Interested in using @synthetix_io?

Want to avoid liquidations whilst collecting max $SNX yield?

Here’s a comprehensive guide to risk management on the @synthetix_io platform, and why a “death spiral” scenario is EXTREMELY unlikely🧵👇

Want to avoid liquidations whilst collecting max $SNX yield?

Here’s a comprehensive guide to risk management on the @synthetix_io platform, and why a “death spiral” scenario is EXTREMELY unlikely🧵👇

As we know, users can stake their $SNX tokens and mint Synths (synthetic assets) against their $SNX with a minimum c-ratio of 400%, receiving synth trading fees in $sUSD + 12 mo escrowed $SNX rewards.

(Min c-ratio constantly changing based on mkt conditions)

(Min c-ratio constantly changing based on mkt conditions)

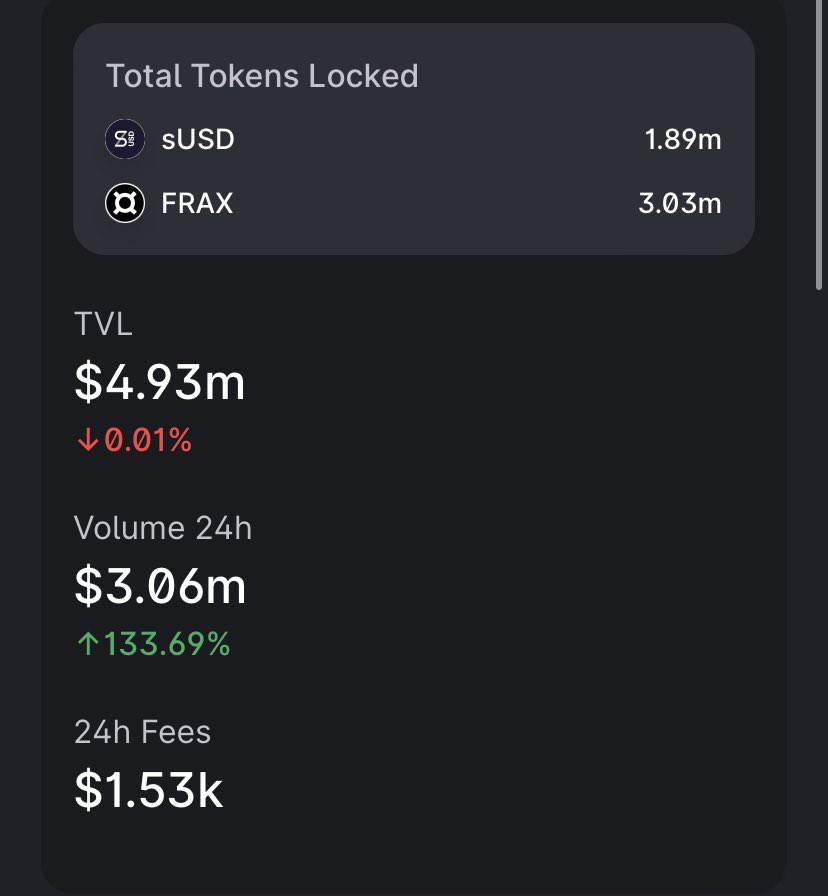

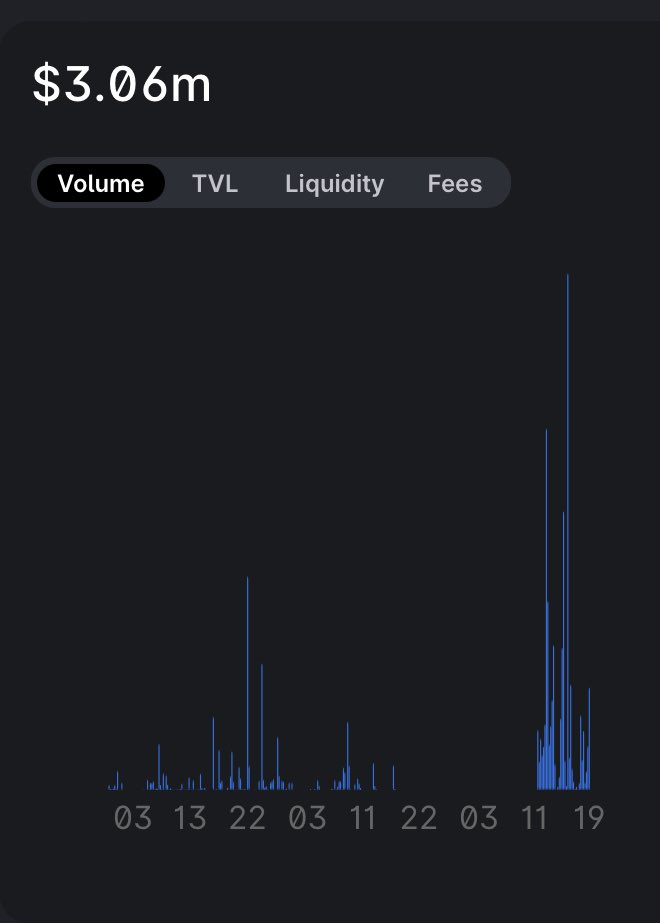

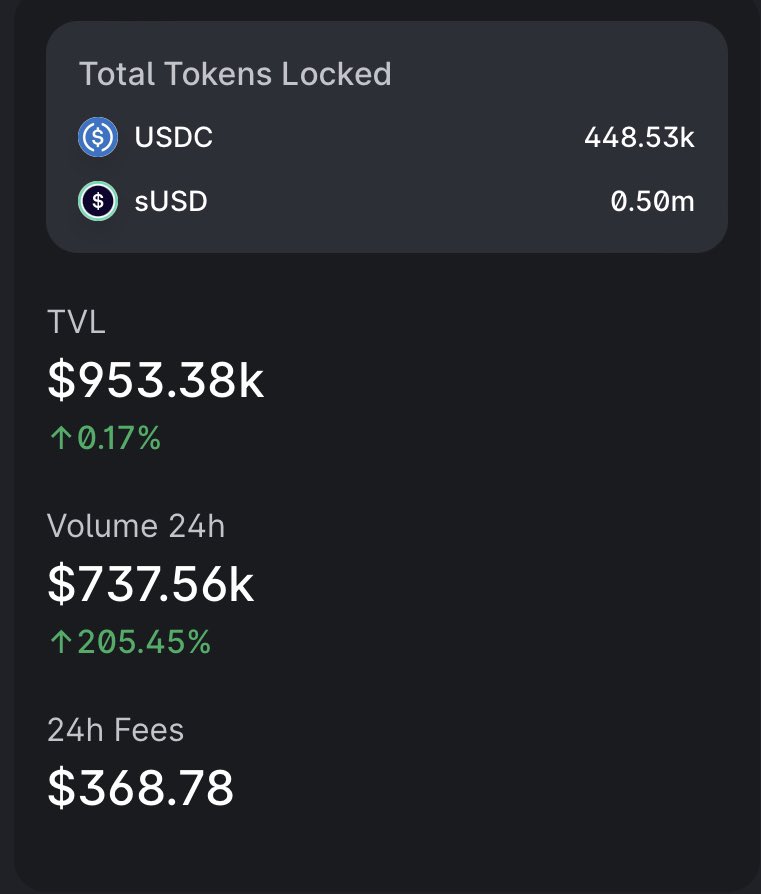

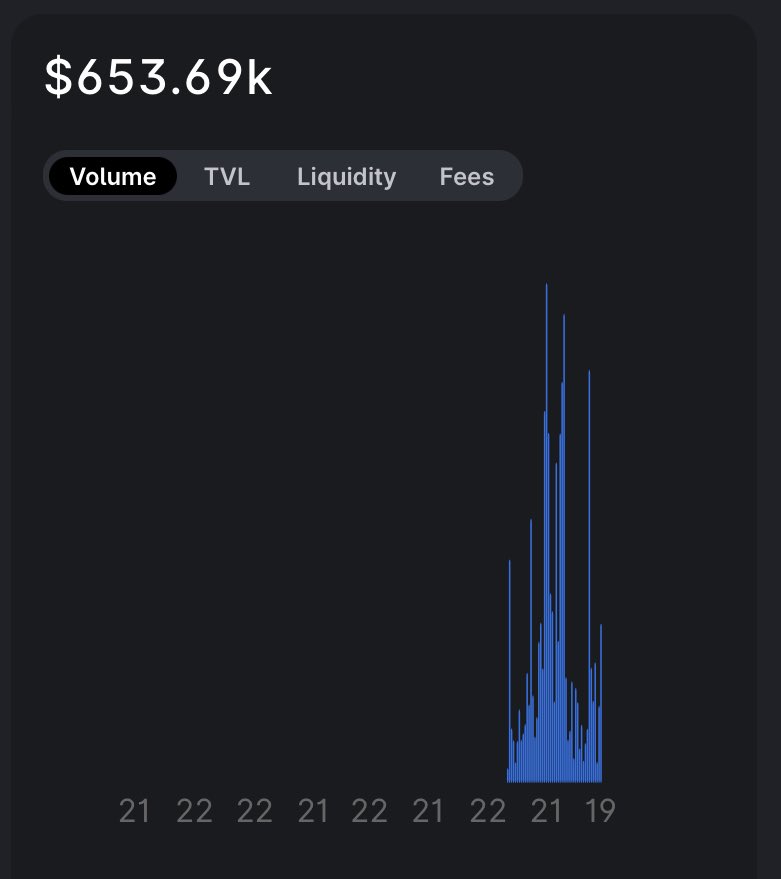

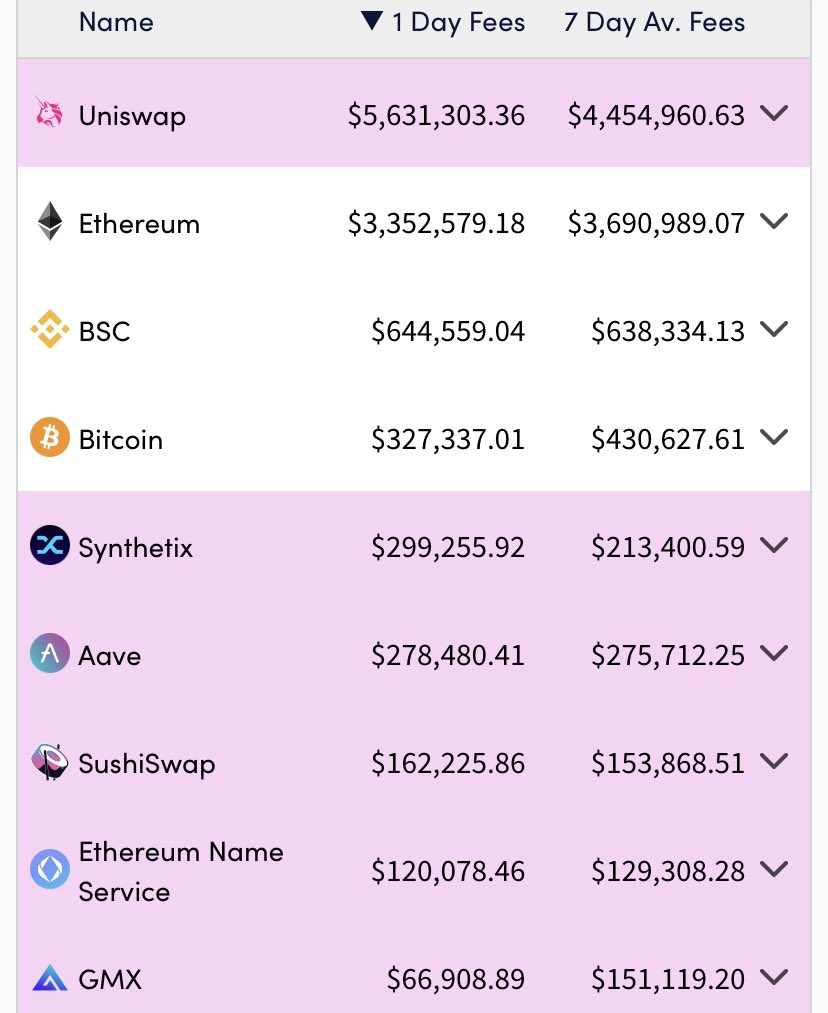

Synths can be used on @kwenta_io for perps, @lyrafinance for options, LPing on Curve, Uniswap Velodrome etc, allowing EXTREMELY low slippage swaps (utilized in swap aggregators like @1inch->juicy $sUSD fee revenue back to $SNX stakers!)

synthetix.io/synths

synthetix.io/synths

“But ser, what happens when $SNX price drops (or debt pool value increases), causing Synth minters’ c-ratio to drop below 400%?”

Simple.

Users will no longer be able to claim $SNX staking rewards UNTIL they either top up $SNX collateral or burn Synth debt back to 400%+ c-ratio

Simple.

