#Juventus 2017/18 accounts cover a season when they won the league (for the seventh year in a row) and the Italian Cup, but were eliminated in the Champions League at the quarter-final stage by eventual winners Real Madrid. Some thoughts in the following thread.

#Juventus moved from €58m profit before tax to €10m loss in 2017/18 (€19m loss after tax), a €68m deterioration, largely due to profit on player sales falling by €46m from €140m to €94m. Including this activity, revenue (per Juve’s definition) dropped from €563m to €505m

#Juventus broadcasting revenue fell €33m (14%) to €200m, due to the earlier exit in the Champions League. For much the same reason, ticket sales declined €1m (2%) to €56m, but commercial income rose €25m (20%) to €146m. Player loans were down €2m to €8m.

#Juventus player amortisation shot up €25m (30%) from €83m to €108m, while depreciation was also €3m higher at €13m. On the other hand, the wage bill was cut by €3m (1%) from €262m to €259m and other expenses fell €14m (10%) to €124m. Net interest payable flat at €9m.

Looking at results announced in the last two seasons, over half of the clubs in Italy’s top flight are profitable with Napoli leading the way with €101m in 2016/17. Although a loss is never great, #Juventus €10m loss before tax is by no means the worst in Serie A.

In fact, #Juventus €19m loss after tax is significantly better than the €126m loss recently announced by Milan and around half Roma’s €36m deficit in 16/17. Club president Andrea Agnelli criticized the Italian tax system, which he said “heavily penalizes” the football sector.

#Juventus loss would have been even higher without €94m profit on player sales, mainly Bonucci to Milan, Lemina to Southampton, Romagno to Cagliari and Lirola & Cassata to Sassuolo. Previous season was a massive €140m, benefiting from Paul Pogba’s lucrative sale to #MUFC.

#Juventus had reported pre-tax profits four years in a row, adding up to €81m, before the 2017/18 loss. However, the club is no stranger to losses, having racked up €151m in the three years between 2011 and 2013. The club currently forecasts another loss in 2018/19.

Profit on player sales has become increasingly important to #Juventus, averaging €117m in last 2 seasons, compared to €22m in preceding 6 seasons. Excluding this activity, loss would be €104m in 17/18. Currently, only €36m for 18/19 (Caldara to Milan & Mandragora to Udinese).

#Juventus EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered as a proxy for cash operating profit, as it excludes once-off items like player sales and exceptional items, increased from €23m to €28m, but is a long way below the 2015 peak of €66m.

That said, #Juventus €28m EBITDA is still one of the best in Italy, only surpassed by two Serie A clubs in 2016/17, namely Napoli €74m and Inter €57m. However, for some perspective, Real Madrid EBITDA was €94m, while #MUFC was an incredible €200m.

Excluding player sales, #Juventus revenue fell €11m (3%) from €422m to €411m. However, worth noting that revenue has grown by €255m since moving to the new stadium in September 2011. All streams have increased: TV €111m, commercial €93m, match day €45m & player loans €6m.

#Juventus revenue of €411m is by some distance the highest in Italy, around €130m more than the closest challenger, Inter €280m, followed by Milan €214m, Napoli €204m, Roma €183m and Lazio €129m. All other clubs in Serie A have revenue less than €100m.

Not only do #Juventus have the highest revenue in Italy, but the gap is growing. Since 2011 they have grown revenue by around a quarter of a billion (using Deloitte Money League definition), while the next highest increase is Napoli €86m. Milan’s revenue has actually reduced.

Juventus have the 10th highest revenue in the world with €406m, according to Deloitte Money League, which sounds fantastic until you appreciate the magnitude of the difference with the elite clubs’ revenue, e.g. Manchester United and Real Madrid were almost 70% higher at €675m.

#Juventus broadcasting revenue fell €33m (14%) to €200m in 2017/18, very largely due to lower Champions League TV money. In 2016/17 their €233m was among the highest in Europe, though driven by €110m from CL. Domestic €123m was much lower than English & Spanish clubs.

#Juventus received estimated €117m from Serie A, distributed: 40% equal share; 30% performance (5% last season, 15% last 5 years, 10% historical); 30% profile (25% supporters, 5% population). New deal from 18/19 is higher, but less favourable to Juve with equal share up to 50%.

#Juventus earned €78m money for reaching Champions League quarter-finals in 2017/18, which was €32m less than the record €110m in 2016/17 when they were finalists. This was less than €82m Roma received for getting to the semi-final, but double Napoli’s €38m for group stage.

#Juventus Champions League revenue has been helped by continually winning the Italian league, as first half of TV pool is distributed based on finishing position in the previous season’s domestic championship, though second half of TV pool was hit in 17/18 by fewer games played.

