@nsitharaman CSR violations not to be treated as criminal offence.

IT orders, notices, summons, letters, etc. to be issued through a centralized system.

IT orders, notices, summons, letters, etc. to be issued through a centralized system.

@nsitharaman @PIB_India @MIB_India @FinMinIndia Relief from enhanced surcharge on Long-term/Short-term Capital Gains.

Withdrawal of so-called 'angel tax' provisions for startups and their investors.

#NirmalaSitharaman

Withdrawal of so-called 'angel tax' provisions for startups and their investors.

#NirmalaSitharaman

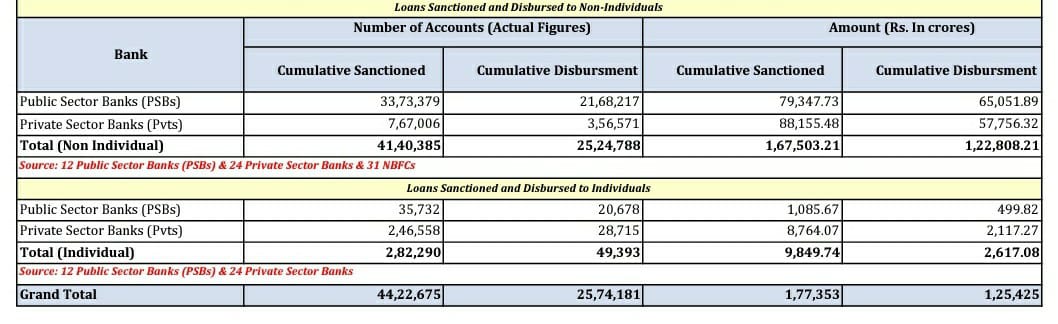

@nsitharaman @PIB_India @MIB_India @FinMinIndia Additional credit expansion through PSBs.

Banks to effect timely rate cuts.

Banks to launch repo rate/external benchmark linked products.

PSBs to ensure mandated return of loan documents within 15 days of loan closure.

#NirmalaSitharaman

Banks to effect timely rate cuts.

Banks to launch repo rate/external benchmark linked products.

PSBs to ensure mandated return of loan documents within 15 days of loan closure.

#NirmalaSitharaman

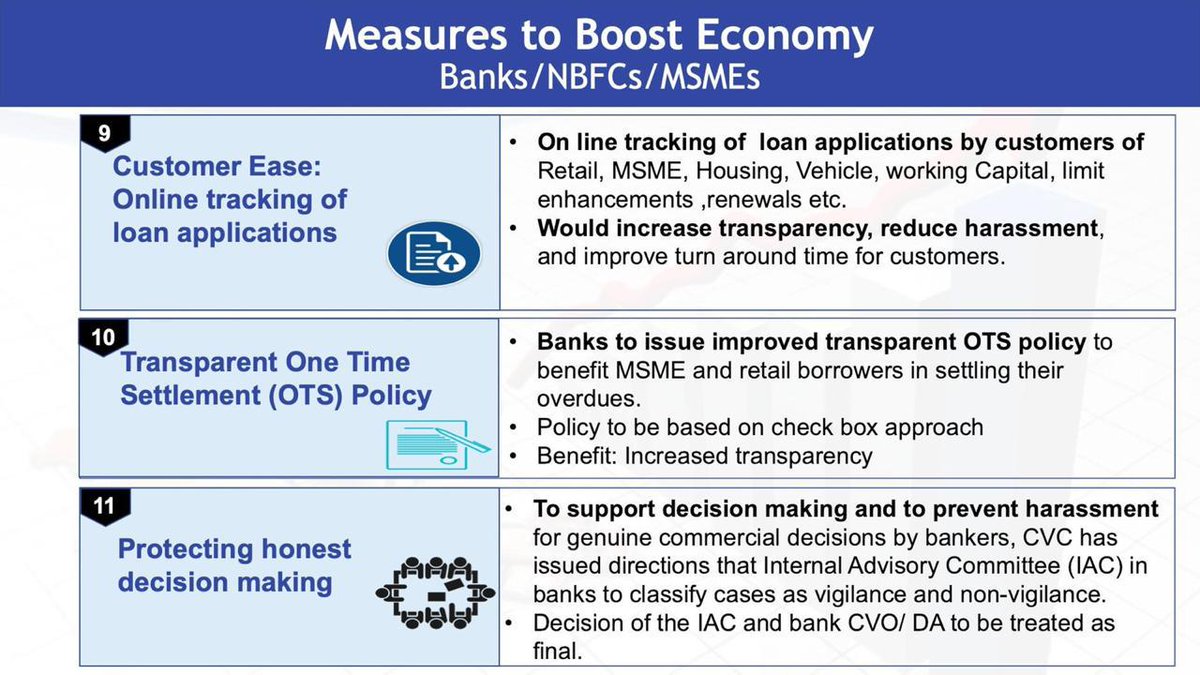

@nsitharaman @PIB_India @MIB_India @FinMinIndia Online tracking of loan applications by customers of Retail, MSME, Housing, Vehicle, etc.

Banks to issue improved One Time Settlement (OTS) policy to benefit MSME & retail borrowers in settling their overdues.

#NirmalaSitharaman

Banks to issue improved One Time Settlement (OTS) policy to benefit MSME & retail borrowers in settling their overdues.

#NirmalaSitharaman

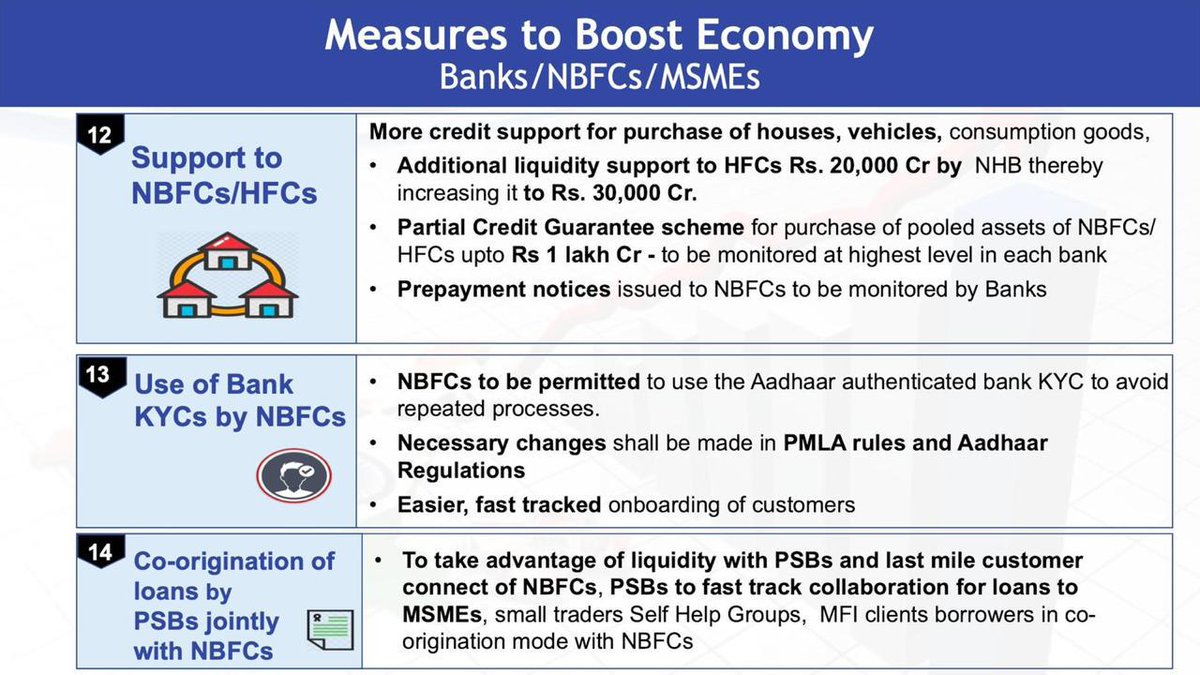

@nsitharaman @PIB_India @MIB_India @FinMinIndia More credit support for purchase of houses, vehicles, consumption good.

NBFCs to be permitted to use the Aadhar authenticated bank KYC to avoid repeated processes.

Co-origination of loans by PSBs jointly with NBFCs.

#NirmalaSitharaman

NBFCs to be permitted to use the Aadhar authenticated bank KYC to avoid repeated processes.

Co-origination of loans by PSBs jointly with NBFCs.

#NirmalaSitharaman

@nsitharaman @PIB_India @MIB_India @FinMinIndia Pending GST refunds to MSME within 30 days.

TReDS to use GSTN system in medium term to enhance market for bill discounting for MSMEs.

Amendment to MSME Act to come up with a single definition of 'MSME'.

#NirmalaSitharaman

TReDS to use GSTN system in medium term to enhance market for bill discounting for MSMEs.

Amendment to MSME Act to come up with a single definition of 'MSME'.

#NirmalaSitharaman

@nsitharaman @PIB_India @MIB_India @FinMinIndia Establishment of an organisation to provide credit enhancement for infrastructure and housing projects.