Users will no longer be able to claim $SNX staking rewards UNTIL they either top up $SNX collateral or burn Synth debt back to 400%+ c-ratio

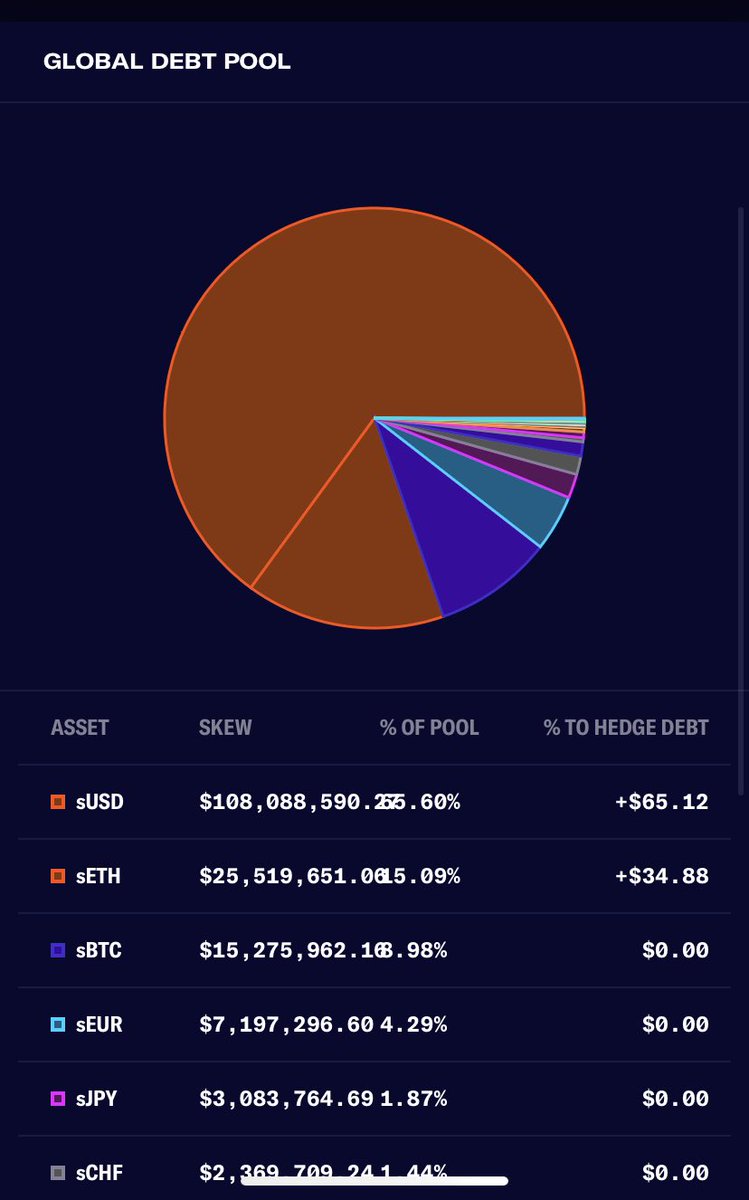

Now, the c-ratio % is given based on the TOTAL debt pool ratio between ALL Synths (not just personal debt)…

For example, let’s say I mint $1000 worth of $sETH and you mint 1000 $sUSD, each with $5000 worth of $SNX staked collateral (500% c-ratio)

For example, let’s say I mint $1000 worth of $sETH and you mint 1000 $sUSD, each with $5000 worth of $SNX staked collateral (500% c-ratio)

Currently, we each own 50% of the debt pool=500% c-ratio.

However, let’s say $sETH price jumps 50% (whilst $sUSD price obviously stays constant)…

Now, the value of my debt=1500$, while yours=1000$

However, let’s say $sETH price jumps 50% (whilst $sUSD price obviously stays constant)…

Now, the value of my debt=1500$, while yours=1000$

Given total debt is based on the debt pool ratio, this equals 1250$ of owed debt per person,(1500+1000=2500/2->1250$) leaving me with a 250$ net profit +you with a 250$ net loss

(If $SNX price stayed constant, our c ratios would now be 400%)

(If $SNX price stayed constant, our c ratios would now be 400%)

Don’t want to worry about this?

Users can effectively hedge against the debt pool on @dHedgeOrg to mitigate risk! (On L2s as well👀)

(Note: this is automatically provided on the Synthetix debt frontend. For backend details, check this👇)

app.dhedge.org/pool/0x59babc1…

Users can effectively hedge against the debt pool on @dHedgeOrg to mitigate risk! (On L2s as well👀)

(Note: this is automatically provided on the Synthetix debt frontend. For backend details, check this👇)

app.dhedge.org/pool/0x59babc1…

Let’s say the Synth minter doesn’t fix his <400% c-ratio, and it goes below 145%.

