1) As the market freaks out over short-term demand destruction from the coronavirus (SARS dented demand by 0.26MM Bbl/d in '03) , I'm focusing on what will matter after the panic ends: US growth deceleration, peaking of global offshore production, and Canadian egress solutions:

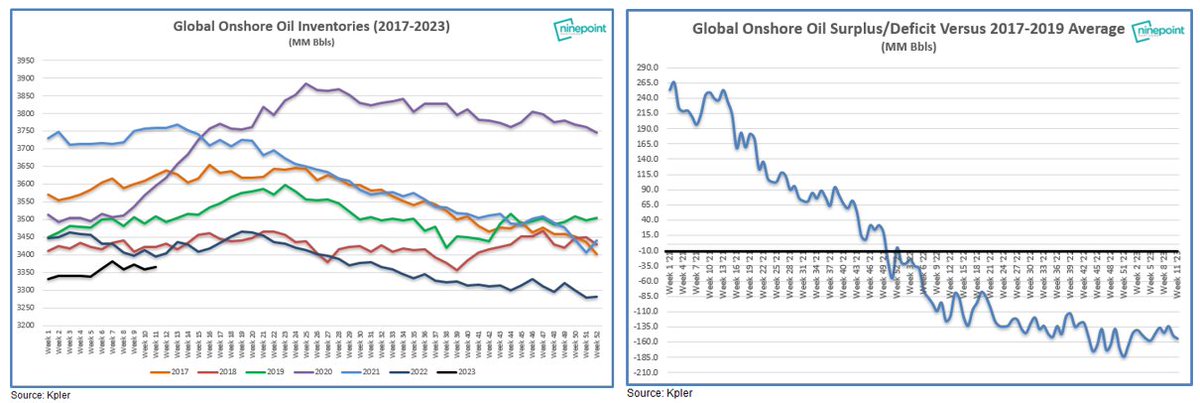

2) 2020 will be the first year in several where US production growth does not fully satisfy global demand growth...this is an extremely important development. Why? #OOTT

3) Non-OPEC+ production has been totally reliant on the US for growth over the past 5 years...without the US non-OPEC+ production would have fallen by 600,000Bbl/d while demand has grown by ~7.5MM Bbl/d. Global offshore production peaks in 2020...the trend will continue... #OOTT

4) The call on OPEC is unanswerable in a few years time...spare capacity will be exhausted and long-lead cycle time of global offshore cannot respond in time (thanks to Bernstein for their terrific piece on global offshore production)... #OOTT

5) So where to invest? Goldman out today agreeing with me...Canada. Lowest valuations + worst sentiment + imminent catalysts to re-rate valuations that are currently at all-time lows... #OOTT

6) Canadian E&P's are the cheapest in the world yet have the highest free cash flow yields...without adequate egress. Normalized differentials in the medium term = another boost to FCF (and buybacks and dividends). Buy the panic...bull market post Q1 seasonal oil demand weakness

• • •

Missing some Tweet in this thread? You can try to

force a refresh