai had an idea to use paper cups for advertising

2014 - Sanil Jain and Siddharth Singh from NMIMS, Mumbai had an idea to use paper cups for advertising

1972 - Ramjibhai Virani, a farmer in Gujarat was facing a tough time making ends meet through farming

1972 - Ramjibhai Virani, a farmer in Gujarat was facing a tough time making ends meet through farming

Jim Simmons was born in Massachusetts in 1938. With a strong interest in Maths, Simmons went to MIT for his bachelors and completed his PhD from UC Berkeley in 1961.

Jim Simmons was born in Massachusetts in 1938. With a strong interest in Maths, Simmons went to MIT for his bachelors and completed his PhD from UC Berkeley in 1961.

1956, UK - Morris Motors manufactured and sold 3 variants of Morris Oxford car

1956, UK - Morris Motors manufactured and sold 3 variants of Morris Oxford car