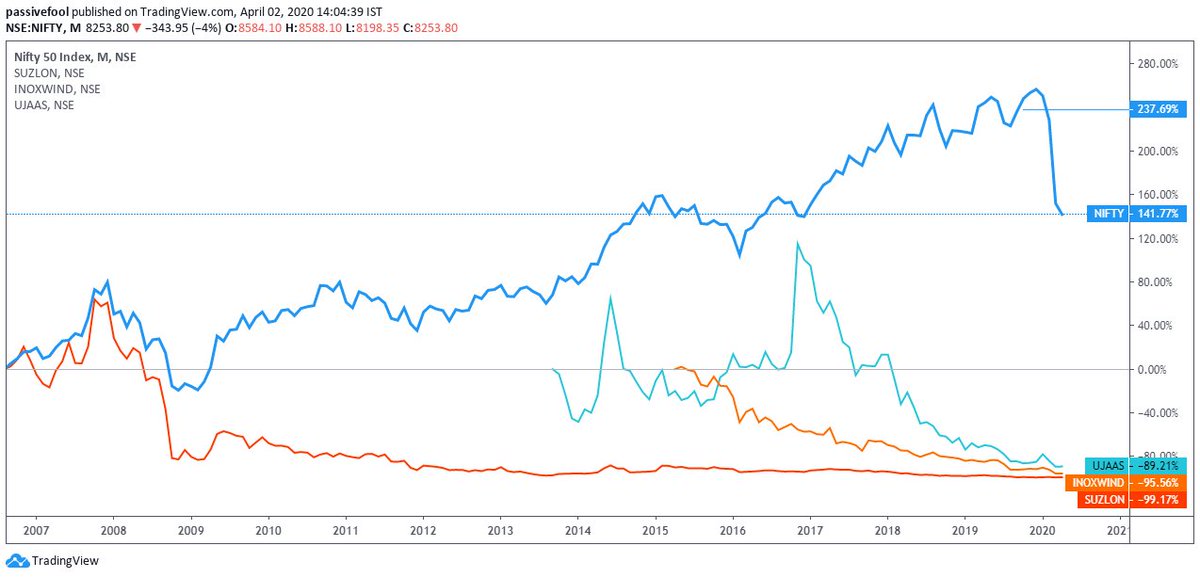

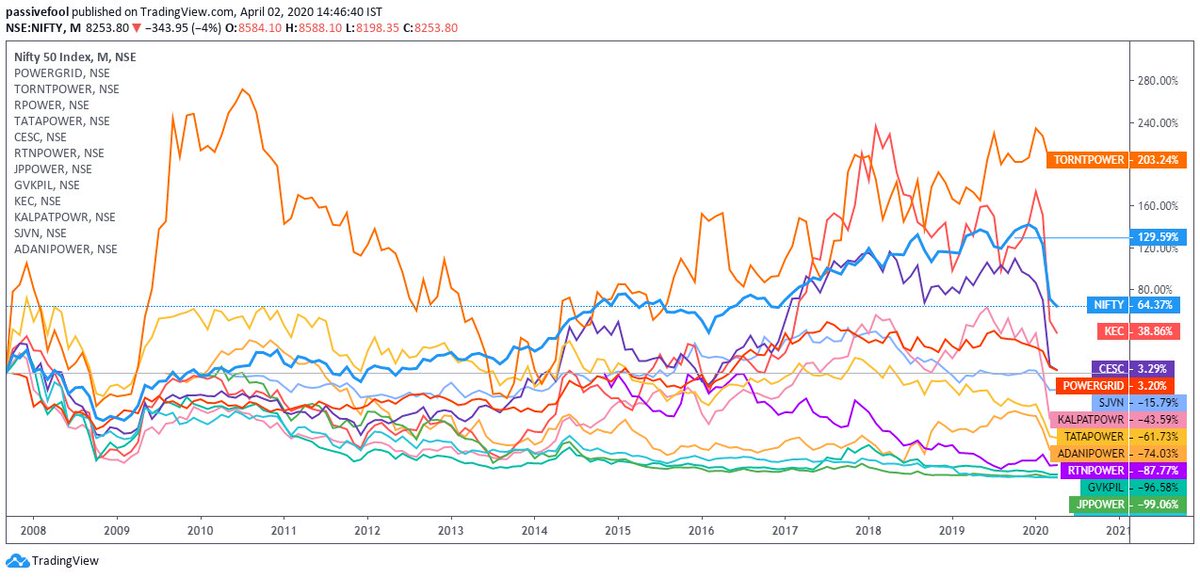

Story: India is a growing economy, which means it needs lakhs of KMS of roads, bridges, ports, etc.

