Building on the work of @drakefjustin, @ryanberckmans, @NorthRockLP, @0xHamz, and others, this thread attempts to provide a basic overview of $eth's economic model post merge.

TLDR:

- Fees are the most important driver of the model post merge;

- I estimate ~9% staking return at merge, trending to 5% longer-term; and

- Because $eth staking rewards are low, ETH can be deflationary even w/ low levels of fee activity.

- Fees are the most important driver of the model post merge;

- I estimate ~9% staking return at merge, trending to 5% longer-term; and

- Because $eth staking rewards are low, ETH can be deflationary even w/ low levels of fee activity.

Ethereum's economics post merge will be driven by two factors:

(1) ETH token issuance to validators (aka stakers); and

(2) Fees generated by the Ethereum network.

(1) ETH token issuance to validators (aka stakers); and

(2) Fees generated by the Ethereum network.

Let's break down each piece.

(1) ETH token issuance to validators:

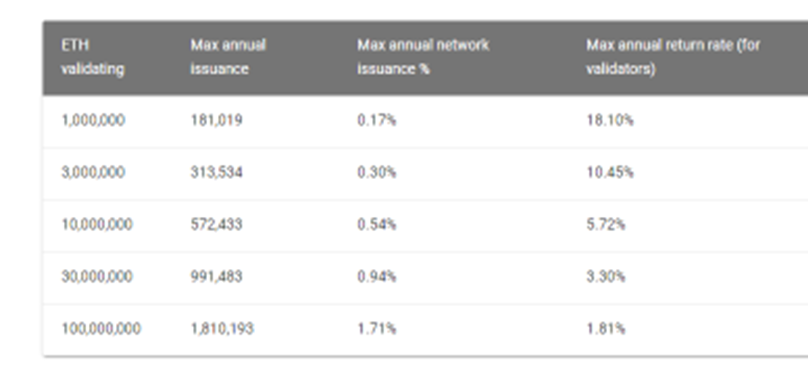

Ethereum will be issued to validators based on the following schedule, which can be found here: docs.ethhub.io/ethereum-roadm…

Ethereum will be issued to validators based on the following schedule, which can be found here: docs.ethhub.io/ethereum-roadm…

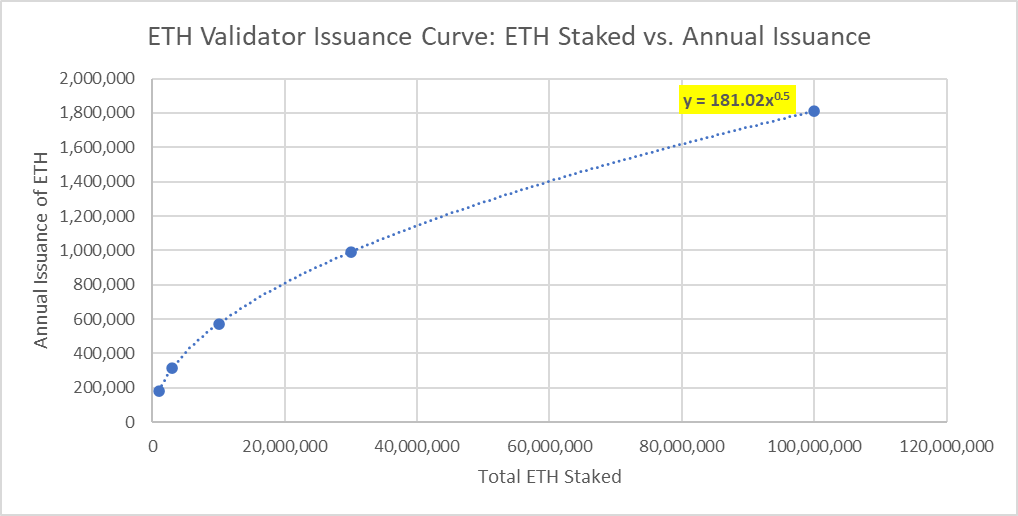

Using the issuance at these various points, we can create a formula to estimate issuance across various staking rates.

There are currently 13.4M $ETH staked.

Assuming 15M ETH staked by the merge, validators would be earning ~0.7M ETH annually from staking issuance.

There are currently 13.4M $ETH staked.

Assuming 15M ETH staked by the merge, validators would be earning ~0.7M ETH annually from staking issuance.

Note that $ETH issued to validators increases but at a *decreasing* rate.

Said another way the $ETH issuance per validator is diluted the more Ethereum is staked to the network.

Said another way every incremental staker is less incentivized to stake before considering fees.

Said another way the $ETH issuance per validator is diluted the more Ethereum is staked to the network.

Said another way every incremental staker is less incentivized to stake before considering fees.

