1/ Ed Dowd makes a very good point here about the technical backdrop in Tesla. The situation now is indeed different. And, when one examines why it’s different, the impact on Tesla shares from Musk’s muzzling by the SEC becomes clear.

2/ To appreciate how much of an impact, it is important to look back at Tesla share performance from the late November 2016 lows, through the then peak in June of 2017 when the stock ripped higher seemingly every day. It’s the period circled in red in the attached.

3/ Keep in mind, during the runup circled in red, there was no material institutional buying during this period. Tencent was the only significant new shareholder. Fidelity added some. Collectively, about 13mm shares between them.

4/ Tesla has always been a headline stock. It has needed headlines to reverse stock slides, and it has used headlines to propel its stock higher, especially around critical events. Tesla shares were pressured for most of 2016, mostly because of the SCTY acquisition.

5/ Before it became a religion, Tesla shareholders could actually smell a pig in a poke. Shares traded down sharply after the SCTY bailout was announced, which was a big problem because Tesla had just completed its largest ever equity raise that May.

6/ With the stock under pressure in 2016, Musk manufactured a “profit” in 3Q16, only the second in Tesla’s history. And was still pumping the solar tile scam.

8/ It is important also to remember the entire trading dynamic in Tesla shares was different in the late 2016/early 2017 period as compared to today as Tesla frequently had low volume trading days then. Let’s call this the “slow period.”

9/ On at least 10 days between April 2016 and March 2017 fewer than 3.0mm Tesla shares traded. Since the peak in June of 2017 to today, Tesla has NEVER traded fewer than 3.0mm shares. Median daily shares traded today are 50% higher than during the slow period.

10/ With lower average daily volumes, the impact from pumps was greater then and pumps were met with little resistance, because everyone was operating in an information void, which is a critical difference as compared to today.

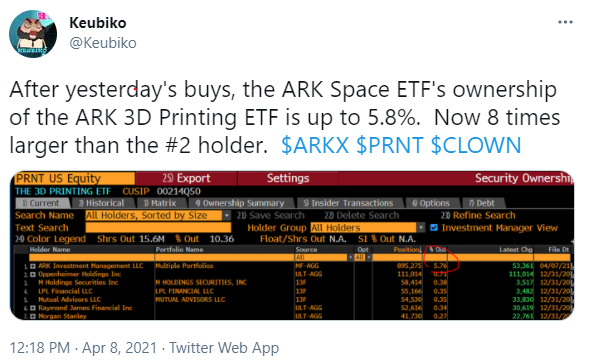

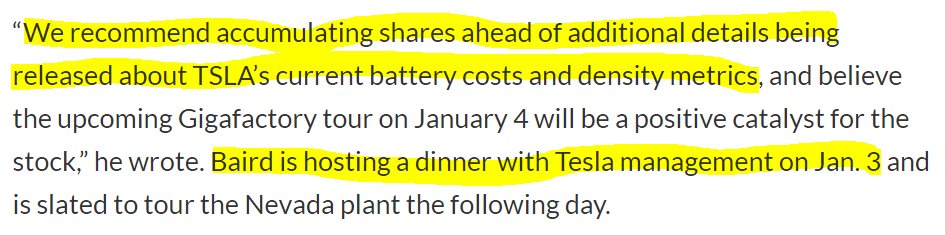

11/ All the OG’s got in on the act. On January 4, 2017, Mr. Melissa Lee toured the gigafactory with investors, and made Tesla his top pick. As usual, his rationale was solid. The stock traded 3x its normal volume that day and continued to move higher from the 2016 lows.

12/ On March 14th 2017, that well-known journal Autocar teased the Model Y, which sent shares up 4%. Of course, this was before even a prototype of the Model 3 had been released, but no matter, the purpose was served as two days later Tesla floated converts and equity.

13/ Almost concurrent with this offering was the announcement that Tencent was now a 5% owner and had purchased shares in the 3/16 secondary. The stock moved substantially higher in the next few weeks.

14/ On a Sunday night in the first days of April, Tesla announced strong S/X delivery results, the stock rocketed to all-time highs, and Musk was feeling his oats. April 3rd was his famous “Stormy times” tweet.

15/ With momentum moving in Musk’s favor, why not pile on with the pumping? On April 13th Musk teased the semi, sending shares higher still. Again, at this point, nothing definitive had been released on the Model 3. Some prototype videos were starting to circulate.

16/ After that, it was all pumping all the time. At this point, VIN #1 of the M3 still hadn’t been produced and all the market had heard was how many reservations Tesla had and how it was revolutionizing production. Shares continued higher and hit an ATH of $383.

17/ But Musk couldn’t help himself and soon soiled the punchbowl by, of course, blaming suppliers for the inevitable and upcoming production delays. Musk being Musk killed the stock, driving it down by almost 20%.

18/ To @DowdEdward's point, the beginning of Model 3 production was peak hype. Since then, the information spigot has been turned on to Tesla’s detriment. We’ve seen garbage piles and fires at the plant, and stories abound of quality issues on the all-important Model 3.

19/ Since the news dropped about the SEC and DOJ, the narrative has changed. Musk is now more of a clownish figure than heroic. Institutions are clearly fleeing the stock except, probably, that other clownish figure at Baillie Gifford.

20/ Many in Tesla FinTwit, whose opinions I respect greatly, have commented on how during the recent selloff Tesla traded with much lower volumes than other stocks in the QQQ. That tells you all you need to know about the shift in narrative.

21/ Without the ability to shamelessly pump, the Tesla news flow, almost uniformly bad for Tesla lately, has had no counterbalance. For so long, Musk was able to take advantage of the information vacuum. With more sunshine now, he has lost the ability to control the narrative.

Personally, we doubt even a raise will help him now. He needs too much money and there are no buyers left. It is also our belief that the no doubt horrific disclosure heretofore inhibiting a raise will kill the stock more than any raise will save it. Please raise. Please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh