EM strategist and Economist. Ex @OxfordEconomics, @IIF, @EBRD. Views are my own. For all things Lebanon check https://t.co/F075X5ODvi

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/AzarsTweets/status/1243476906143625217No matter how you do the DSA or how you tackle the maths, its inescapable that local-currency debt will also have to be restructured. So if haircuts on EBs, USD CDs and adding in NPLs doesn’t wipe out banks’ capital, then haircuts on the LBP-held notes portion surely will

The dark blue bar nets resident FX deposits from the consolidated net foreign asset position banks (nonresidents) and BdL. This is essentially a measure of the lollarisation rate and shows the lack of FX in the system to satisfy FX resident deposits. see @AndyKhalil1 below

The dark blue bar nets resident FX deposits from the consolidated net foreign asset position banks (nonresidents) and BdL. This is essentially a measure of the lollarisation rate and shows the lack of FX in the system to satisfy FX resident deposits. see @AndyKhalil1 below

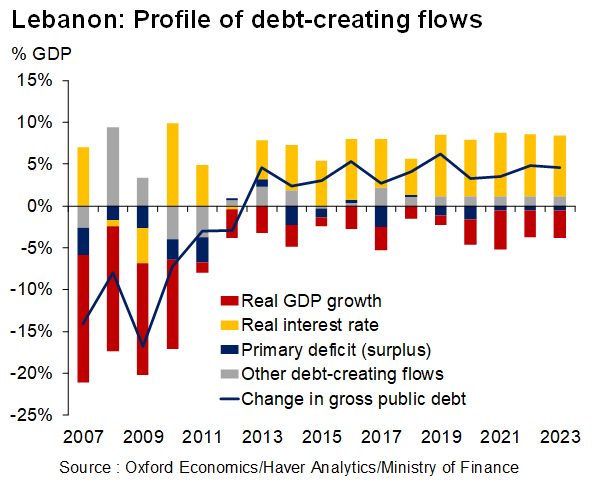

For the debt ratio (160% of GDP, o/w 60% in USD and 100% in LBP) to actually budge, a plan needs to encompass restructuring the massive internal (LBP) debt, restructuring the BdL’s CDs, and, by extension, recapitalising the banks.

For the debt ratio (160% of GDP, o/w 60% in USD and 100% in LBP) to actually budge, a plan needs to encompass restructuring the massive internal (LBP) debt, restructuring the BdL’s CDs, and, by extension, recapitalising the banks.

We cannot be talking about whether Lebanon should default or not without knowing how much dollars BdL has. The gross reported figure is around $30bn in hard-currency liquid reserves, which exclude the $13.9bn in Gold and the $5.7bn that BdL currently holds on its balance sheet

We cannot be talking about whether Lebanon should default or not without knowing how much dollars BdL has. The gross reported figure is around $30bn in hard-currency liquid reserves, which exclude the $13.9bn in Gold and the $5.7bn that BdL currently holds on its balance sheet

