Data-driven approach to financial markets /

Helping traders succeed in market speculation /

Managing Director at Xcelcap Investment Research Pvt. Ltd.

How to get URL link on X (Twitter) App

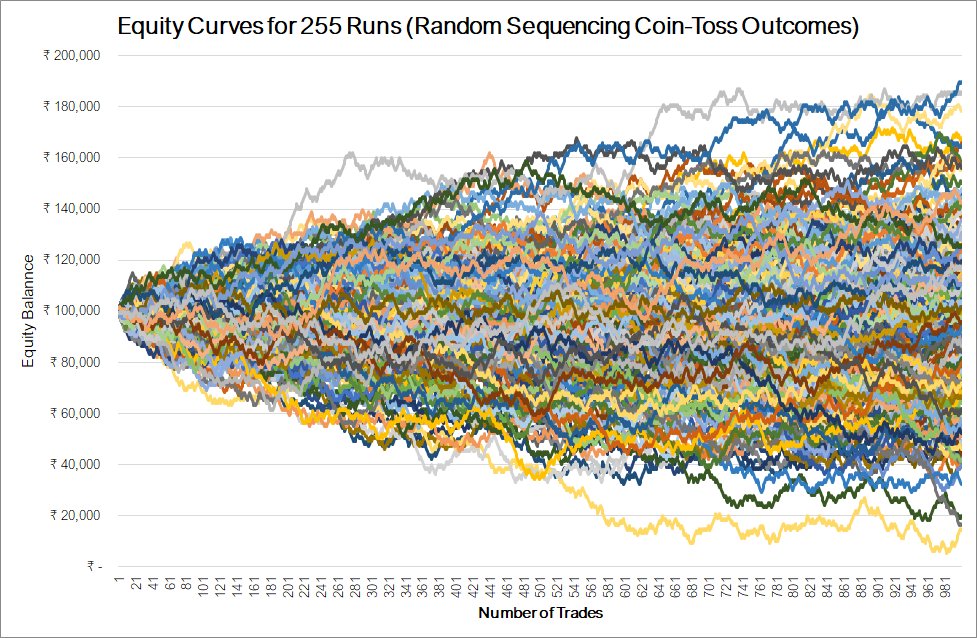

https://twitter.com/vipulramaiya/status/1270740644378685441?s=20https://t.co/kc147pqizy 2/n The only 2 pillars (that really matter) to successful trading are positive expectancy and risk management.

