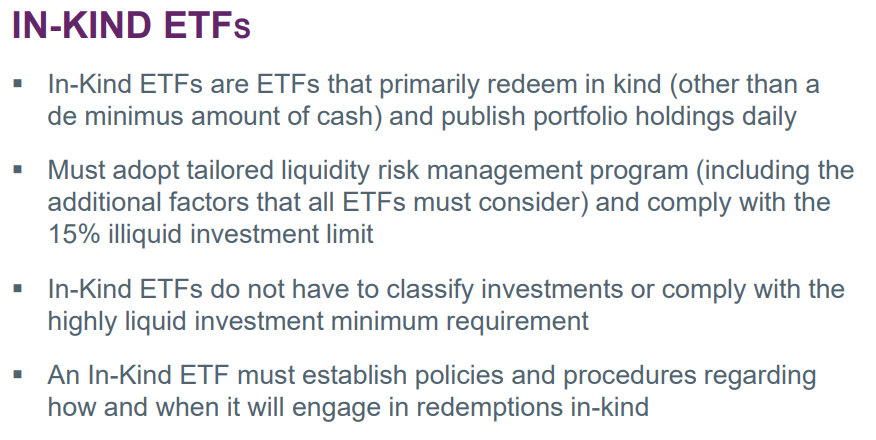

1/ Alot has been written about illiquid, concentrated positions in ETF’s and the risk that poses to investors. A lot more will be written. You may be shocked to know that the SEC looked hard at liquidity provisions in RIC’s and actually imposed a new liquidity rule in 2019.

2/ The Rule, 22e-4, is commonly referred to as N-PORT. Complying with the rule was easy, but its costs were enormous ($86,000 annually to my funds in 2019). One of the rules mandated funds establish Highly Liquid Invest Minimums in any portfolio.

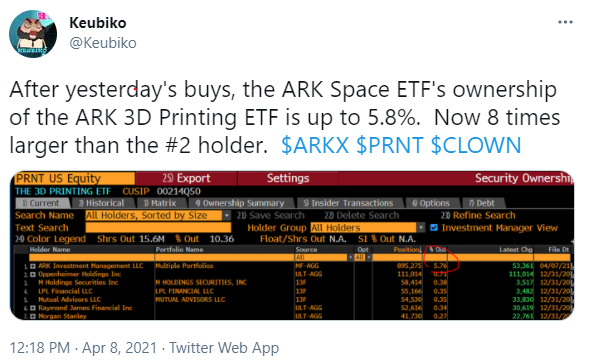

3/ Guess who was exempt from compliance with the HLIM provisions? In-kind ETF’s and ETF’s that publish daily holdings.

4/ 22e-4 aimed to reduce “liquidity risk,” defined as the risk that a fund could not meet redemptions without significant dilution of remaining investors’ interests in the fund. Aimed at mutual funds and probably triggered by this Third Avenue Fund issue as much as anything.

5/ The rule was supposed to also respond to the issue of "significant increases in inflows into less liquid fund strategies, such as fixed income, emerging market debt, and alternative." Note no mention of equities. . .

6/ The SEC’s goal was “promoting. . . more effective liquidity risk management across open-end funds” as it had been 20 years since the last update. Attached is our funds template for the calculation. Simple calc based on % of fund and % of daily ave volume.

7/ More than anything, the SEC's goal was to identify ILLIQUID assets. We had to bucket our holdings into four categories of liquidity (more on that in a minute).

8/ In mutual funds, guidelines generally limit holdings of “illiquid assets” to 15% of a fund’s total assets. A security is considered illiquid if it cannot be sold in the ordinary course of business within seven days at approximately the value at which the fund has valued it.

9/ Here’s a mutual fund-only requirement: Form N-LIQUID must be filed with the SEC to report a breach of the 15% illiquid investment limitation or if a fund falls short of its highly liquid investment minimum for 7 consecutive calendar days. But not in-kind ETF’s.

12/ Here’s where N-PORT gets interesting. The rule states no fund or In-Kind ETF may purchase an illiquid investment if, immediately after the acquisition, more than 15% of its net assets would be illiquid investments. That’s wide-open to interpretation. And monkey business.

13/ Here’s what you’re supposed to do: If a fund holds more than 15% of its net assets in illiquid investments, it must report to its board within 1 business day with an explanation of the extent and causes of the breach, and its plan to decrease its illiquid investments.

14/ Such a breach must also be confidentially reported to the SEC within 1 business day.

15/ A fund must disclose the percentage of its holdings in illiquid investments on Form N-PORT; definition of “illiquid” for purposes of the 15% limit is the same definition used for classification purposes– a departure from long-standing SEC guidance.

16/ These definitional issues are the key and are Bill Clinton-parsing-worthy. The key is the volume of the underlying shares RELATIVE TO PRICE ACTION. If one can get out of a position without moving the price materially in a bad market, that’s a liquid security.

17/ Now imagine a bad market and a thin stock. You think that might change your views on whether a company’s shares are liquid or not? It damn well should.

18/ We used to be a top 5 holder in Shenandoah Telecom. Every month for 11 years, that name was on our illiquid list for obvious reasons. It would take me a month to exit, and I’d still move the price. Now think about what you could do to “manage” your way in and out?

19/ I’ve been doing this a long time. Ain’t no babe in the woods. There are many, many popular well-known prominent fund managers who routinely appear on CNBC that walk their less liquid positions up into quarter end. It’s a little bit of a game.

But the SEC has rules governing this stuff. Admittedly open to interpretation, but rules do exist.

• • •

Missing some Tweet in this thread? You can try to

force a refresh