Back from a weekend of travelling..time to continue the teardown of #probanx #isignthis #deepdive part 2.

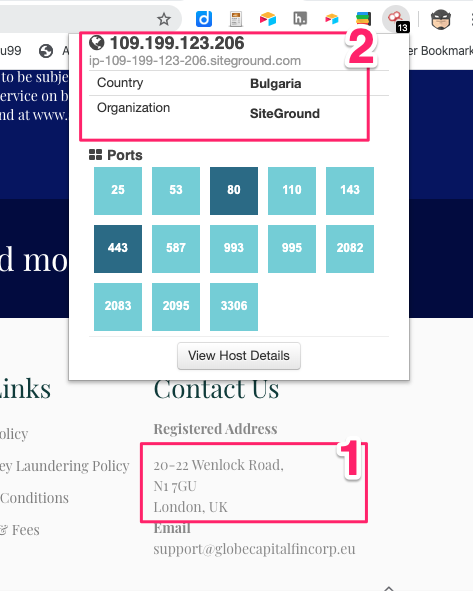

#probanx customer #globecapitalfincorp 'leading investment bank and financial institution based in the USA and UK (probanx words not mine)

1. 20-22 Wenlock Rd - NOT the office of a ‘leading investment bank’. It's the office of shell factory ‘Companies made simple’ and a known post box for dubious companies.

#bitconnect being a prime example - #ponzi #hyip .

#bitconnect being a prime example - #ponzi #hyip .

Bulgaria - Why would a 'leading investment bank’ based in the ‘USA and UK’ operating its online presence out of Bulgaria? Obvious answer is they don’t.

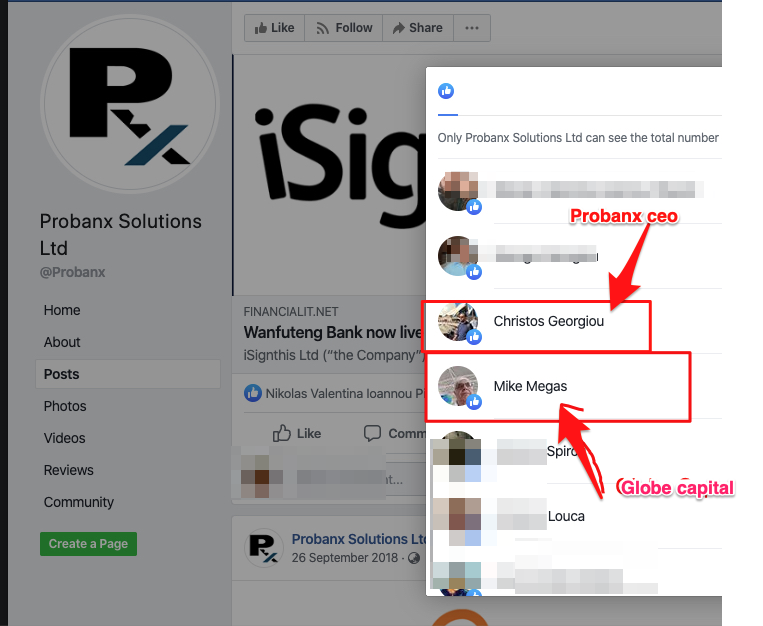

#probanx here's a tip. Your customers are already pumping themselves no need to double pump.

“USA and UK investment bank” is very different to spivvy debit card provider run by Cypriots for cypriots.

“USA and UK investment bank” is very different to spivvy debit card provider run by Cypriots for cypriots.

#isignthis @probanx #whenitrainsitpours this is actually getting rediculous now. I was going to stop waxing on about #globecapital as the point was made. But I recognised a couple of other dodgy logos and domains.

@probanx then the wheels on the dodgy bus started to fall off.

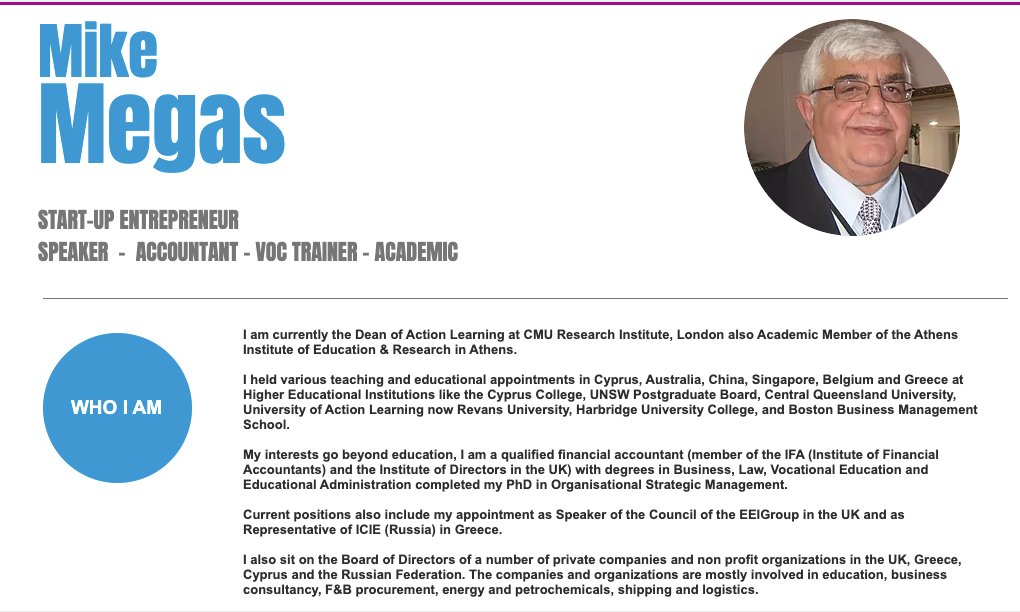

All these cross entities there was a common name #megas but he wasn't up in lights like the others . It was almost like he had gone MIA.

But once you find him....he's kinda everywhere #michaelmegas

This is #megas was quite famous in Australia back in the day

Here's a little snippet from a retiring supercop who fondly remembers his time chasing #megas for what he warmly remembers as his career best collar.

But thats not what put #megas on the map. It was the fact that 10 days out of the big house he managed to talk his way into the role of acadamic principal at a college.

Where he immediately went about doing what he did best. here a few tidbits from NSW enquiry into the scam

Globe Capital Fincorp Ltd is Agent of SatchelPay UAB, authorized by Bank of Lithuania. SatchelPay UAB conducts business under the laws of the Republic of Lithuania, according to the EU Directive (2009/110/EC) and Directive (EU) 2015/2366 on EU-wide payment services. nia.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh