Is it good time to invest in #Gold? Historically Gold has given superior returns during economic crisis, and now global markets are heading towards recession due to Coronavirus impact, will the Gold outperform all other asset classes? squareoff.in/single-post/Is…

When global markets were tanking in 2008, Gold started its steady upward journey. #GoldBees moved from 10 to 30 in next 5 years, 200% increase in less than 5 years time. And from 2014 to 2019, Gold was trading in narrow range, by Jan 2020 it moved out of that range.

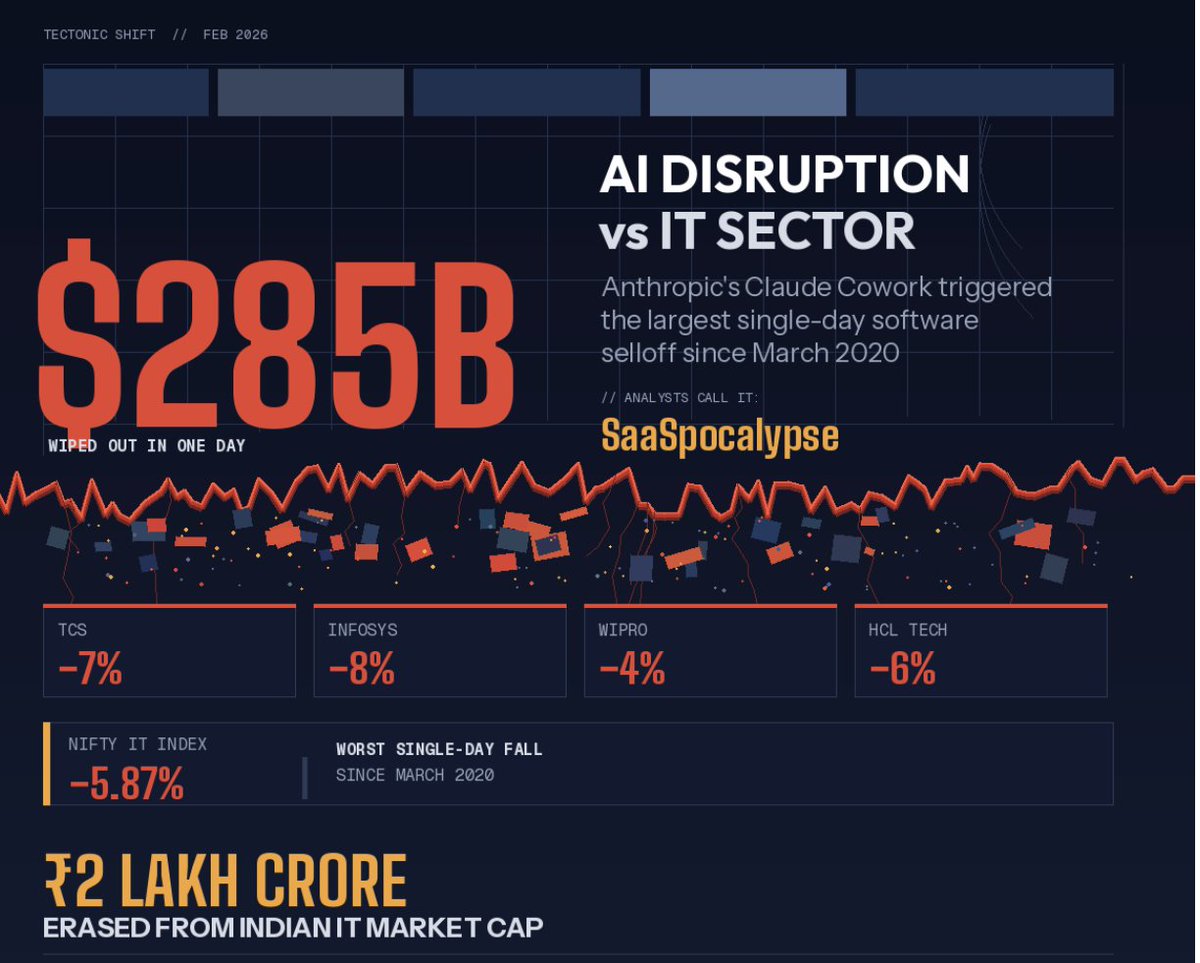

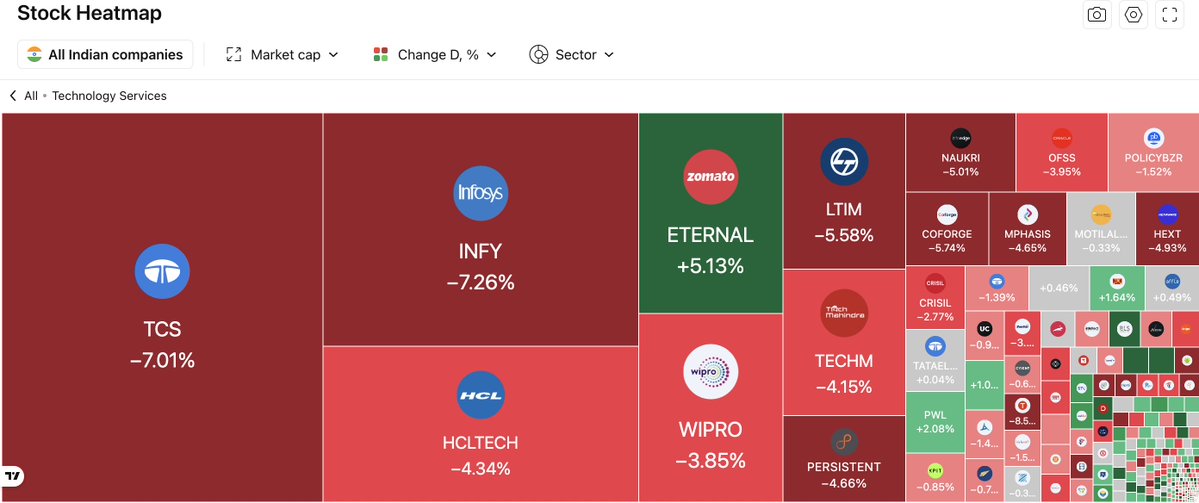

When the economic outlook was weak during the 2008 period, Nifty continued to slide down and ended up with -52% that year. But Gold gained +24% by 2008, in next 5 years gained +200% where Nifty took more than 5 years to regain back its 2008 year high.

Similarly now, in 2020 Nifty dropped around -30% so far and Gold appreciated +18.4% so far. Due to Corona virus impact global economy is in worst situation now than compared to 2008 financial crisis .If the current trend continues, then we can expect a huge bull run in Gold.

During 1970's President Nixon announced that the convertibility of the dollar into gold or other reserve assets, ordering the gold window to be closed such that foreign governments could no longer exchange their dollars for gold, closed the gold window.

The price of gold has increased more than 2100% during the 1970's. From a price of $35.65 in 1971, gold has risen to $800 by 1980. As you can see in below chart clearly, whenever Stock market gets into bear phase, Gold gets into bull phase.

Gold price almost doubled in dollar terms when it broke all time high in 2008, currently it is trading at $1779 and all time high is $1912, many analysts strongly believe that all time high is soon to be broken, when that happens, we could witness a huge up move in Gold price.

• • •

Missing some Tweet in this thread? You can try to

force a refresh