Thread: A little bit of fun #Bitcoin history. Back in 2010, someone posted a contest on the Bitcointalk forum pledging 20 BTC to whoever submit the funniest bitcoin image with the word "Bitcoin GALORE!" It quickly ballooned to 40 BTC as others added to the pot. 👇

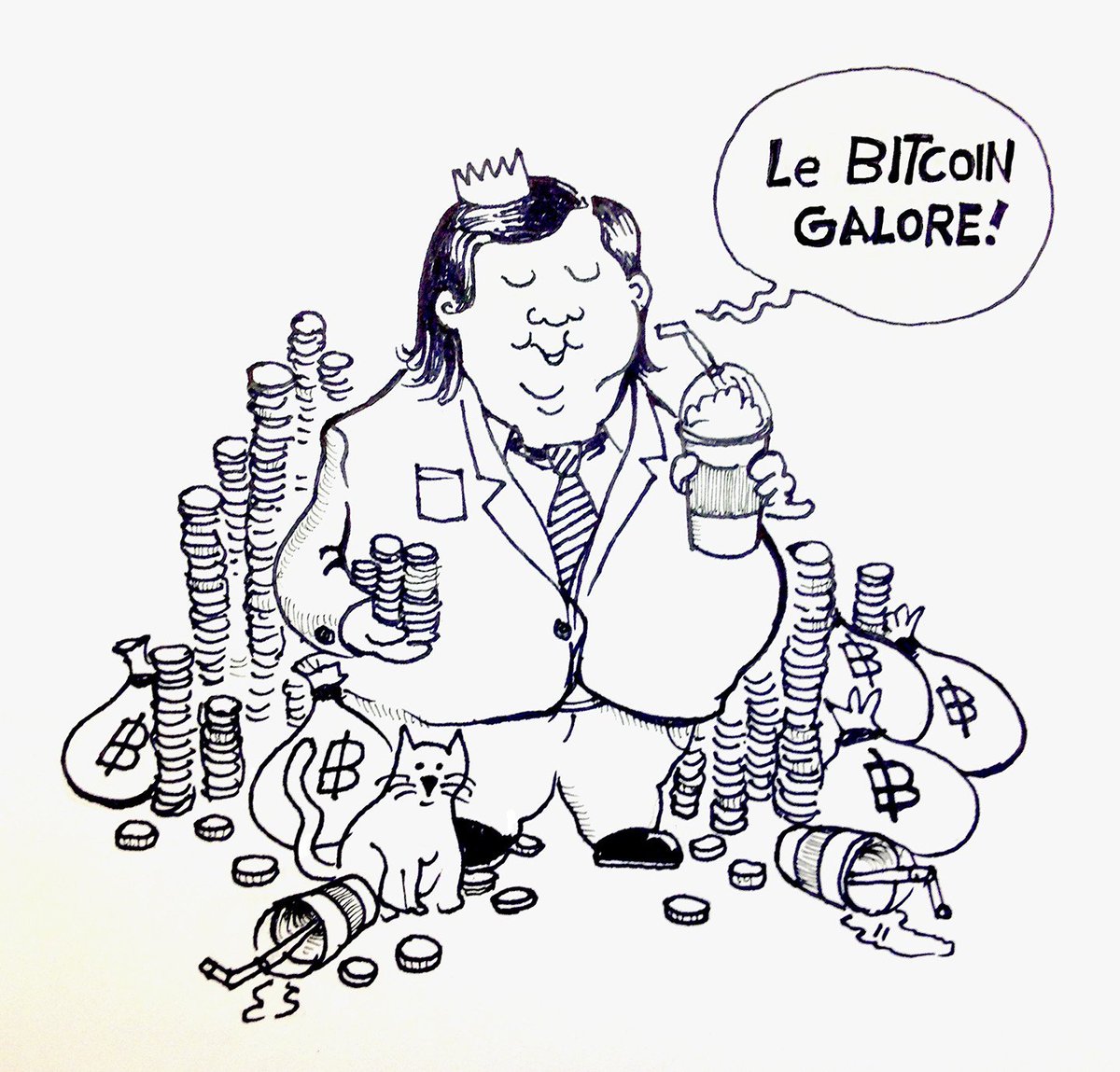

At the time, that was worth about $20. Today, that's worth about $430,000. THIS was the glorious winner of the contest, a piece of art that would put Da Vinci to shame:

Four years later, in November of 2014, I posted a similar contest on Reddit. No, I didn't give 40 BTC. I gave the USD equivalent of $20, which was at the time .04 BTC or 4,000,000 sats. I also added 4M sats more for the top ten submissions. One Bitcoin was $440 at the time.

In today's #Bitcoin price, that's $850. This was the masterpiece that won that contest. For those who have been around since those early days, we all know who this guy is. A dead accurate rendition of one of the most infamous people in Bitcoin.

I actually did it again, four years later, in 2018. This time I celebrated 1M subscribers on r/bitcoin with the same contest, and gave away 1,000,000 sats, which was about $40 at the time, now worth $107. Fewer people participated, so I had to choose the most original entry.

Maybe one day it will also become a part of #bitcoin history... but probably not😆. It was called "The Regretful Nocoiner":

So it goes without saying that I will be doing this again in 2022. What's the contest going to look like in 2022? How many Satoshis will $40 cost? How much will all that BTC I gave away be worth? How much will the original 40 BTC be worth?

Let's HODL and see. 💪🚀

Let's HODL and see. 💪🚀

LINKS:

Bitcointalk thread: bitcointalk.org/index.php?topi…

My 2014 Reddit contest results: reddit.com/r/Bitcoin/comm…

My 2018 Reddit contest results: reddit.com/r/Bitcoin/comm…

Bitcointalk thread: bitcointalk.org/index.php?topi…

My 2014 Reddit contest results: reddit.com/r/Bitcoin/comm…

My 2018 Reddit contest results: reddit.com/r/Bitcoin/comm…

• • •

Missing some Tweet in this thread? You can try to

force a refresh