I have tried to highlight some important facts which revolve around these concerns..

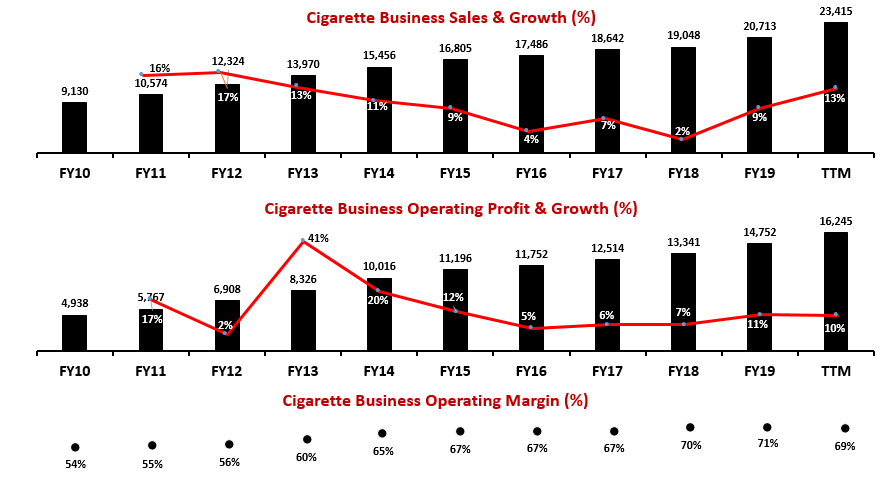

Cigarette business is and continues to remain a very strong cushion which lets #ITC go out and take risks. It gives the company a tremendous capacity to suffer.

Here is what history has to say..

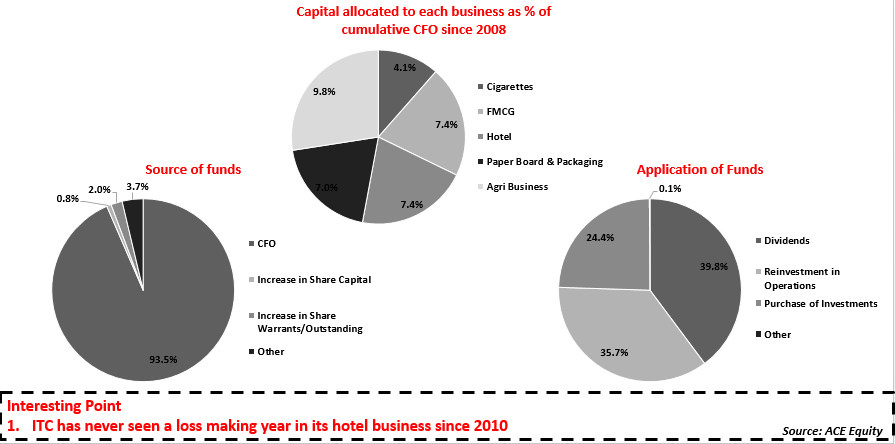

Hotel is not regarded as a good business among investors, because low ROCE.. But the question is, is it worth focusing too much upon in context of ITC? #ITC has only invested 7% of its cumulative CFO into the hotel business since 2008.

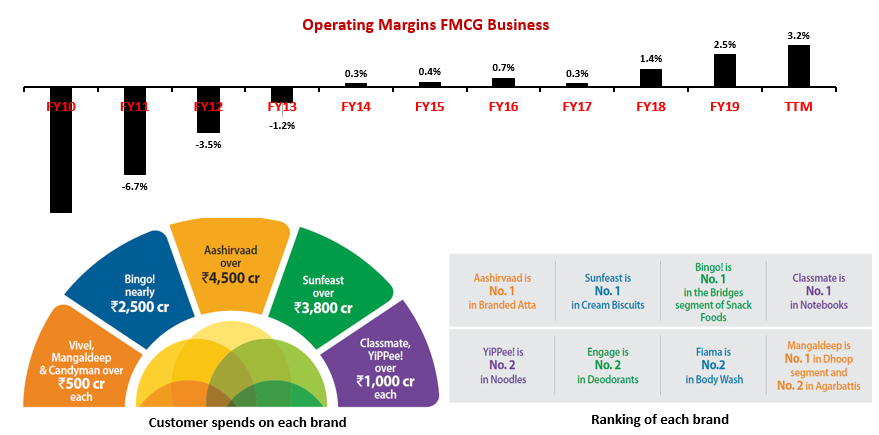

FMCG part of #ITC has been under pressure but it has started to show a lot of promise.

FMCG should become more stable and promising. Not to forget the powerful innovation engine which powers FMCG.

