So, I was thinking about Nigeria's problems, and I came to the conclusion that, we do not know how to create wealth.

I want to teach 1000 people here, how to create wealth.

1000RTs and I'll start the lesson. Sorry it has to be worth my time.

I want to teach 1000 people here, how to create wealth.

1000RTs and I'll start the lesson. Sorry it has to be worth my time.

Hi guys....Okay. I'm starting the wealth creation class.

Here we go....

Let me answer my wife first.

Here we go....

Let me answer my wife first.

Okay...So this is gonna be a part series class, and I will teach it from my head, not based on any theoretical jargon or funny anecdotes. It is strictly proven advise from tested principles. Easily verifiable and can be done by anybody. I will use examples, when I can.

So what is wealth? You know those definitions that say, it's not about money, blah blah....scratch that! It's all about having money. Creating wealth is all about making money. Yes, you have to develop relationships, build character, integrity and all that. That's not our focus.

Our focus here is "How to make money!" No stories, no come and buy this book or that pamphlet, here is the foundation of making money. Like they say, "you can take a horse to the river, but you can't force it to drink...."

Chapter 1: VALUE.

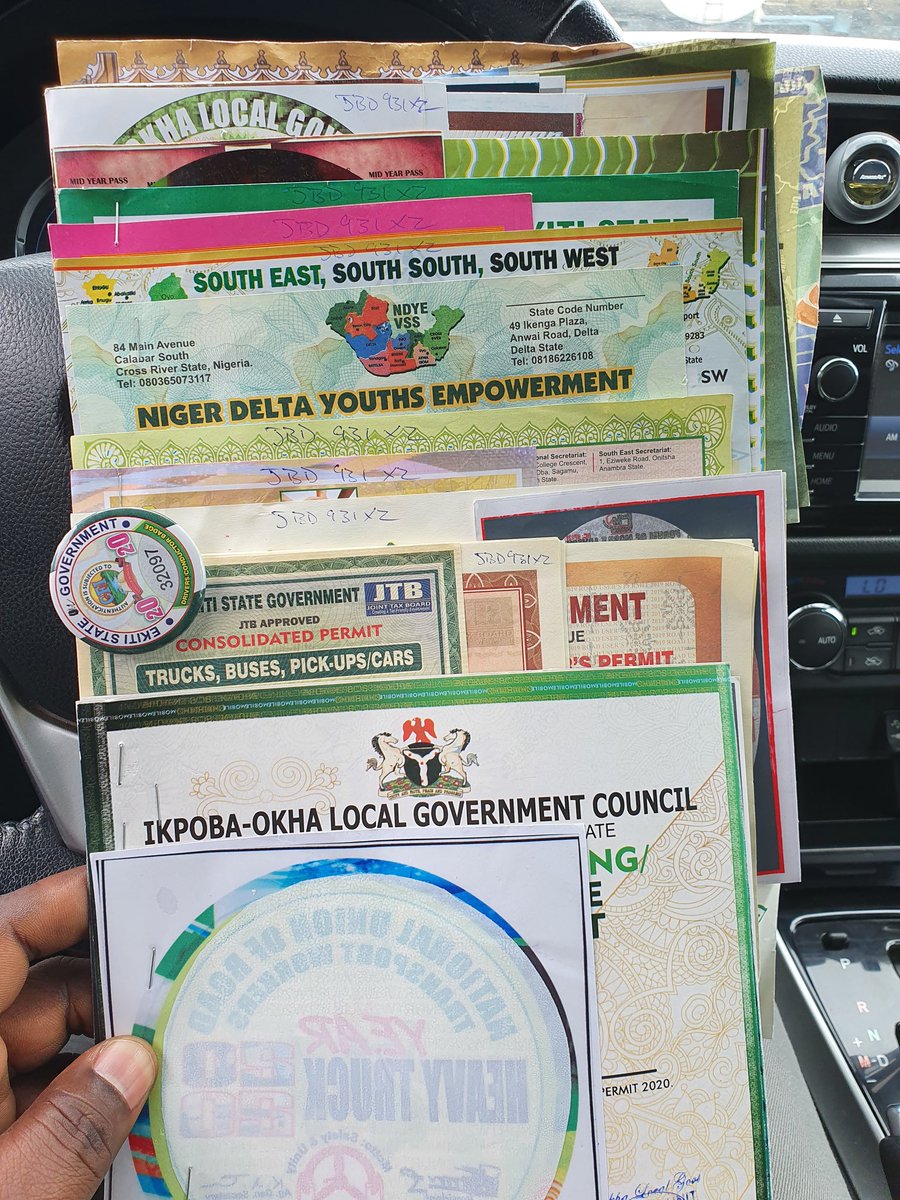

I don't have that much money in my wallet, but this is convenient for our discussion.

