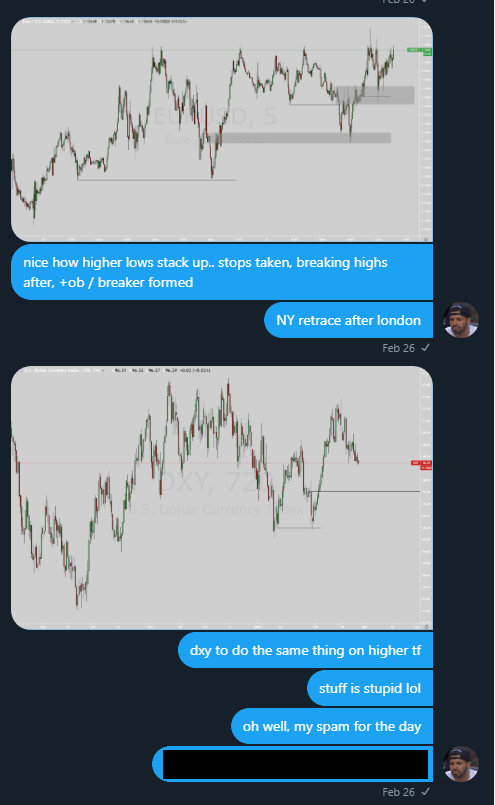

my main thing about these moves is if it doesn't react as you'd expect just stay out or get out, it probably isn't ready yet.

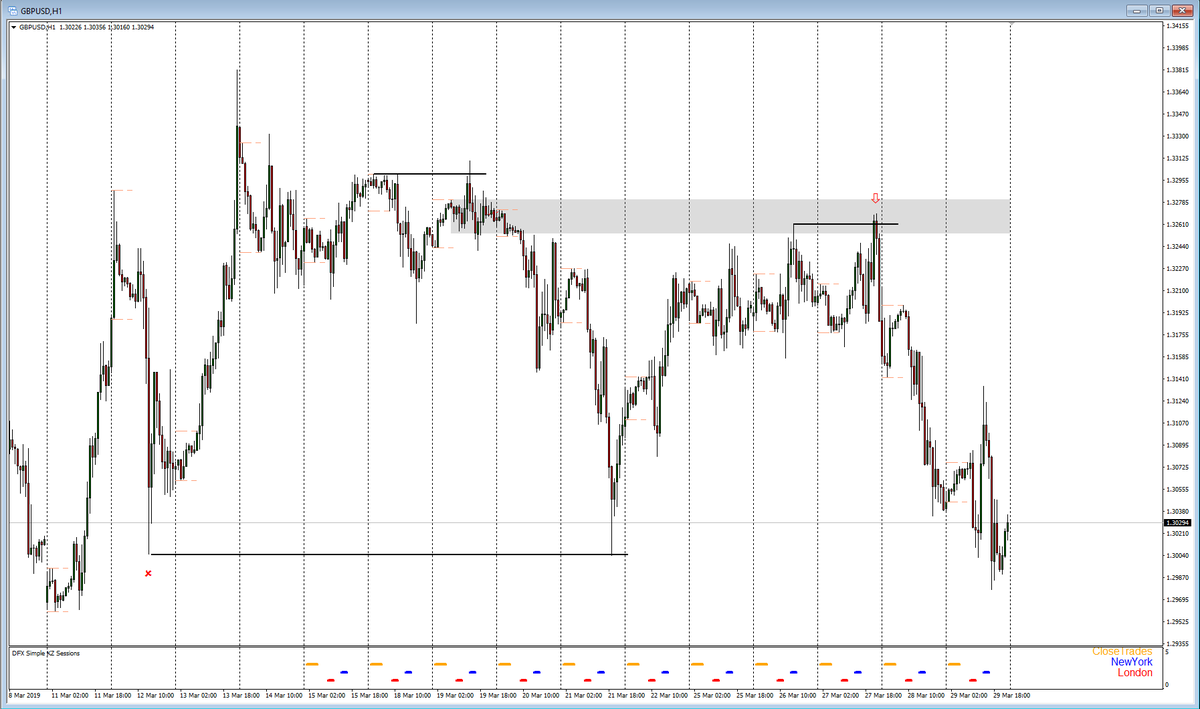

as long as it doesn't break it's ranging, no trend before that imo.

1) a defined trend direction

2) break of m/s confirming trend continuation

3) anticipate bearish retracement

4) wait for a liquidity run ( preferably into a block that broke m/s)

5) invalidation above liq run (new m/s high)

patience, which I try to build by backtesting like in the thread: seeing that the swing setups take place after a ~70% retrace making a liq run into the last place where you're wrong, which is where your ideal entry is.

then not trying to fight it lol