1/ What is #Chainlink Economics 2.0?

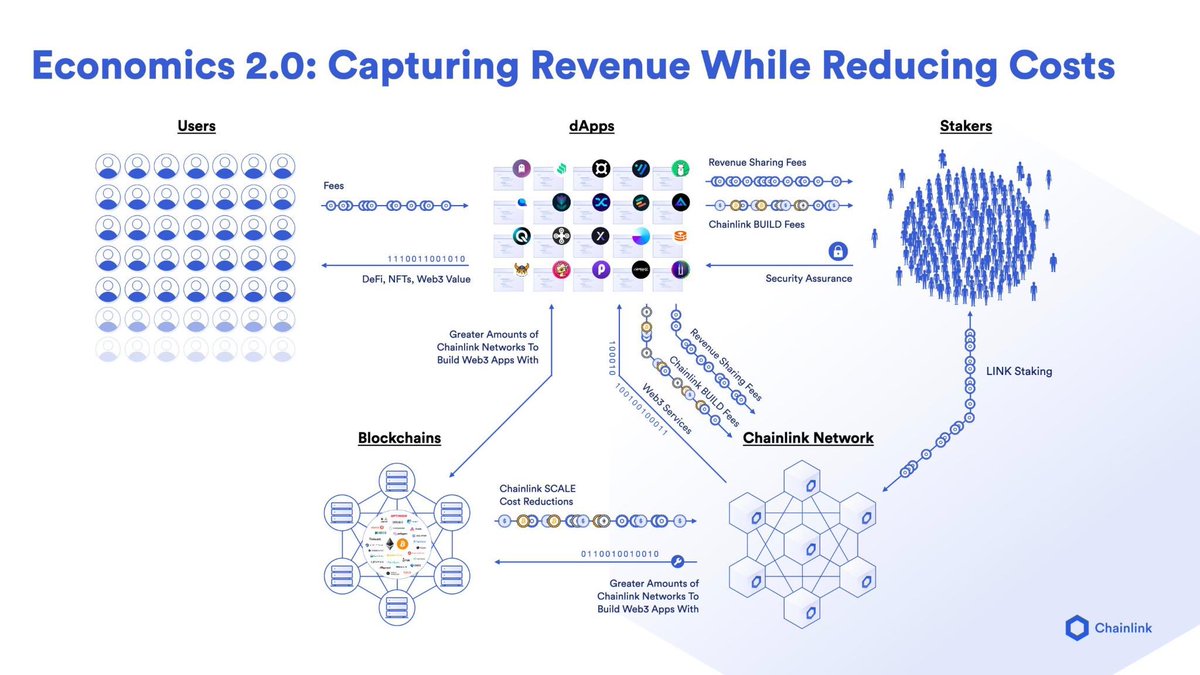

- Increasing network revenue

- Reducing operating costs

- Cryptoeconomic security via staking

In this 🧵 I’ll break down how $LINK is rapidly evolving to become a productive asset that captures real value

- Increasing network revenue

- Reducing operating costs

- Cryptoeconomic security via staking

In this 🧵 I’ll break down how $LINK is rapidly evolving to become a productive asset that captures real value

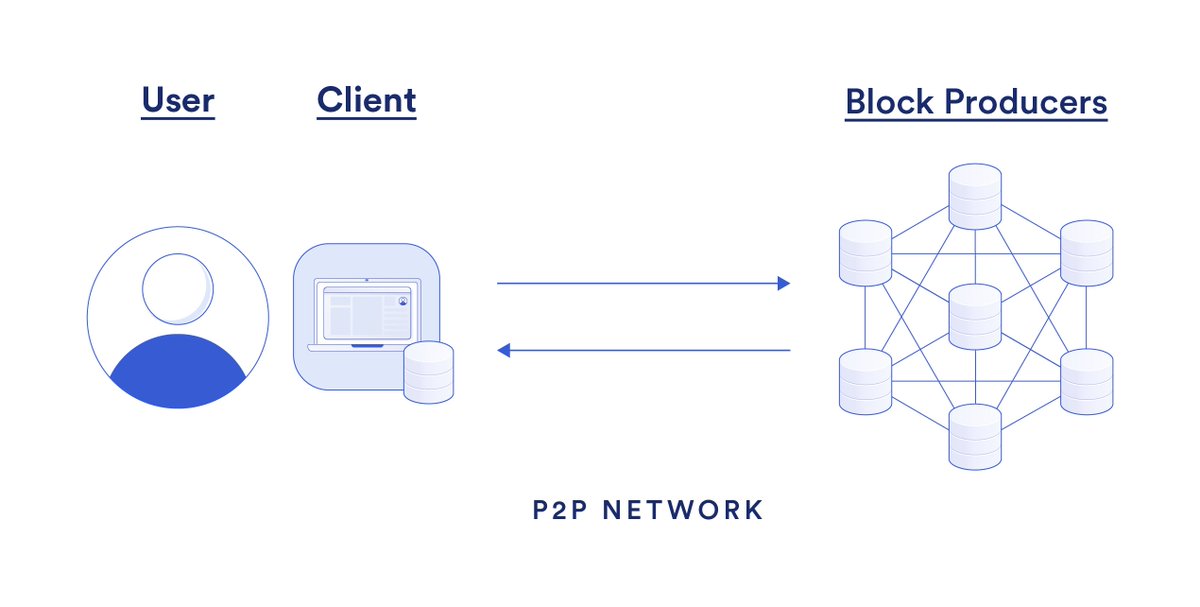

2/ The economics of a decentralized Web3 services platform like Chainlink is crucial

Not only for accelerating adoption but for ensuring the long term sustainability of the network where service providers are paid for their work

Not only for accelerating adoption but for ensuring the long term sustainability of the network where service providers are paid for their work

3/ That last part is important, this isn’t paying value to passive actors who contribute nothing

