#optionselling - We know #StockMarket always moves up in longer run, what if we short the Put options every month, can we make money in the longer run, as it would expire worthless as market move up? So, I tested this logic with last 11 years data, including 2008 bear market.

I do not want to short deep OTM options, since premiums are too low in it, so i took OTM options which are just 2% away from Spot price. I enter the trade on expiry day and exit on next month expiry day. Monthly expiry,not weekly.

I did a scatter plot to find what's the close price of all trades from 2008 to 2019. As you can see, out of 140 expiry, almost 100 expiry, all put options expired worthless. near zero ,however there are certain days, where market tanked, and PUT options expired deep ITM

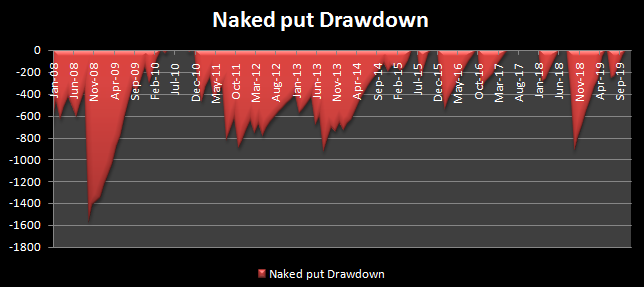

Did Naked Put #optionselling testing, Short 2% OTM expiry strikes and close it at the end of expiry day. No Stop loss. This is how the cumulative returns are, made 1269 points from 140 expiry, for last 11 years, with avg profit per expiry of just 9 points.

Obviously the draw down is higher and at times, for months to years, equity is under water, takes more time to recover when market tanks.

With Stop Loss: Since naked put involves high risk, i wanted to come up with #riskmanagement to control the loss when market tanks. I do not want to keep checking markets and do adjustments, so how do i exit the position when market keeps dropping?

Keep a stop loss of Entry price*2. If your entry price is Rs.100, stop loss is Rs.200. We give enough room for the markets to fluctuate, if it goes beyond this level, we book loss and exit the position. If not, we close it by end of expiry. Here;s the result, made 3000 points.

With implementing stop loss, parameter, we not only more than doubled the profits, we also reduced the draw down to a greater extent, even it takes lesser time to recover, since risk is limited in this strategy.

Short & Long: Now I got an another idea, i see that when market tanks, it drops big, so what if I not only close my position, if i also go long in put option when stop loss hits, what would be my profits?

So entry at 100, stop loss hits at 200, exited shorts with loss -100, now go long at 200, so that if market keeps dropping I make higher returns with my long put options. And this has resulted in even higher profits than the last two strategy, yielding 5000 points profits.

Though Drawdown is higher, its because after market dropping and triggering long trades, it can bounce back up and make put option expire worthless, there by losing trades in both long and short position. But we have got much higher returns than naked put writing.

Yearly performance of both Short only and Short/long strategy. After analyzing the 11 years, data sets, I can very well say, there is a trading edge in this strategy, where people can implement their own risk management rules to control the risk even further.

The complete blog post is here squareoff.in/single-post/Ni… Please RT and tag option experts to get their views and make the strategy even more robust.

• • •

Missing some Tweet in this thread? You can try to

force a refresh