If there's another 10%+ market fall or if they stay depressed for a long time, all the weak hands (dumb retail investors) will be shaken out.

amazon.com/All-About-Asse…

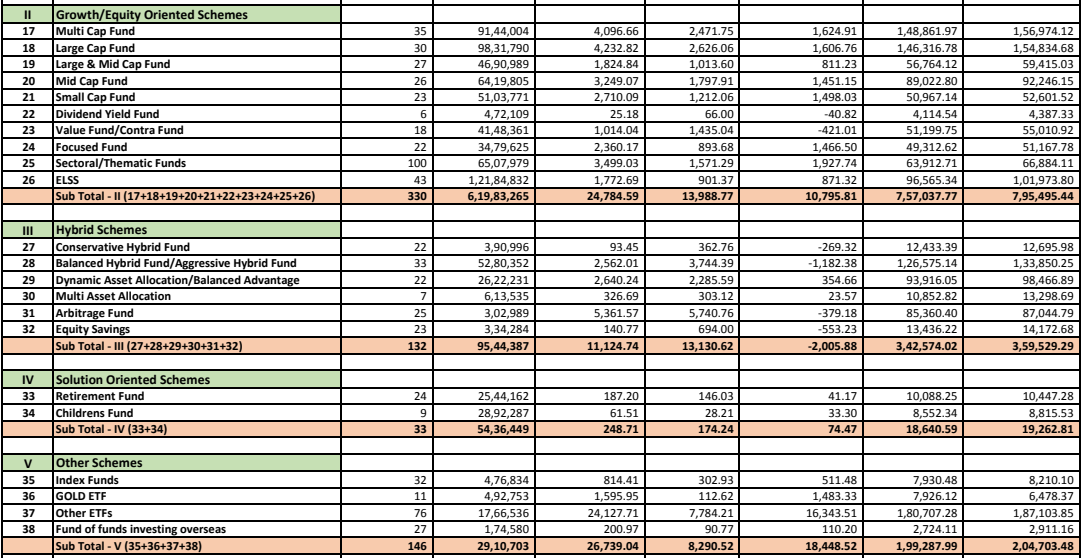

Next, stop chasing fads, thematic bullshit funds, small-cap funds ETC, you don't need 10 funds, you don't need 5 either!

Good advice and solutions are worth paying for. Don't be penny-pinching idiots.

You don't need shiny funds

Stop checking your portfolio 37 times a day. The more you check your portfolio, the higher the chances you doing really silly and DUMB things. Don't take my

Stop performance chasing

ASSET ALLOCATION DRIVES A VAST MAJORITY OF YOUR PORTFOLIO RETURNS!! Spend time on it.

Learning how to DIY your investments is probably one of the best investments you can make in life.

betterment.com/resources/high…