1/ @retheauditors @premnsikka @alexralph The curious case of the Grosvenor Motley Crew’s Baldock’s & Bothers Beal. **Part of what would have followed has been removed due to unfinished U.K. criminal court cases.** Back in the 2000’s (before New Labour’s “A-Day” wild west) ..

2/ John Russell-Murphy had a different name + a “different game”(next curious case). Benjamin Beal tells us in 2008 he joined “Intelligent Investment”, a murky unregulated SIPPshitting op hawking the usual off plan property & land “schemes”. Looking at Intelligent Investment’s

3/ website back in 2010 we see the notorious Ames Clan’s Harlequin Property “scheme”

https://twitter.com/ianbeckett/status/1182255011344109573?s=20along with an Australian wheat Farm Land “scheme”(The notorious Renwick Haddow ran an infamous Australian wheat farm land scam “Agri Firma” [Capital Alternatives] with..

4/ similar pitch & Gordon Verrall in Common mondediplo.com/openpage/catch… AND redd-monitor.org/2015/03/13/on-… ) + UK Land Investment. “UK Land Investment” leads us to a swish SW19 Chartered Accountants “EKAS” + 2 SPV’s (setup in 2006 with EKAS as nominee Shareholder until struck off in 2015).

5/ this time with Benjamin Beal/Sas Parsad joining as directors in early 2008 again + both resigning in late 2008. “EKAS” & it’s head honcho Stephen Clive Hedley Jennings is one for another day, but it’s interesting to note their reported activity in the notorious SMS spamming..

6/ scene shkspr.mobi/blog/2011/11/s… . Sas Parsad (aka Sasan Parsad) from his “IT’d up” linkedin bio tells us he joined “intelligent Investment” in 2010 but Mr Parsad is shy about his FCA record. Mr Parsad was an FCA IFA with an “intelligent Investment” email/address + ..

7/ no less than 6 trading names in the 20 months (04/11-12/12) he was a FCA authorised IFA including “Love Financial”. Mr Parsad tells us after “Intelligent Investment”/“love financial” it was “Mirox” (John Russell-Murphy/Benjamin Beal) + then a complete about face in to a ..

8/ senior contract position in the RSA Datacentre + one would hope a high security world of one of the largest Life & Pensions data-centres in the EU. As it turns out the RSA data-centre/offices in Horsham seem to be notorious for data theft & ICO fines. In 2011 the UK/..

9/ /Australian Land schemes disappeared, to be replaced by “Detroit Property Investment”. As if we couldn’t guess where that came from USA Citizen Glen Glagow joined “Intelligent Investment” in early 2012 from the notorious “Axis Property Investment”, notorious for its ..

10/ “Detroit etc Property Investments” + it’s USA partners “Metro Property Group” e.g. eu.freep.com/story/money/bu… AND propertytribes.com/rod-thomas-axi… AND propertytribes.com/metro-property… AND papworths.com/memphis.html. Axis’s head honcho “Rod” Thomas (a Deloitte man) & associate David Ball put ..

11/ Axis in to liquidation in 2009, the liquidation accounts make interesting reading with £3.2m owed to a likely offshore entity “Star Global Realty Ltd” residing in a Liverpool Suburb & £290k owed to HMRC. Axis seamlessly continued to ply its trade with the same trading ..

12/ name, people, location, wares etc via “Actium Property Ltd” (Messrs Keith Stoner, local builder & Peter Tuffin, a Hacker Young man) until liquidated in 2016. In mid 2012 the uber notorious SIPPshitting FCA IFA “1 Stop Financial Services” fca.org.uk/news/press-rel… AND ..

