Thread

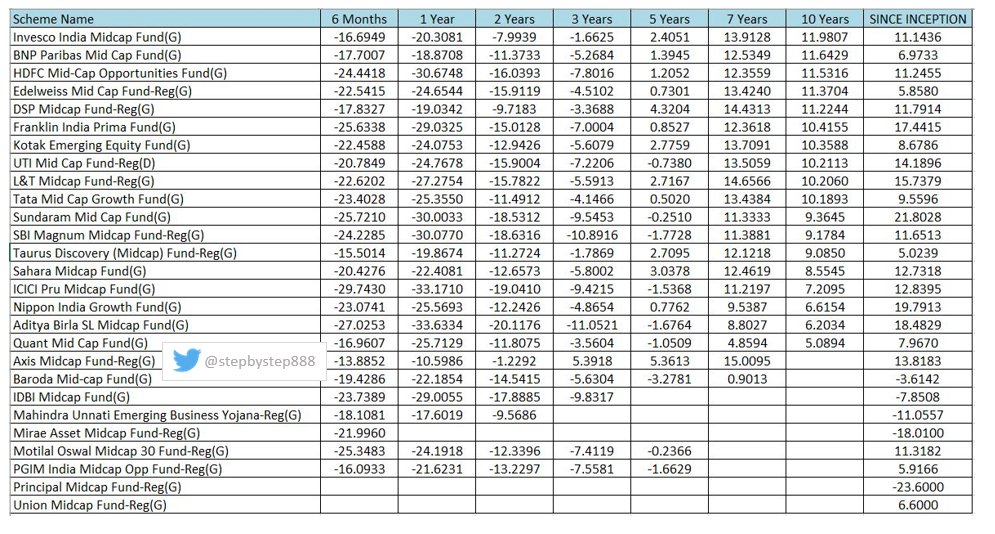

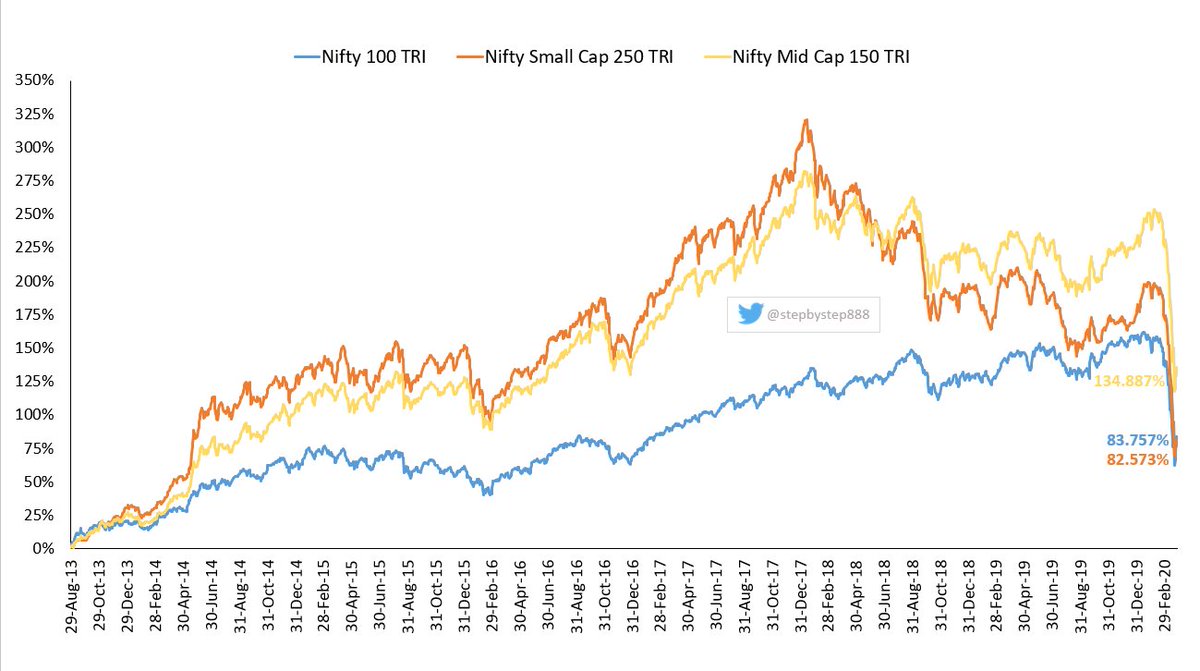

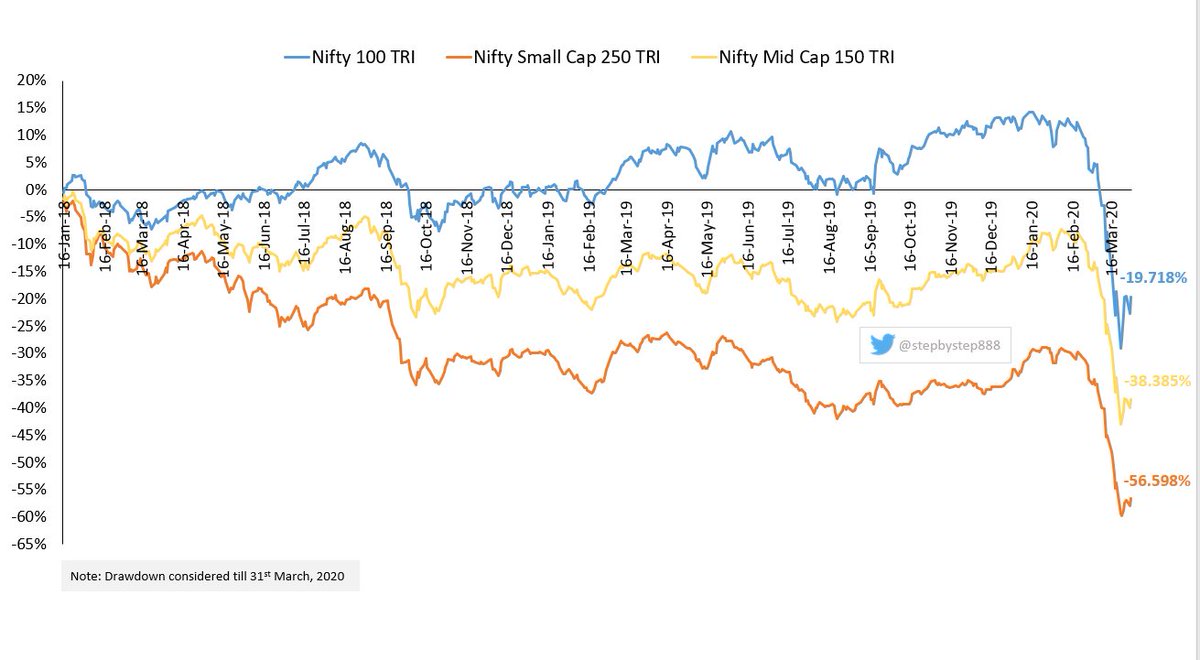