Further action on development of Credit Default Swap markets.

#NirmalaSitharaman

Further action on development of Credit Default Swap markets.

#NirmalaSitharaman

@nsitharaman @PIB_India @MIB_India @FinMinIndia The Depository Receipt Scheme 2014 is expected to be operationalised soon.

Aadhar-based KYC to be permitted for opening of Demat account and mutual funds investment.

Simplified KYC for foreign investors and FPIs.

#NirmalaSitharaman

Aadhar-based KYC to be permitted for opening of Demat account and mutual funds investment.

Simplified KYC for foreign investors and FPIs.

#NirmalaSitharaman

@nsitharaman @PIB_India @MIB_India @FinMinIndia Ministry of Finance is working with RBI to permit trading of USD-INR derivatives in GIFT IFSC.

#NirmalaSitharaman

#NirmalaSitharaman

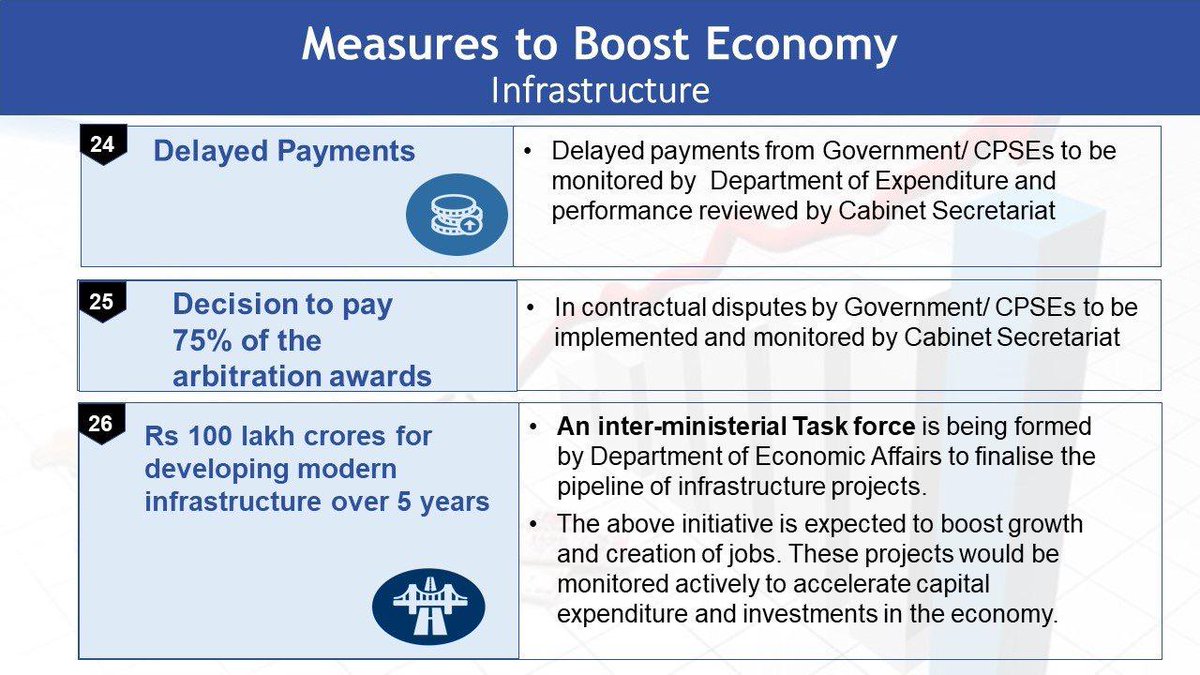

@nsitharaman @PIB_India @MIB_India @FinMinIndia Delayed payments from govt/CPSEs to be monitored by Department of Expenditure & performance reviewed by Cabinet Secretariat.

Decision to pay 75% of the arbitration awards

Rs 100 lakh crores for developing modern infrastructure over five years.

#NirmalaSitharaman

Decision to pay 75% of the arbitration awards

Rs 100 lakh crores for developing modern infrastructure over five years.

#NirmalaSitharaman

@nsitharaman @PIB_India @MIB_India @FinMinIndia BS IV vehicles purchased till 31.03.20 to remain operational for entire period of registration.

Additional 15% depreciation on all vehicles, to increase it to 30%.

Ban on purchase of new vehicles for replacing all old vehicles by departments lifted by govt.

#NirmalaSitharaman

Additional 15% depreciation on all vehicles, to increase it to 30%.

Ban on purchase of new vehicles for replacing all old vehicles by departments lifted by govt.

#NirmalaSitharaman

• • •

Missing some Tweet in this thread? You can try to

force a refresh