#libertyinvestorday

I will be tweeting though from the livestream.

Nice shout out in the opening remarks to @maffei_fake

I will be tweeting though from the livestream.

Nice shout out in the opening remarks to @maffei_fake

Maffei: We take the discount seriously $LSXMK. We are not going to mistreat tracking stock shareholders.

Maffei: There was a time when a media company was a great business but those times are changing. Multiples are compressing, Too much content, too many platforms. There are only 24 hours in a day. Over 200 OTT services.

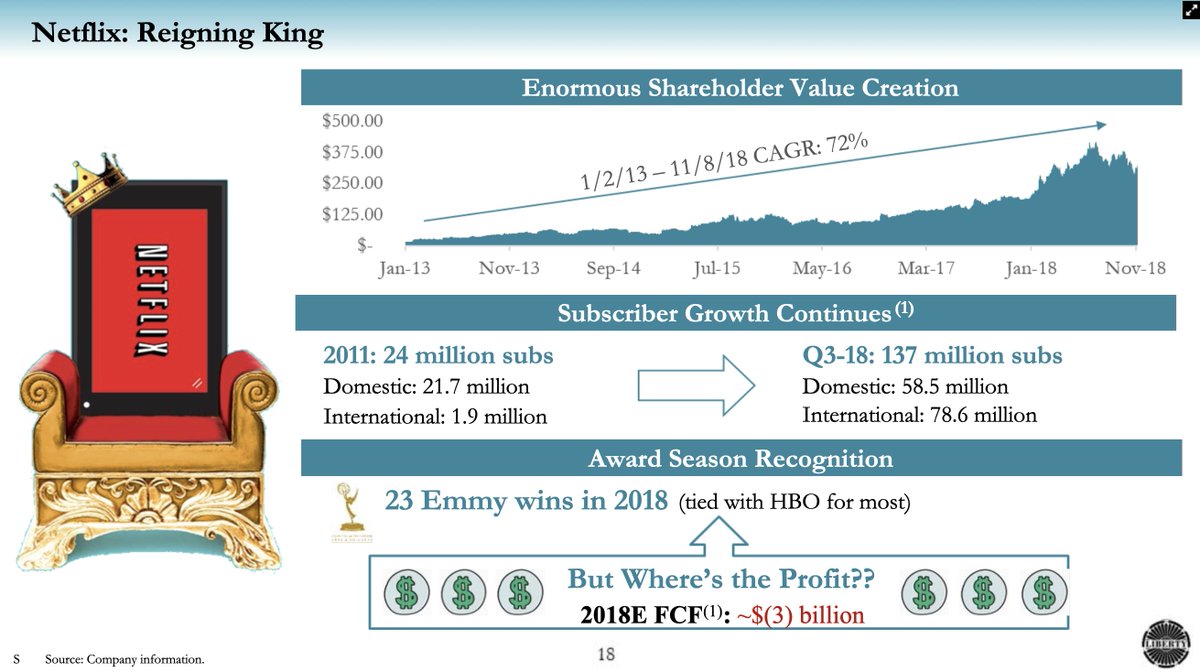

Maffei: No traditional media companies can compete with Netflix but Netflix might not even be able to compete with big tech companies. (Maffei is calling out $NFLX as likely having future problems and being capital intensive).

Meyer: We are in the radio business not the music distribution business. Our content spend has stayed in the range of 6-7% of revenue. In September, we reached an agreement that our royalty rate will remain flat for the next 9 years. Better than other media companies.

$SIRI

$SIRI

Meyer on the Used car market opportunity. The average car is owned 3.1x. There is much more we can do here. 360L is the future of dashboards, so get used to it. (dominant radio interface by the end of the decade in new cars)

Meyer on their Spectrum holdings: It's time to recognize this value. Mentions its use in autonomous driving.