But rather enabling service providers to get paid for the value they provide

Oracle nodes :: computation

Data providers :: data provisioning

Stakers :: cryptoeconomic security

But rather enabling service providers to get paid for the value they provide

Oracle nodes :: computation

Data providers :: data provisioning

Stakers :: cryptoeconomic security

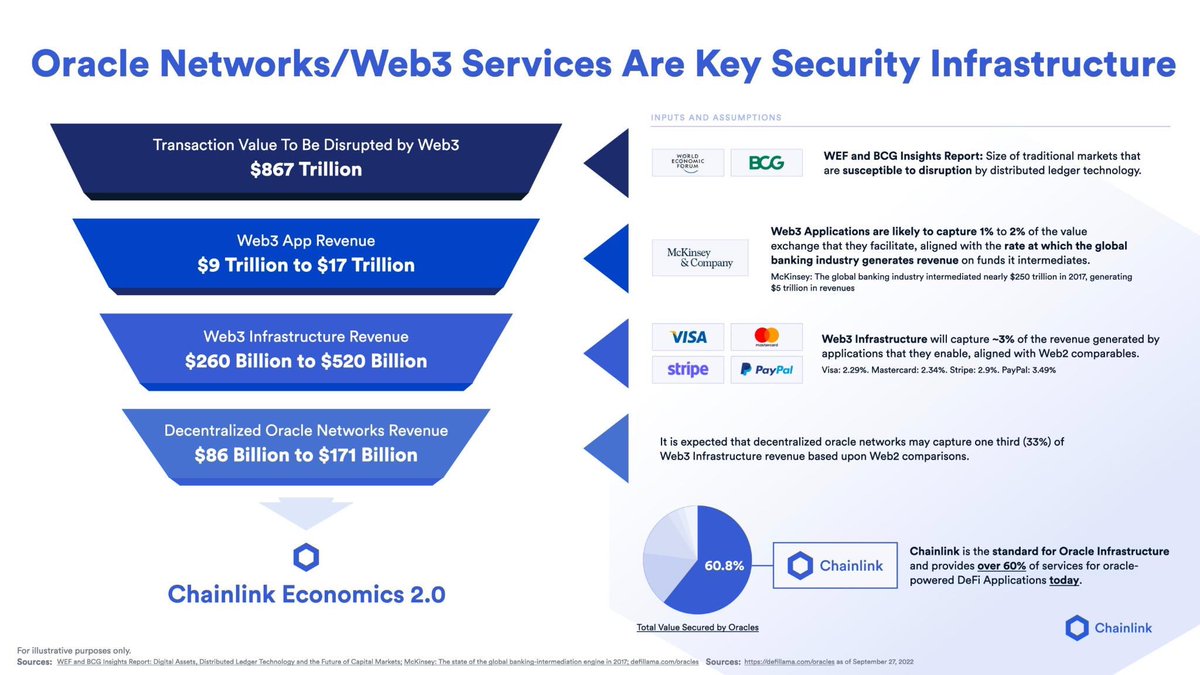

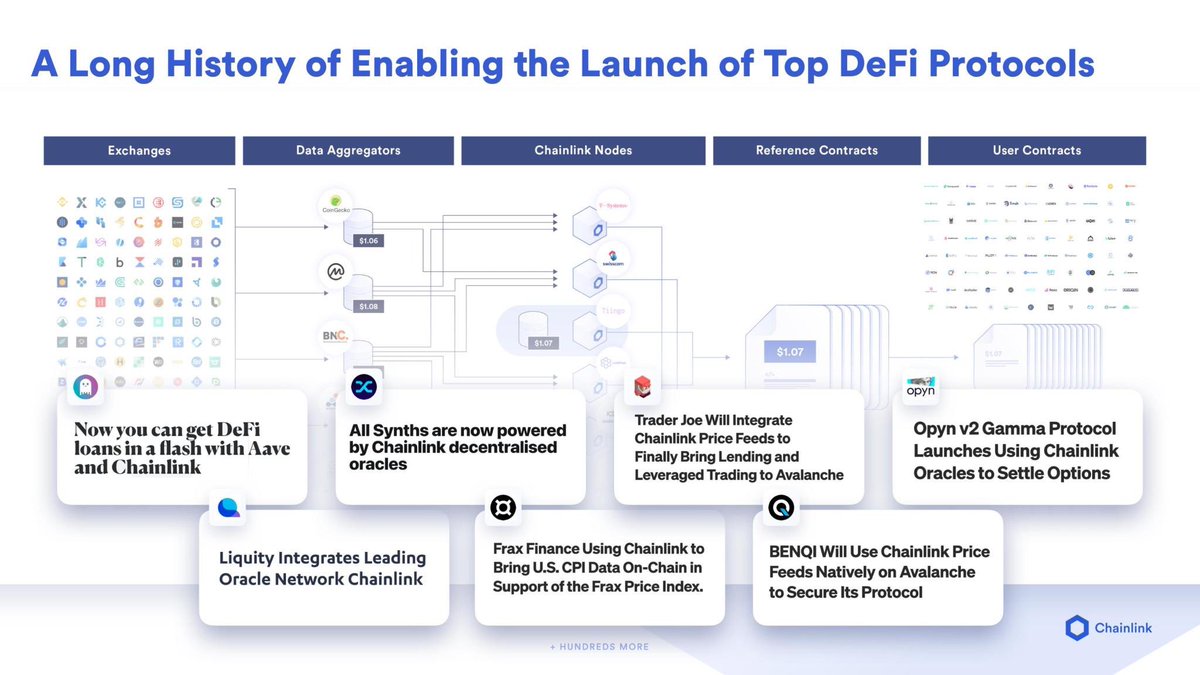

4/ Since mainnet, the Chainlink Network has been in growth mode, deploying resources to capture market share

With market dominance established for key services like Data Feeds, the Chainlink Network is now shifting towards value capture and monetizing its network effect

With market dominance established for key services like Data Feeds, the Chainlink Network is now shifting towards value capture and monetizing its network effect

https://twitter.com/ChainLinkGod/status/1502041125158154243

5/ REVENUE

The first step in accelerating value capture is increasing revenue / revenue opportunities for Chainlink service providers

Historically, revenue opportunities has been driven by the deployment of new services and supporting new chains (which will continue)

The first step in accelerating value capture is increasing revenue / revenue opportunities for Chainlink service providers

Historically, revenue opportunities has been driven by the deployment of new services and supporting new chains (which will continue)

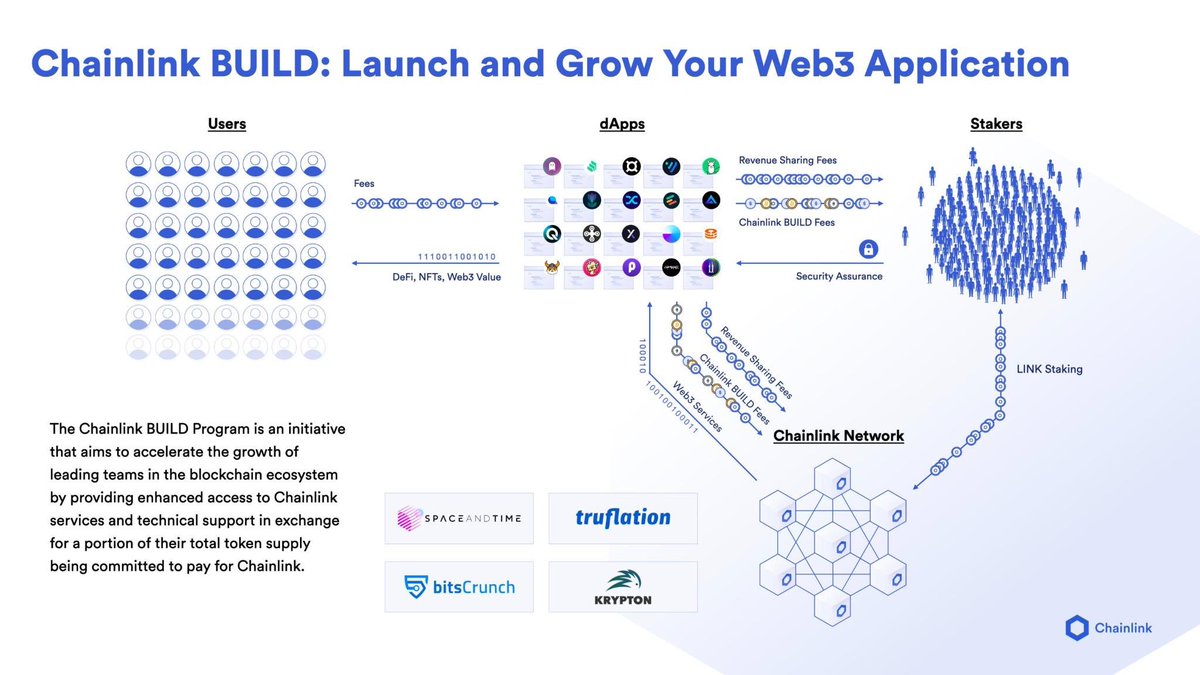

6/ In addition to increasing fees paid by existing users, new ways for pre-revenue early stage projects was needed

Such projects don’t have the resources to pay in traditional ways but they do have a lot of their own tokens

This is where Chainlink BUILD comes into play

Such projects don’t have the resources to pay in traditional ways but they do have a lot of their own tokens

This is where Chainlink BUILD comes into play

7/ Chainlink BUILD is a new Econ2 program where projects pay a significant portion (3-5%) of their native token supply in exchange for oracle services and technical support

Such tokens can then flow to service providers in the Chainlink ecosystem like stakers

Such tokens can then flow to service providers in the Chainlink ecosystem like stakers