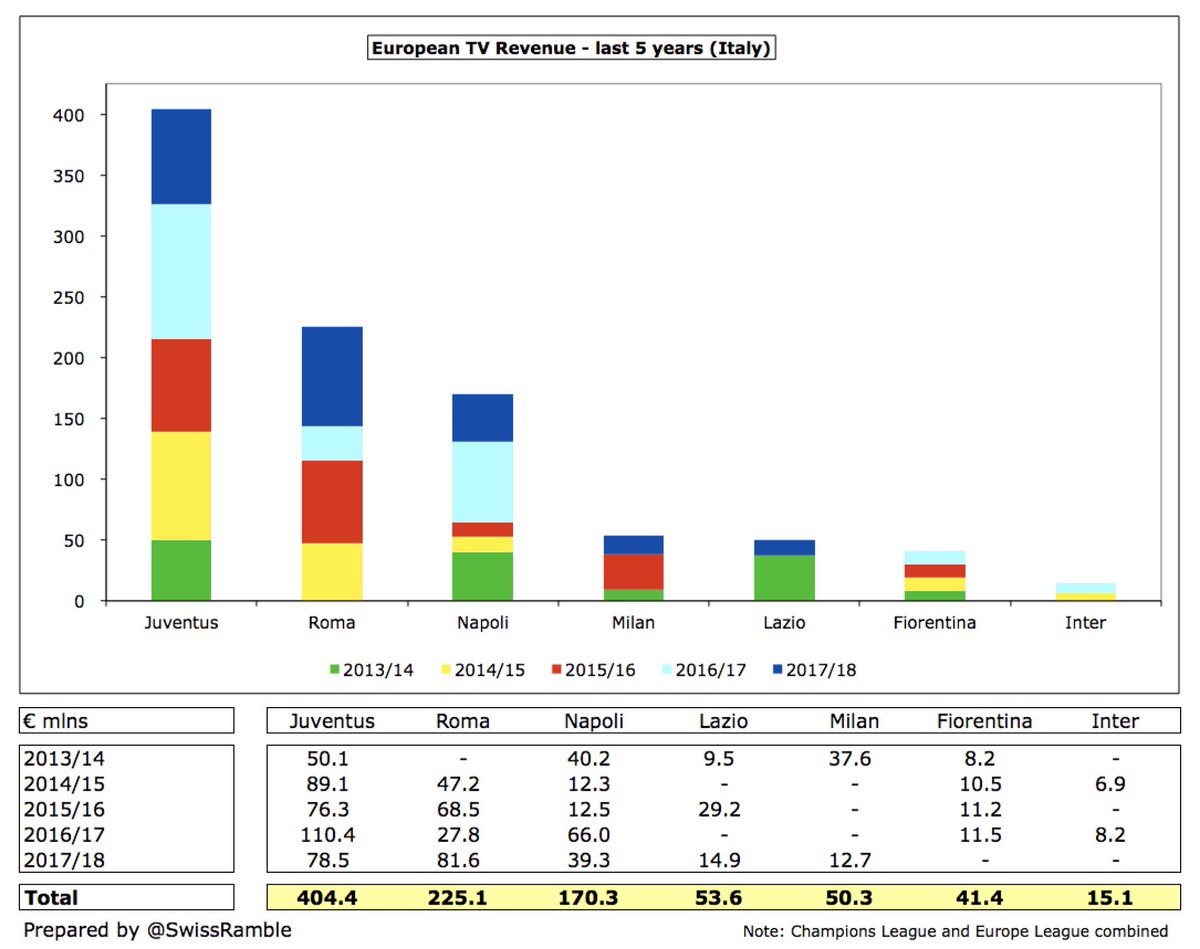

The Champions League is extremely important for #Juventus, who have earned an impressive €404m from Europe in last 5 seasons. Not only is this much higher than other Italian clubs (Roma €225m, Napoli €170m, Lazio €54m), but the most in Europe (next highest Real Madrid €358m)

Champions League revenue will rise by 54% in 2018/19. There is also a new UEFA coefficient payment (based on performances over 10 years), where #Juventus has the 6th highest ranking of clubs competing this season, guaranteeing them €30m (Inter €18m, Napoli €13m & Roma €12m).

#Juventus match day income fell €1.4m (2%) from €57.8m to €56.4m, mainly due to one less Champions League game, but still by far the highest in Italy, twice as much as 2nd placed club Inter €28m. Stadium is one of only three club-owned in Serie A (others: Udinese & Sassuolo).

However, #Juventus average attendance of 38,500 is only 4th highest in Italy, behind Inter, Milan and Napoli, though 41,500 capacity is much lower. Despite an average 30% price increase for 2018/19, all 29,300 season tickets have been sold, increasing revenue by €4m.