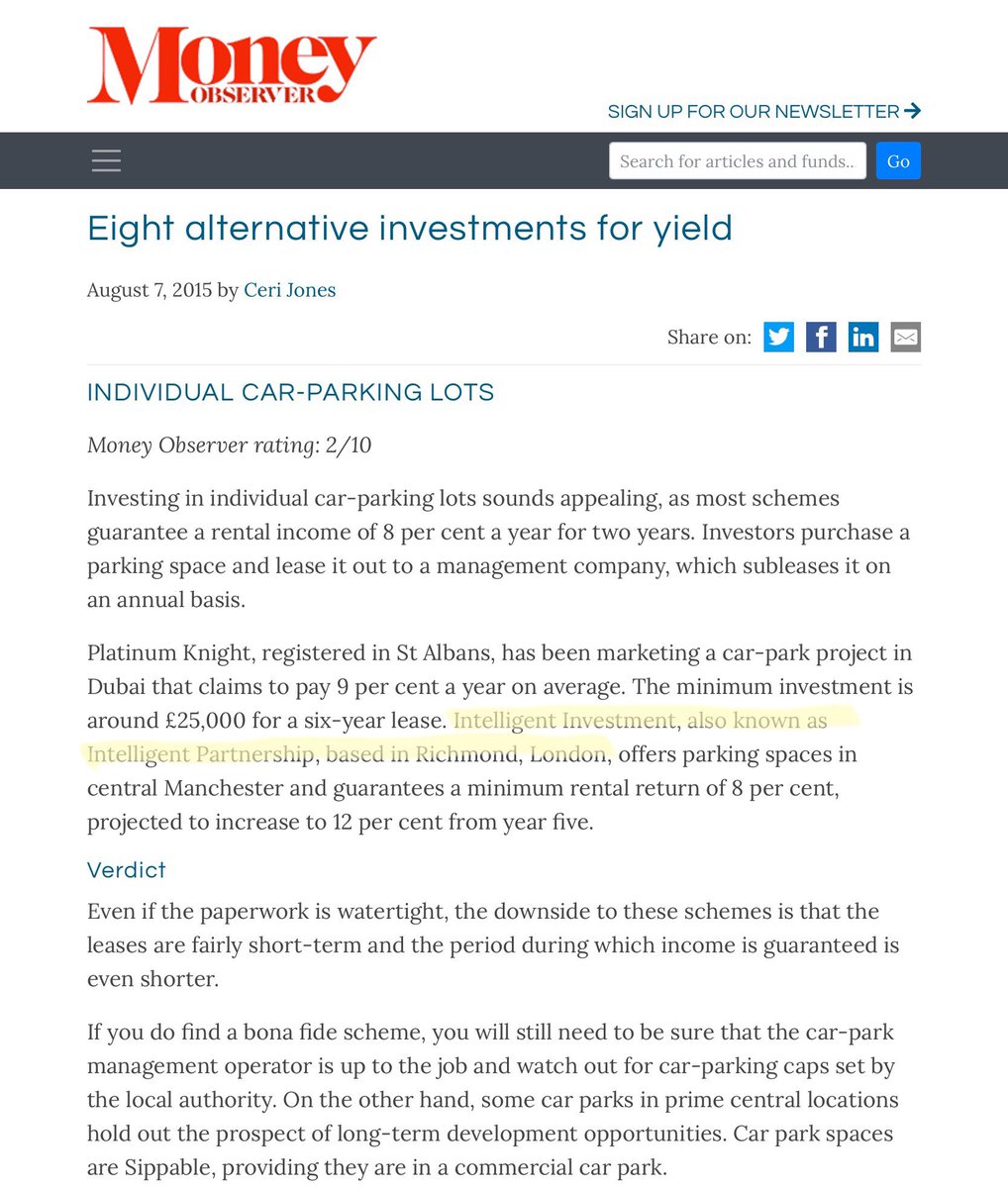

13/ pembrokeshire-herald.com/4425/1-stop-di… appeared on the foot of the “Intelligent Investment” website as sole FCA IFA. All this begs the question, who was pulling the strings at “Intelligent Investment”? .. intriguingly Money Observer wrote in the day that “Intelligent Partnership” ..

