How to get URL link on X (Twitter) App

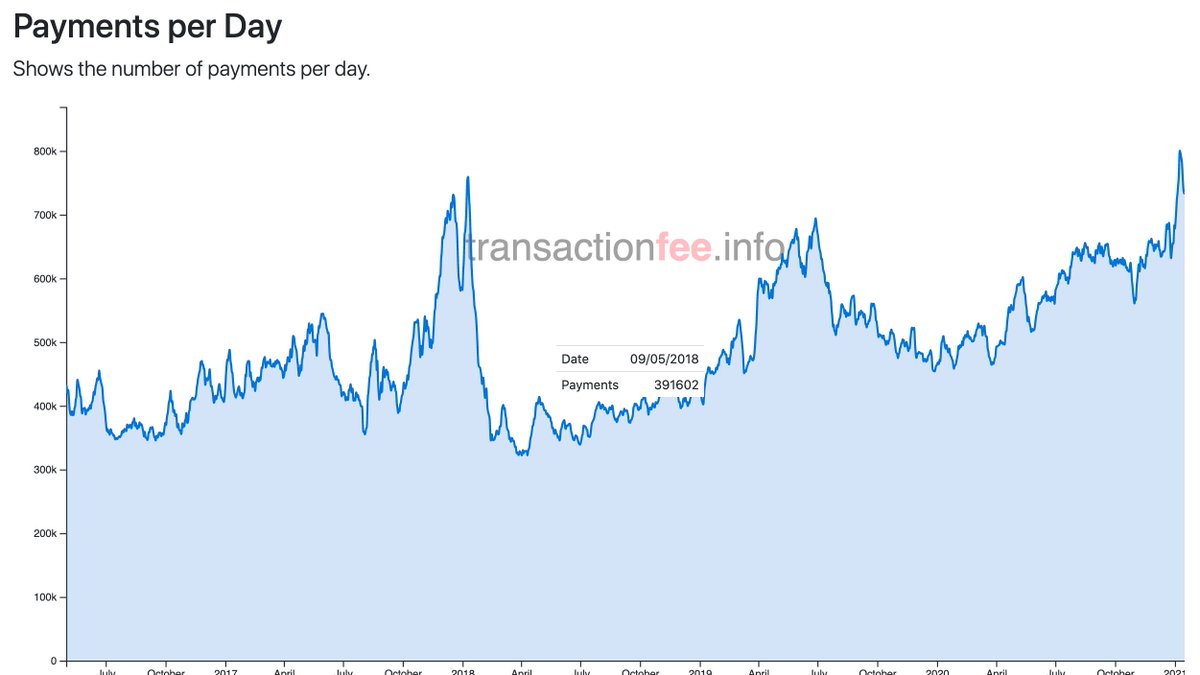

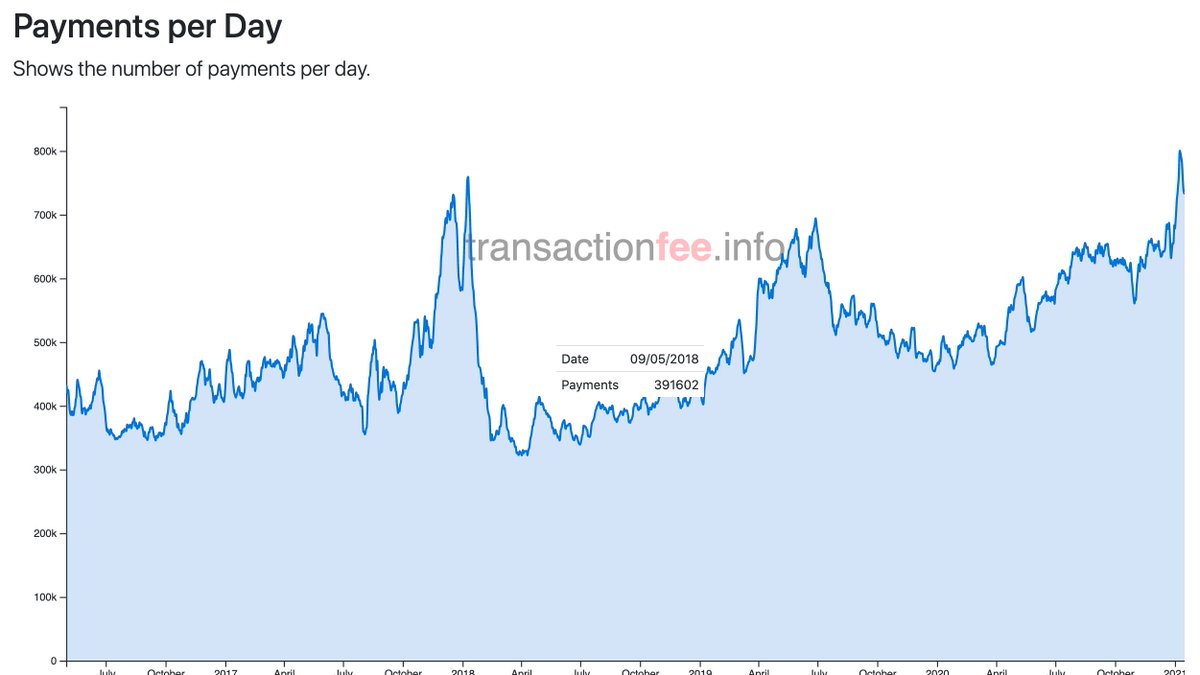

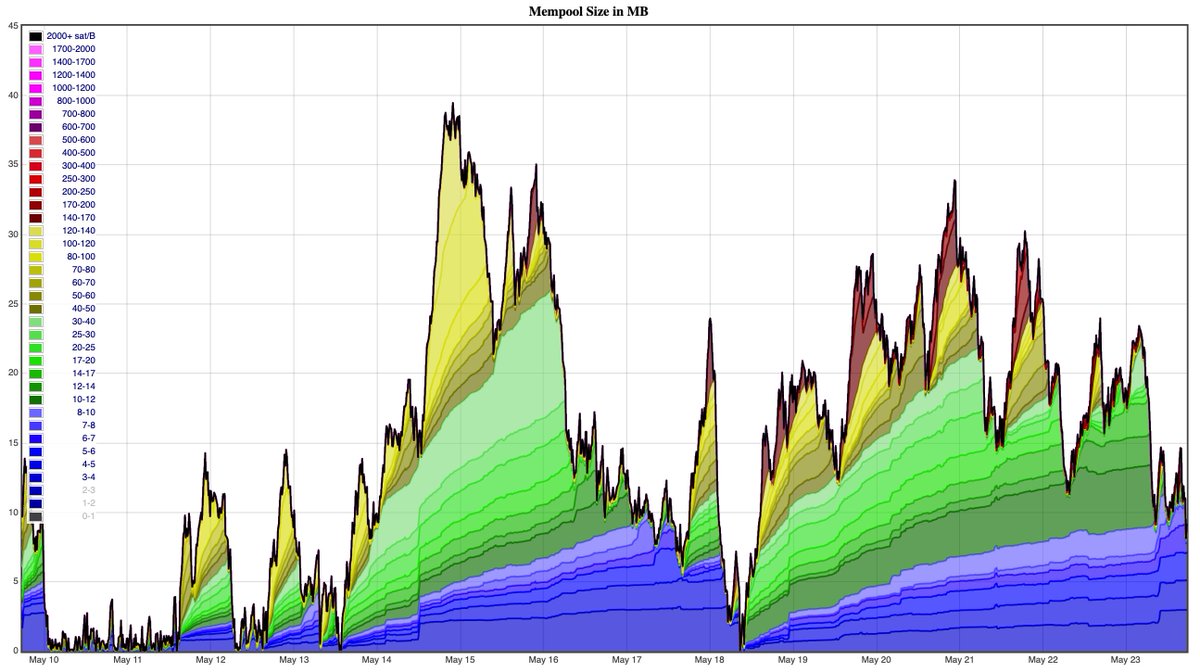

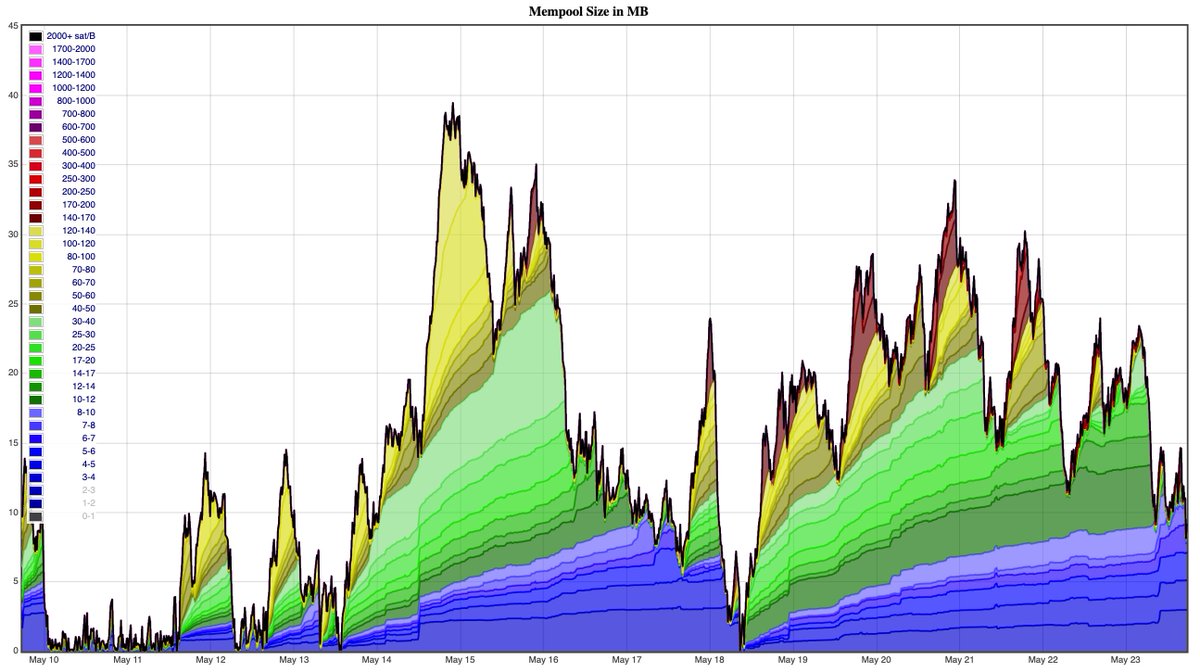

Given this, it's astonishing how well the mempool is holding up and and how comparatively low the transaction fees are.