(2) Fees generated by the Ethereum network:

Thanks to EIP 1559, only ~30% of fees generated by the chain go to validators.

The remaining ~70% are burned, i.e. taken out of circulation forever.

Thanks to EIP 1559, only ~30% of fees generated by the chain go to validators.

The remaining ~70% are burned, i.e. taken out of circulation forever.

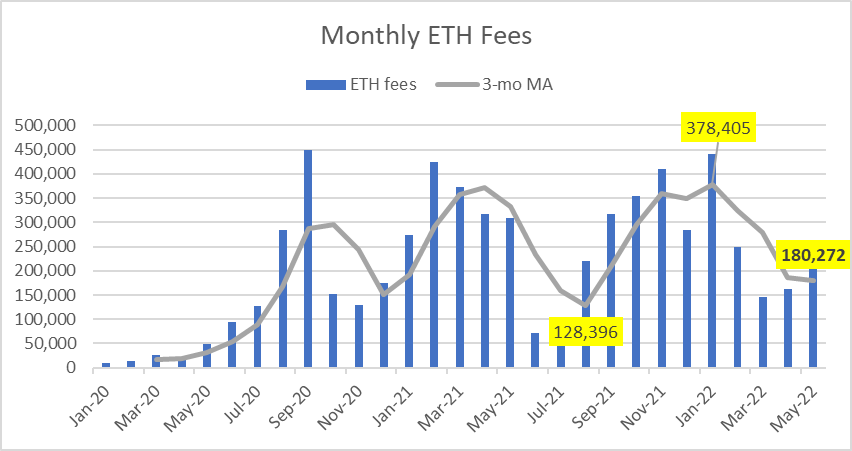

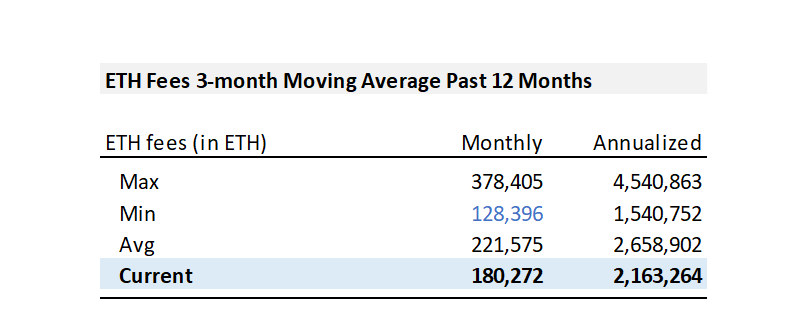

Using @glassnode data, we can see the fees in ETH generated by the chain over the past year.

Over the past year based on the 3-month moving average, on a run-rate basis the Ethereum network maxed out at annual 4.5M annualized ETH fees in Fall'21 and troughed at 1.5M in Summer'21.

The network is currently run-rating at roughly 2.2M $ETH in annualized fees.

The network is currently run-rating at roughly 2.2M $ETH in annualized fees.

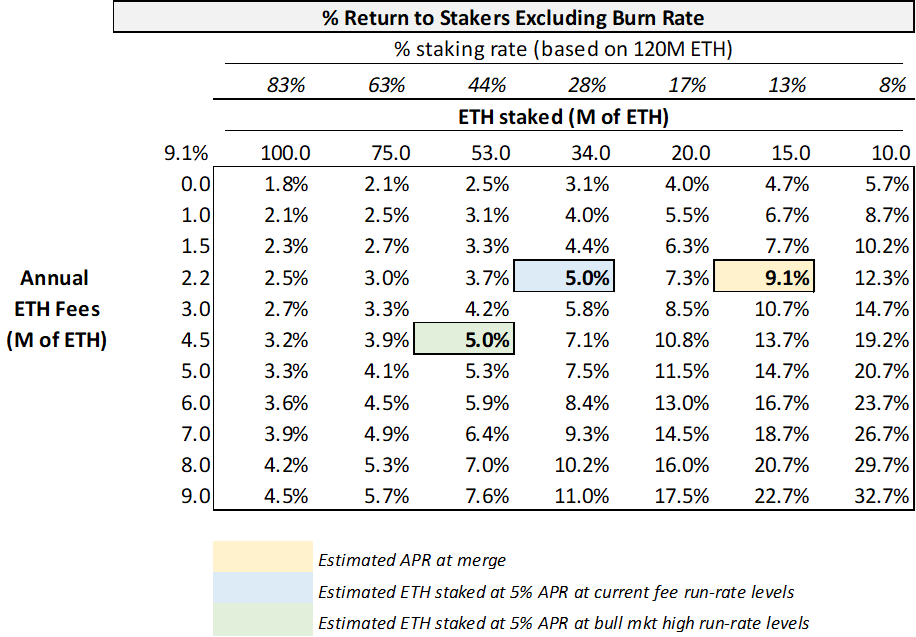

Putting (1) + (2) together:

