CMT, CFTe, MFTA®, MSTA. Author of five books. Building @definedge

82 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/Prashantshah267/status/1274221823081639936?s=20

https://twitter.com/Definedge/status/1601243473268834305?s=20&t=DkuBvVXWhaNzJ0YNDS1_tA

A momentum indicator developed by William Blau, the True Strength Index (TSI) measures a stock's strength.

A momentum indicator developed by William Blau, the True Strength Index (TSI) measures a stock's strength.

2-period RSI is a popular concept introduced by Larry Connors.

2-period RSI is a popular concept introduced by Larry Connors.

The Ulcer Index indicator was developed by Peter Marin and Byron McCann. The indicator was first introduced in their 1989 book, The Investor's Guide to Fidelity Funds.

The Ulcer Index indicator was developed by Peter Marin and Byron McCann. The indicator was first introduced in their 1989 book, The Investor's Guide to Fidelity Funds.

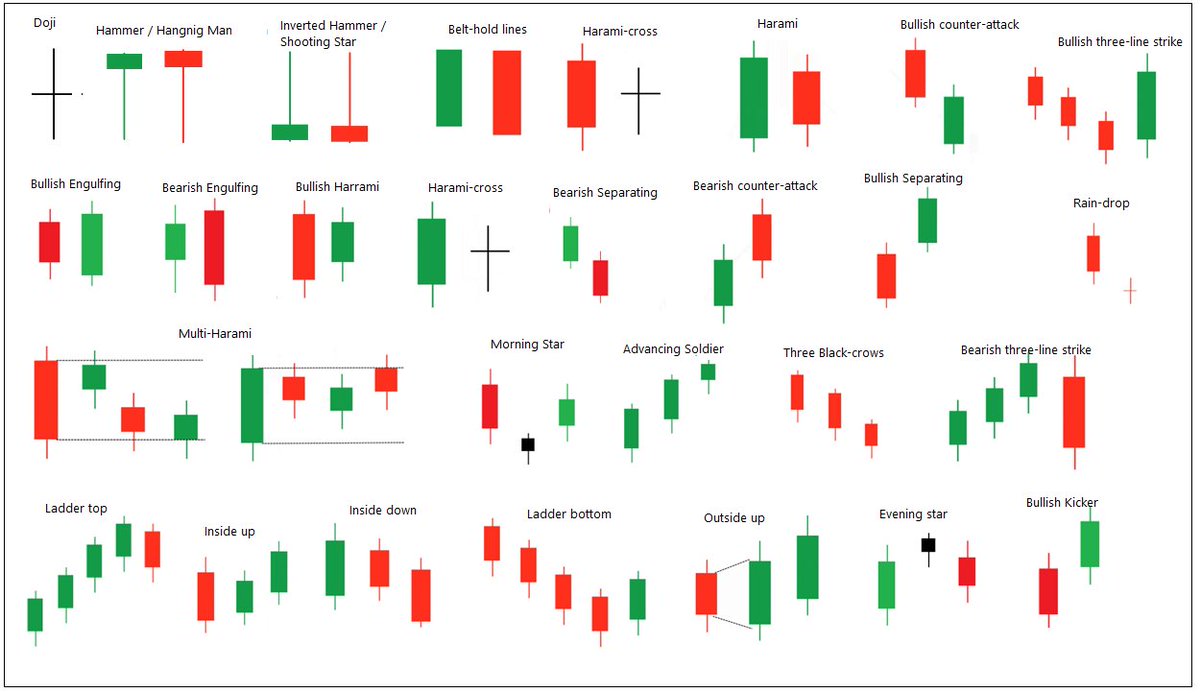

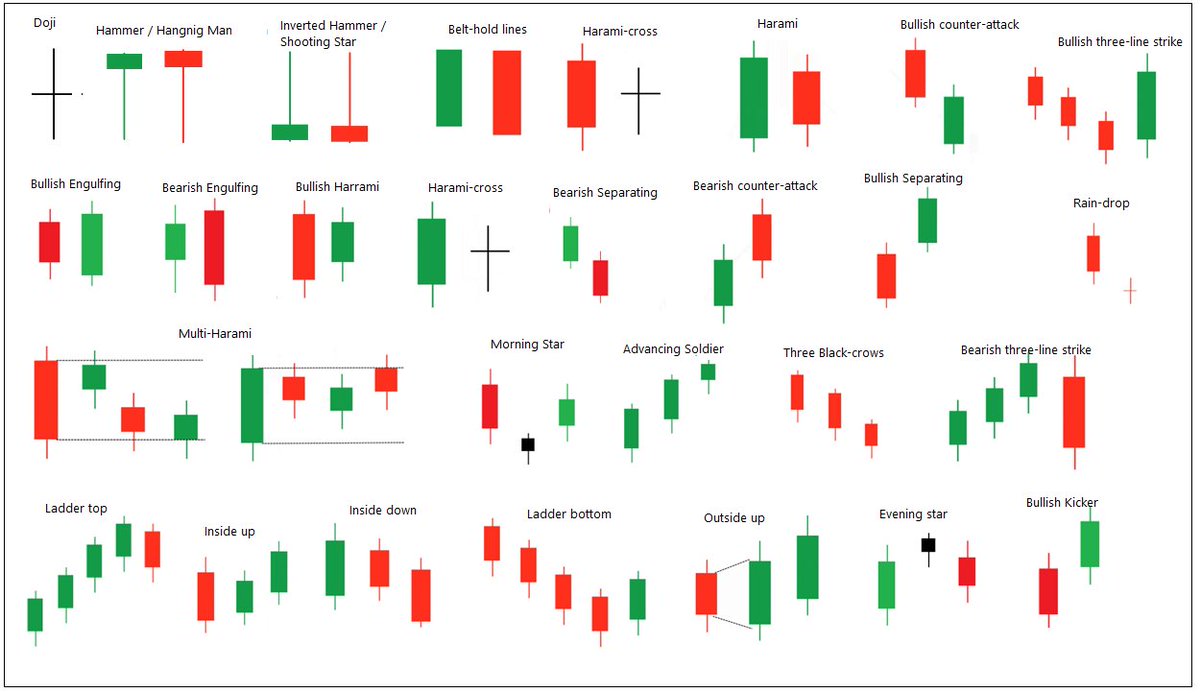

I was doing to design multi-chart setups. But the information in the thread can be useful for people practicing candlestick chart patterns. There are many patterns & we keep coming across more. The data can give you a rough idea about the past performance of patterns.

I was doing to design multi-chart setups. But the information in the thread can be useful for people practicing candlestick chart patterns. There are many patterns & we keep coming across more. The data can give you a rough idea about the past performance of patterns.

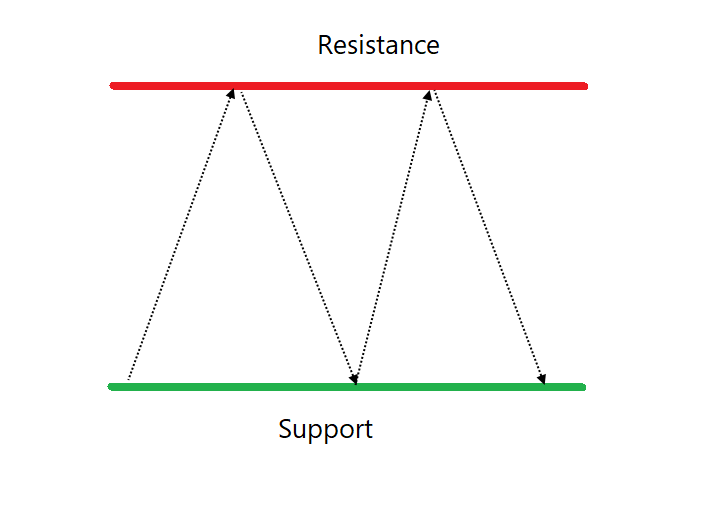

The Camarilla equation was first developed by a bond trader named Nick Scott in 1989. It is said that he didn't disclose the equation, but people studied the levels & reverse engineered it to find the formula. There r different versions of this formula.