Reality: Lanco, JP Group, IL&FS, Reliance Infra, Aban, Punj Lloyd and a 10s of other POPULAR infra stocks are worthless.

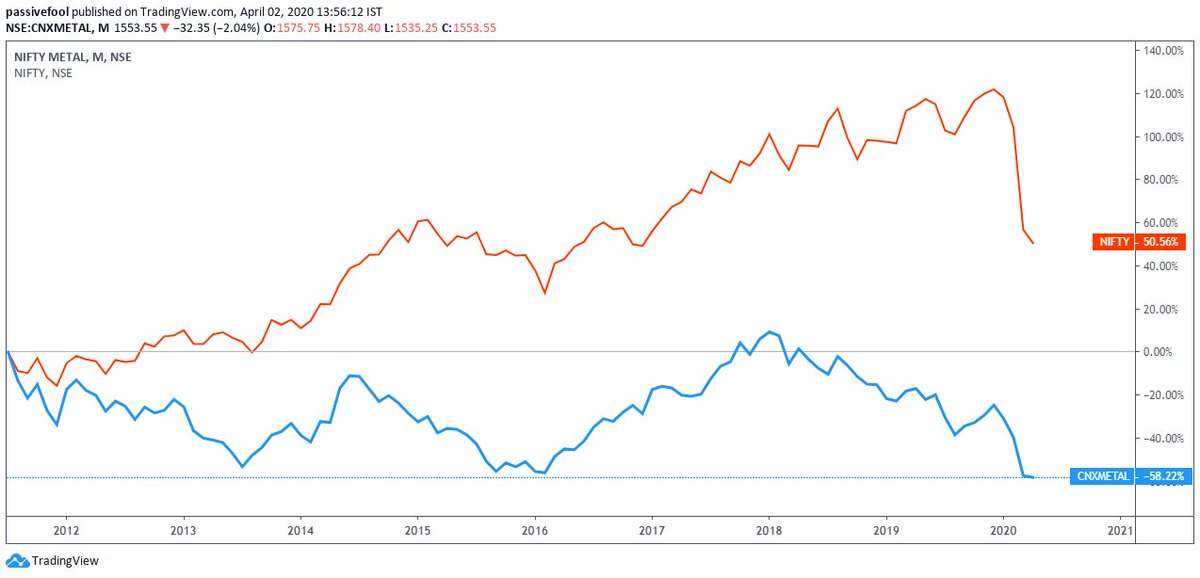

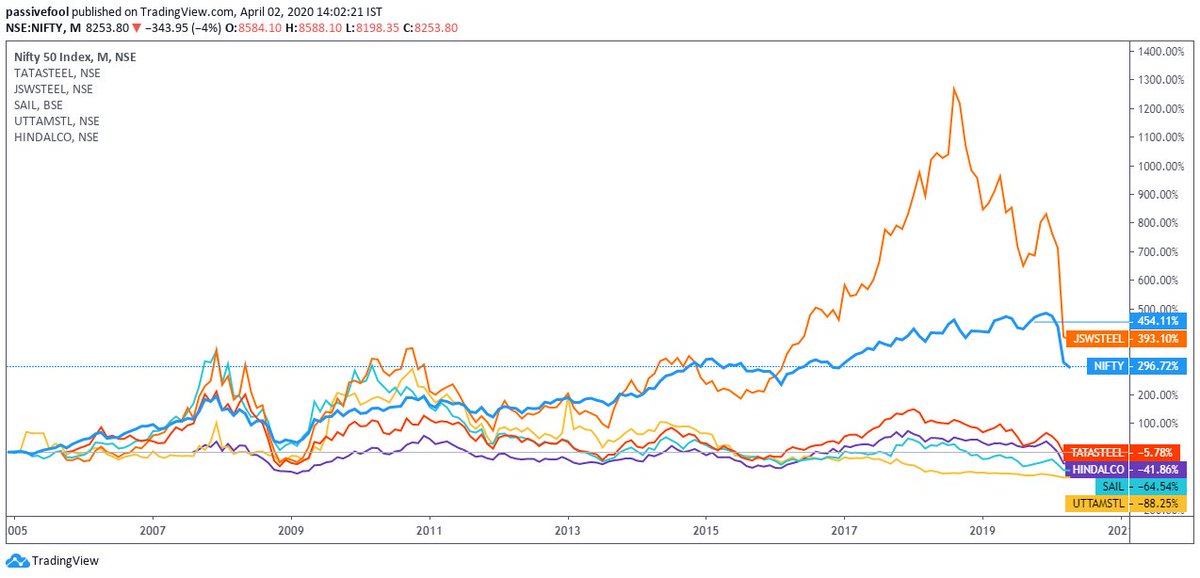

Story: A growing India needs a humongous amount of steel. Buy steel stocks.

