From a broker this morning: "The Case for Egyptian Equities: Our Egyptian coverage is trading at 8.9x 12-month forward earnings, with a 2019-21 EPS CAGR of 20% [...], with a market cap weighted upside of 39%. Egypt’s discount to EMs is near an all-time high". #Egypt

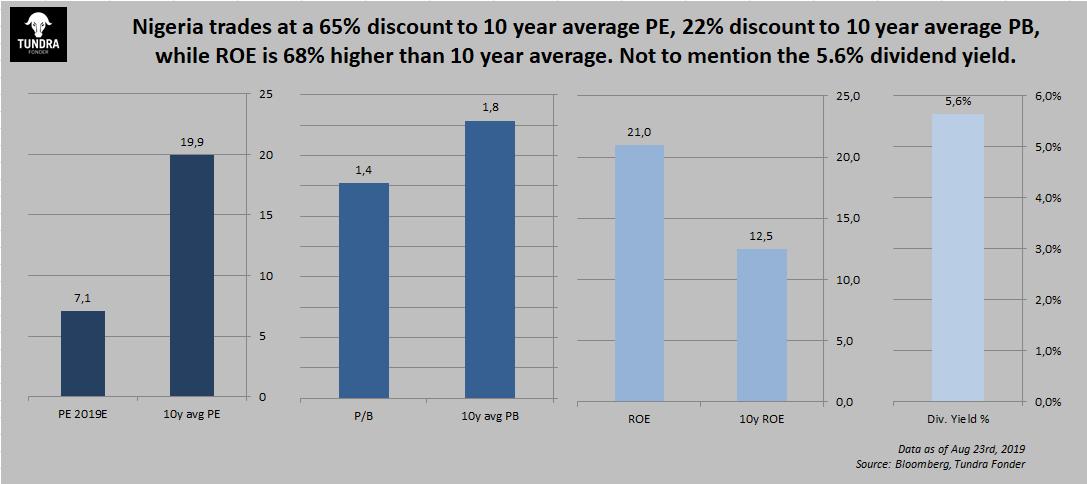

And similar arguments can be made for most of our investment universe, like #Nigeria #Pakistan etc. But as long as global investors continue to prefer to invest in negative yielding treasuries instead of almost certain growth discounts will remain.

Main question here is how long this irrationality will prevail.

• • •

Missing some Tweet in this thread? You can try to

force a refresh