What you see here is currency, money. It is what is used as a means of exchange, in a financial transaction. Money DOES NOT bring wealth! Having a high income....

I don't have that much money in my wallet, but this is convenient for our discussion.

What you see here is currency, money. It is what is used as a means of exchange, in a financial transaction. Money DOES NOT bring wealth! Having a high income....

Having a high income does not guarantee wealth. In fact, many celebrities, once wealthy, are now homeless or at least considered bankrupt. So, owning cash will not translate to wealth. It is what you do, with the cash you earn, that determines if you will end up wealthy.

Cash or money, represents Value. At some point in time, a $100 bill, at some point represented as equal amount of gold held in the vaults of the American Treasury. At some point, 1 Ounce of gold was equal to $1. So if you held a $100 note, you were sure to have 100 ounces of gold

That doesn't hold true today, because at some point, the government couldn't keep up with backing up their cash with gold, so the gold standard was broken. More cash started showing up, than was held at the bank.

So today, the cash in your hand really, is just a piece of paper. The value it holds, is what the government says, and not necessarily what it has, to back that cash note with. So, if money is just paper, what really do we exchange in financial transactions?

VALUE. If you go to a filling station to buy fuel, you exchange the cash you have, for a liter of petrol. What you did really, was exchange the value you posses, for the value you intend to extract from a liter of petrol. Exchanging money = Exchange of VALUE.

If you ask me to consult for you, I charge N5m, what you will be paying for, is the inherent value I will be providing, that to you, is worth N5m, because I will only be exchanging an intangible asset, for a tangible one.

If my consultancy fee, which only produced information on a piece of paper, was to be paid in liters of PMS, I would be getting an equivalent of N5m worth of petrol. Meaning that piece of paper = N5m = N5m worth of PMS. The common denominator here, is VALUE!

Now, why is Messi a more expensive player, than Ahmed Musa? VALUE! Ahmed Musa, though an able bodied man, same as Messi, can not deliver the same value to a club like Messi can. That's why Messi attracts more money, than Ahmed Musa.

If you have Value, money will follow you. Why? Because Money is fundamentally value. Can you have steam without water? No! Value birthed money, so money will always return to value. Posses value and money will show up!

So, how do you get the most money and have as much income as possible.

"He that will be the greatest, must be the servant of all...."

Meaning, if you can provide value for the most people, and exchange it for a fee, higher than the original value worth, the net value will +ve.

"He that will be the greatest, must be the servant of all...."

Meaning, if you can provide value for the most people, and exchange it for a fee, higher than the original value worth, the net value will +ve.

The NET value created, will be positive, in your favor. So Jeff Bezos, the richest man in the world today, exchanges the value he creates with Amazon, for a fee, to a large Number of people, higher than the original value he put in, and thus gets a net flow of VALUE, inwardly.

This inward flow of VALUE, denominated now in currency, makes him worth $100bn. Note, he didn't makes sales of $100bn, his value is worth that amount, compared to how much liquid cash he actually has. So income money does not necessarily lead to wealth!

However, what you do with the income received, and a persistent and continuous generation of VALUE, over time, will lead to wealth.

Chapter 2: VELOCITY OF MONEY.

Remember I said, that if you approached me to consult for you, I'll charge, say N5m. Now obviously, not everybody can pay N5m for my services. But there are people who can pay N1m, or less. If I only have one N5m paying client a month versus 10 N1m

Remember I said, that if you approached me to consult for you, I'll charge, say N5m. Now obviously, not everybody can pay N5m for my services. But there are people who can pay N1m, or less. If I only have one N5m paying client a month versus 10 N1m

Which batch do you think I should serve? The only N5m paying client, monthly, or the bunch of 10, N1m paying clients, a month? Obviously, the latter. N10m cumulatively is greater than N5m monthly. This is what is referred to as the VELOCITY OF MONEY.