14/ (Messrs Hounsell & Tolhurst) traded as “Intelligent Investment”. Marc Hounsell together with a couple of the “Cherish Chums” (Messrs Wright + Smith) + a couple of bankers for the clever/offshore stuff setup/ran “Project Kudos”/“Hypa” etc. It isn’t surprising therefore..

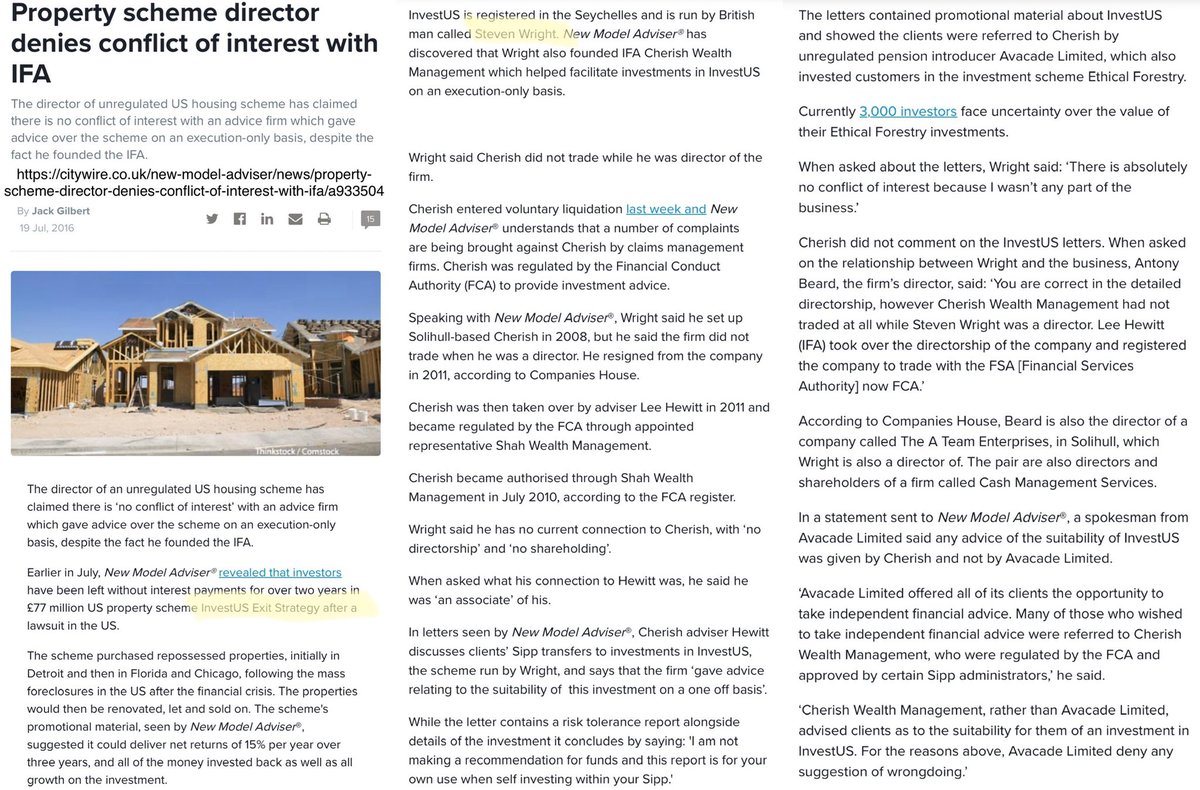

15/ that the first #LCF bond involved/was peddled by “Cherish”/“Project Kudos”/“Hypa”. Easy to see how GCEN(Global Custodial Services Ltd) may have ended up as #LCF’s minibond “payment Institution” being as it was reported used in for example Mr Wright’s “InvestUS” Detroit …

16/ housing scheme. When the notorious Ames clan’s “Harlequin” scheme was put in to administration in 2013 it’s creditor list was insightful (pity the #FCA didn’t look at it) - a hotspot in + around Eastbourne yields Intelligent Partnership, Intelligent Investment, …

17/ , #LCF John Russell-Murphy & Grosvenor Motley Crew, Axis Property Investment, #LCF Spencer Golding’s op + David Jenkins’s (of “accountancy firm” MDJ Services) - Contrast Investments/Buy Overseas. More from Mr Jenkins later. Also on the list was David Robertson, partner..