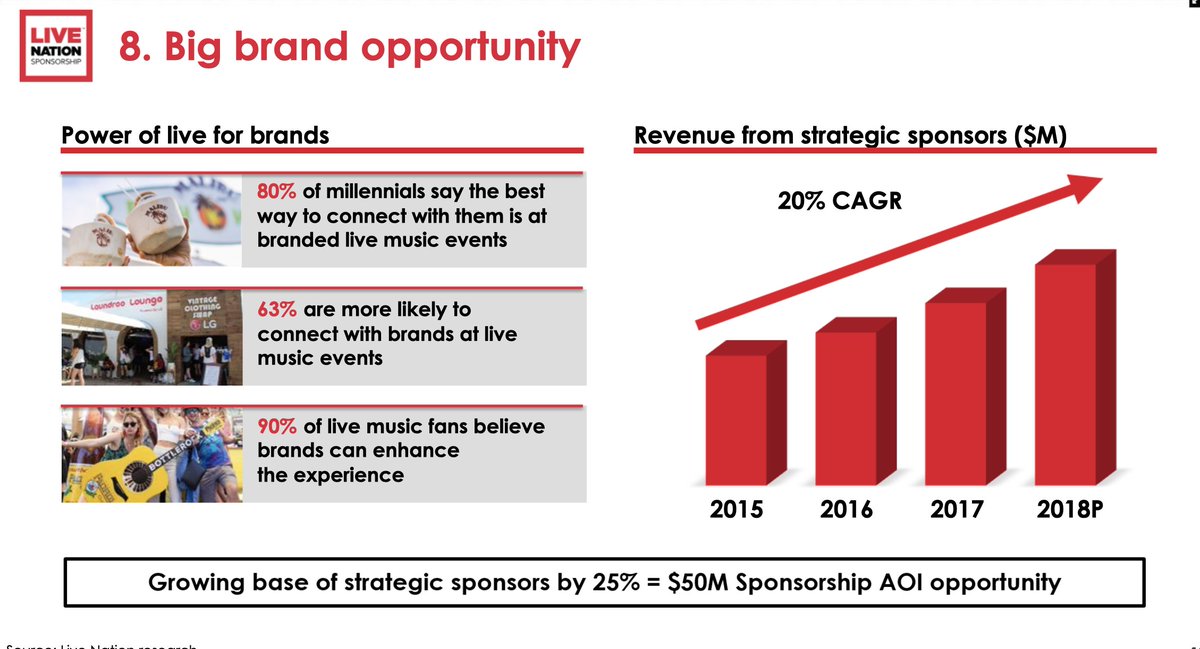

Rapino: Market is still fragmented. We look at it from a global perspective as music is global. Rihanna is global.

Rapino: Secondary ticket market will be solved by mobile tickets. Barcodes will be gone. Tickets will have to be authenticated by TicketMaster.

Rapino: Expect double digit top and bottom line growth. Not done yet. I just got options with a strike price of $75. (stock at $55). $LYV

Trip Advisor is doing a social network? $FB $TRIP

(This seems difficult to me) or is this just a Facebook plug-in?

(This seems difficult to me) or is this just a Facebook plug-in?

Kaufer: "Most consumers still see Google as just a search engine." (I feel that might be a stretch...) $TRIP $GOOGL

Q&A:

Q: On Liberty Sirius XM Discount.

A: We could eliminate the discount tomorrow but there is a tradeoff.

Malone: "A discounted capital structure is an opportunity, creates double leverage. Higher IRR. Doesn't bother me as a long term shareholder, it's an opportunity.

Q: On Liberty Sirius XM Discount.

A: We could eliminate the discount tomorrow but there is a tradeoff.

Malone: "A discounted capital structure is an opportunity, creates double leverage. Higher IRR. Doesn't bother me as a long term shareholder, it's an opportunity.

Malone: Not everybody will be able to build a direct to consumer platform, there will be orphans. Expect a lot of transactions. The merger of Discovery with Scripps would be an example, while they figure out how to navigate the transition.

Malone: The broadcasters' fees are dependent on sports. Their entertainment programming is being supplanted by the Netflixes of the world. They don't have the content budge to compete, and their ad budgets are losing to data driven companies like Google and Facebook.

Malone: Netflix disintermediated content production. Amazon and Apple are now doing the same. A lot of companies today are becoming free radicals. (eg. expect more M&A).

Looks like I missed the afternoon session. The replay will be on their website.

ir.libertymedia.com/events-and-pre…

Looks like I missed the afternoon session. The replay will be on their website.

ir.libertymedia.com/events-and-pre…

Rich Greenfield asking why didn't Charter sell when it had 4 bidders

Malone: We didn't have an attractive enough offer.

Q: On Linear video long term.

Maffei: Video is clearly declining, we can be a retailer or content and that can be a good business.

Malone: We didn't have an attractive enough offer.

Q: On Linear video long term.

Maffei: Video is clearly declining, we can be a retailer or content and that can be a good business.

Malone is essentially saying that cable companies will become the digital home hub. (This is a new comment to me)

• • •

Missing some Tweet in this thread? You can try to

force a refresh