How fast can you exchange the value you posses, for money, or how quickly can you cause people to access your created value, and collect the equivalent money value from them. This is why the internet is so big, and it's billionaires the richest.

They cause their value to be exchanged faster, more efficiently and directly to their clients, faster than any other industry. It is why IT has been a catalyst to any industry, since "dot com" was invented.

If you have goods, sitting in a shop, on a shelve, to be sold at N10, profit margin N5, and your neighbour sells the same item for N8, profit N3. Who do you think will end up with the higher income, month end? Your neighbour. Because he/she would have exchanged by VELOCITY, more.

He/she, by sheer speed of transaction, would have made more money, than you, at the end of the month. Be wise, go after VELOCITY OF MONEY rather than wait longer for a higher margin. Velocity of money always wins, it is why religious centres are so wealthy.

Next chapter: TIME VALUE OF MONEY.

Guys, let's create wealth in Nigeria, retweet this and use the hashtag #WealthSerieswithFemi

Let's educate, let's transform.

Let's educate, let's transform.

Continuing this thread.

Chapter 3: TIME VALUE OF MONEY.

Remember, I previously mentioned The gold standard and how cash/paper money was delinked from the gold reserve. That "delinking" led to gold having more worth, than the paper money representing it.

Chapter 3: TIME VALUE OF MONEY.

Remember, I previously mentioned The gold standard and how cash/paper money was delinked from the gold reserve. That "delinking" led to gold having more worth, than the paper money representing it.

So, before, $1 represented 1 Ounce of gold. So as more money was printed and circulated, the cost of 1 ounce of gold continued to increase, over time. Today, 1 ounce of gold is > $1000. So, the value of money has reduced vs gold, over the same period of time.

If you had 1000 ounces of gold, which was initially $1000, you will now have >$1,000,000.00 today. Your money would have increased in value by 100,000% over the period of time. While this is true, the other side is also true. If you held $1000 before, now you can only buy 1oz.

So value can appreciate over time, but money depreciates over the same period. Except Gold is found in large quantities, to satisfy total world demand, paper money will continue to depreciate over time. This loss of VALUE is called INFLATION.

When an item of VALUE becomes scarce, the cost price of that item increases and is known as Demand pull INFLATION. Let's concentrate on this type of Inflation here, there is another type worthy of note.

INFLATION is a silent thief of money.

INFLATION is a silent thief of money.

"Make savings your habit and you will become rich"......LIES.

The best savings account in the world, will never give you an interest on your deposit higher than INFLATION. So if you store up your money in a bank account, you're losing it slowly, to inflation.

The best savings account in the world, will never give you an interest on your deposit higher than INFLATION. So if you store up your money in a bank account, you're losing it slowly, to inflation.

However, you can increase the value of your money, over time, by putting it to work for you, and earning an Interest on your initial capital. That interest must be above Inflation for you to become wealthy, over time. Whatever you do with the initial cash, ensure it pays interest

Interest, over time, is the rate at which your money increases. Say Inflation for 2017, was 10%. If your money only earned 9% Interest, you have lost 1% of your initial money/capital. If your money earned 20%, you have only really earned 10%, because inflation has taken 10%.

3 men dreamt of buying a car worth N20,000. Mr A. had N20,000 in his account, deposit interest rate = 5% per annum. Mr B. had same in hand, did nothing with it. Mr C invested his N20,000 in a business with an Internal rate of return of 20%. Inflation = 10%.

By the following year, they meet at the dealership, car now worth N22,000 due to inflation. Mr A. had N21k (5%), Mr B still had his N20k, he did nothing, while Mr C. has N24k (IRR = 20%). Who will still be able to buy the car? Mr C., with N2k change to spare.

This is a perfect example of the TIME VALUE OF MONEY. It can work for you, or against you. Depending on your choices and what you do with your Income, cash or paper money over time. Use time in your favour, don't let it work against you.

Chapter 4: COMPOUND INTEREST, INVESTMENT AND DEBT.

Join me tomorrow.

Goodnight.

#WealthSerieswithFemi

Join me tomorrow.

Goodnight.

#WealthSerieswithFemi

Continuing this Thread...