The Camarilla equation was first developed by a bond trader named Nick Scott in 1989. It is said that he didn't disclose the equation, but people studied the levels & reverse engineered it to find the formula. There r different versions of this formula.

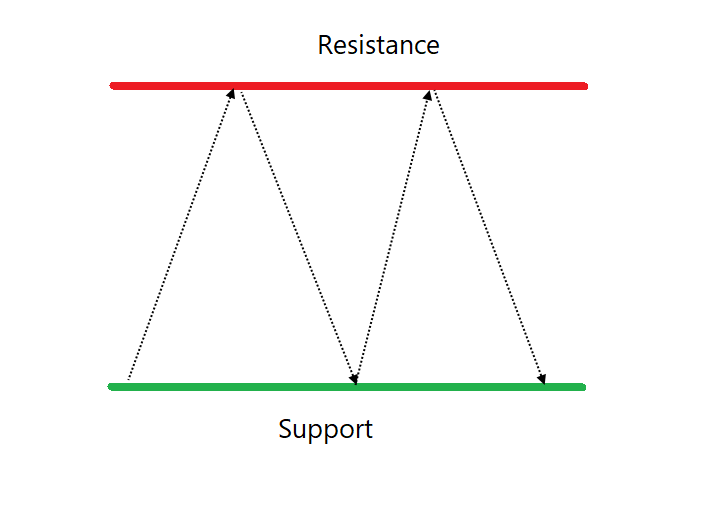

You may recall that I explained the calculation of Pivot levels in an earlier thread. CPR stands for Central Pivot Range. It is always a center line of the three lines that gets plotted in the chart.

You may recall that I explained the calculation of Pivot levels in an earlier thread. CPR stands for Central Pivot Range. It is always a center line of the three lines that gets plotted in the chart.

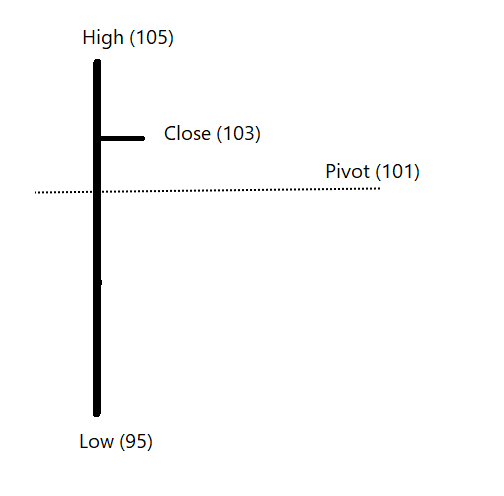

The pivot calculation method considers the previous day prices to calculate the support and resistance levels.

The pivot calculation method considers the previous day prices to calculate the support and resistance levels.

Alligator indicator is created by Bill Williams. He was a popular trader and author.

Alligator indicator is created by Bill Williams. He was a popular trader and author.

