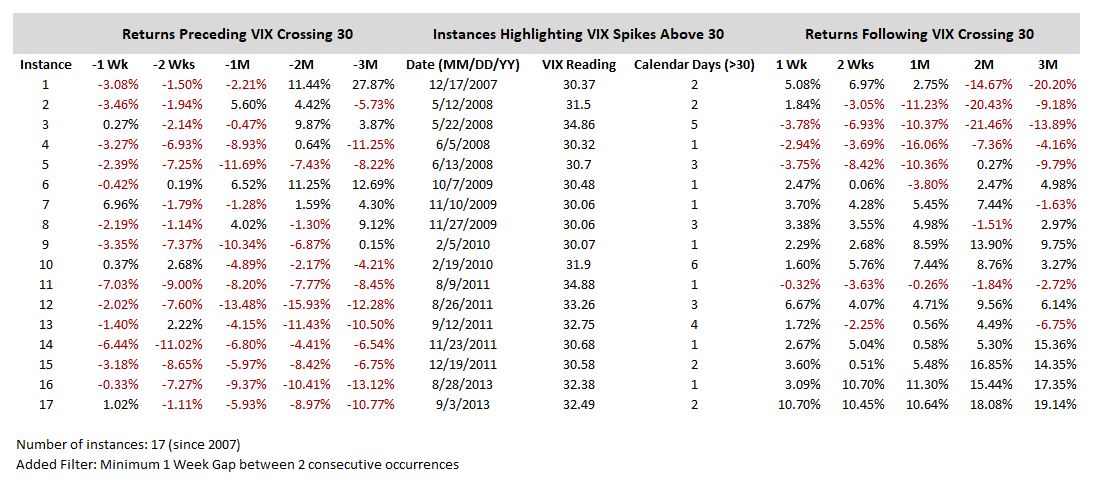

(1/n) Should investors be prepared for a longer period of negative returns? Or are the #Nifty and #Sensex in for a prolonged struggle? Let's analyze some data from the #VIX (India VIX) into consideration.

Chart 1: Line Chart of IndiaVIX starting 2007 to present.

Chart 1: Line Chart of IndiaVIX starting 2007 to present.

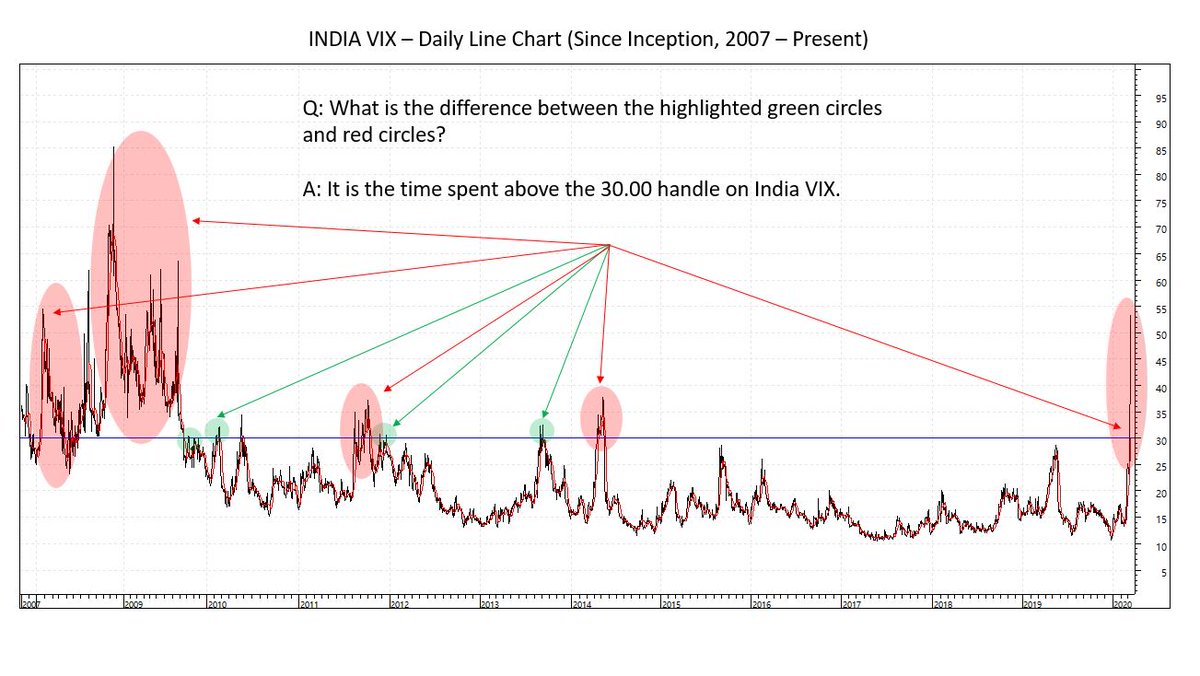

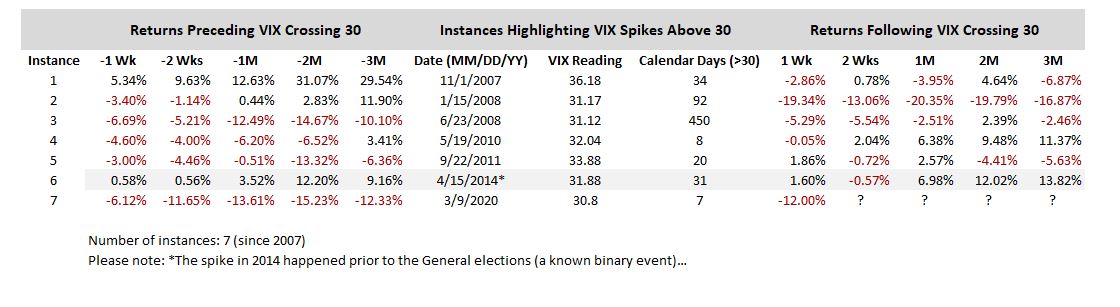

(2/n) As of close today, the India VIX ended at 58.88. The first close above 30.00 was registered on March 9, 2020 (7 days ago).

Let's look at similar instances in the past, where the VIX stayed above 30.00 for over a week (on a closing basis).

Let's look at similar instances in the past, where the VIX stayed above 30.00 for over a week (on a closing basis).

(4/n) Takeaways:

1) Despite limited sample size, data since 2007 suggests that 1-3 bar excursions beyond 30 on the VIX typically align with short-term corrections in a bull market, typically showing positive follow-through over the next several weeks and months.

1) Despite limited sample size, data since 2007 suggests that 1-3 bar excursions beyond 30 on the VIX typically align with short-term corrections in a bull market, typically showing positive follow-through over the next several weeks and months.

(5/n) Takeaways (Continued)

2) The initial precedents to a longer-duration correction (or a bear market) are VIX staying above 30, with the jump in volatility triggered by a meaningful sell-off (in this scenario, #Nifty is down by 12% since March 9 (the 1st close on the VIX > 30)

2) The initial precedents to a longer-duration correction (or a bear market) are VIX staying above 30, with the jump in volatility triggered by a meaningful sell-off (in this scenario, #Nifty is down by 12% since March 9 (the 1st close on the VIX > 30)

• • •

Missing some Tweet in this thread? You can try to

force a refresh