Canadian listed #govermedia caught my eye yesterday having recognised #EXMO from #cryptocapital. Gover is keen to acquire EXMO as per the MOU signed in Nov. It appears most news sites have assumed that its the UK registered company EXMO Financial that Gover signed up.

But Gover appears to have occidentally forgotten to state which #EXMO entity the deal is with. To be fair they could be confused themselves as the register has been flooded with new EXMO entities, 2 EXMO LLC companies were recently renamed

belize, seychelles, malta, romania, Lithuania, Russia what a well travelled and colourful group (that may or may not even be a connected group). Two names of interest popped out. Pavrel Lerner and Ivan Petuhovschii.

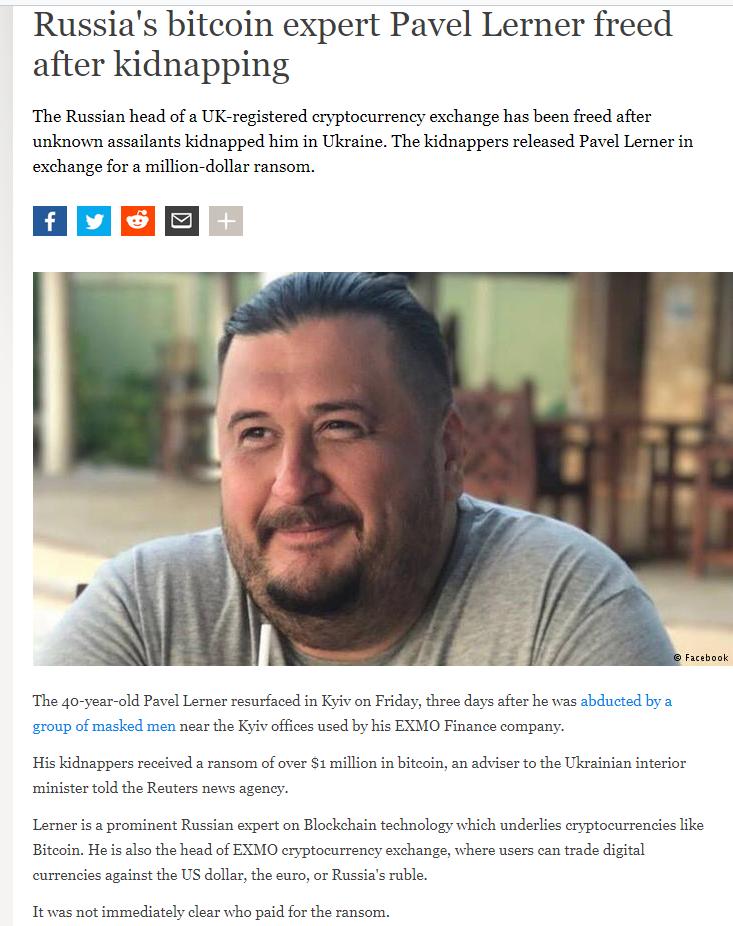

Poor old Pavrel had run of bad luck back in 2017, when he was kidnapped and had to cough ransom of $1m in bitcoin. But that might only be part of the story - in Jan 2018 Pavrel transferred his 50pc of EXMO financial to Romanian Olga M beneficial owner and first time director.

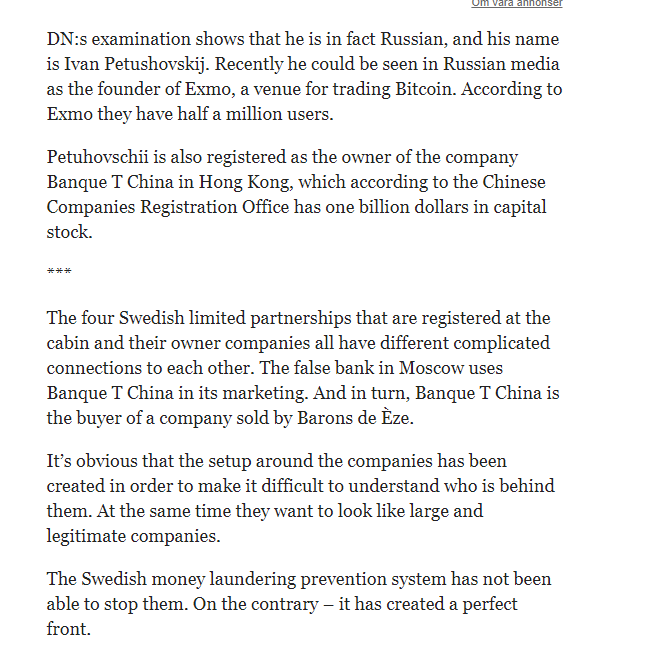

As interesting as that is. Its not a shade on co-founder Petuhovsky. Who owns this retro chic shack in Sweden. Where him and his mates appear to have built a nice niche for themselves. dn.se/nyheter/sverig…

I’ve run of time. I could have rambled on for ever. Might take a look at their other deals tomorrow...

unroll @threadreaderapp #bitsonar

• • •

Missing some Tweet in this thread? You can try to

force a refresh