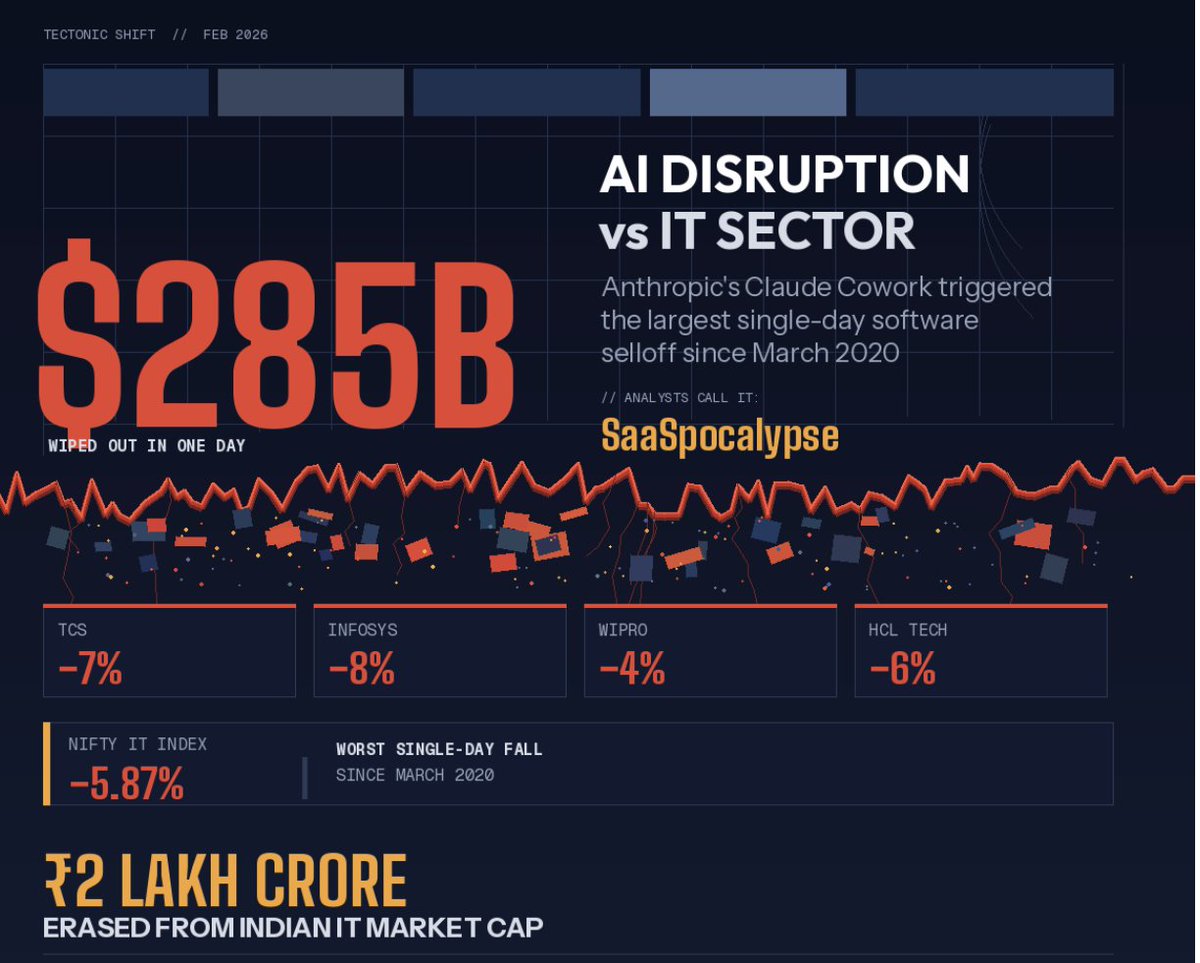

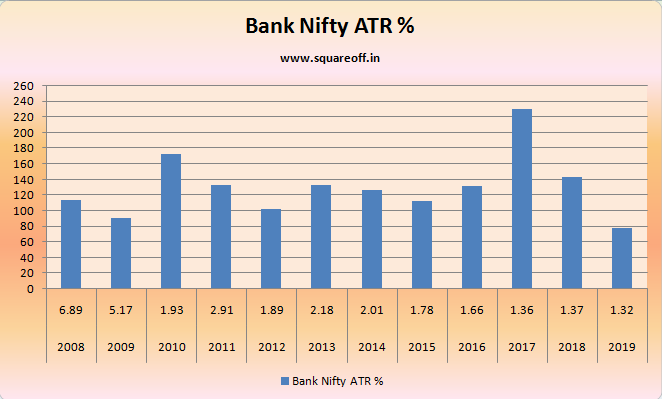

This is a 10 year data analysis on #BankNifty index,

Y axis represents no of days and X axis represents each year and what is the Bank Nifty #ATR % that has occurred maximum in that year.

Y axis represents no of days and X axis represents each year and what is the Bank Nifty #ATR % that has occurred maximum in that year.

For instance, year 2008 was highly volatile year every recorded in history where more than 100 days, the ATR % was around 7%, which means if Bank Nifty is at 10000, it can move 7% either direction in just 1 day from its previous close price.

Is your breakout trading strategy did not work in 2017?

Its because 2017 has seen the lowest volatility ever in history, where Bank nifty ATR was just 1.36%, means, consider Bank Nifty at 25000, it did not move more than 350 points in either direction from its previous close,

Its because 2017 has seen the lowest volatility ever in history, where Bank nifty ATR was just 1.36%, means, consider Bank Nifty at 25000, it did not move more than 350 points in either direction from its previous close,

which means than most of the otm #options expired worthless 90% of the time, out of 252 trading days, more than 220 days, 90% of the time #BankNifty did not see any violent move at all, that was the obvious reason why #optionsellers made huge returns in the year 2017.

• • •

Missing some Tweet in this thread? You can try to

force a refresh