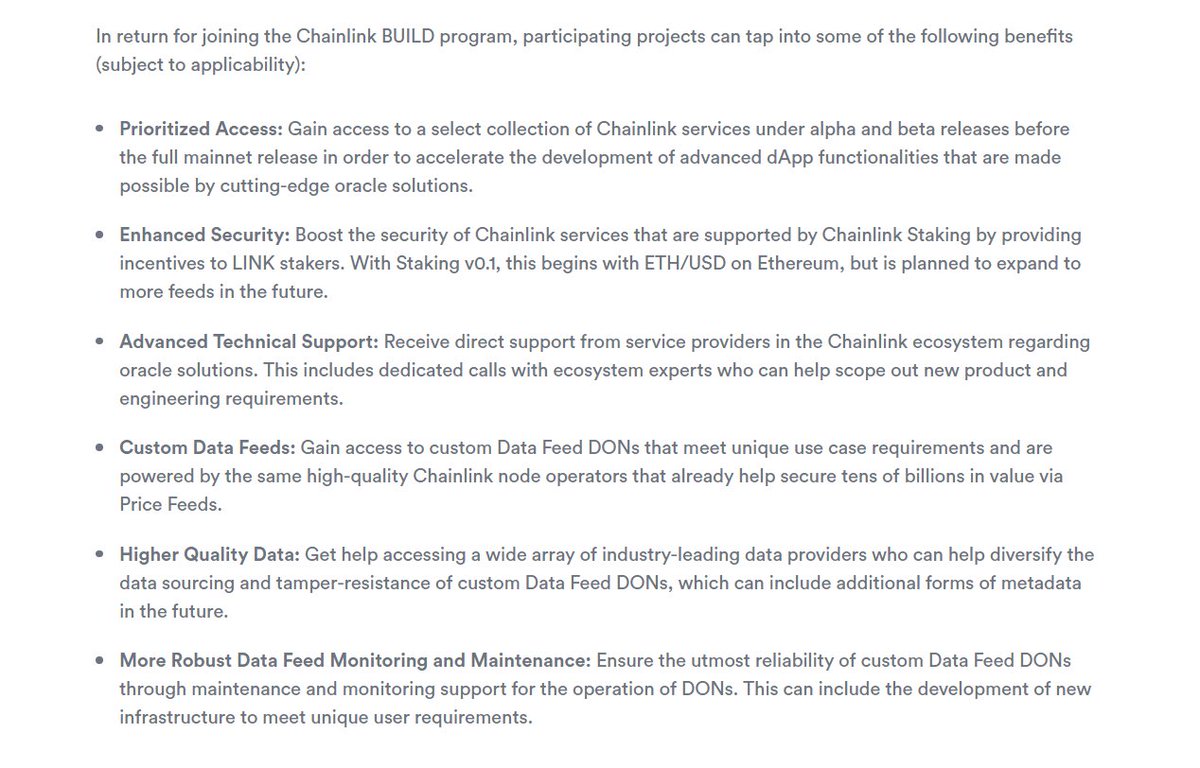

8/ More specifically, BUILD partners get access to wide range of benefits

This includes early access to beta-stage Chainlink services, custom oracle networks, and the ability to boost the security of services they use by incentivizing stakers

A win-win economic relationship

This includes early access to beta-stage Chainlink services, custom oracle networks, and the ability to boost the security of services they use by incentivizing stakers

A win-win economic relationship

9/ As BUILD participants scale up and begin to generate their own revenue

This revenue can be shared with the Chainlink Network on a percentage point basis (or other schedule if that works better)

Revenue that can be converted to $LINK and paid to service providers

This revenue can be shared with the Chainlink Network on a percentage point basis (or other schedule if that works better)

Revenue that can be converted to $LINK and paid to service providers

10/ As a $LINK staker, this effectively means that in addition to $LINK rewards, you’ll also have the chance to earn a basket of tokens from projects in the Chainlink ecosystem

Congrats, you’re now effectively seed investors in some of the most promising early-stage projects

Congrats, you’re now effectively seed investors in some of the most promising early-stage projects

11/ More info on Chainlink BUILD, including initial participating projects, can be found here

blog.chain.link/chainlink-buil…

blog.chain.link/chainlink-buil…

12/ COSTS

The flip side to revenue is costs, specifically operating costs

The operation of oracle networks is not free, as there are associated on-going costs like on-chain transaction (gas) fees

Minimize these costs and profit margins can increase

The flip side to revenue is costs, specifically operating costs

The operation of oracle networks is not free, as there are associated on-going costs like on-chain transaction (gas) fees