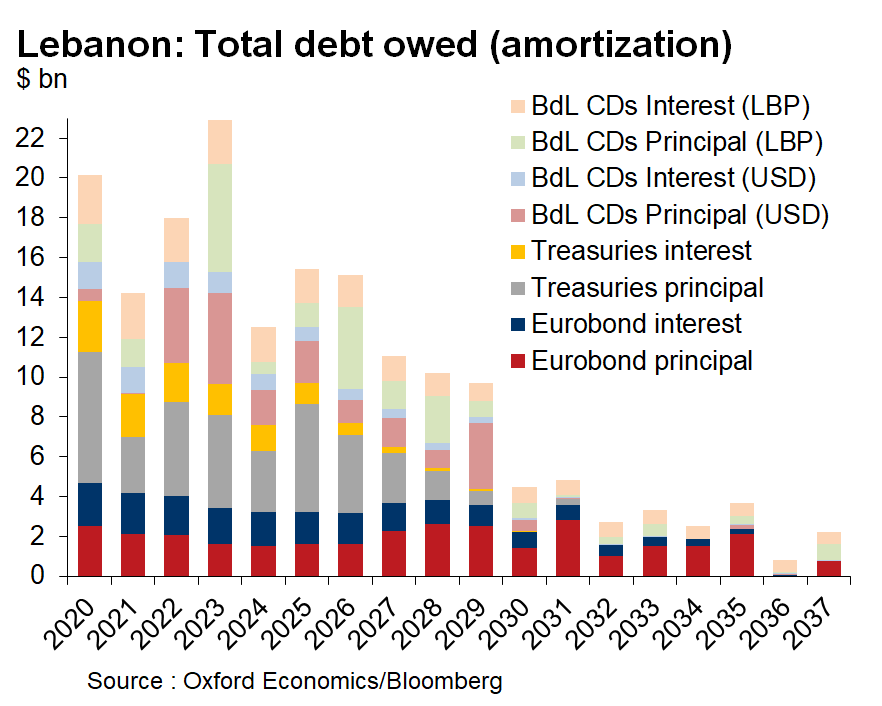

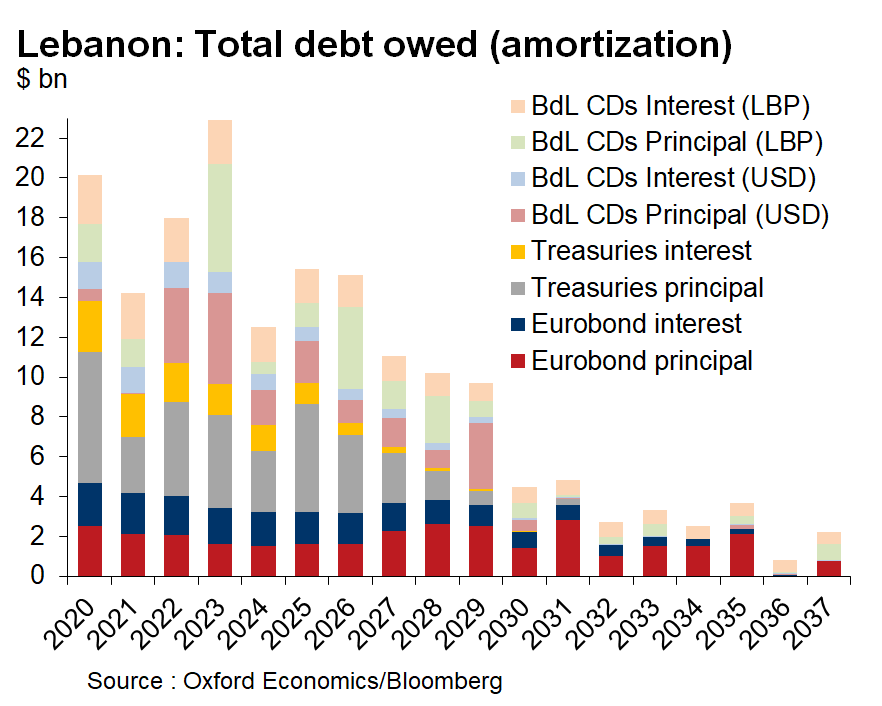

I've put this chart up before, for different reasons. But in 2022 alone, the BdL owes $3.8bn to banks in the form of USD CDs and an additional $1.3 billion of interest payments on outstanding CDs. $5.1 bn in total, without even considering EB amortization.

I've put this chart up before, for different reasons. But in 2022 alone, the BdL owes $3.8bn to banks in the form of USD CDs and an additional $1.3 billion of interest payments on outstanding CDs. $5.1 bn in total, without even considering EB amortization.

https://twitter.com/lebfinance/status/1217814636986277888@camilleasleiman @lebfinance Says lack of CAC isn't a major issue. 75% voter threshold on series-by-series basis is surmountable he thinks. Large domestic ownership of those bonds helps. Confirms that older bonds lack that threshold (point @M_PaulMcNamara made already)

More importantly, the composition of that financing has changed drastically since 2010. Steady, stable, long-term flows like FDI, which used to finance a large chunk of the C/A deficit, are now insignificant (unsurprising given the unfavourable investment climate)

More importantly, the composition of that financing has changed drastically since 2010. Steady, stable, long-term flows like FDI, which used to finance a large chunk of the C/A deficit, are now insignificant (unsurprising given the unfavourable investment climate)