The minter will be flagged for liquidation, giving them 12 hours to raise their c-ratio all the way back to 400%+…

(+higher staking rewards for everyone else if <400%)

The minter will be flagged for liquidation, giving them 12 hours to raise their c-ratio all the way back to 400%+…

(+higher staking rewards for everyone else if <400%)

The minter has 3 options…

a. Top up $SNX collateral or burn Synths back to 400%+ c-ratio

b. Self liquidate->20% staked $SNX liquidation penalty

c. Does nothing->30% staked $SNX liquidation penalty

a. Top up $SNX collateral or burn Synths back to 400%+ c-ratio

b. Self liquidate->20% staked $SNX liquidation penalty

c. Does nothing->30% staked $SNX liquidation penalty

Where does this “penalty $SNX”+ synth debt go after liquidation?

You guessed it — proportionally back to $SNX stakers based on debt pool share!

($SNX is escrowed over 12 months. For example, $SNX stakers could receive 130$ of escrowed $SNX+100$ of extra synth debt)

You guessed it — proportionally back to $SNX stakers based on debt pool share!

($SNX is escrowed over 12 months. For example, $SNX stakers could receive 130$ of escrowed $SNX+100$ of extra synth debt)

So why exactly is this system so robust?

1. Violating synth minters cannot claim $SNX staking rewards well before liquidation (targeted around 85% APR in $SNX+sUSD).

If unclaimed by the end of the week, his share of rewards will go back into the pool for next week’s rewards.

1. Violating synth minters cannot claim $SNX staking rewards well before liquidation (targeted around 85% APR in $SNX+sUSD).

If unclaimed by the end of the week, his share of rewards will go back into the pool for next week’s rewards.

Because of this, the liquidation-flagged violator would have to be…

a. synth minter who simply forgot to top up, and will most likely self liquidate (20% fee)

b. someone nowhere to be found and/or trying to wreck the system, and will be liquidated by a 3rd party (30% fee)

a. synth minter who simply forgot to top up, and will most likely self liquidate (20% fee)

b. someone nowhere to be found and/or trying to wreck the system, and will be liquidated by a 3rd party (30% fee)

2. Other stakers are heavily incentivized to keep a healthy c-ratio due to substantial liquidation fees.

In addition, liquidators do NOT use their own funds to pay off debt (as we traditionally see, potentially resulting in earned collateral sold…

In addition, liquidators do NOT use their own funds to pay off debt (as we traditionally see, potentially resulting in earned collateral sold…

…->further price dump->c ratios ⬇️ ->more liquidations->repeat)

Rather, violator debt+ $SNX collateral+ 20-30% liquidation fee is proportionally distributed to $SNX stakers, whilst those who perform the liquidation are rewarded with a flat 20 $SNX reward! (2 $SNX on L2)

Rather, violator debt+ $SNX collateral+ 20-30% liquidation fee is proportionally distributed to $SNX stakers, whilst those who perform the liquidation are rewarded with a flat 20 $SNX reward! (2 $SNX on L2)

3. Large insolvent accounts that are unable (some synth debt liquidated on @kwenta_io, didn’t hedge against debt pool) or willing to burn debt/top up SNX collateral can simply self-liquidate any time below target c ratio if desirable and incur a smaller “net loss”

So what’s the potential “death spiral” doom scenario?

Well, since accounts are flagged 12 hrs before liquidation, it gives the violator extra time to top up and/or self-liquidate…

Well, since accounts are flagged 12 hrs before liquidation, it gives the violator extra time to top up and/or self-liquidate…

The $SNX price would have to drop 50-90% EXTREMELY quickly +small amount of self liquidations in order to cause multiple below 100% c-ratio liquidations, causing lots of bad debt to accrue to other stakers…

(Aka very unlikely :)

(Aka very unlikely :)

But that’s not all…

As synth swap utilization scales due to low slippage from atomic swaps on mainnet/L2 (more aggregator/amm swaps)->more sUSD trading fees back to SNX stakers->users incentivized to top up c ratio-> healthier system!

(Will write on Synth atomic swaps soon 👀)

As synth swap utilization scales due to low slippage from atomic swaps on mainnet/L2 (more aggregator/amm swaps)->more sUSD trading fees back to SNX stakers->users incentivized to top up c ratio-> healthier system!

(Will write on Synth atomic swaps soon 👀)

Thank you for reading.

Like and retweet!

Follow for daily DeFi threads

@BarryFried1

Comment below what I should cover next👇

Like and retweet!

Follow for daily DeFi threads

@BarryFried1

Comment below what I should cover next👇

https://twitter.com/BarryFried1/status/1549376455095865345

• • •

Missing some Tweet in this thread? You can try to

force a refresh