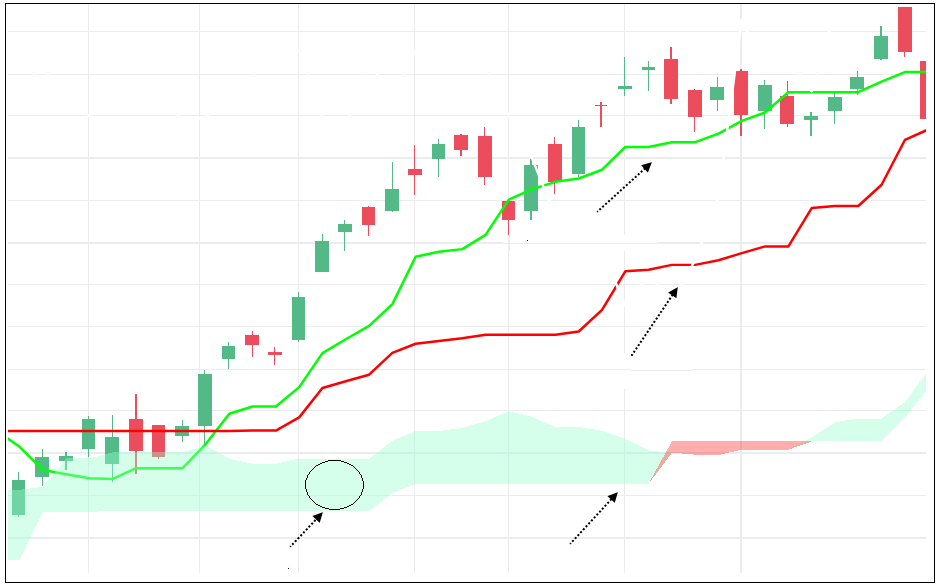

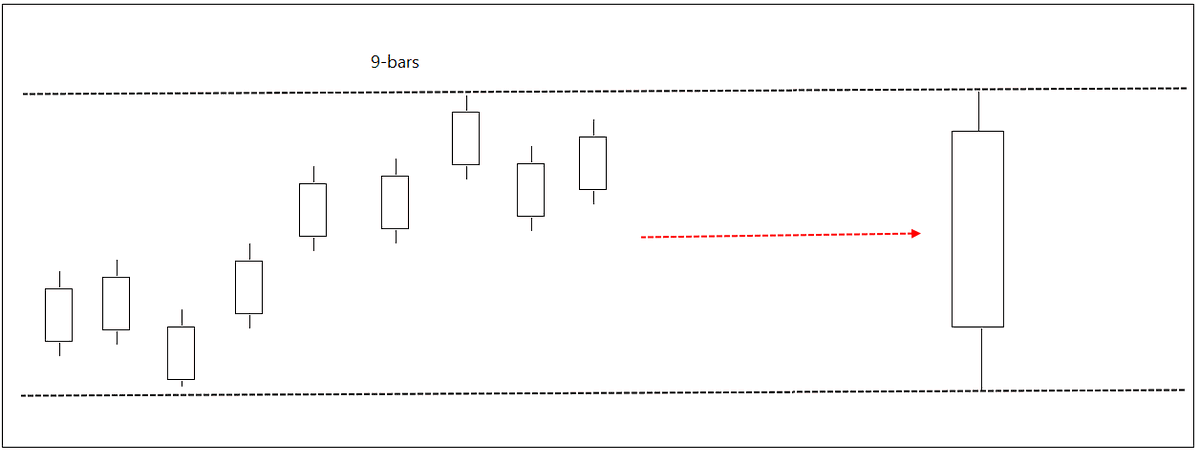

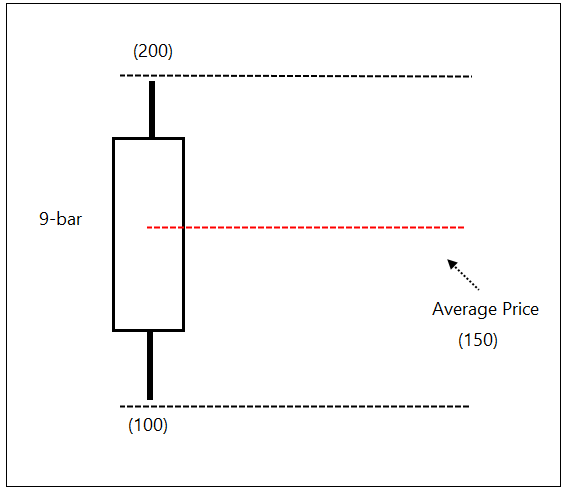

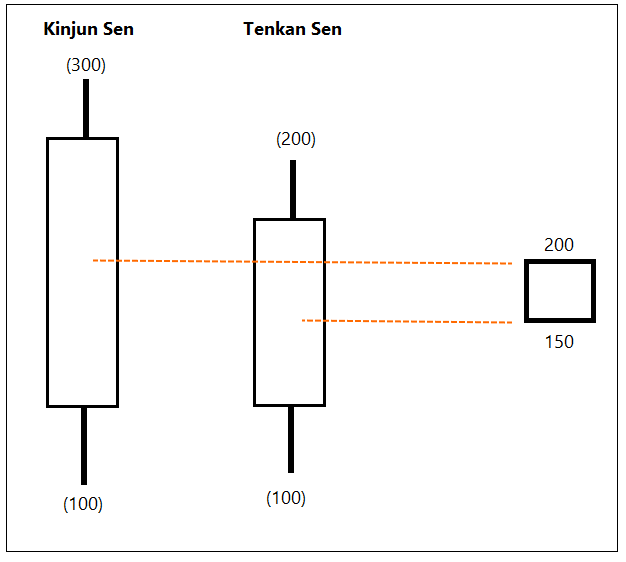

TL = 9-bar average price

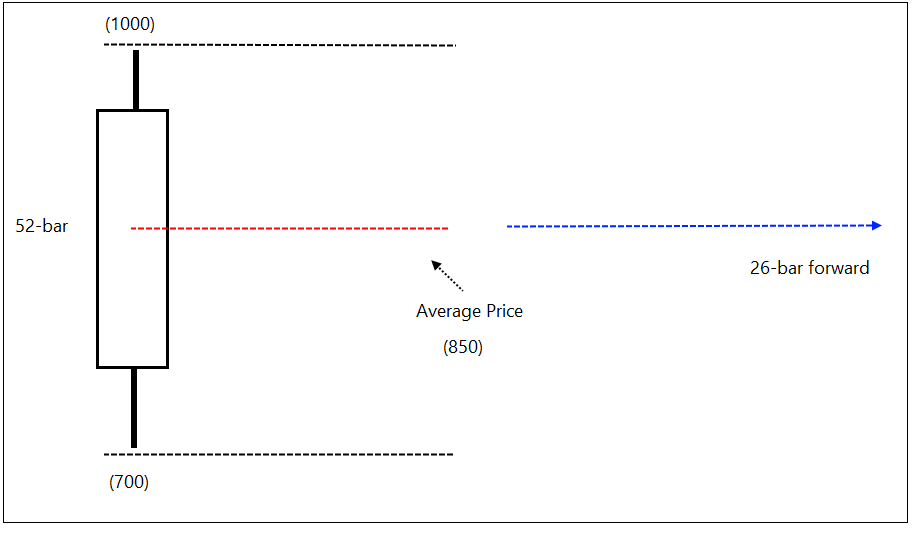

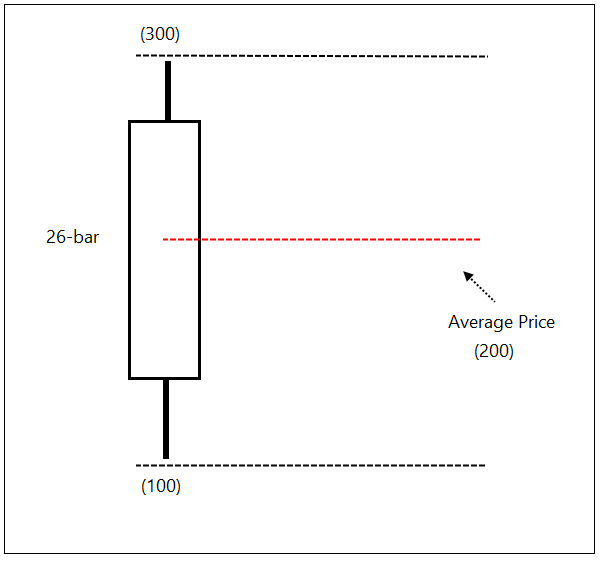

KL = 26-bar average price