Given this, it's astonishing how well the mempool is holding up and and how comparatively low the transaction fees are.

For context this is the equivalent thread from 1y ago,

For context this is the equivalent thread from 1y ago,https://twitter.com/ziggamon/status/1134490575925927936

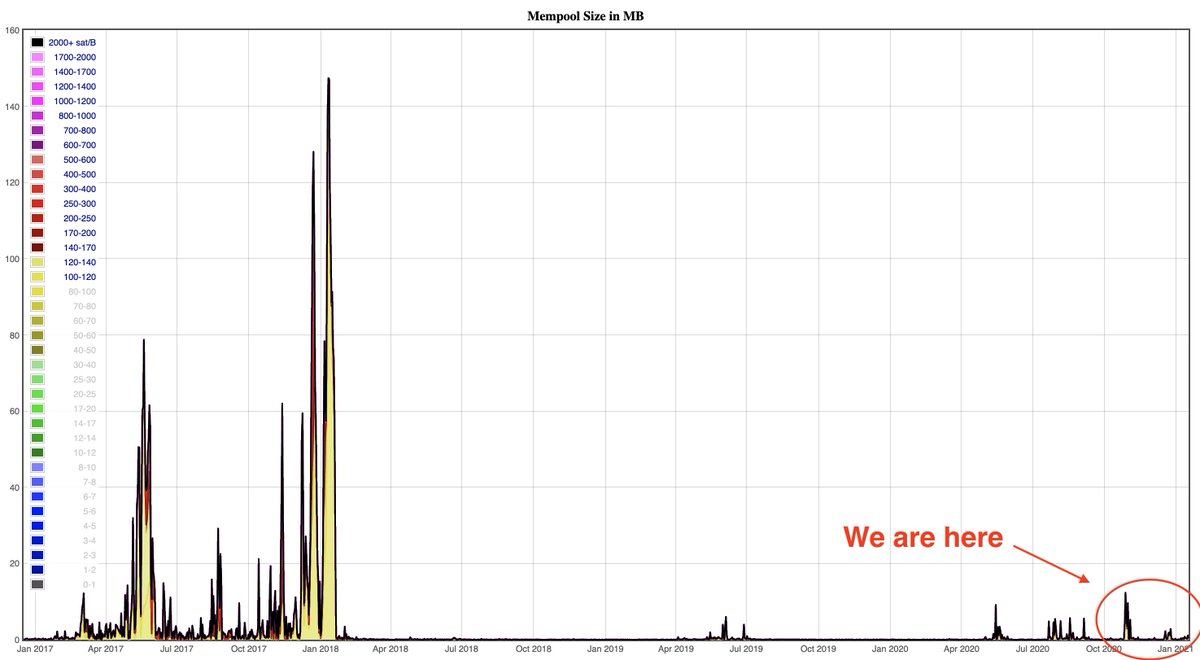

https://twitter.com/ziggamon/status/975067727785349121Now, it's important to keep in mind that this situation is NOWHERE near what we had in December 2017. Here's a zoomed out mempool (I adjusted min fees because in 2017 transactions were overflowing the mempools).