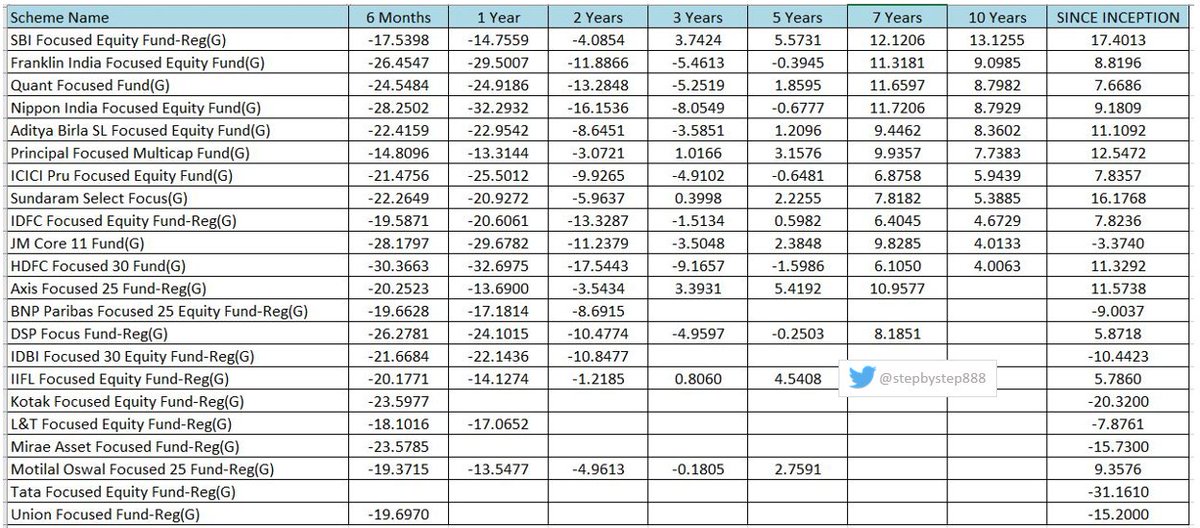

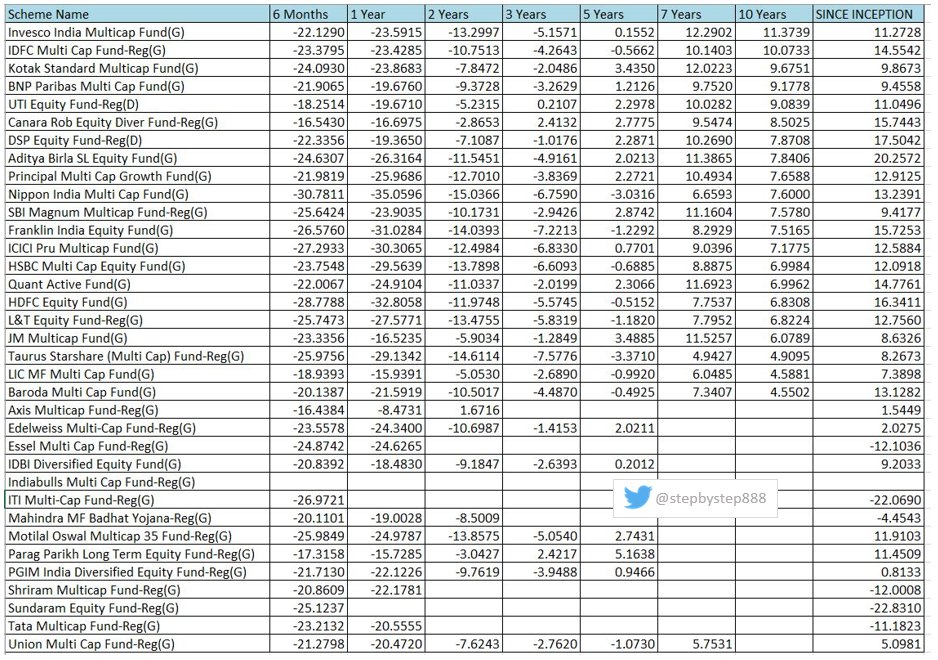

Please note, most of the investors do investing using rear view mirror (past performance).

look at the size of front windshield (it tells you what is coming) Vs. rear view mirror which tells you what has passed.