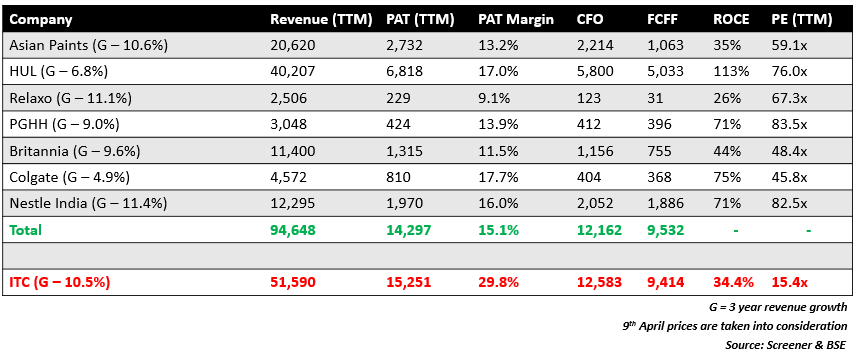

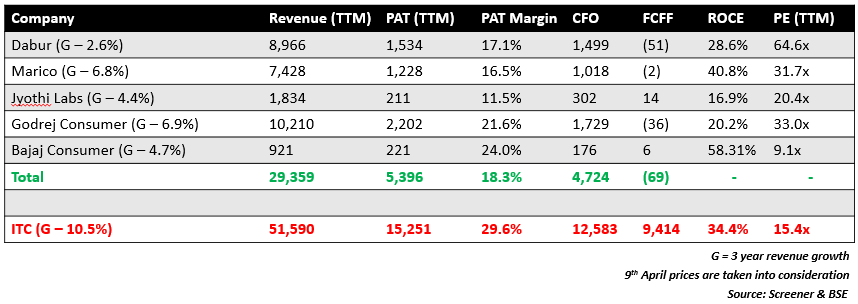

Basic comparison with market darlings shows that #ITC is not lagging behind in terms of growth or any other parameter, baring 2 companies (Still the difference is less than 2%)

But Valuations..

But Valuations..

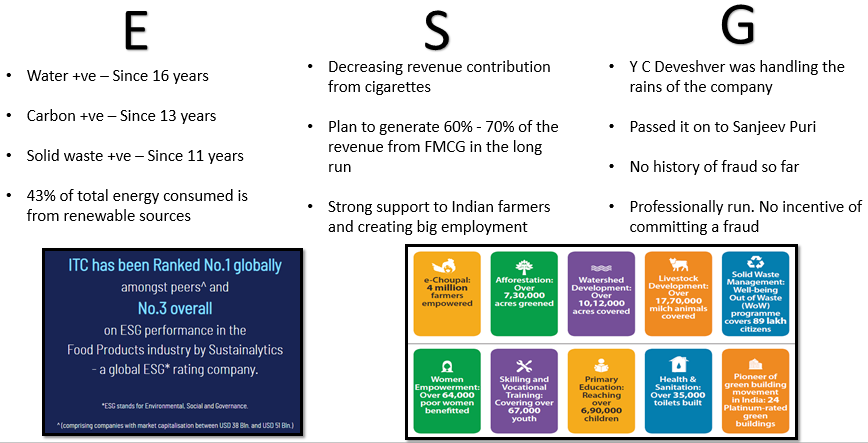

Yes, Cigarette can be a socially questionable business but isnt #ITC doing the right thing by moving away from the business?

But they are actually doing a lot of things which ticks the ESG box. In fact, most of the companies globally fail to meet ITC’s standards

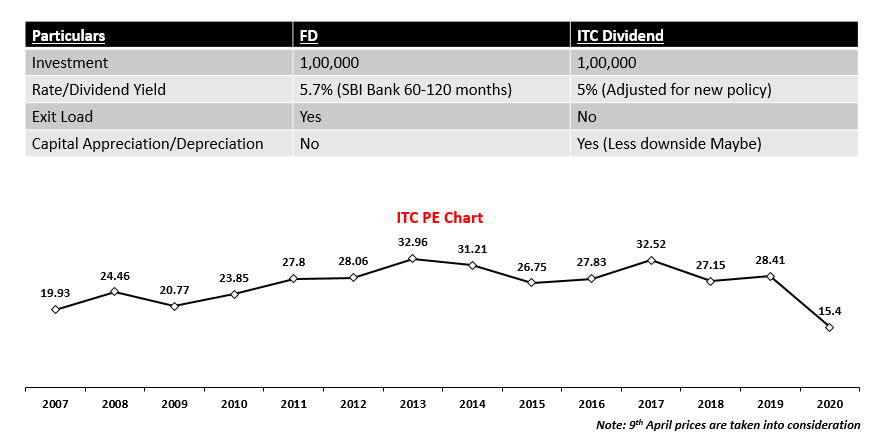

ITC is currently at the lowest PE since 2007.