18/ of the #FCA’s golden couple (+Grosvenor Motley Crew business buds), the Barrett-Treens (e.g. Sustainable Agroenergy/Sustainable Growth Group “Scheme”

https://twitter.com/ianbeckett/status/1163230806413889536?s=20). One does ponder what the pre #LCF name “Sustinere” was intended for rather than what it ended..

19/ up being used for in the #LCF crews boiler room offshore SPV trail ;-) Back to Benjamin Beal, he tells us he left “Intelligent Investment” in mid 2011 to join the rather notorious “Group First International”, associate of the rather notorious Group First & it’s rather …

20/ notorious head honcho Toby Whittaker

https://twitter.com/ianbeckett/status/1185116829985001472?s=20. Andrew Drummond writes of Group First International in “Beware the Snipers of Phnom Penh” andrew-drummond.com/2016/05/09/bew… . Benjamin Beal doesn’t tell us however of the “Beal Brothers” venture “Murex Marketing” ..

21/ fronted by brother Joe Beal, a “sales lead generation” come the usual “alternative investment marketing” op. Meanwhile Joe Beal shy about Murex Marketing tells us he was simultaneously a member of John Russell-Murphy’s “Grosvenor Motley Crew” at Grosvenor Park …

22/ Intelligent Investments (GPII). Benjamin Beal tells us he joined GPII himself in 2013. It’s reported that GPII did credit card processing for #LCF Spencer Golding’s boiler room ops (Timeshare buy bait, off-plan property sting .. incl. #LCF Lakeview first time around …

23/ thisismoney.co.uk/money/news/art… ) after they were blocked by Card Processors. GPII’s notorious schemes pedalled included HIGHGROVE OSPREY MINIBONDS (

https://mobile.twitter.com/ianbeckett/status/1190993225374412801) , DETROIT PROPERTY ( beatthebanks.co.uk/unregulated-pe… ), ECO PLANET BAMBOO ( medium.com/@reddmonitor/t… AND …

24/ iomtoday.co.im/article.cfm?id… AND redd-monitor.org/2018/08/21/eco… AND redd-monitor.org/2018/04/27/has… etc , PARK FIRST/STORE FIRST(

https://twitter.com/ianbeckett/status/1185116829985001472?s=20AND thisismoney.co.uk/money/news/art… ), HARLEQUIN PROPERTY (

https://twitter.com/ianbeckett/status/1182255011344109573?s=20), SCS FARMLAND Argentinian Wheat Farm Land …

25/ ( thisismoney.co.uk/money/midasext… AND beatthebanks.co.uk/pension-transf… ) and VENTURE OIL ( scribd.com/document/44550… ). “Intelligent Partnership” tell us they were “consultants” on the Green Oil Plantations (Australia) & SCS Farmland (Argentina) “schemes”, just how many of these “schemes”..

26/ have intelligent Partnership been “involved” in? (one for another day). Scratch the surface of e.g. Venture Oil, InvestUS, EOS Solar & Prosperity Palm Springs N.E. Brazil “schemes” + it’s clear to see who is behind them, follow the money in for example the Prosperity ..

27/ Palm Springs “scheme” + we see unsurprisingly Venture International Holdings Ltd/Glenmuir International Ltd, Carey Pensions Trustees UK Ltd, Lee Smith, Richard Chamberlain .. very chummy, very Cherish chummy. Follow the money further to a bank account in Wolverhampton ..

