ft.com/content/fd1d35…

tandfonline.com/doi/full/10.10…

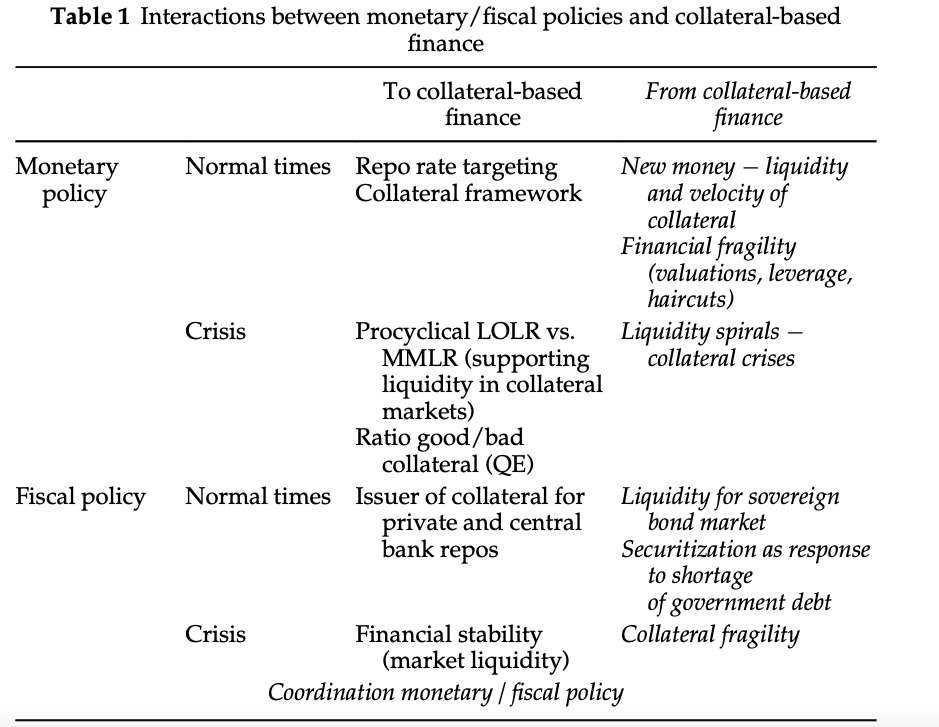

For past 30 years, w central bank independence, clandestine encounters in finance land.

Central banks looking for financial stability in sovereign bonds, governments looking for liquidity.

When this happens, it's a question of financial stability for central banks.

Why: central banks (ECB) adopted the customs of finance land in relating to the sovereign (collateral valuation framework).

That old relationship was monetary financing.

Central banks reluctant to call it that, jealously guarding independence.

It is now obvious to most (hello Germany) that the old marriage is a better institutional form to cope with shocks.

bis.org/publ/bisbull05…

* welcome back Greece

* across the board reduction in haircuts

* foreign currency loans (hello Eastern European banking systems)

ecb.europa.eu/press/pr/date/…

So far, more solidarity via ECB extraordinary operations than from elected politicians.

ft.com/content/da1411…