Some of my notes on the likely disruption coming in 2020 in mining sector in India.

This will be due to the lease of several mines expiring under

(1) MMDR Amendment Act 2015

(2) State Govt and Indian Bureau of Mines (IBM)

Let's see each one of them and likely impact. (1/n)

This will be due to the lease of several mines expiring under

(1) MMDR Amendment Act 2015

(2) State Govt and Indian Bureau of Mines (IBM)

Let's see each one of them and likely impact. (1/n)

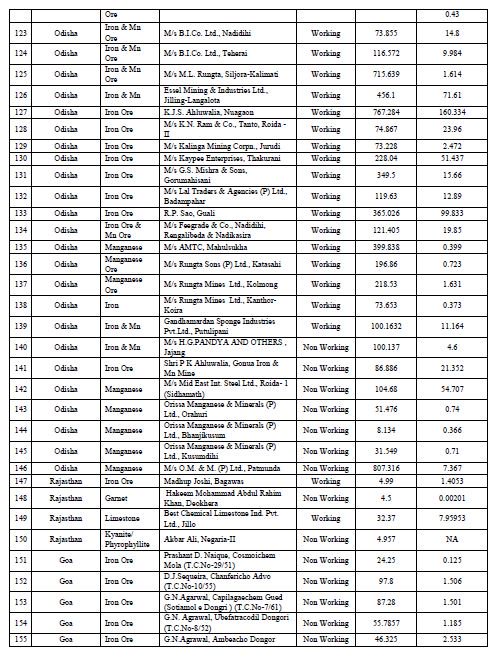

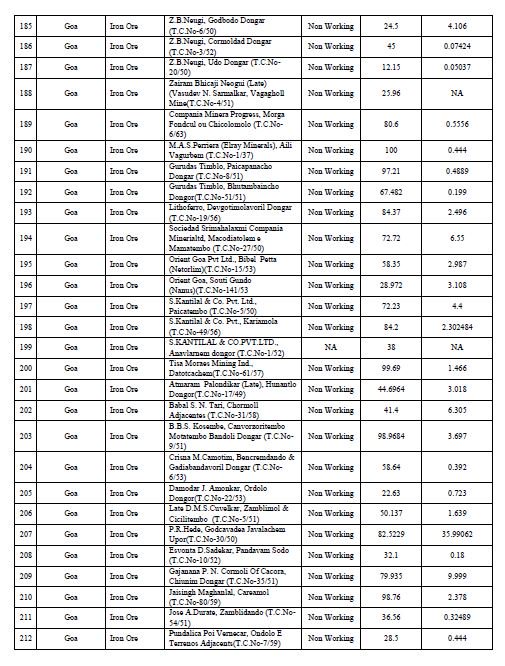

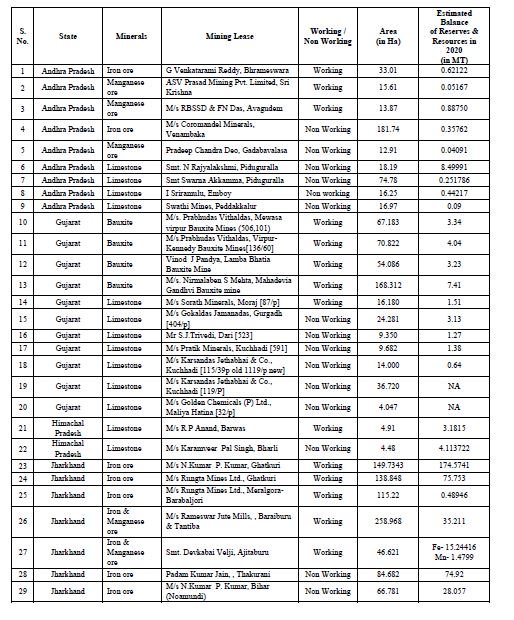

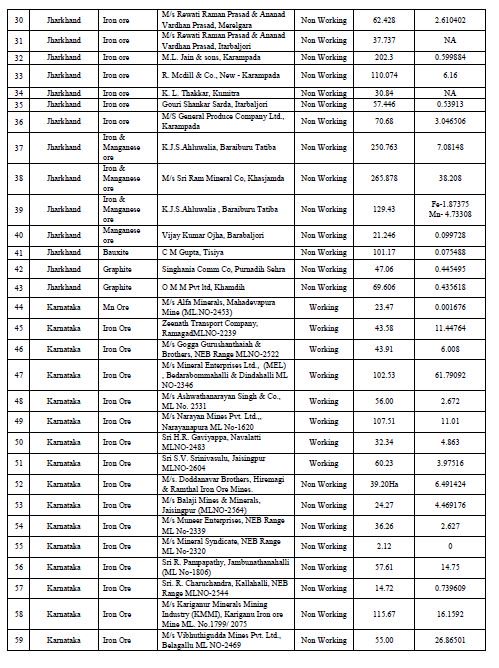

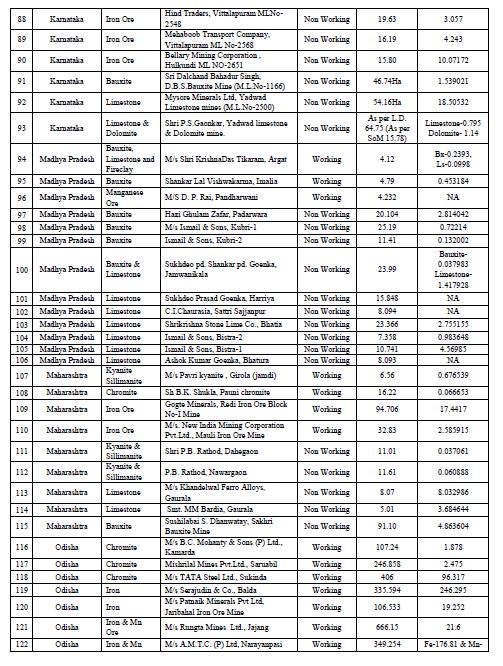

MMDR Amendment Act 2015, there will be 334 leases (49 working and 285 non-working) of iron ore/Manganese/Chromite mines to be expiring in 2020.

The key in this list of 334 mines is 31 mines from Odisha and 50 from Karnataka. (2/n)

The key in this list of 334 mines is 31 mines from Odisha and 50 from Karnataka. (2/n)

The working mines of Odisha and Karanata contribute approx 28% of iron ore capacity, 15% of Manganese and 50% capacity of Chromite of India. These may cause major disruption in the supply of iron-ore in 2020. (3/n)

Beside mines under MMDR, State Governments and Indian Bureau of Mines (IBM) have 104 mines (49 working mines) to be put on auction in 2020 and the majority of them are from Odisha and Karnata. (4/n)

The committee set up by GOI taking corrective steps to avoid disruption. However, we have seen what happened in Donimalai mine case of NMDC. The Karnataka government did not allow the lease extension causing disruption. (5/n)

Source: the latest GOI report. (6/6)

Details of the mining leases expiring in 2020. This includes name and status of the mine, area covered and available MT mining for 2020.

7/n

7/n

@threadreaderapp please #unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh