1/ What is Hegic?

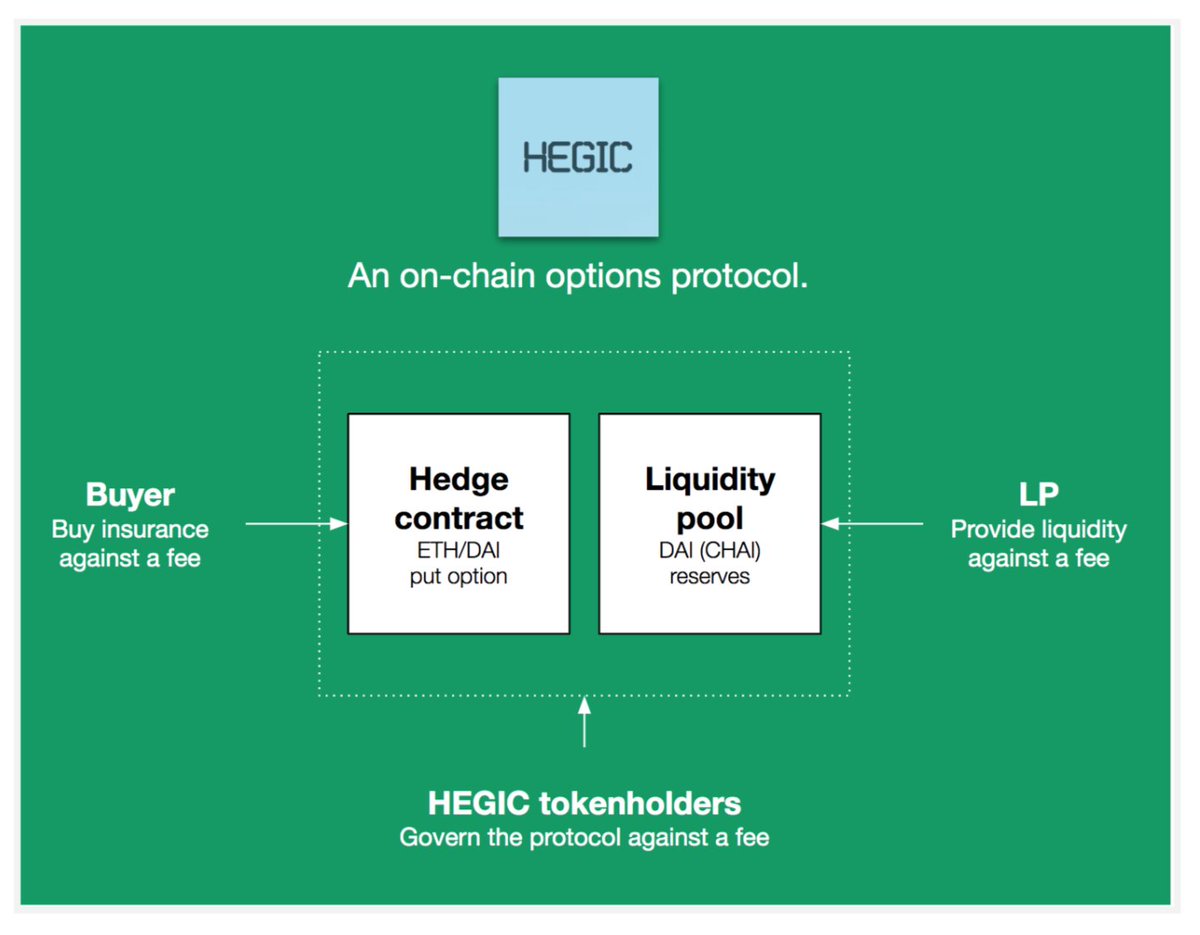

A protocol for on-chain hedging contracts (= American options).

1st implementation = at-the-money put options on ETH backed by a shared liquidity pool of DAI.

The DAI deposits by liquidity providers (LPs) are distributed between many hedge contracts = risk diversification, improved liquidity & capital-efficiency.

Assumption: long-term returns for Hegic LPs > returns of a solo options writer.

LPs deposit DAI into the pool (DAI <> CHAI via Uniswap) and get writeDAI that corresponds to their pro rata share of the total pool.

LP earns = pro rata share of premium fees + DSR.

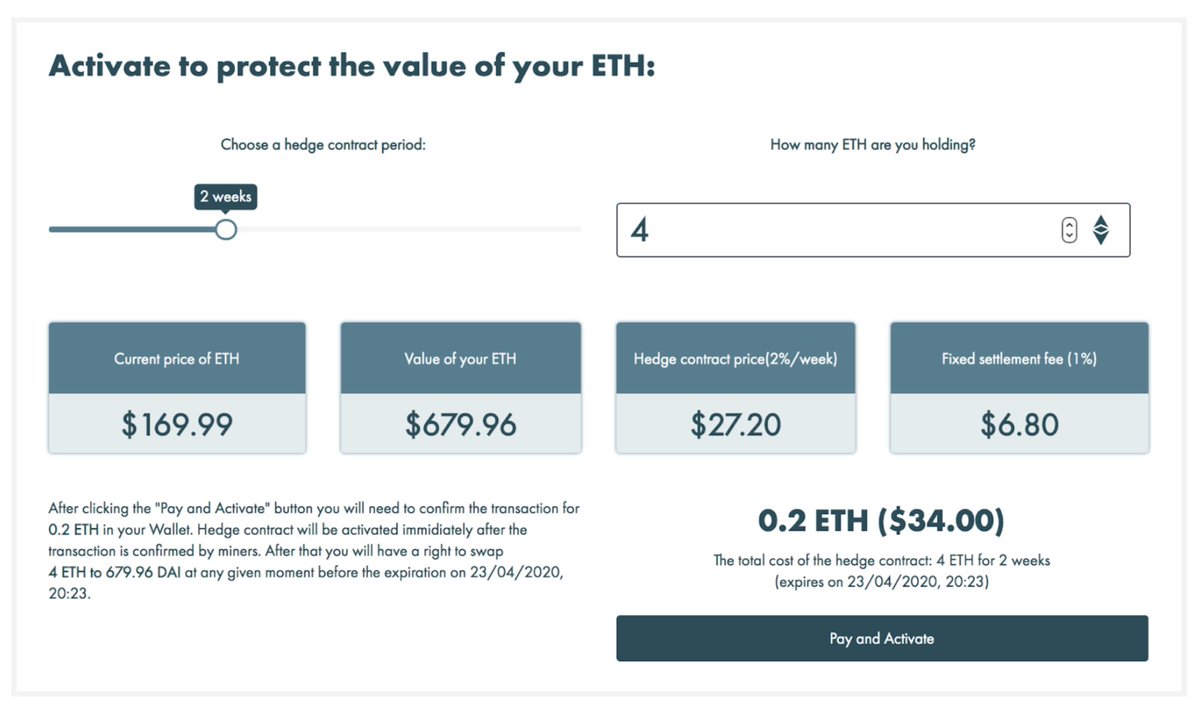

The hedge buyer sets: expiry date (in weeks) and # of ETH. ETH/USD strike price from @chainlink.

Cost: 2% premium (per week) + 1% settlement fee.

Premium fees distributed to LPs & settlement fees to HEGIC tokenholders.

On-chain: Nexus, Opyn → pros: protection for current ETH value & shared liquidity.

Off-chain: Deribit, FTX → pros: transparency & trust-minimization.

The 1st implementation supports only non-tradable at-the-money ETH/DAI puts.

Future: a decentralized options protocol with the features of a centralized options exchange like @DeribitExchange.