Minimize these costs and profit margins can increase

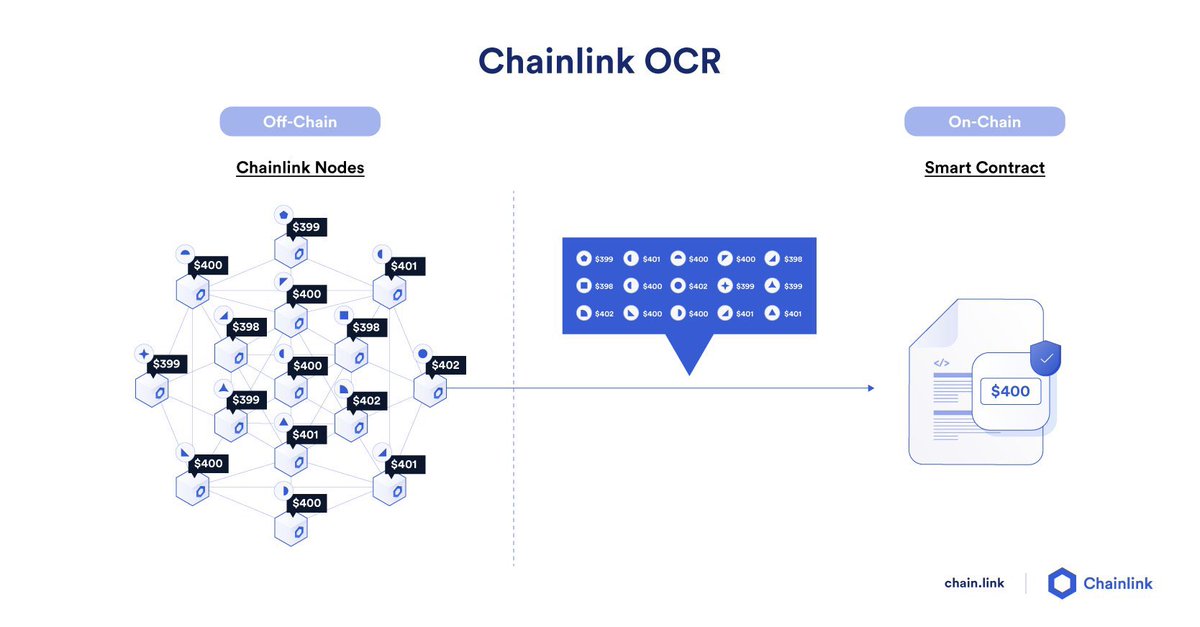

13/ There’s already been major strides made in this direction over time like the Off-Chain Reporting (OCR) protocol in 2021 reducing gas costs of oracle network by up to 90%

OCR 2.0 will further reduce gas costs by another 25%, allowing for even more data to be brought on-chain

OCR 2.0 will further reduce gas costs by another 25%, allowing for even more data to be brought on-chain

14/ In parallel blockchains are finally starting to scale

Rollups, sidechains, subnets, supernets, shards, etc

As chains become more efficient, the costs for oracle networks on those chains also reduce

But that’s the beginning

This is where Chainlink SCALE comes into play

Rollups, sidechains, subnets, supernets, shards, etc

As chains become more efficient, the costs for oracle networks on those chains also reduce

But that’s the beginning

This is where Chainlink SCALE comes into play

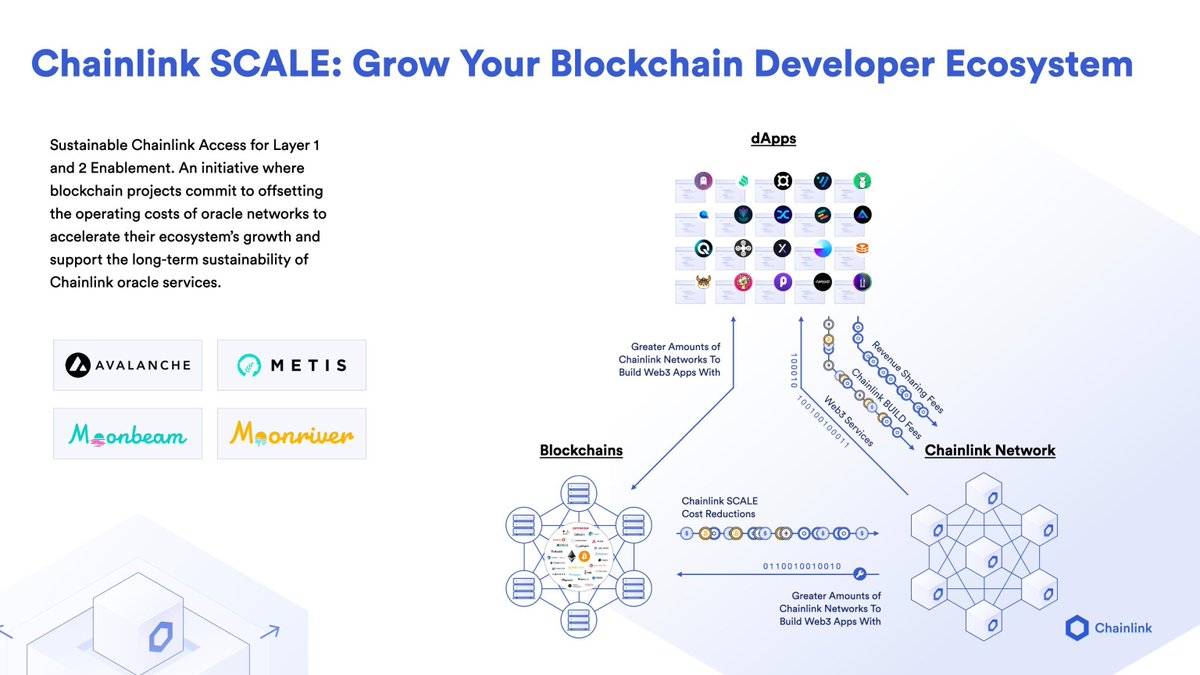

15/ Chainlink SCALE is a new Econ2 program where blockchain projects commit to offsetting the operating costs of Chainlink oracle networks on their chain

The significantly increases profit margins and eliminates the need for subsidized oracle rewards for those networks