28/ + does a trail lead to a rather infamous fellow fronting a well known minibond op? (one for another day). John Russell-Murphy’s “GPII” partnered with amongst others a chum from the “old days”, the rather notorious (+ still FCA authorised) Anthony “Tony “ Frost …

29/ (Choices-Your Mortgage Solutions). To get some idea of other (than mentioned already) schemes Tony Frost worked his “FCA IFA pension transfer magic” on, a peek at F.O.S. judgements against him + we see the notorious Sustainable AgroEnergy “scheme”

https://twitter.com/ianbeckett/status/1163227002557607939?s=20.

30/ Look a bit closer at Choice’s FCA record + we see it T/A “MDJ Financial Services”. David Jenkins was a director of MDJ Financial Services Ltd as well as “accountancy firm” MDJ Services (note Contrast Investments/Buy Overseas from the Harlequin “scheme” earlier).

31/ John Russell-Murphy ran Grosvenor Park International Ltd (GPI) & Grosvenor Park Finance Ltd (GPF) in addition to GPII - before this John Russell-Murphy had a different name and a “different game”. John Russell-Murphy (along with associate Nick Feeney, who has a penchant..

32/ for Porsches & “Loose Women” thesun.co.uk/tvandshowbiz/4… ) used GPI to hawk the Harlequin “scheme” pre GPII + used GPF as a FCA authorised IFA (Appointed Rep.) with Nick Feeney as the FCA IFA. No surprise that (in 2011) his/GPF’s “Principal” Mortgage Shop (Shoreham) Ltd was ..

33/ wound up with the FSCS picking up the tab. GPF introduced a couple of new faces, Joanne Baldock (who #MJSCapital/#LCF Minibond victims will know very well) + Lib. Dem. local politician (ACCA Accountant) Colin Swansborough (Business-74 Brodrick Road, Eastbourne). Noteworthy..

34/ is accountancy firm LMDB (Railview Lofts, 19C Commercial Rd.) providing services not just to John Russell-Murphy’s ops but also #LCF Spencer Golding’s ops. (accountancy firm “Ogilvie Booth Coles” spawned in to “LMDB” & “AEQUITAS” in 2006/7). Joanne Baldock (T/A GPF) …

35/ replaced Nick Feeney as John Russell-Murphy’s pet FCA IFA in 2011 for a year + then T/A(according to her website) FCA authorised IFA “Joanne Baldock”/“JB Financial Services” until well in to 2016, many months after her FCA authorisation(App. Rep.) had been terminated.

36/ In 2016 @reddmonitor wrote about “INDUSTRY RE” in ‘Industry RE + a very big REDD carbon credit scam’ redd-monitor.org/2016/09/20/ind…. This £13m carbon credit scam took place 2009 - 2013 gov.uk/government/new… + if we look at “Accountant” David Jenkins (yet again) + his ..

37/ Contrast Investments website, Industry RE takes pride of place alongside Harlequin + MDJ Financial Services. It’s worth noting that #LCF Sedgwick was disciplined by the SRA for involvement in the very same type of “scheme” involving the sale of “carbon benefit units”..

38/ from the same April Salumei REDD project in Papua New Guinea. @reddmonitor goes on to tell us that “IndustryRE partnered with R.O.I. SPV Celestial Green Ventures PLC” + in more detail here redd-monitor.org/2012/03/13/cel… AND lab.org.uk/brazil-the-car… . It’s worth noting that ..

39/ on the board of Celestial Green Ventures PLC alongside John Russell-Murphy was Francis “Mike” Starkie, a PWC man who #LCF victims will know as a director of LOG, Asset Mapping, LPC, LPM, Waterside Villages, Leisure & Tourism Developments, International Resorts Group etc.

40/ @reddmonitor tells of the very close links “Accountant” David Jenkins has with Celestial Green Ventures PLC head honcho & ex mining executive Ciaran Kelly + of the R.O.I. tax office moving to close down Celestial Green Ventures PLC redd-monitor.org/2016/03/31/iri… . Enter …

41/ John Russell-Murphy & the Grosvenor Motley Crew in 2012 to “market” Celestial Green Ventures “Natural Capital Credits” as an “Asset Backed Bond” - the 3yr 9.75% “Natural Capital Bond”. John Russell-Murphy & FCA IFA Joanne Baldock setup/ran the R.O.I. SPV ..

