Thread

FMP Vs. open-ended debt fund

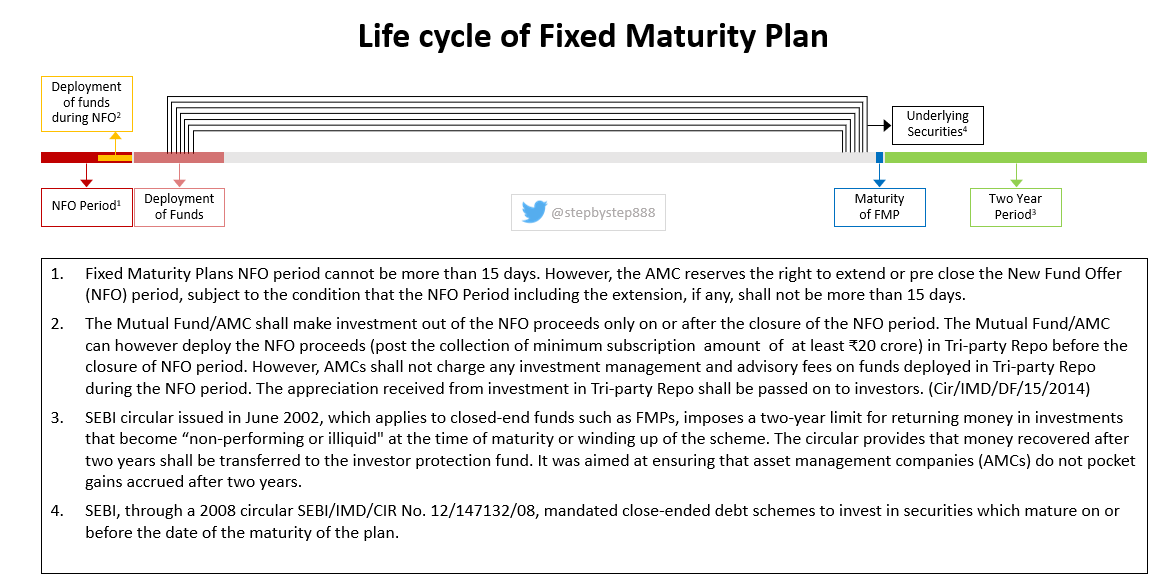

life cycle of a FMP

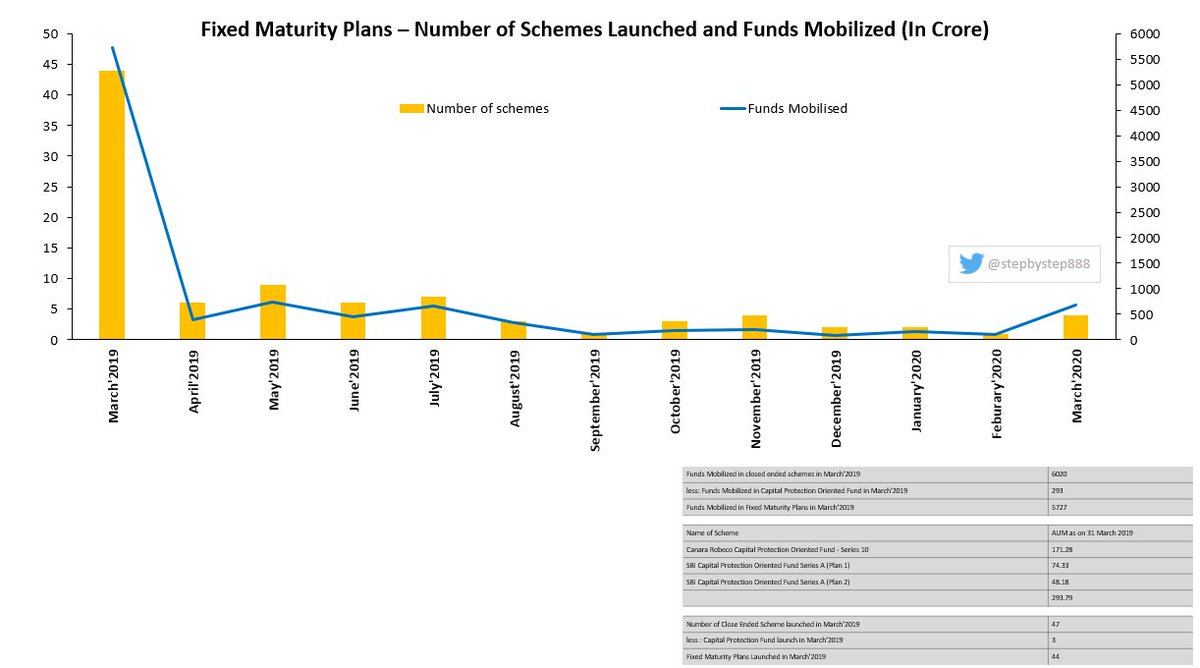

no of FMPs Launched & AUM Mobilized

taxation & indexation

Once the darling of AMCs, Mutual Fund Distributors, Wealth Management firms, HNIs & Corporates, why it has lost its sheen.

