Thread with quotes from the book

"Because leverage is so dangerous [due to blow-up risk and higher trading costs], deciding how much to use is the single most important decision any trader has to make." (p. xv)

amazon.com/Leveraged-Trad…

"Leverage magnifies the three mistakes retail traders typically make: overconfidence, over-betting, and over-trading." (p. 4)

"If things go well, he will be pleasantly surprised and should bank the gain with cool detachment.

"For realists, avoiding mistakes is paramount: controlling risks and trading costs." (p. 6)

"Addicted losers take dangerously large risks when the odds are against them: long-shot horses, slot machines, dodgy unregulated products, binary options, or day trading.

"Disregard maximum leverage limits: sensible traders never use as much leverage as brokers would let them.

Professional stock analysts (Anomalies and News):

Misguided Beliefs of Financial Advisors:

Quality Minus Junk

Doing this leads to factor exposures similar to Warren Buffett's:

"Simple trading systems (trend following and momentum) exploit these biases." (p. 48)

Demystifying Managed Futures

aqr.com/Insights/Resea…

Enduring Effect of Time-Series Momentum on Stock Returns Over Nearly 100 Years

Two Centuries of Trend Following

Time Series Momentum

"You can easily apply the same rules to many different instruments. Diversification is the holy grail of finance and results in a significant improvement to your expected returns." (p. 48)

Death of Diversification Has Been Greatly Exaggerated

Value and Momentum Everywhere

Strategic Allocation to Commodity Factor Premiums

(p. 58)

The author uses a consistent set of units for signals and risk management, making the calculations largely a matter of dimensional analysis. *Everything* is volatility-scaled.

Target risk = annualized standard deviation

Required leverage factor = (Target risk) / (Instrument risk)

"Negative skew or high kurtosis reduces the optimal leverage. For FX carry (modest negative skew), optimal leverage is reduced by around 5%." (p. 66)

The author elaborates here:

qoppac.blogspot.com/2018/06/kelly-…

For target risk of 15%/year and costs of 1.5%/year, your risk-adjusted costs are 1.5%/15% = 0.10.

"This is how much of your gross Sharpe ratio will get eaten up by costs." (p. 68)

"Look for a broker who is happy to operate with a funding spread of 0.4% or lower, depending on how volatile the market is." (p. 80)

"Dated products (futures and products based on futures) have wider spreads but lower holding costs. Slower traders should prefer dated products." (p. 83)

"Estimate the worst possible loss that could occur before you have a chance to close your position." (p. 95)

"At 16%/year volatility, a 7% S&P 500 daily drop should only happen once every 3.4 billion years. There have been six such falls in the last 40 years, with four in 2008 alone." (p. 96)

"Most professional traders are wary of that target. First, the Kelly criterion makes unrealistic assumptions about the statistical distribution of returns.

"Finally, a gross Sharpe is a pre-cost return. Using expensive products to trade will bring the Sharpe ratio down substantially.

"Most use a more conservative target of half Kelly." (p. 98)

"A Sharpe of 1 on an individual instrument is extremely optimistic. Some will do this for a year or two, but very few have consistently done it." (p. 117)

"Most 'experts' are earning kickbacks from brokerage firms, which love day traders (as they generate much higher profits). Don't be taken in by the hype." (p. 118)

"I said, 'You probably don't appreciate this right now, but this project will add more value to this company than pretty much anything else.' I was right." (p. 166)

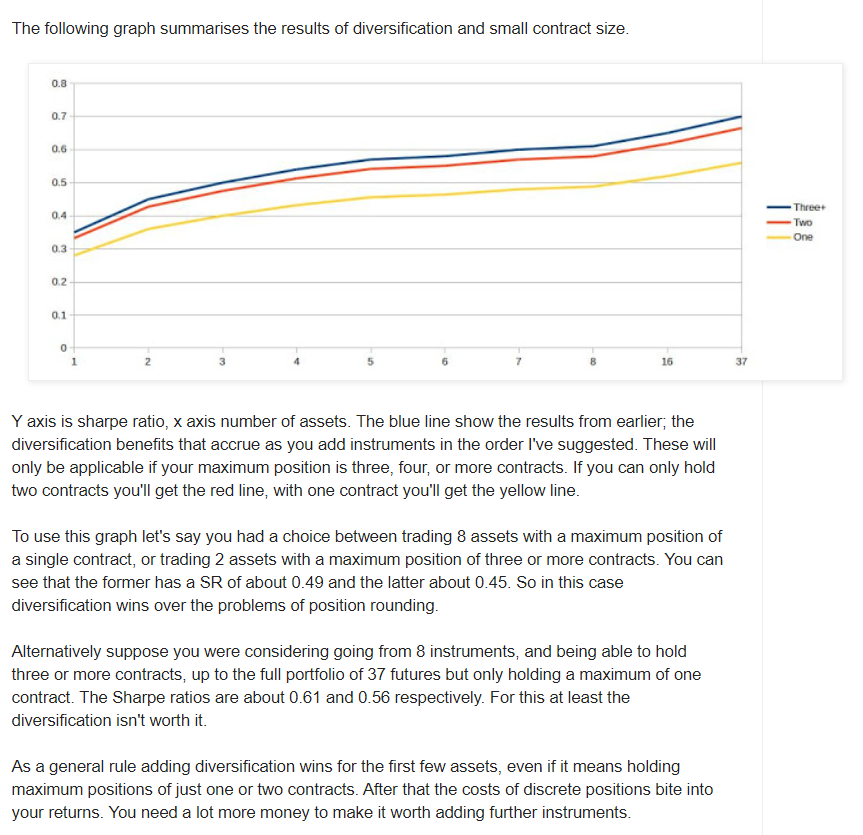

"Most traders would prefer to swap diversification for higher returns. This is done by applying leverage and running the strategy for each instrument at a higher risk target." (p. 166)

"Correlations of trading systems for a given pair of instruments is nearly always much lower than the correlation of the actual instruments' returns." (p. 173)

"Adding instruments is better than adding new rules, but adding rules doesn't require a larger minimum capital requirement." (p. 194)

"But they should assure you that it's safe to trade without a stop loss. [Just close a trade when the opening rule(s) have reversed.]" (p. 238)

Volatility and the Carry Trade

Alpha Momentum and Alpha Reversal

Volatility-Adjusted Momentum

The author explains this in detail:

qoppac.blogspot.com/2016/03/divers…

"It's necessary to avoid making frequent small adjustments: only trade when your position is way off target." (p. 254)

"Avoiding bid-ask in spot FX is also of limited benefit: the funding spread makes up most of total costs." (p. 302)

* Systematic > discretionary

* Be careful with leverage

* Execution costs and financing spreads matter

* Adjust signals for volatility

* Measure position sizes in dollar * standard deviation units

* Diversification works wonders: add markets and create ensembles