Chapter 4: COMPOUND INTEREST, INVESTMENT AND DEBT.

In the last chapter we mentioned INTEREST and showed an example of what it can do, over time.

RATE is the measurement of any quantity, over a certain time frame. So if I say, Inflation rate....

Chapter 4: COMPOUND INTEREST, INVESTMENT AND DEBT.

In the last chapter we mentioned INTEREST and showed an example of what it can do, over time.

RATE is the measurement of any quantity, over a certain time frame. So if I say, Inflation rate....

.....you know I mean, the rate at which the price of goods and services, increase over a year (12 months). So, Interest rate is the additional amount of money paid, in addition to the initial amount deposited/invested/borrowed, which is a percentage of the initial amount.

Now, Mr C. had an extra N4,000, which amounted to an interest rate of 20%. This is the SIMPLE INTEREST accumulated on his money. If Mr C. decides to re-invest his N24,000 for another year, his COMPOUNDED INTEREST becomes N4800 + N4000 = N8800 over the 2 yr span.

Now, if he removed the N4,000 he made in the first year, and reinvested the principal alone, he would have made another N4,000 at the same Interest rate. But his total simple interest will be N8,000, as against N8,800. So COMPOUND INTEREST gave him an additional N800.

This is what compound interest does, it's a continuous giver, it continues to give bonuses, for consistency and investment stamina. If you're quick to withdraw and spend your simple interest, you will never know COMPOUND INTEREST. Remember the goal is to end up wealthy.

Now, COMPOUND INTEREST is also funny, in the sense that it gives more, as the time is shortened, however, the additional amount given reduces. If Mr C. decided to negotiate a monthly compounding of his interest, instead of a yearly compounding, Mr C would have ended with >N8,800.

Simple interest compounded monthly and daily are not far from each other, almost the same, monthly and yearly have a significant difference. Below is an example.

Instead of N8,800, Interest compounded monthly yielded N9,738 over the same 2 years. This is a classic example of COMPOUND INTEREST at work. Now, what is the strategy that can be used to achieve wealth with compound interest?

CONSISTENCY!

You must be focused on your goal!

CONSISTENCY!

You must be focused on your goal!

"A double minded man will never receive anything...."

You have to be consistent and on some cases ruthless. This is because you are planning for your wealthy future. Keep that image in your head!!! Don't waver, allow compound interest, compounded monthly, work for you.

You have to be consistent and on some cases ruthless. This is because you are planning for your wealthy future. Keep that image in your head!!! Don't waver, allow compound interest, compounded monthly, work for you.

INVESTMENT.

Now, I'm sure you are asking;

"what type of investment can I make, to grow my money?"

Now, you're thinking properly. This is how the wealthy think.

Investment simply is, putting your money to work, for you. There are multiple investment opportunities out there.

Now, I'm sure you are asking;

"what type of investment can I make, to grow my money?"

Now, you're thinking properly. This is how the wealthy think.

Investment simply is, putting your money to work, for you. There are multiple investment opportunities out there.

The safest Investment you can make, is in government issued securities. These are backed by the sovereignty of nations. Nigeria must and will pay your interest and capital when due, without fail, before even funding her budget. It is a must!

Note this! The system is rigged, in favor of, the multiplication of capital not labour. If you work harder you may not necessarily get more money, else the average labourer should earn more than Dangote. But if your money works harder for You, as capital? Gobe!! Skssksskssk!

Now, back to government issues securities. The government issues Treasury bills and Bonds, available on @SECNigeria website or the @DMONigeria. The least capital required to start is N3,000. Yes 3K. They pay as high as 14%, higher than INFLATION, most times.

Inflation in most countries is single digit, and usually lower than the benchmark Interest rate, MPR. Monetary policy rate is the rate at which the banker of bankers lends money out. So banks follow this rate to set their lending rate and Interest rate.

"The owner of capital, always gets more capital...."

"He who has, more will be added to him, but he who has not, that which he has will be taken from him....."

This is the principle of Investment and Capital.

"He who has, more will be added to him, but he who has not, that which he has will be taken from him....."

This is the principle of Investment and Capital.

From the above strategy, let's assume you earn 200,000 monthly. You invest 100,000 monthly. With a target of 10 years, say you are 20 years old. By the time you are 30, you will have N22,197,643.77.

N22.2m at 30 years of age, brethren.

Think on this for a minute.

N22.2m at 30 years of age, brethren.

Think on this for a minute.

Now, that N22m was strictly based on investment in government held securities. The most stable and risk free investment out there.

Now imagine you invested in some thing with more risk. Say, a business, with an IRR, of say 25%. That accumulated amount will be far more....

Now imagine you invested in some thing with more risk. Say, a business, with an IRR, of say 25%. That accumulated amount will be far more....

However, you must note, the more risk there is, the higher the tendency for you to lose your money. Though, the higher risk investment, almost always leads to a higher return.

Not everyone has an appetite for risk, so invest based on your understanding and appetite.

Not everyone has an appetite for risk, so invest based on your understanding and appetite.

DEBT.

"Owe no man a debt, either a debt of time or of money...."

That statement has been greatly misconstrued. It says do not owe, but doesn't say do not borrow. If you borrow to payback in a month, will the lender come and arrest you after one week? No! Because it is not due.

"Owe no man a debt, either a debt of time or of money...."

That statement has been greatly misconstrued. It says do not owe, but doesn't say do not borrow. If you borrow to payback in a month, will the lender come and arrest you after one week? No! Because it is not due.

So, borrowing is not bad, if you do it with the right strategy and you pay back on time. In fact, some people think the best way to get a high credit score, is to stay away from debt. Not true. Lending and debt are part of any economy. You must borrow!

Borrowing however, must be done with a clear strategy on paying back. Most times, you can only borrow by providing an equivalent or more costly collateral, as a form of assurance. You must thus have skin in the game, before someone else lends you money.

Back to our example.

Back to our example.

The guy who invests and compounds his N100k, has a bankable collateral with which he can borrow against. However, he must ensure that whatever he is investing in, must provide a return higher than the lending rate. Interest rate of investment, must be > lending/borrowing rate.

This way, you can leverage on the borrowed money, to create additional wealth for yourself, on a NET basis. As you payback, it becomes cheaper and easier to borrow more and more. This way, you make more, and more money by letting compound interest run wild!!

Imagine, from the example above, after the first year, man decides to borrow 100,000 monthly, against his already invested and compounding N1.2m. This will mean, he will be investing 200k instead of the initial 100k in year 1. 👇

He will compound N47.3m by age 30.

He will compound N47.3m by age 30.

Once I was speaking at a forum and someone said, but life is not that straight, things happen. Brothers, sisters, family....etc.

I responded "Love your neighbour, as yourself".

Another said...."Tithe nko...."

I said, it is supposed to be 10% of your INCOME.

Let me explain.

I responded "Love your neighbour, as yourself".

Another said...."Tithe nko...."

I said, it is supposed to be 10% of your INCOME.

Let me explain.

If you deprive yourself, of a certain amount, as preparation for your future, does someone else deserve your future, more than you do? Love as yourself, not more than yourself. If you have set it aside, don't give it to anyone else. CONSISTENCY!! UNWAVERING!! FOCUS!!

This is why wealthy men/women don't have time, they are always on the move, not listening to idle talk. This is because, they are seeking more ways, to put compound interest to work for themselves.

Tithe is out of your Income, not capital. If your salary is your capital? Then..

Tithe is out of your Income, not capital. If your salary is your capital? Then..

3 men were given $5, $2 and $1 each. Mr 5 went and multiplied his, got 5 more, 100% Interest. Mr 2, did same, came back with 4, 100% Interest. Mr 1, said it was small and not enough, he did nothing.....Well...we all know what happened. 5 and 2 got the same reward. 1....?

You have something, there's no one, who doesn't have something of VALUE. Educated or uneducated, you can create value. Identify it, exchange it, invest it, compound it, monthly.....and become wealthy.

"Think and grow rich!!" - Napoleon Hill.

"Think and grow rich!!" - Napoleon Hill.

Chapter 5 - CONTINUOUS WEALTH..

#WealthSerieswithFemi

Tomorrow....day of rest. We will continue Monday.

Spread the word, our generation must change Nigeria.

Peace guys....

#WealthSerieswithFemi

Tomorrow....day of rest. We will continue Monday.

Spread the word, our generation must change Nigeria.

Peace guys....

@threadreaderapp unroll

CHAPTER 5: CONTINUOUS WEALTH.

So, we have touched on a lot of things so far, including basic investment strategies. So we are going to look at how to ensure your wealth continuously generates wealth, through your life time.

Class starts now....

So, we have touched on a lot of things so far, including basic investment strategies. So we are going to look at how to ensure your wealth continuously generates wealth, through your life time.

Class starts now....

Looking at our investment strategy above, there are a couple of things you would notice, 1. Is that we didn't deduct the effect of Inflation, through the period in question. You remember we said; "Inflation is a silent thief...". Well, yes, inflation will take a chunk off.

As the years roll by and compound interest works for you, inflation is busy being a "bad belleh" ~ /pidgin for "Hater"/, hacking at your profits slowly. So, how can you exorcise this demon? By adjusting your deposits for inflation. As you grow older, it is expected that you earn.

As the years roll by and compound interest works for you, inflation is busy being a "bad belleh" ~ /pidgin for "Hater"/, hacking at your profits slowly. So, how can you exorcise this demon? By adjusting your deposits for inflation. As you grow older, it is expected that you earn.

And that your earnings increase. If this is true, it means that you have to adjust your investment deposits to cover for the effect of Inflation. If inflation is 10%, yr 1, but only 8% yr 2, it means your deposits in yr 2 must rise 10% and fall to an 8% rise in yr 3.

By this method, Inflation will not touch your investment portfolio and thus you are guaranteed continuous wealth down the line. See example 👇

So it follows, that if you successfully adjust your investment deposits to accommodate for inflation upfront, rather than allow it take from your value yearly, you clearly will have a larger deposit at yr 10 - N67.7m.

Assuming you keep this going for 30 years?? N1.58bn.

Assuming you keep this going for 30 years?? N1.58bn.

So, a 20 year old guy, after working for 30 years and sticking to his investment plan, will become a billionaire by age 50. This should encourage every young person out there.....

"The best time to plant a tree was 20yrs ago, the next best time is now" - Chinese proverb.

"The best time to plant a tree was 20yrs ago, the next best time is now" - Chinese proverb.

Please note, this is an example. Investment returns do not usually remain constant for 10 years. Different reasons cause them to fluctuate as the years go by. But as an Investor, you can work to ensure you keep your returns stable through many methods like diversification.

"Will I just keep investing, without actually enjoying my returns in my life time?"

This is why I waited for this chapter to talk about this. We have set the ground rules, everyone understands what it takes, now we can look a little deeper into financial asset management.

This is why I waited for this chapter to talk about this. We have set the ground rules, everyone understands what it takes, now we can look a little deeper into financial asset management.

Take a look at the yearly interest, in our example chart. You can see the profile of the increase in its figures. Your investment is an asset, assets can be used as collateral to negotiate loans. Loans can be used to finance more assets and start businesses..

For you to enjoy the perks of your investment, you must not kill the goose that lays the golden egg. But you can use it to trade. At this point you need to be careful, you either take loans that won't affect the capital, or you ensure that you protect your ventures adequately.

If you take a 22% loan, ensure you invest it on an Interest yielding asset that covers the loan, and your expected Return on Investment (ROI).

There are some extreme planners, who advise that you live on a loan, payback from your invested income at year end, and reinvest the balance. That way, you never lose your capital and it continues to improve your credit ratings as well.

This is a cash flow quadrant by .@theRealKiyosaki. It helps show the path you can thread, in your quest to becoming financially free.

Working your way through that, while keeping your investment going is no mean feat, but dedication and consistency will get you there. Work at it! The more you invest, the more your risk appetite will increase and you can improve your margins.

You could be an EI, SI or BI. Make sure you are always Investing, no matter what part of the quadrant you are in...

Lastly, watch your EXPENDITURE.

You can follow this chart, keep to path (1) and (2) as much as possible to continue to multiply your wealth. Path (3) and (4) will diminish your wealth over time.

Copyright @theRealKiyosaki

Copyright @theRealKiyosaki

Bottom line, wealth creation and multiplication requires work. You have to put in the work, there are no shortcuts.

Good luck.

#WealthSerieswithFemi

Good luck.

#WealthSerieswithFemi

• • •

Missing some Tweet in this thread? You can try to

force a refresh