@_sbr1 @SqueezeMetrics 1/ You *still* seem to have this entire thing perplexingly misunderstood.

1. ‘computation itself assumes…dealers hedge (GEX) by exclusively trading the underlying.’

No it doesn’t. The paper asserts that SPX options dealers hedge their *deltas* – by trading in the underlying.

1. ‘computation itself assumes…dealers hedge (GEX) by exclusively trading the underlying.’

No it doesn’t. The paper asserts that SPX options dealers hedge their *deltas* – by trading in the underlying.

@_sbr1 @SqueezeMetrics 2/ The rationale is that rather than cannibalizing the liquidity they exist to provide by purchasing the requisite options to maintain a gamma-neutral book, dealers tend to hedge their deltas directly by adjusting their position in the underlying.

@_sbr1 @SqueezeMetrics 3/The GEX metric exists to *estimate* the magnitude and direction of said delta-hedging forces that arise on account of a 1-pt change in the SPX. Gamma, as the first derivative of delta, is a prime candidate for the task. (Again, as a predictor of delta-hedging.)

@_sbr1 @SqueezeMetrics 4/This useless ‘GEX-%flux’ that you’ve regressed seems a novel invention – a numeric straw-man to knock down. It is not a metric anyone is employing, advertising, or selling as a means to forecast realized volatility…

@_sbr1 @SqueezeMetrics 5/ It's almost like we’re saying “The aggregate number of BigMacs eaten this year materially affects the odds of having a heart attack 10 years later.” And bizarrely, you’ve responded by regressing the % change in someone’s consumed burgers year over year against the same y-hat.

@_sbr1 @SqueezeMetrics 6/ It is, analogously, the magnitude of the aggregate that meaningfully modulates the frequency of the other event. Regressing t big mac volume against t+1 heart attack frequency will beget a relationship of significance....

@_sbr1 @SqueezeMetrics 7 /Regressing % change in consumption (year/year) will not have the same affect on the same y-hat. Habits die hard, and most people will fluctuate within some definite stratification. Going from 100-110, or 20-22 burgers may not have a measurable affect at all. 20->100 will.

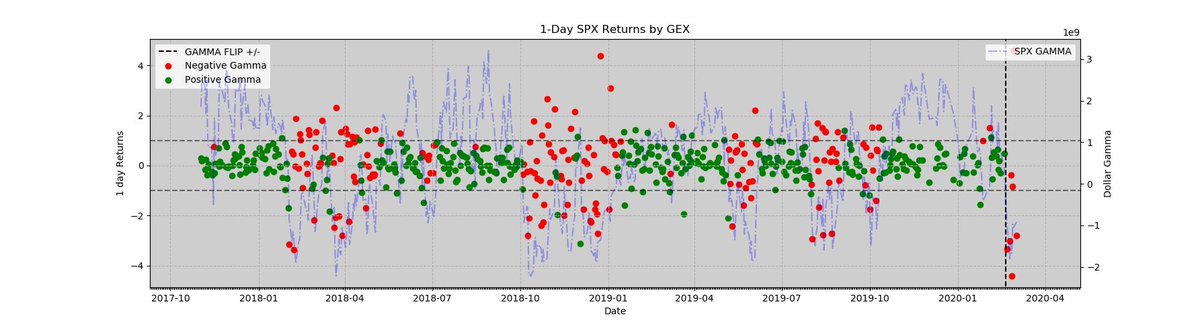

@_sbr1 @SqueezeMetrics 8/ That is essentially what you’ve done with this regression. You’ve invented a useless number and declared victory by demonstrating that it is, in fact, useless. You need to work with the aggregate values:

• • •

Missing some Tweet in this thread? You can try to

force a refresh