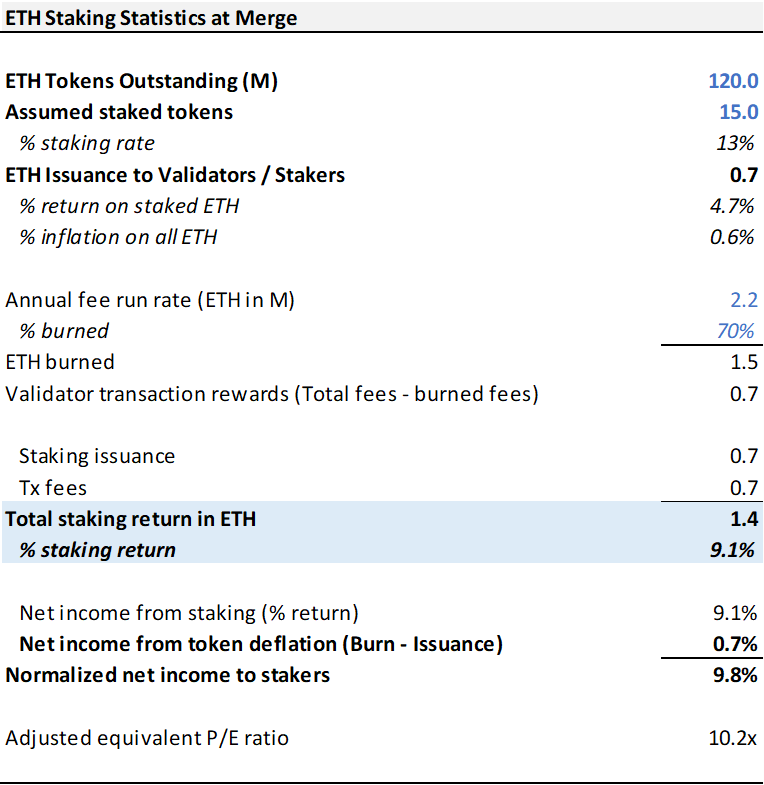

Assuming (1) 15M ETH staked at the merge & (2) the current 2.2M ETH fee run-rate, my math suggests:

- Stakers would be earning a ~9% return at the merge; and

- ETH would be roughly 0.7% deflationary (1.5M ETH burned vs. 0.7M ETH issued to validators).

Assuming (1) 15M ETH staked at the merge & (2) the current 2.2M ETH fee run-rate, my math suggests:

- Stakers would be earning a ~9% return at the merge; and

- ETH would be roughly 0.7% deflationary (1.5M ETH burned vs. 0.7M ETH issued to validators).

Other interesting observations:

- Including the burn rate in the return to stakers, the "real" return to staking is closer to 10% at merge.

- Implied P/E at merge is 10x for stakers, a multiple many would consider extremely cheap (hat tip to @NorthRockLP for the framework).

- Including the burn rate in the return to stakers, the "real" return to staking is closer to 10% at merge.

- Implied P/E at merge is 10x for stakers, a multiple many would consider extremely cheap (hat tip to @NorthRockLP for the framework).

Note: Unlike @0xHamz, I believe staked $eth vs. unstaked $eth should NOT be considered equal.

$eth stakers are putting their capital at risk to secure the network and taking on significant opportunity cost.

This is different than common equities which share equal risk and equal economic claims to a business.

This is different than common equities which share equal risk and equal economic claims to a business.

Therefore the staking return should be considered vs. STAKED $eth as opposed to ALL of $eth.

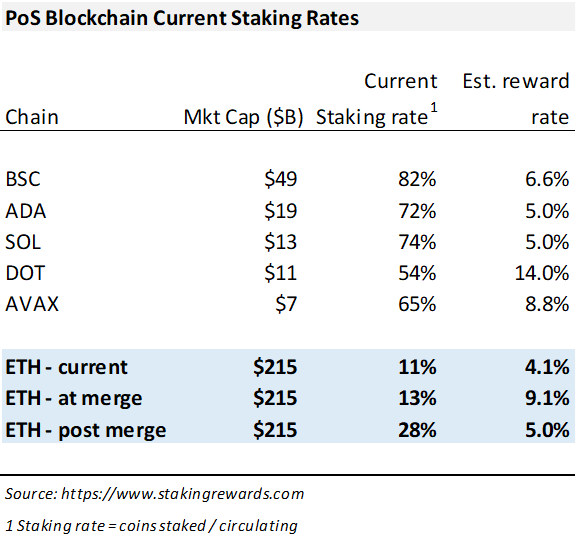

Once we're past the merge, ETH's staking rate is likely to go up so its reward rate matches other PoS chains.