#Juventus commercial income rose €25m (20%) to €146m, comprising sponsorship/advertising €87m, merchandising €28m & other €31m (including museum & stadium tours). This is the highest in Italy, ahead of Inter €137m & Milan €107m, then a big gap to Napoli €39m & Roma €34m.

However, #Juventus commercial income is still a long way behind the European elite, such as Bayern Munich €343m, #MUFC €325m and Real Madrid €301m. As Agnelli said, “We must be capable of significantly increasing our commercial revenue to consolidate our position at the top.”

#Juventus have long-term sponsorship deals with Adidas €23m and FIAT (Jeep) €17m. Renegotiated shirt deal to bring licensing and merchandising in-house, which costs more, but has greater revenue potential (important with Ronaldo signing). €6m for Allianz Stadium naming rights.

#Juventus player loans income down €2.3m (22%) from €10.8m to €8.5m in 2017/18, though this will increase to €27m in 2018/19 (Higuain to Milan €15m, Pjaca to Fiorentina €6m and Audero to Sampdoria €6m).

#Juventus wage bill decreased by €3m (1%) from €262m to €259m, due to lower bonuses, offset by higher fixed salaries, though wages to turnover ratio increased from 62% to 63%. Wages have grown €75m (41%) in 4 years. Ronaldo annual salary reportedly €30m (€60m including tax)

#Juventus wages have grown by €119m (85%) since 2011, clearly outpacing other Italian clubs. Growth is more than twice Napoli €50m & three times as much as Lazio €41m and Roma €38m. Both Inter & Milan have seen their wage bills dramatically cut (€42m and €39m respectively).

Following the slight increase to 63% in 2017/18, #Juventus wages to turnover ratio is mid-table in Italy. Of the bigger clubs, this is lower (better) than Roma 79% and Milan 70%, but higher (worse) than Inter 56% and Napoli 50%.

In Europe #Juventus had the 7th highest wage bill of the Money League clubs in 2016/17, though their €262m was €115m below Real Madrid €377m. This is 3 positions higher than their revenue (10th largest) Wages are around the same level as Bayern Munich €265m.

The other #Juventus staff cost, player amortisation, which is the annual cost of writing-off transfer fees, increased by €25m (31%) from €82m to €107m, reflecting investment in the playing squad. This expense has more than tripled from €35m in 2011.

As a result, #Juventus player amortisation of €107m is the highest in Italy, a fair way ahead of Napoli €76m, Inter €74m, Roma €53m and Milan €44m. For more context, player amortisation at the big spending Manchester clubs (United and City) is around €155m.

#Juventus net transfer spend has significantly increased recently, almost doubling in the past 4 years with an annual average €65m, compared to €35m in the previous 6 years. Gross spend up from €65m to €189m, while sales also up from €30m to €124m.

Over the last 4 seasons, #Juventus have the second highest net spend of €259m in Serie A, only behind Milan €279m, but well ahead of Inter €152m, Bologna €40m and Napoli €39m. Roma have net sales of €90m.

The difference is even more stark in gross spend with #Juventus €757m being over €300m more than Inter €439m and Milan €432m, followed by Roma €385m and Napoli €273m. 2018/19 purchases include Ronaldo €100m, Cancelo €40m, Bonucci €35m and Perin €12m.

#Juventus net financial debt increased from €163m to €310m; as gross debt rose from €307m to €329m, while cash fell from €144m to €19m. Comprises bank loans €182m, amounts owed to factoring companies €110m and due to Istituto per il Credito Sportivo €37m.

#Juventus gross debt of €329m is the second highest in Italy, only behind Inter €429m (linked to Goldman Sachs financing). Much of Juventus debt is due to funding required for their new stadium. Net interest payable was €9m, much lower than Inter €33m & Roma €21m.

In addition, #Juventus owe €175m transfer fees, the highest in Italy, ahead of Roma €129m, Inter €113m and Napoli €112m. However, on a net basis this reduces to €58m after considering €117m owed to Juve by other clubs.

#Juventus had a net €82m cash outlay in 2017/18. Generated €7m from operations, but spent net €119m on players, €15m tax, €13m capital expenditure & €6m interest payments. There was €50m of new funding & €50m increased use of committed lines, but €35m loan repayments.

In the last decade #Juventus have had €740m available cash: €305m from operations, €152m loans (net), €119m share capital and €165m from a reduction in cash balance. Over half spent on players (net) €399m with €227m capex (mainly stadium) plus €71m tax and €43m interest.

The #Juventus business model requires good progress in the Champions League – or they need profitable player sales. They have gambled on the expensive purchase of Cristiano Ronaldo, though the plan is that higher commercial revenue will help cover the outlay.

• • •

Missing some Tweet in this thread? You can try to

force a refresh