#mutualfunds

explained the same in an earlier tweet

Sab chalta hai.

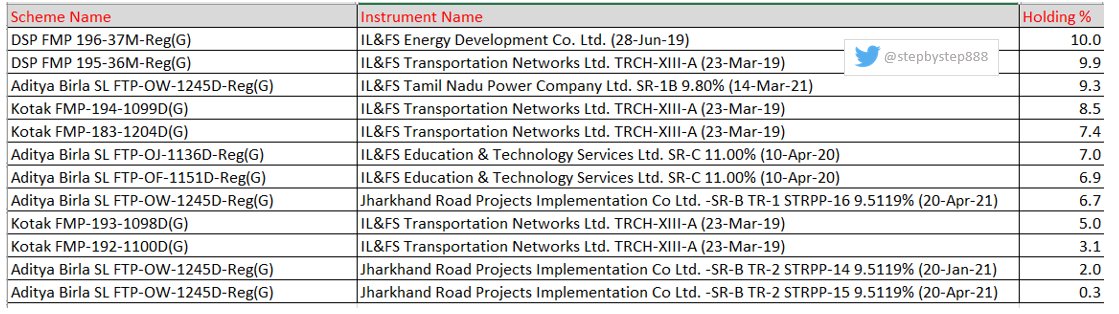

1) AMCs have taken exposure as high as 20% in FMPs (the upper ceiling as per regulation).

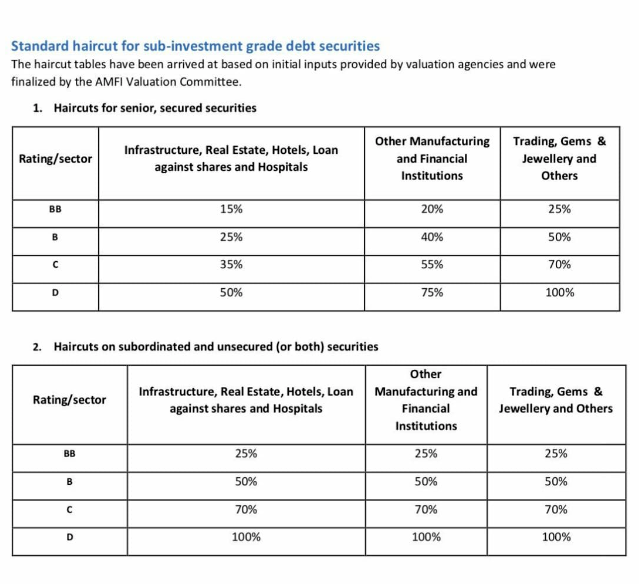

2) LAS has risks of equity but returns of debt

3) standstill, really?

*END*

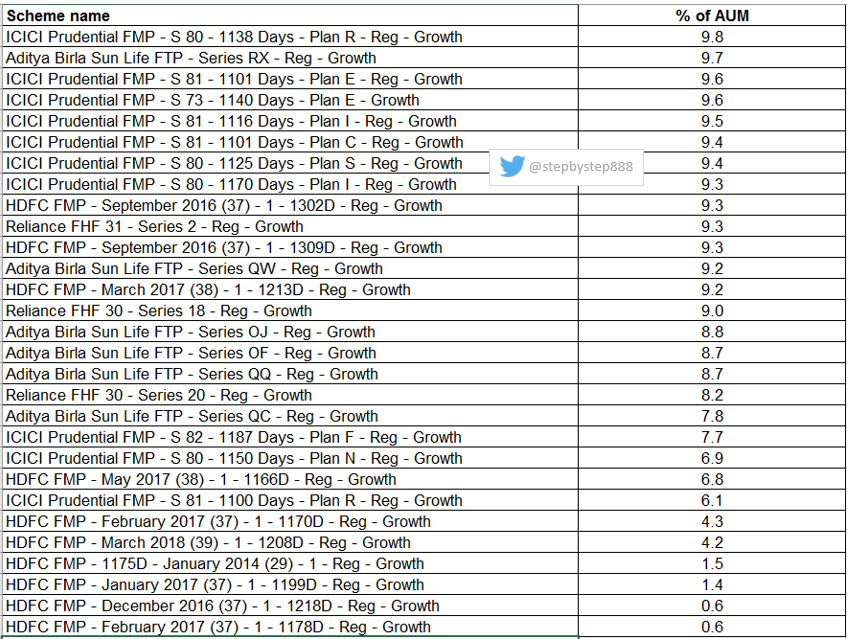

Net Assets Under Management on 31st March 2020 for this category is ~140594 Crore only second to liquid funds with 334725.33

more info.