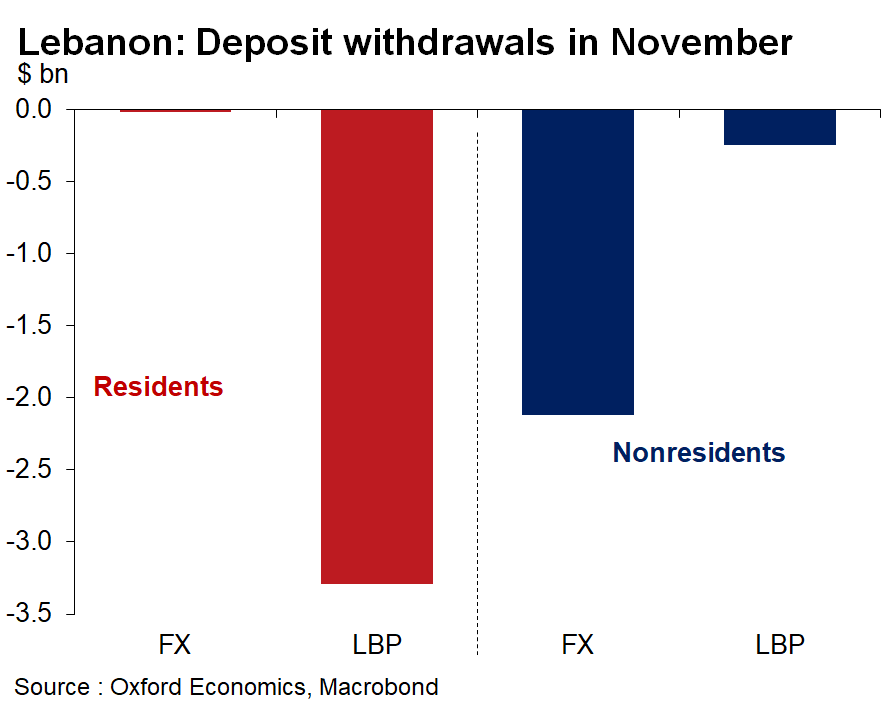

This is worrying because a) the controls aren’t preventing seepage, as is widely suspected. @AndyKhalil1 this point in his thread on banks’ balance sheets. Capital controls on resident FX deposits are working, but not all nonresident FX deposit withdrawals are necessarily exiting

This is worrying because a) the controls aren’t preventing seepage, as is widely suspected. @AndyKhalil1 this point in his thread on banks’ balance sheets. Capital controls on resident FX deposits are working, but not all nonresident FX deposit withdrawals are necessarily exiting

At first glance, the BdL’s headline reserves figures seems sufficient to cover current account deficit financing and repayments of Eurobonds and BdL's USD CDs (principal and interest) coming due in 2020-21.

At first glance, the BdL’s headline reserves figures seems sufficient to cover current account deficit financing and repayments of Eurobonds and BdL's USD CDs (principal and interest) coming due in 2020-21.

https://twitter.com/o_ghida/status/1202829922705825792Importantly, banks held 65% of debt (and 40% of eurobonds); sector profits tied to high interest on govt debt —> so vulnerable to restructuring involving FV haircut, and concern over stability and solvency of banks (2)

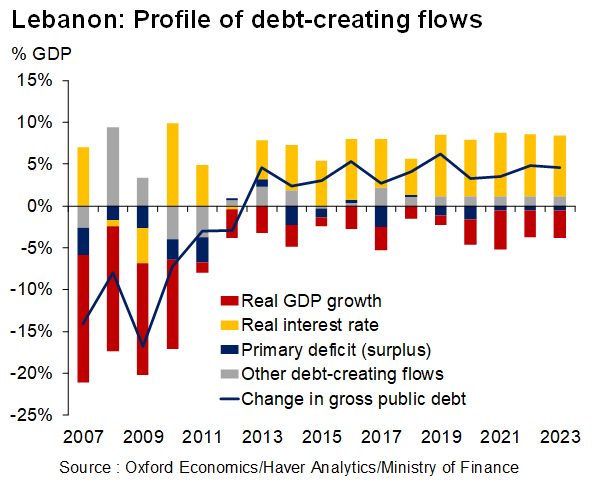

Interest payments run at around 9.5% of GDP. Interestingly, that’s almost exactly how much Hariri has pledged to cut the deficit by next year. So a nominal deficit target of 0.6% of GDP in 2020 (from around 10% now), would bring the primary surplus well within the comfort zone

Interest payments run at around 9.5% of GDP. Interestingly, that’s almost exactly how much Hariri has pledged to cut the deficit by next year. So a nominal deficit target of 0.6% of GDP in 2020 (from around 10% now), would bring the primary surplus well within the comfort zone