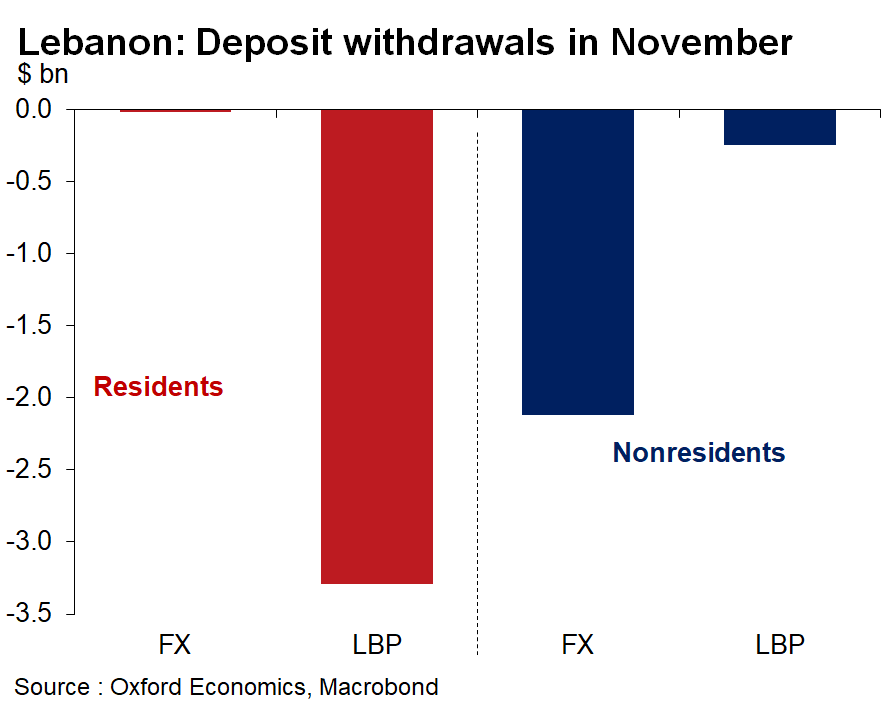

Despite capital controls in #Lebanon, there is a large amount of FX leakage going on. Looking at sources of remaining real hard $ suggests the FX outflow accelerated from $1bn in Oct to more than $3bn in Nov (the month when banks were closed or capital controls were in place)

This is worrying because a) the controls aren’t preventing seepage, as is widely suspected. @AndyKhalil1 this point in his thread on banks’ balance sheets. Capital controls on resident FX deposits are working, but not all nonresident FX deposit withdrawals are necessarily exiting

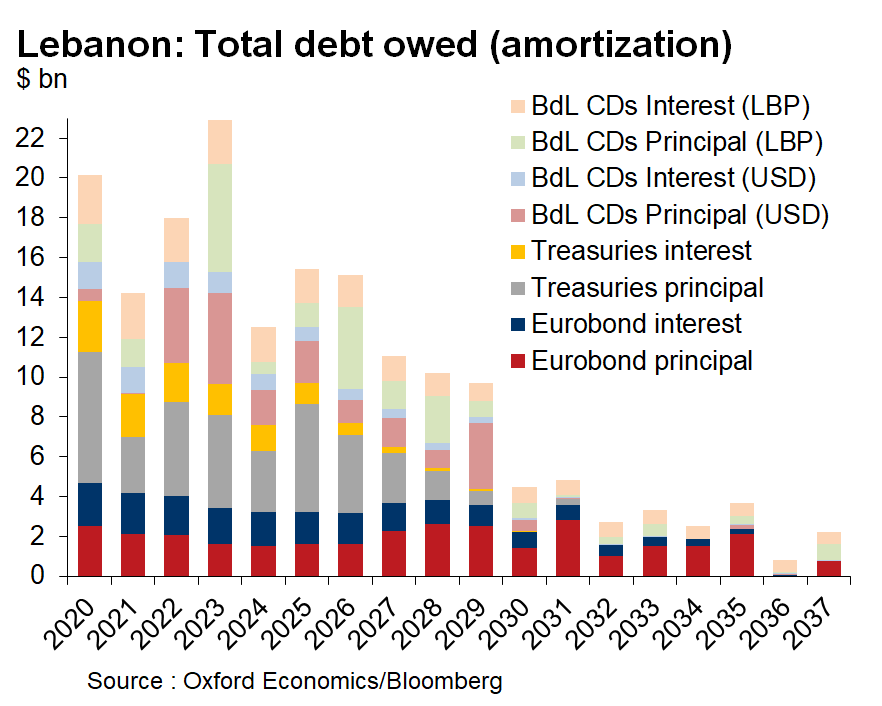

@AndyKhalil1 And b) it means that BdL’s reserves will last less than previously estimated (thread below), under assumptions of functional capital controls and import compression. If this pace of outflows is maintained, gross reserves would be depleted by August 2020.

https://twitter.com/nafezouk/status/1208043260683440128

@AndyKhalil1 Which is why, as @lebfinance pointed out, the existence of a reverse swap clause in BdL’s latest circular. The willingness to repay March 2020s exists, but BdL needs a backdoor to be left open if it is still unable or unwilling to control how much FX leaks out of the country

@AndyKhalil1 @lebfinance lots of side conversations about this with @AndyKhalil1 @lebfinance @EHSANI22 @AzarsTweets

• • •

Missing some Tweet in this thread? You can try to

force a refresh