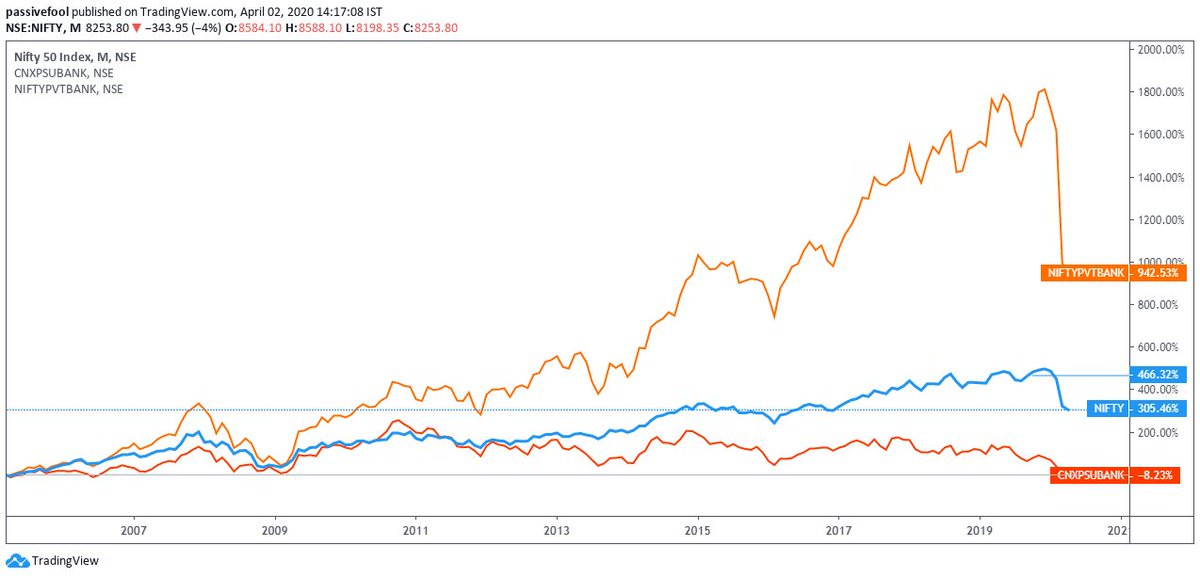

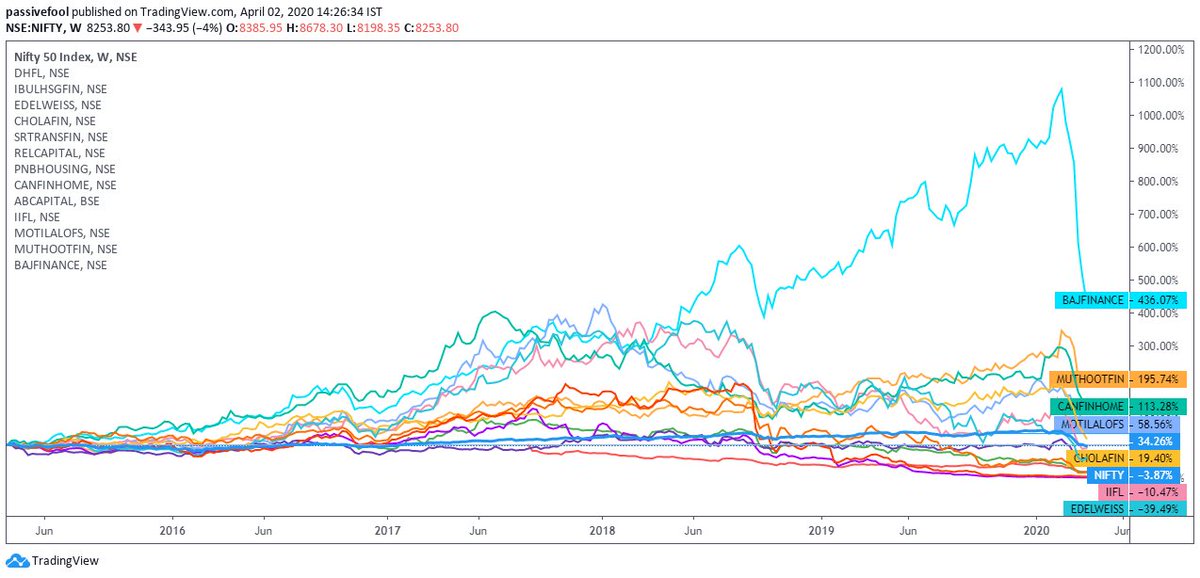

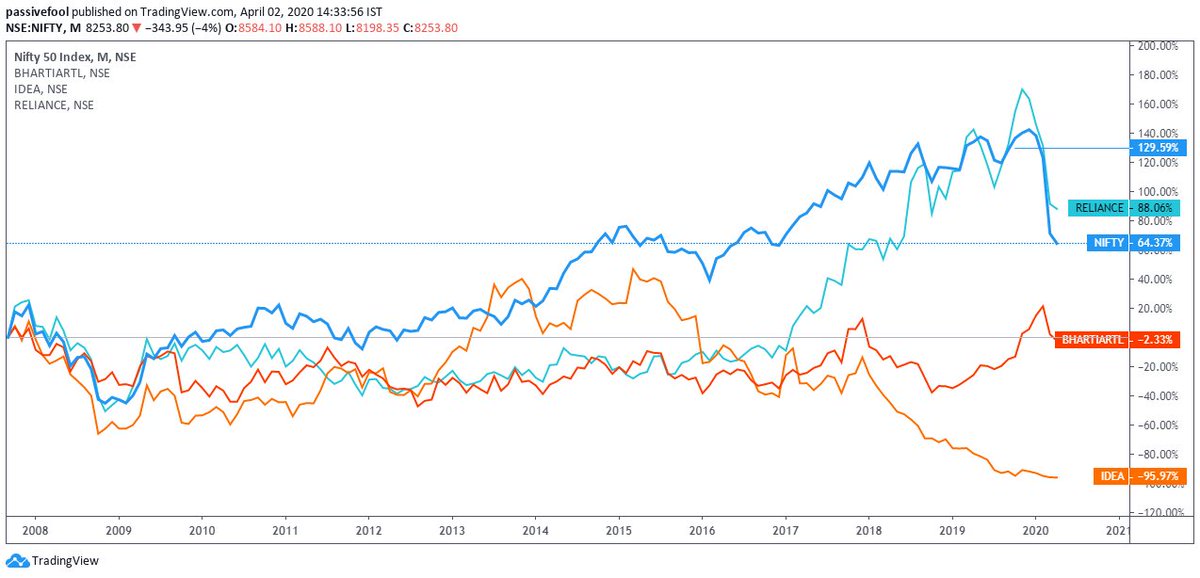

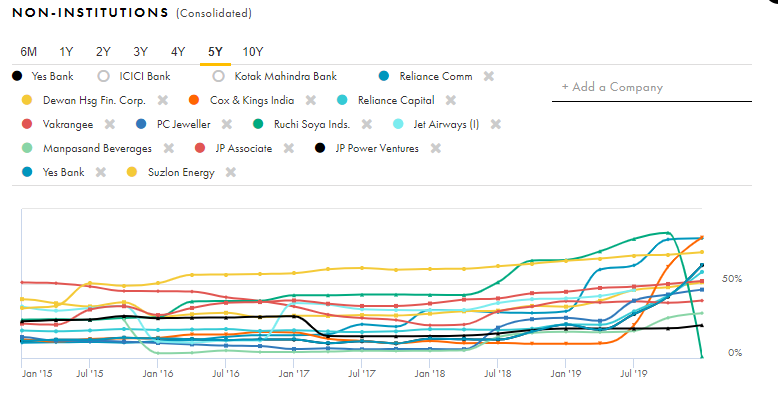

Reality: This one is a tale of 2 cities. While Pvt banks except Yes Bank have done phenomenally.

indexheads.substack.com/p/lets-start-f…

ideas.ted.com/an-eye-opening…

Solution? I am not saying investors should be dispassionate, unemotional, and robotic when analysis stocks, I don't even think

"Stories are more powerful than statistics because the most believable thing in the world is whatever takes the least amount of effort to contextualize your own life experiences."

"Most stock-picking stories, advice and recommendations are completely worthless." Ed Thorp

Of course, I also understand that I can be completely wrong and look like a doney's bottom.