#mutualfunds

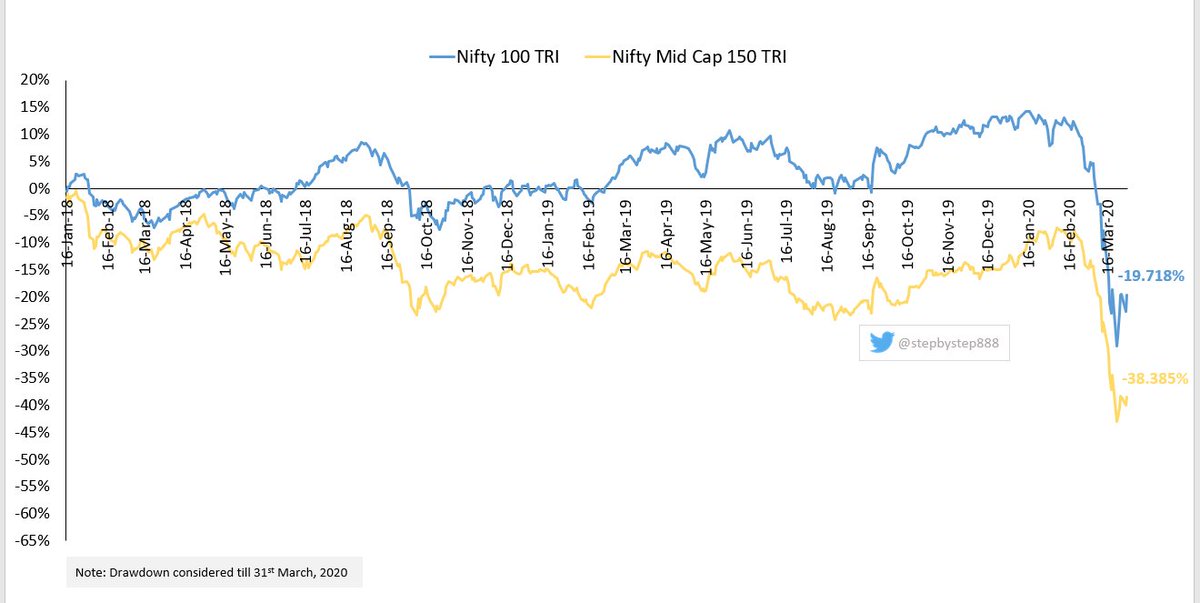

I hold similar view for mid cap as well ;)

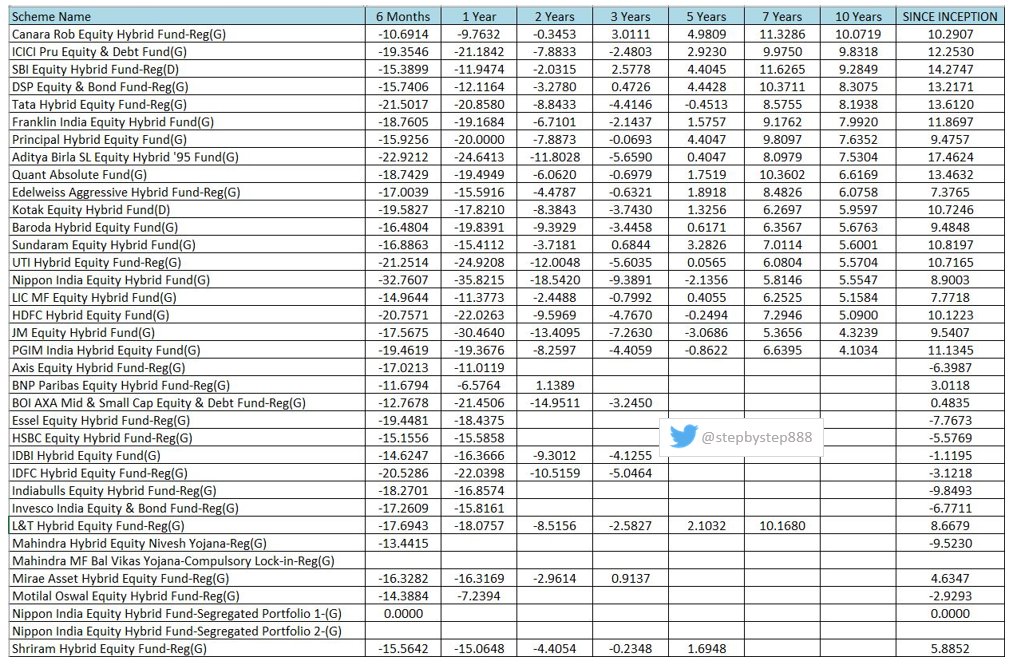

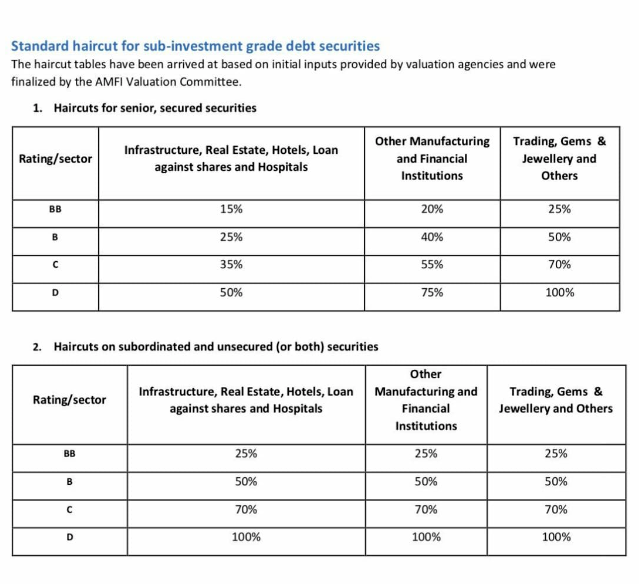

at these depressed yields when 20-35% of the debt portion is charged with equity like expense, it affects the overall returns.

TER/Yield applicable for these funds in regular mode is around 38%

yes, 38% of the returns from debt component get charged