42/ Natural Capital Wealth Ltd, associate Giovanni de Clemente ran the U.K. op (Natural Capital Financial Ltd) + Joe Beal tells us he took care of international sales, spending time in USA. Meanwhile the rest of what would become the #LCF crew were busy running …

43/ timeshare buy bait/offplan property sting boiler room ops (after Lakeview & Harlequin) on Lakeside YOO Phuket & Sanctuary Dominican Republic [Lakeview & Dominican Republic sites are future #LCF “borrowers” assets]

https://twitter.com/ianbeckett/status/1154527506411560960?s=20AND

https://mobile.twitter.com/ianbeckett/status/1149258514008854528+ …

44/ + pivoting their fledgling “Sales Aid Finance” op in to what would become #LCF. As the “battle of the Lakeview timeshares” raged on between the #LCF crew (who now controlled Lakeview) + the timeshare management committee (timeshare freehold in a trust), the chairman …

45/ of which its reported had brought in the “Bullfrog” (Stuart Lamont - Club Leisure Group, CRI etc) iol.co.za/business-repor… AND timeshareconsumerassociation.org.uk/2015/02/16/aro… . We can guess how this ends - not well for the timeshare owners + the #LCF Crew & “Bullfrog” cutting a deal. Enter …

46/ Oystershare Sales Ltd [since renamed] with FCA IFA Joanne Baldock, #LCF Sedgwick & S.Hume-Kendall along with the notorious Sterling Mortimer duo Bowman & Clink

https://twitter.com/ianbeckett/status/1124083305933148160?s=20+ out pops a Lakeview Fractional Timeshare op with F.O.C. to be run out of …

47/ Sterling Mortimer’s layer in Cheltenham. Meanwhile the #LCF crew awestruck at the successful SIPPshitting carried out with the Highgrove Osprey bonds

https://twitter.com/ianbeckett/status/1190993225374412801?s=20(pedalled by the Grosvenor Motley Crew) moved to replicate this with the “secret sauce” to …

48/ take it to the next level - #adtech & “comparison” sites. #LCF bondholder victims report dealing with “LCF branded” FCA IFA Joanne Baldock from early 2015 .. astonishing. Joanne Baldock’s FCA IFA Appointed Rep. authorisation was terminated in 09/2015, pity she …

49/ didn’t update her IFA business website for months, but it was minibond (as the FCA would brand them much later) mayhem time. Still time though for the Grosvenor Motley Crew’s John Russell-Murphy & Joanne Baldock (whilst still a FCA IFA) to bang out another minibond op …

50/ this time with a bit of the old Meikle “Razzall Dazzle” from Lord Razzall - #MJSCapital PLC .. they never end well (for bond holders that is). Every night is party night though for the Baldocks & Russell-Murphys + for one of John Russell-Murphy’s associates from the …

51/ “old days” - Damian Paul Scott who unsurprisingly runs an unregulated SIPPshitting op with a similar taste in “schemes” to GPII e.g. HARLEQUIN, SCS FARMLAND(FWE GROUP), USA DISTRESSED PROPERTY, GREEN OIL PLANTATIONS LTD. citywire.co.uk/new-model-advi…. As is de rigeur in these..

52/ kinds of ops Mr Scott tells us he has FCA IFA(s) to hand. Mr Scott tells us over 95% of products he looks at fail his due diligence, if Mr Scott had said 95% of the products his website offered fail “investors” I could well believe that. Meanwhile there was ..

53/ hardly time to party for the Baldocks & Russell-Murphys as the volume of punters rose exponentially as Captain Careless & his Scroogle crew at “Surge” slapped those #LCF FCA & ISA stickers on to their “comparison sites” + lit the PPC & SEO touch-paper. Joe Beal meanwhile ..