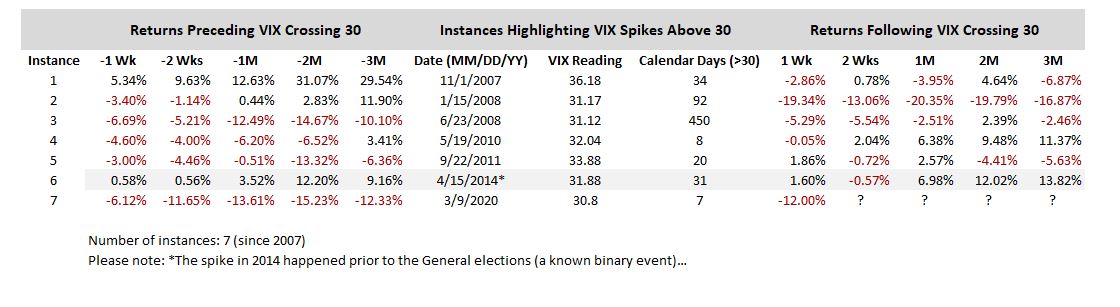

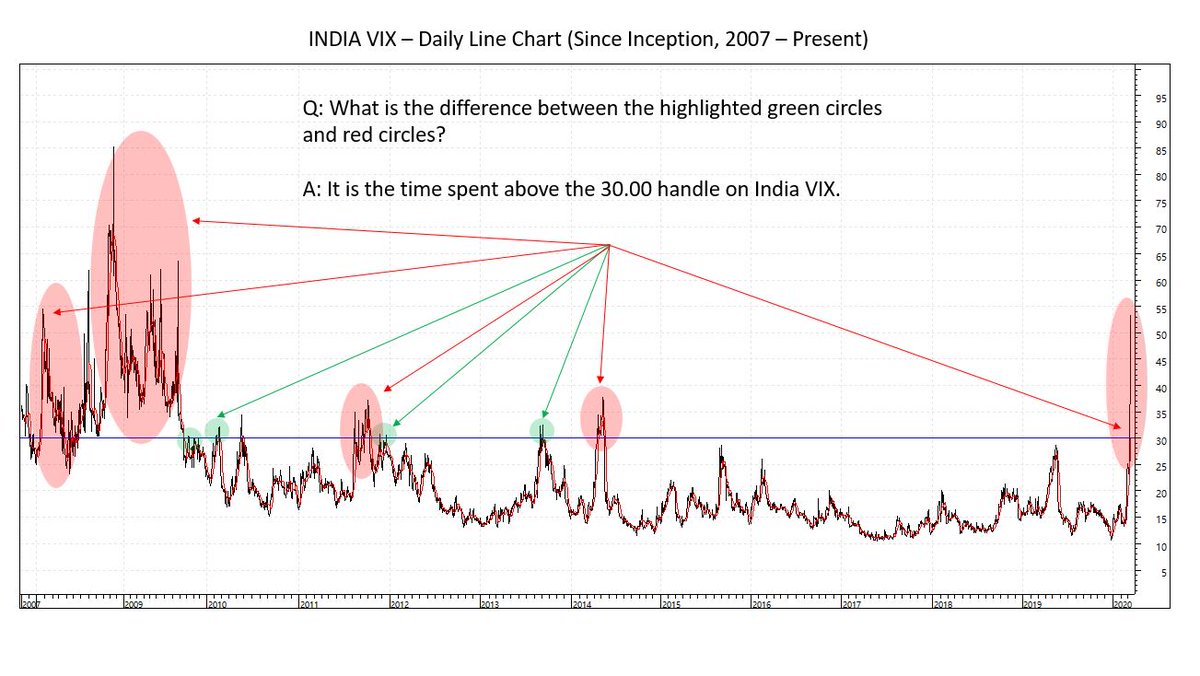

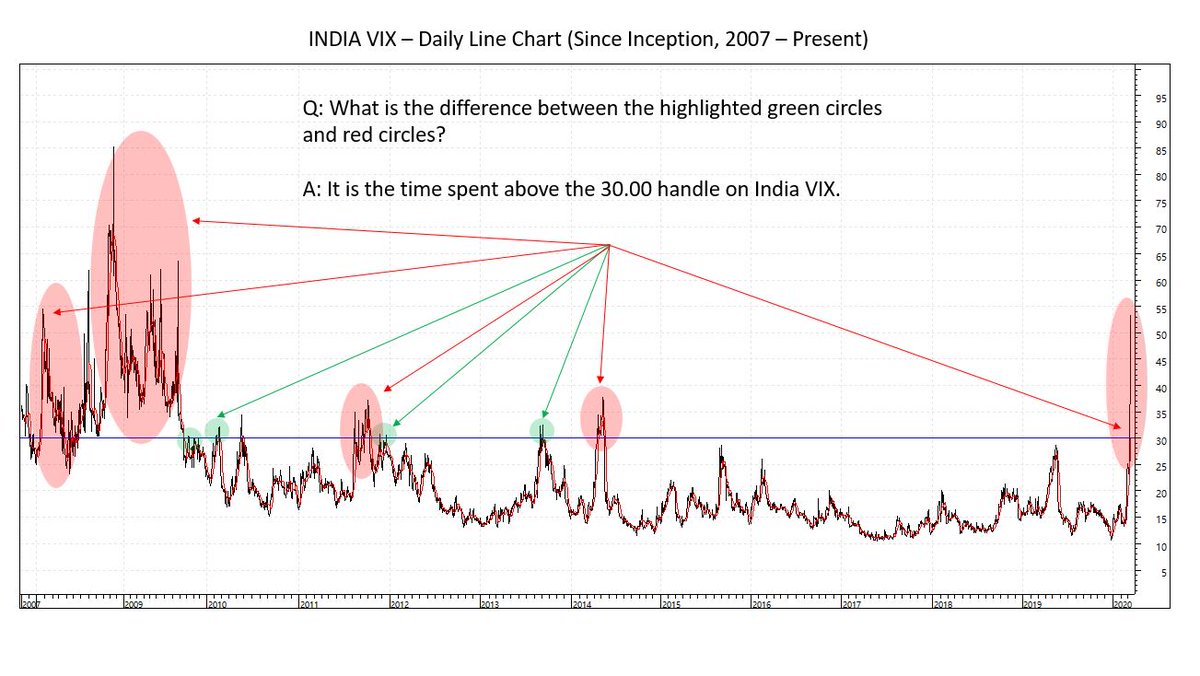

(2/n) As of close today, the India VIX ended at 58.88. The first close above 30.00 was registered on March 9, 2020 (7 days ago).

(2/n) As of close today, the India VIX ended at 58.88. The first close above 30.00 was registered on March 9, 2020 (7 days ago).