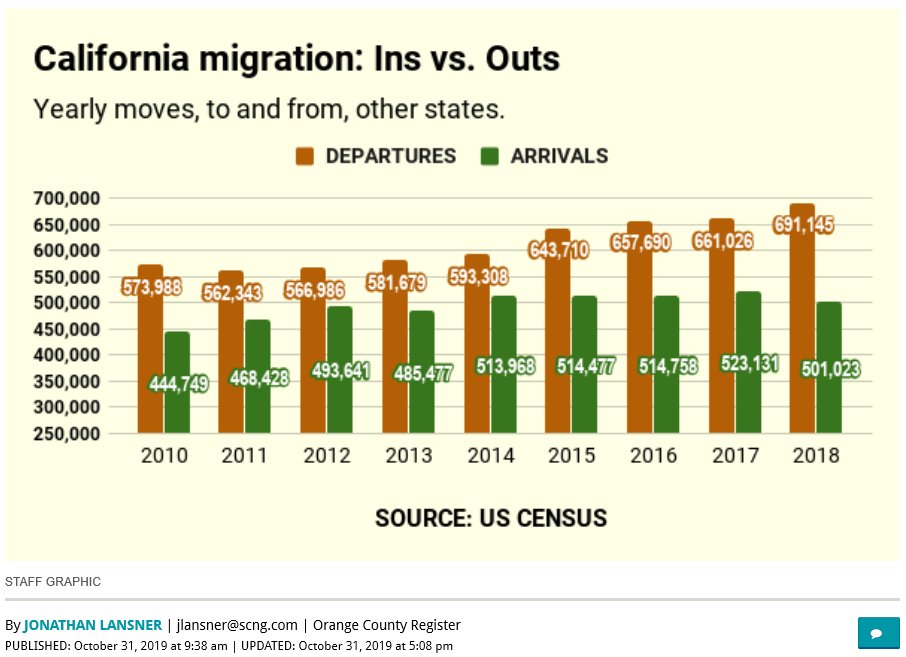

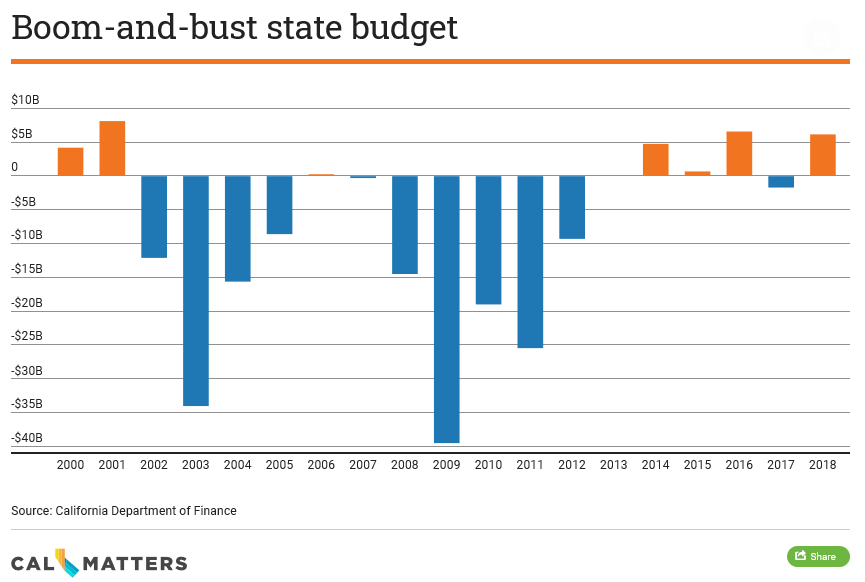

The California economy—and state budget—is about to get absolutely slammed.