The significantly increases profit margins and eliminates the need for subsidized oracle rewards for those networks

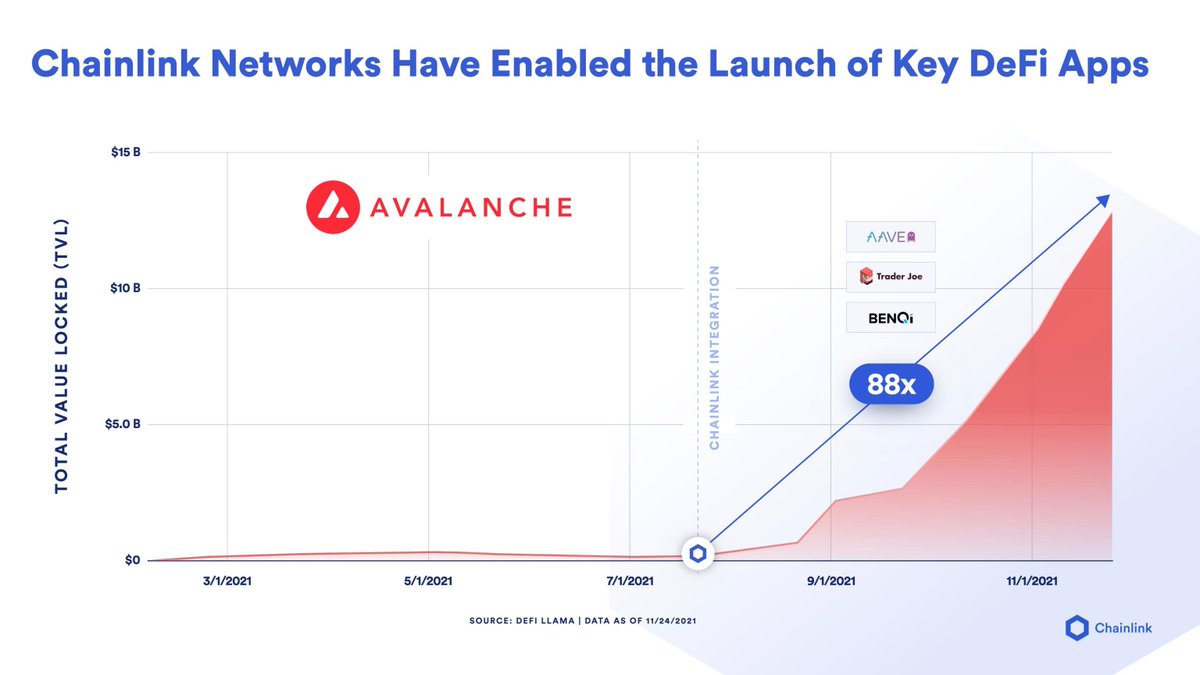

16/ For example, @avalancheavax joined SCALE meaning Chainlink oracle networks will receive grants in AVAX to cover on-chain gas fees on their chain

This is another win-win relationship as chains need more oracle data to fuel their dApp ecosystems (as has been historically seen)

This is another win-win relationship as chains need more oracle data to fuel their dApp ecosystems (as has been historically seen)

17/ Even as blockchains scale, the gas costs won’t be zero and data delivery delivery throughput is usually also increased

Chainlink SCALE covers the primary costs of oracles, meaning economic resources can be used more efficiently like driving more revenue opportunities

Chainlink SCALE covers the primary costs of oracles, meaning economic resources can be used more efficiently like driving more revenue opportunities

18/ More info on Chainlink SCALE, including initial participating blockchains, can be found here

blog.chain.link/chainlink-scal…

blog.chain.link/chainlink-scal…

19/ STAKING

The last major part of Chainlink Econ2 is the long-awaited staking

By locking up $LINK in smart contracts, Chainlink service providers can prove their commitment and increase the cryptoeconomic security of oracle services

The last major part of Chainlink Econ2 is the long-awaited staking

By locking up $LINK in smart contracts, Chainlink service providers can prove their commitment and increase the cryptoeconomic security of oracle services

20/ As explored in a June blog post, Chainlink Staking will rollout in stages and evolve with more functionalities over time

This starts with an initial v0.1 beta which is launching this December 👀

blog.chain.link/chainlink-stak…

This starts with an initial v0.1 beta which is launching this December 👀

blog.chain.link/chainlink-stak…

21/ v0.1 sets the groundwork for staking by introducing a decentralized alerting system for reporting node mal-performance