At current levels of fee activity and assuming a 5% reward rate inline w/ $ADA and $SOL, I estimate @ethereum's staking rate would shake out to around 28% over time.

At current levels of fee activity and assuming a 5% reward rate inline w/ $ADA and $SOL, I estimate @ethereum's staking rate would shake out to around 28% over time.

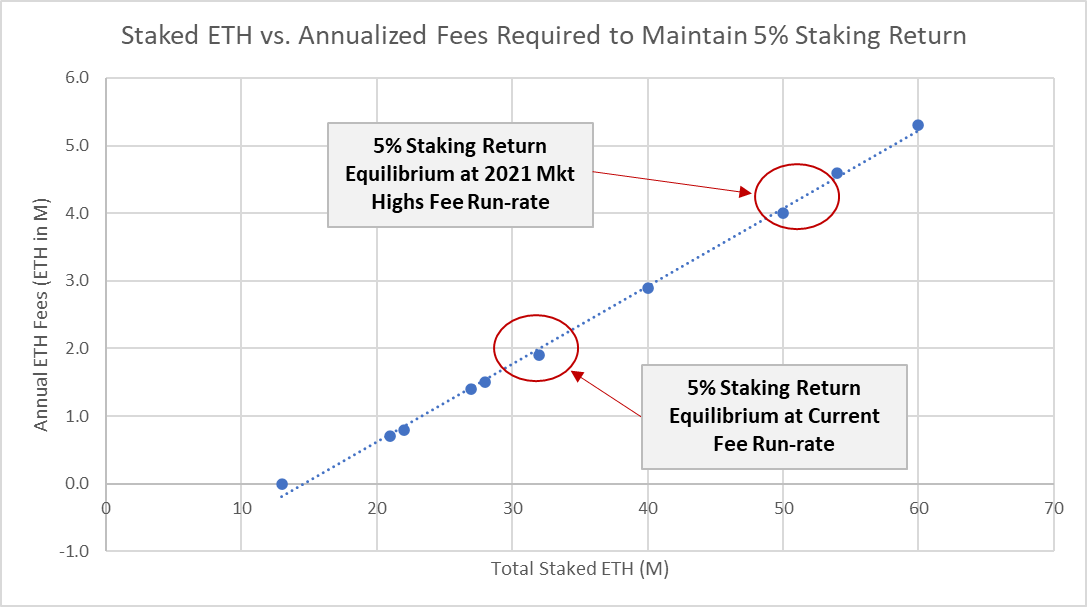

Because ETH's staking return is a two variable function - staking rate + fees, to get a sense of how ETH's staking rate may vary over time, we can assume a 5% staking return at various fee levels.

At current run-rate fee levels, I estimate ETH staked would trend towards the mid 30 millions of ETH.

At 2021 bull-market high run-rate fee levels, I estimate ETH staked would trends towards low 50 millions of ETH.

At 2021 bull-market high run-rate fee levels, I estimate ETH staked would trends towards low 50 millions of ETH.

Assuming the mkt requires higher staking returns like say 8%, the % of ETH staked will turn out to be lower than my estimates unless the fees generated by the chain are higher than current levels.

Another cool thing worth noting about ETH post merge:

Because issuance is so low, (i.e. 1M ETH issued for 30M ETH staked, or 0.8% inflation rate), @ethereum can be deflationary even at low levels of onchain activity.

Because issuance is so low, (i.e. 1M ETH issued for 30M ETH staked, or 0.8% inflation rate), @ethereum can be deflationary even at low levels of onchain activity.

I est. ETH would be slightly deflationary even at '21 bear market lows of fee activity (1.5M annualized) and 34M ETH staked (vs. 13.4M staked currently).

OTOH, if fee activity returns to bull market levels & then some, ETH would be >1% deflationary even w/ high staking rates.

OTOH, if fee activity returns to bull market levels & then some, ETH would be >1% deflationary even w/ high staking rates.

If you made it this far, firstly: congrats!, and secondly drop a like and retweet the first tweet (linked below).

aloha \m/ 🏄

aloha \m/ 🏄

https://twitter.com/808_Investor/status/1532874022215733248?s=20&t=Tv-2HlsP0hq71spflKWkXQ

.@antiprosynth @sassal0x @Tetranode @tztokchad @spencernoon @pythianism @cburniske @cdixon @VitalikButerin @SquishChaos @RyanSAdams @TrustlessState

• • •

Missing some Tweet in this thread? You can try to

force a refresh