pewtrusts.org/en/research-an…

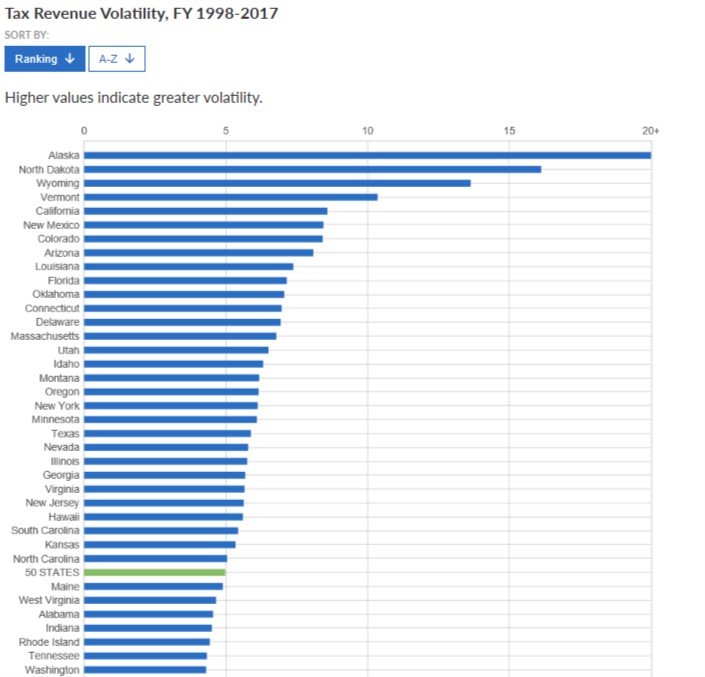

A large amount of regular tax revenue just got vaporized overnight

routefifty.com/finance/2020/0…

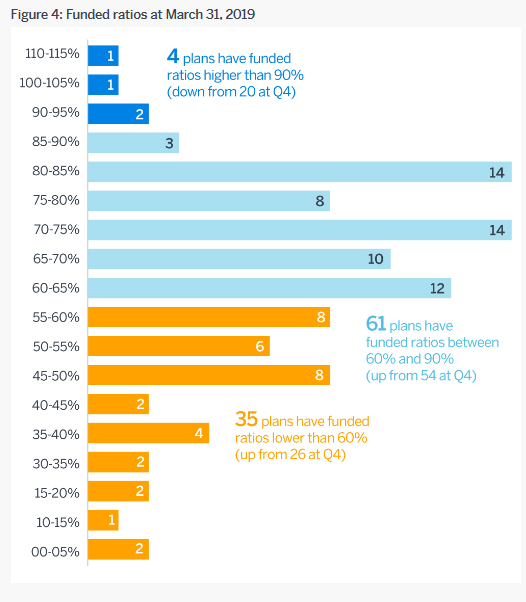

Prior to the market meltdown, state public pension plans were on average ONLY 72% funded—and about 40% invested in equities😬

According to Moody’s, a loss of just 6.2% in assets requires a 32% increase in contributions

routefifty.com/finance/2020/0…

HALF of California cities were not even saving enough money to pay pension benefits in just FIVE YEARS, according to State Auditor Elaine Howle

In a spell of record growth😲

usnews.com/news/best-stat…

It’s not *only* pensions that threaten to sink California’s cities.

More than 70% of cities in CA do not have **ANY** funds set aside for other post-employment benefits—such as retiree health care—according to Howle

None. Zero. Zilch.

dailybreeze.com/2019/10/24/la-…

latimes.com/california/sto…

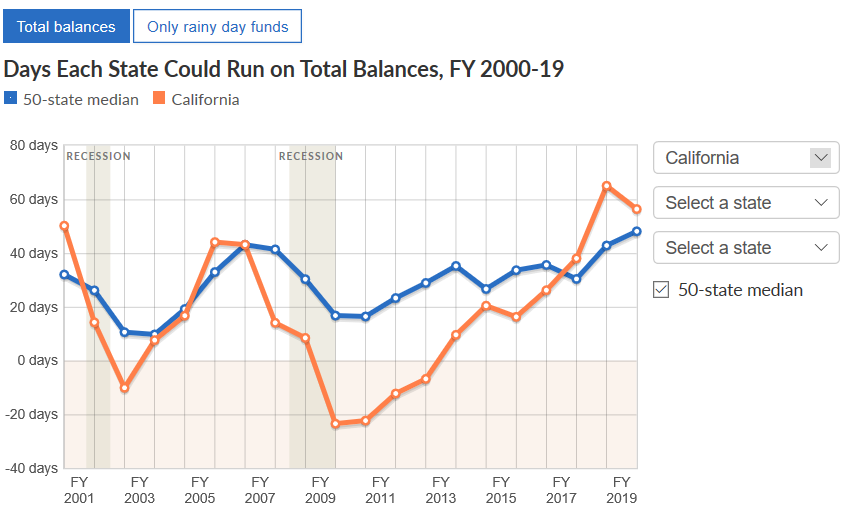

The unprecedented $54.3 billion deficit is nearly 37% of the state’s general fund😲

It vaporizes the $16 billion rainy day fund—three and a half times over

It signals a financial tsunami—cuts to schools, health care and other programs

calmatters.org/economy/2020/0…

In the largest single quarterly drop in the history of this index, the funded ratio sank to 66.0%

35 of the 100 largest plans are now below 60% funded.😲

#FiscalDoomsday

milliman.com/en/insight/Pub…

By 2016, state employee pensions cost taxpayers $5.4 billion—more than 30x what the state paid for retirement benefits in 2000

Voters recalled Davis—but the fiscal cancer spread

latimes.com/projects/la-me…

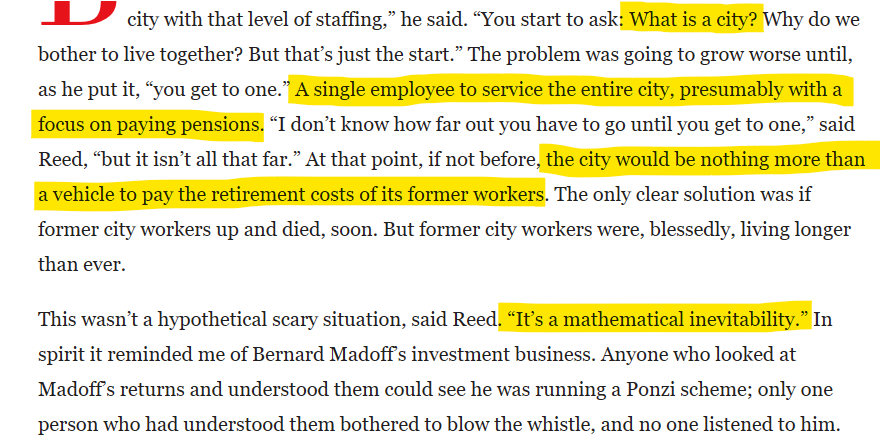

In the words of former San Jose Mayor Chuck Reed: "What is a city?"

Context—this is a chapter from the great Michael Lewis' book "Boomerang", and a great read

vanityfair.com/news/2011/11/m…