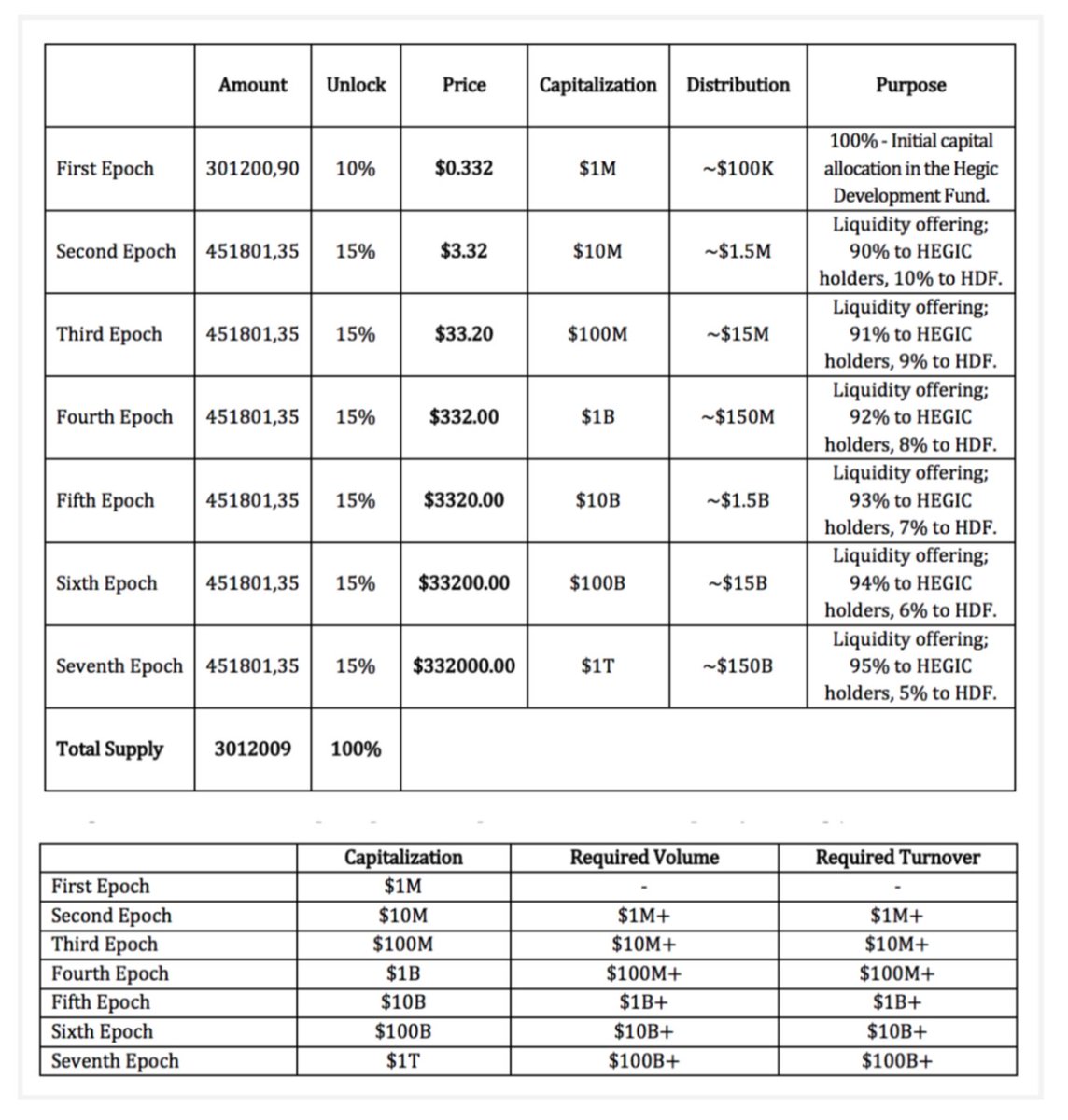

HEGIC token = economic (settlement fees) & governance (voting) rights.

Governance (e.g. premium & settlement fees, supported strike prices, hedge contracts & pool assets) to be implemented after 100 MAUs.

Buyers get a 30% discount on premium fees by proving a HEGIC token balance > contract value.

LPs get priority to unlock liquidity from the pool by proving a HEGIC token balance > liquidity value.

The Q&A between @DeFi_Dad, @DegenSpartan & @0mllwntrmt3 in the Hegic discord served as great inspiration for this thread.