For future versions, this enables stake slashing and eventually Loss Protection as a form of insurance for users if an oracle network breaks its SLA

For future versions, this enables stake slashing and eventually Loss Protection as a form of insurance for users if an oracle network breaks its SLA

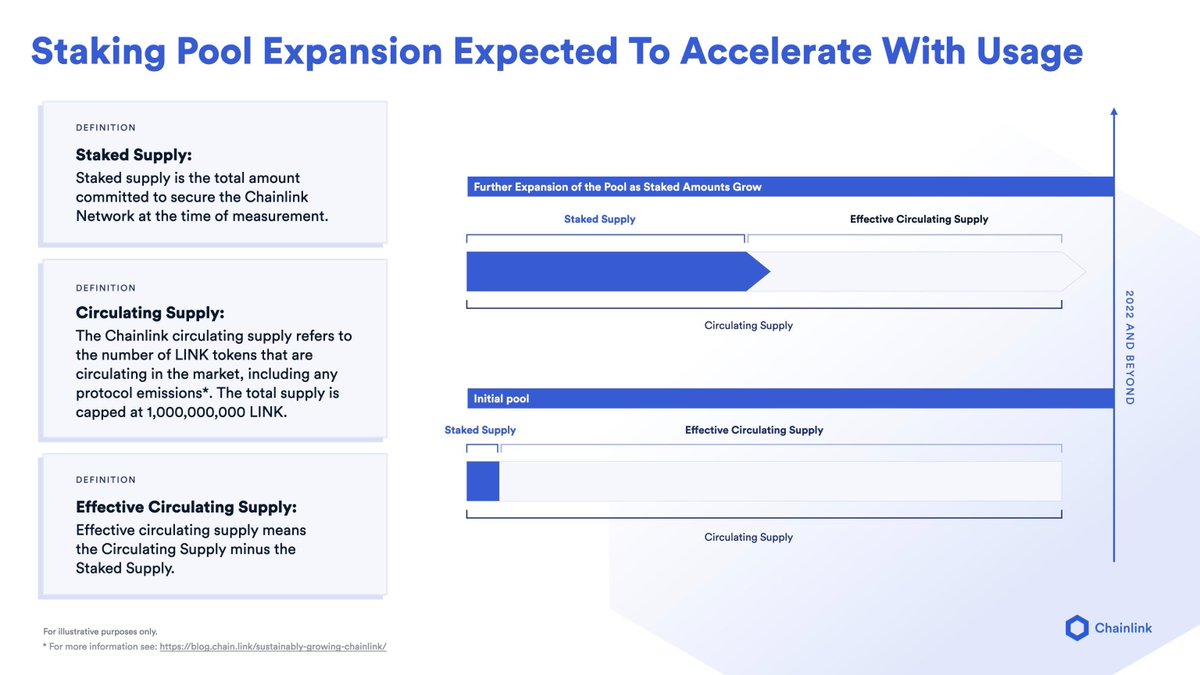

22/ In Staking v0.1, the pool is capped at 25M LINK and will expand to 75M LINK over time

Initially there will 22M LINK available for the community to directly stake and 3M for node operators

Rewards will start with subsidized LINK and evolve to revenue sharing and BUILD fees

Initially there will 22M LINK available for the community to directly stake and 3M for node operators

Rewards will start with subsidized LINK and evolve to revenue sharing and BUILD fees

23/ v0.1 will start with an Early Access period and then later open up to a General Access phase

Early Access eligibility is based upon historical on-chain and off-chain activity

Check your Early Access eligibility for v0.1 below 👇

blog.chain.link/chainlink-stak…

Early Access eligibility is based upon historical on-chain and off-chain activity

Check your Early Access eligibility for v0.1 below 👇

blog.chain.link/chainlink-stak…

23/ Introducing staking to the most widely adopted oracle standard is no small feat, hence the progressive rollout where feedback can be incorporated before scaling up

Excited for what the future brings here

Excited for what the future brings here

24/ To sum it up, the Chainlink Network is evolving from a growth oriented approach to growth + value capture approach:

Chainlink BUILD increases revenue

Chainlink SCALE reduces costs

Chainlink Staking increases security and participation

Welcome to Economics 2.0

Chainlink BUILD increases revenue

Chainlink SCALE reduces costs

Chainlink Staking increases security and participation

Welcome to Economics 2.0

• • •

Missing some Tweet in this thread? You can try to

force a refresh