54/ had joined up with #MJSCapital’s Martin Westney for the “Long Drive World Series” + very recently joined Var One Ltd, a rather notorious Group First partner (using AFC’s Ian Wright to advertise) that was founded/run by Heath Williams. Just like they all do, Mr Williams ..

55/ tells us now he’s a vc, but he’s very shy about his time at Var One … perhaps Mr Williams should delete his Var One LinkedIn url .. bit of a giveaway. Meanwhile next up for …

56/ ex mining executive Ciaran Kelly having knocked up a “Natural Forest Standard” which certified “Natural Capital Credits” which spawned the “Natural Capital Bond” so predictably was the world of #CryptoCrap. Reportedly transferring from related parties ..

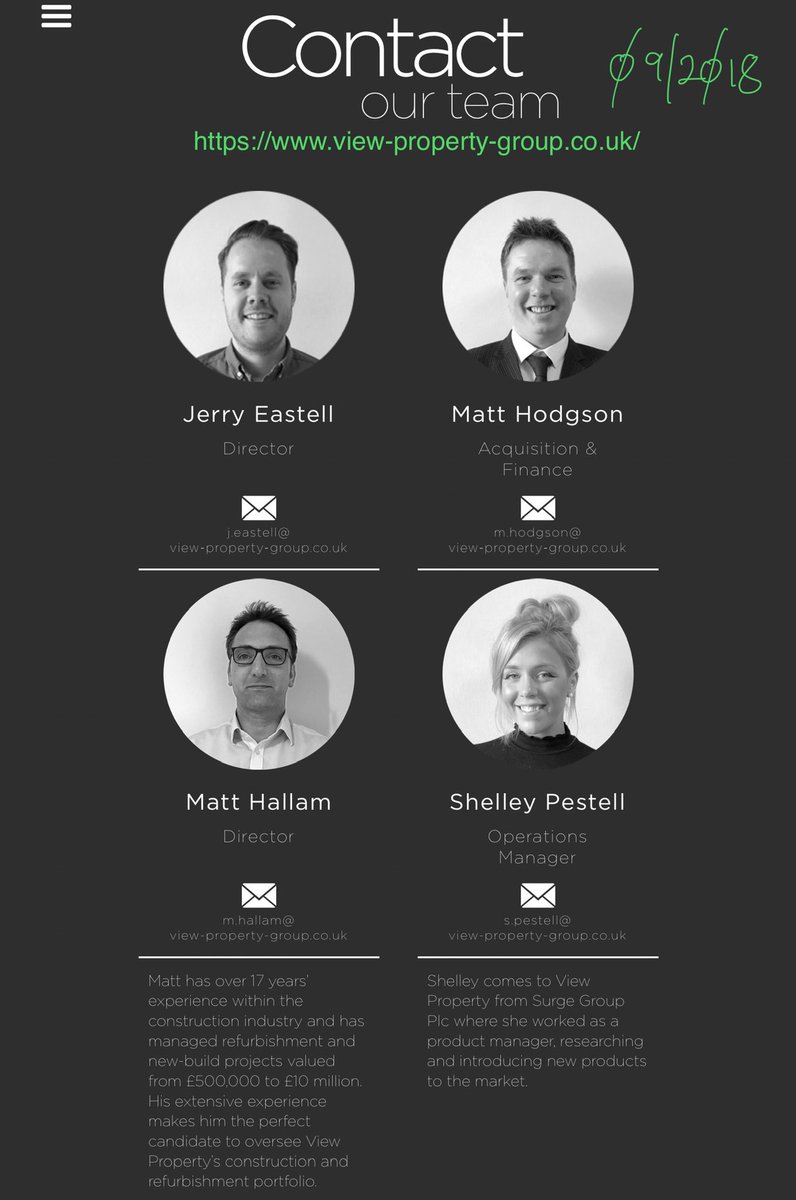

57/ 7million of those “Natural Capital Credits” (7billion EGT Tokens) for Ecoingot Ltd based in Malta’s #CryptoCrappery. We were told it was Ecoingot #ICO time - Ethereum Blockchain token “EGT”, $’s for Tokens (Natural Capital Credits). We were told theres an app + we’re ..