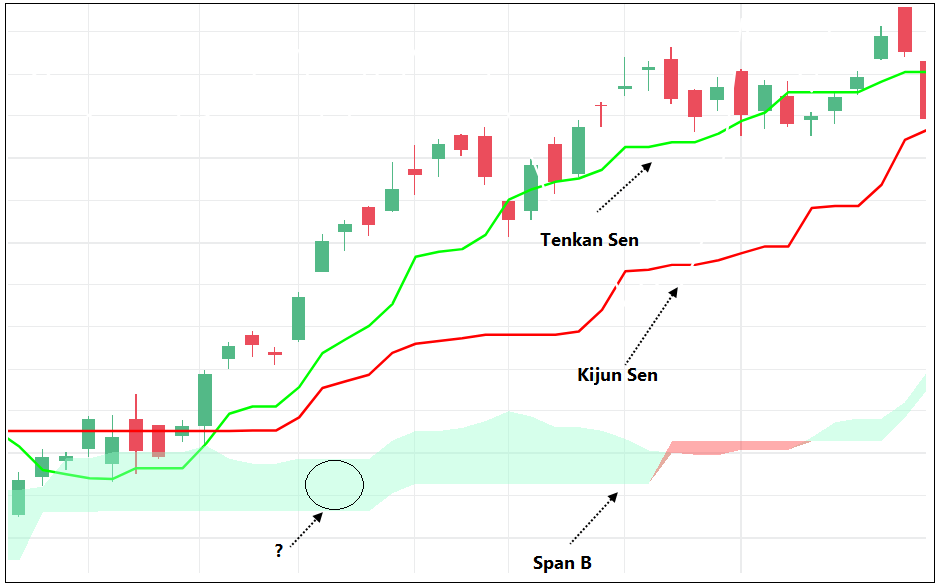

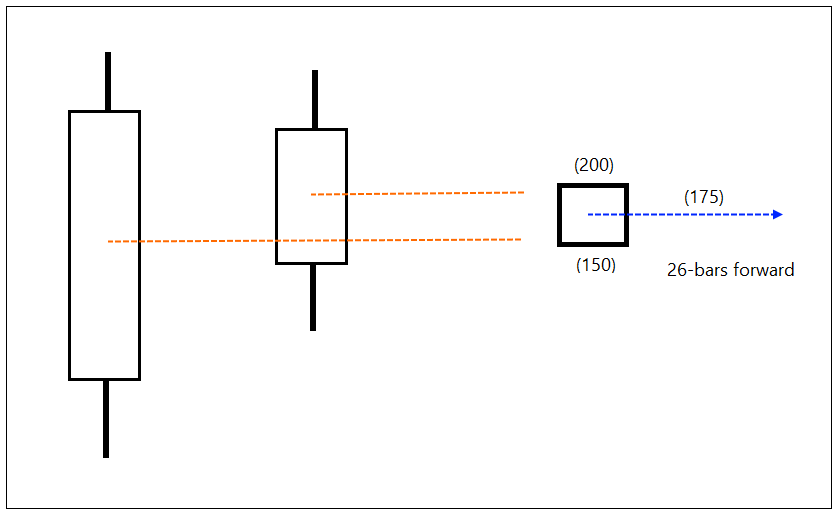

Span A = Average of TL & KL 26-days before

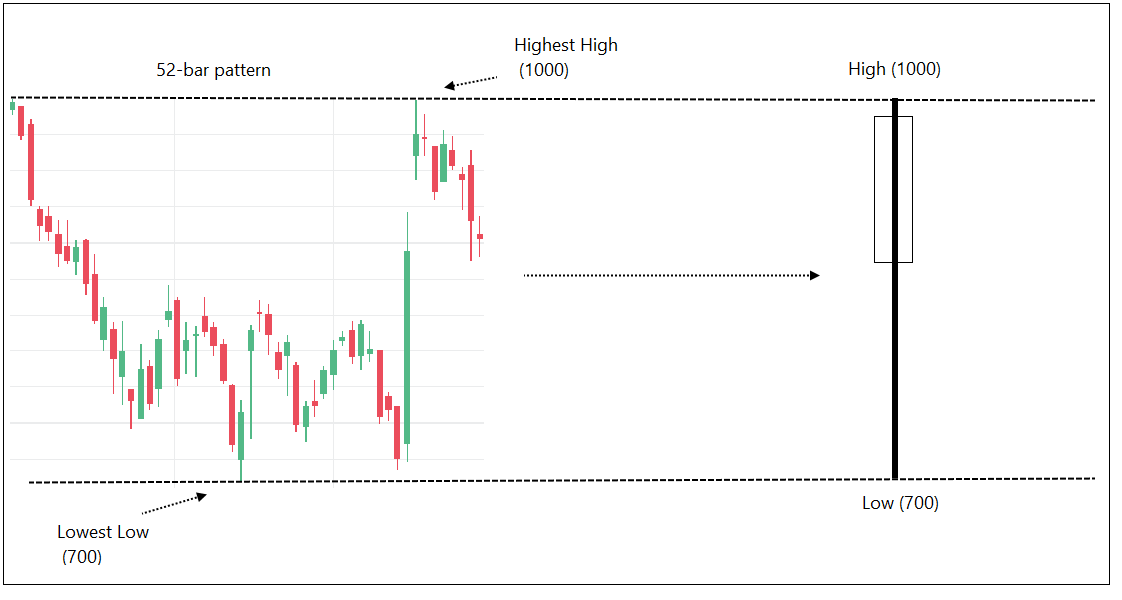

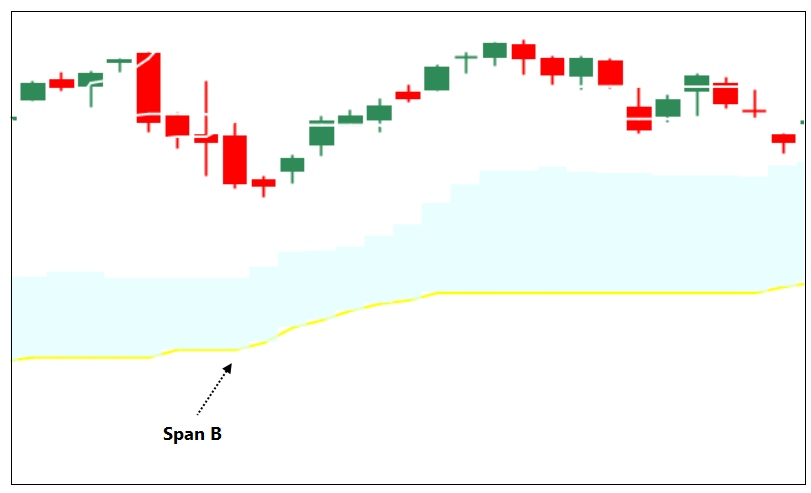

Span B = 52-bar average price of 26-days before

TL > KL = Bullish

If it is above clouds and if clouds are bullish – it is a strong bullish signal.

TL < KL = Bearish

If it is below clouds and if clouds are bearish – it is a strong bullish signal.

When price is between clouds – avoid taking trading signals.

9-26-62 are default periods. You can change that and experiment with different parameters.

There can be more rules and there are many traders following this method.

Tenkan Sen = Conversion Line

Kinjun Sen = Base Line

Senkou Span A = Leading Span A

Senkou Span B = Leading Span B

There is one more line – Chikou span (Lagging Span) in Ichimoku indicator. I will explain that next time.

End of thread.