58/ going to RFID scan things , get all woked up + buy EGT tokens to offset our carbon emitting lifestyle. We were told there’s “ full + transparent tracking” … so where’s the app?.. where’s the dapp? .. where are the ethereum blockchain transactions? .. what happened to ..

59/ the ICO (Oct 2018-Mar-2019)? Benjamin Beal tells us he was part of Ecoingot, he was also involved in a number of Property, CryptoCurrency & Minibond companies some of which included John Russell-Murphy & Francis “Mike” Starkie. Noteworthy was the provision of services by ..

60/ “Together We Count”, 21A Blatchington Road, Brighton and Paddenburg & Co, 100 Church Street, Brighton. In 2016 Matthew James Dean Hodgson was declared bankrupt which centred around a property development company MBS Property Development Ltd where he was a director ..

61/ along with a Mrs Sarah Beal. It’s noteworthy the accountants were “Together We Count”. If we look at Mr Hodgson’s Companies House filings post 2011 we see property development/unregulated financial companies (invariably with Luc Higgs or Aaron McLeish), a FCA authorised ..

62/ #DoorstepLender (Home Credit Finance Ltd) via the precursors of Home Credit Finance, the FCA authorised Buckingham BridgeFinance etc(T/A LoansWizard, LoanUlike, Home Credit Finance etc).

Mr Hodgson’s associates included Luc Higgs (Relative of Roy Higgs), Michael Wipfler, ..

Mr Hodgson’s associates included Luc Higgs (Relative of Roy Higgs), Michael Wipfler, ..

63/ Nick Powter + Aaron McLeish(a Moore Stephens man) with “Together We Count”(Aaron McLeish)/Colin Swansborough providing services. Luc Higgs, Roy Higgs & Michael Wipfler are FCA authorised. Roy Higgs, Nick Powter & Michael Wipfler by curious coincidence swam in the same pond..

64/ John Russell-Murphy when John Russell-Murphy had a different name & “different game”. The Argus (Brighton) reports Mr Hodgson was convicted of producing Cannabis in 01/2018 + later in 2018 acting as a director whilst being an undischarged bankrupt.

65/ It’s a fascinating read + one ponders why Aaron McLeish, a Moore Stephens man couldn’t/didn’t provide advice. The Argus tells us Mr Hodgson had a new job in “Financial Services” on £60k pa, the Argus’s readers offer insightful comments - “what sort of idiots would offer…

66/ this crook a job on a salary of £60k”, “something fishy about that, getting a job in financial services with his background” + most succinctly “… this is not the full story”. #LCF victims I’m sure can think of a “Financial Services” company that would offer him a job …

67/ that’s right his £60k job was with Captain Careless & his Scroogle crew at Surge Financial/View Property Group. View Property’s SPV “View Property SPV5 Ltd” being particularly interesting as traces of #LCF’s Elten Barker as a director have been removed under s1095 CA 2006..

68/ (directors not consented to act)… spooky, particularly as Elten Barker, John Russell-Murphy & Captain Careless are now the shareholders. Finishing with another visit to the Grosvenor Motley Crew - there’s a mechanistic jungle of 25 money laundering regulators in the UK, ..

69/ with so many there are hundreds of “executive committee” members that must set an example or at least you would hope so .. let’s take a peek at one of these, the ATT (Association of Taxation Technicians) + you be the judge. wired.co.uk/article/money-… .

70/70 Next up - The curious case of John Russell-Murphy & the pond he used to swim in when he had a different name & a “different game”.

*correction* “on the board of Celestial Green Ventures PLC alongside John Russell-Murphy...” should read “on the board of Celestial Green Ventures PLC alongside Ciaran Kelly..”

• • •

Missing some Tweet in this thread? You can try to

force a refresh