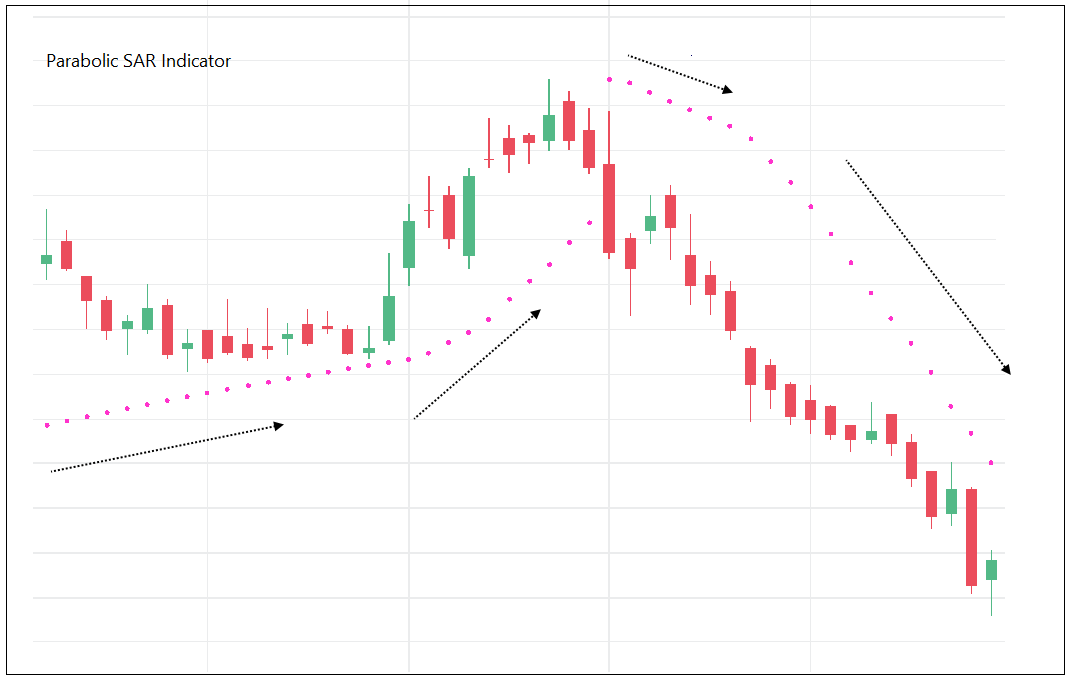

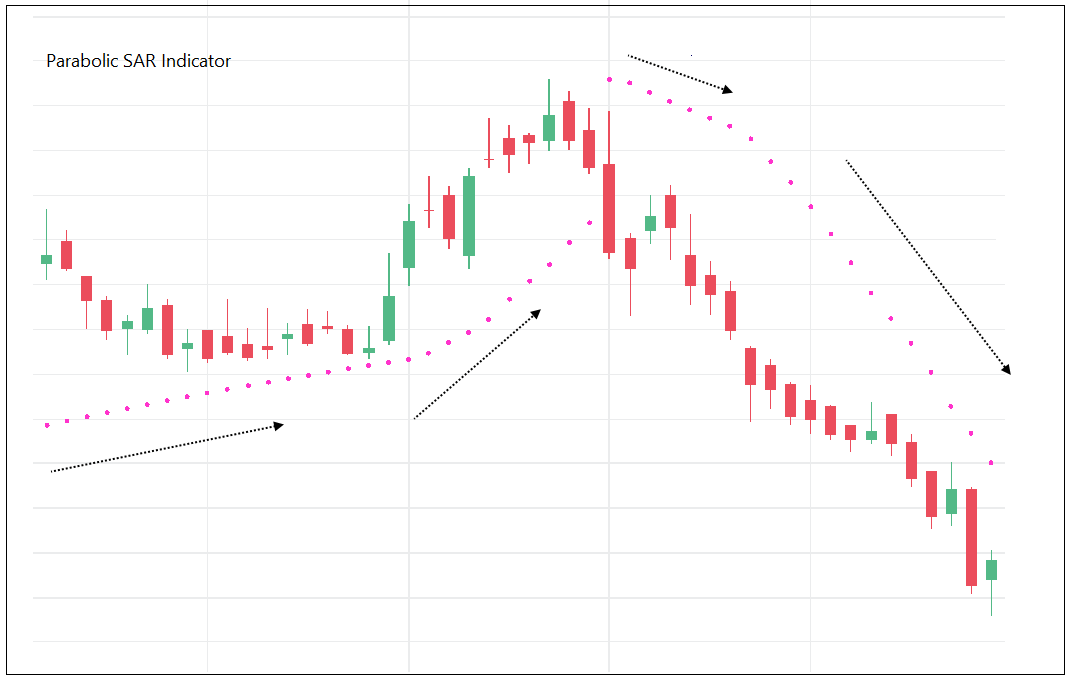

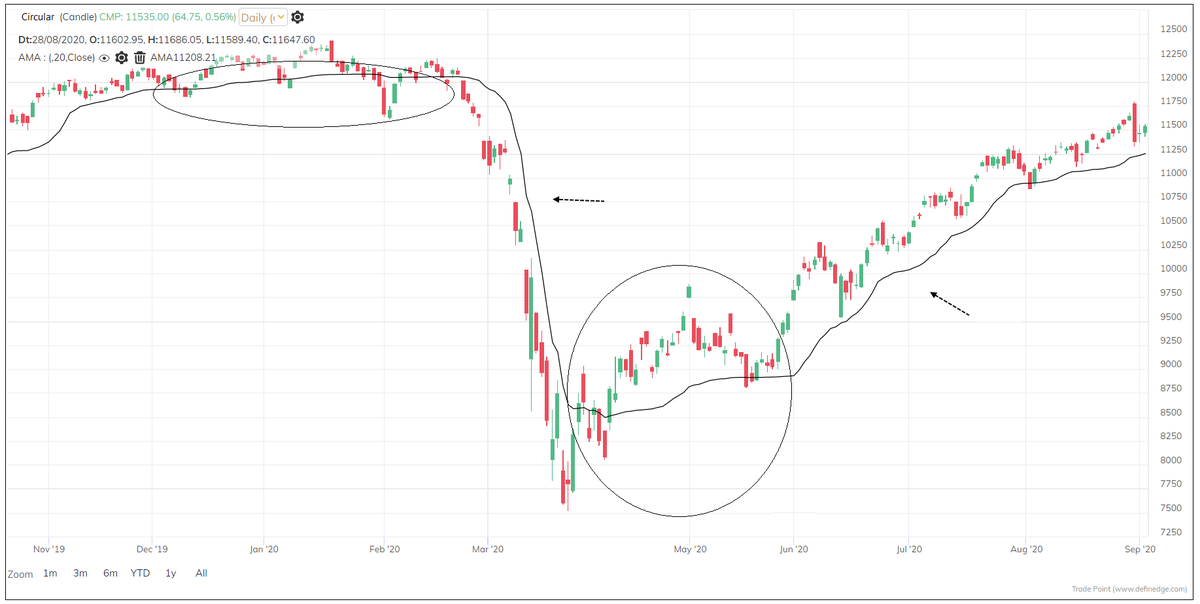

Was it possible to exit before the reversal? Yes, but there will be a cost for it.

Was it possible to exit before the reversal? Yes, but there will be a cost for it.

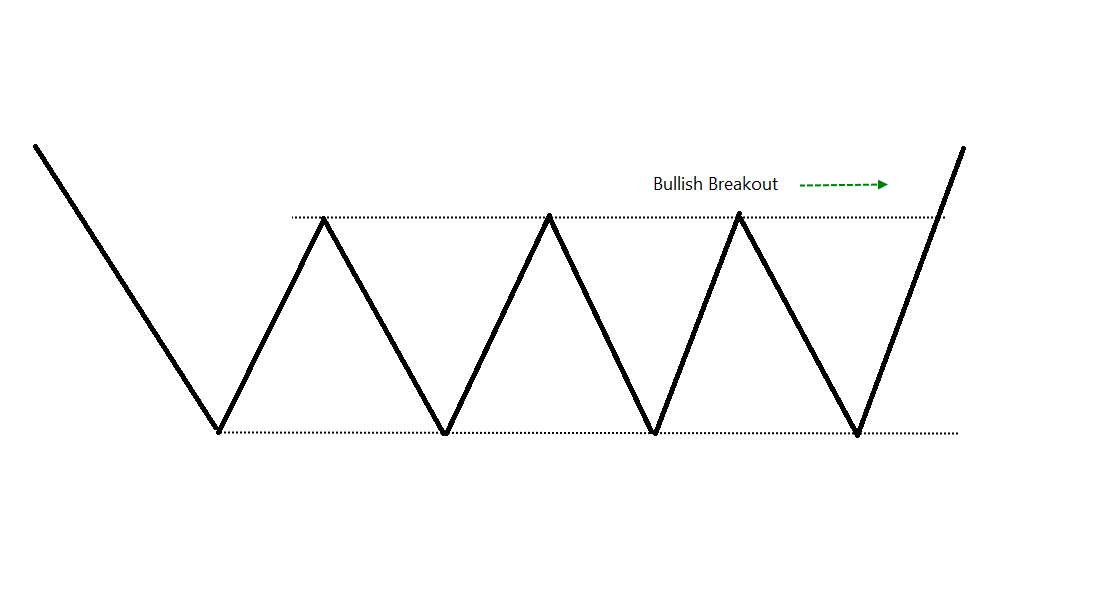

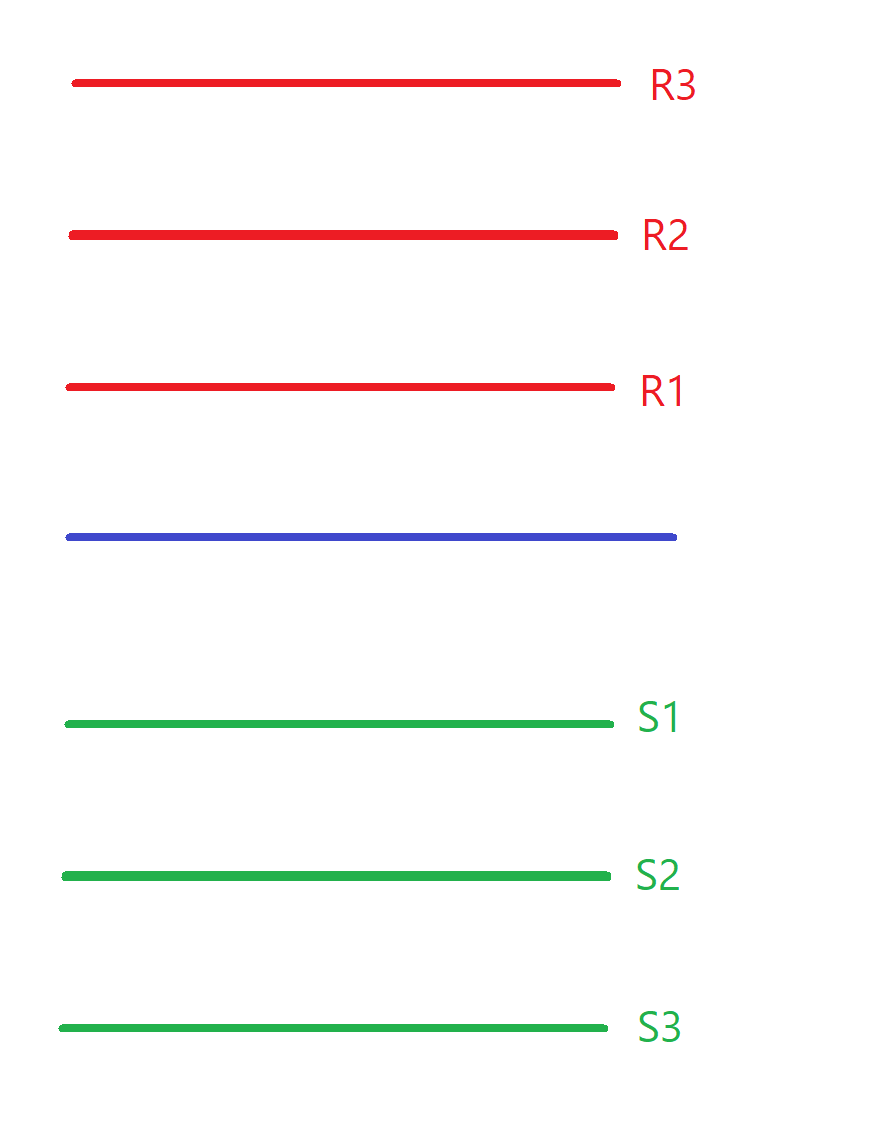

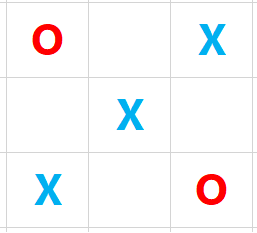

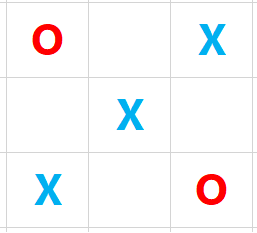

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

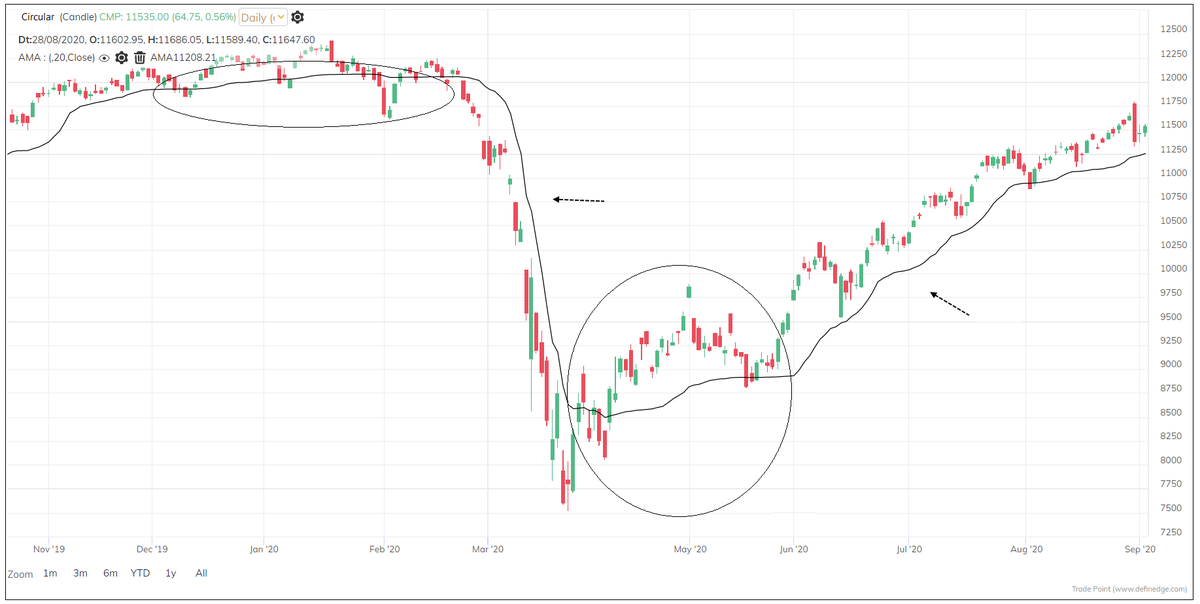

The calculation of this indicator is a bit complex, but the concept is extremely useful. I will try to simplify it and explain the logic. I will briefly explain the concept, calculation and reading.

The calculation of this indicator is a bit complex, but the concept is extremely useful. I will try to simplify it and explain the logic. I will briefly explain the concept, calculation and reading. https://twitter.com/Prashantshah267/status/1269996432724865024?s=20

Chester W. Keltner (1909-1998) was a Chicago grain trader. He worked with successful traders who back-tested trading systems. He talked about Ten-Day Moving average trading rule in his book 'How to Make Money in Commodities' in 1960.

Chester W. Keltner (1909-1998) was a Chicago grain trader. He worked with successful traders who back-tested trading systems. He talked about Ten-Day Moving average trading rule in his book 'How to Make Money in Commodities' in 1960.

Rate of change (ROC) is a study that measures how much price moved up or down from previous bar. The daily rate of change captures the trend. When we make it absolute, captures volatility.

Rate of change (ROC) is a study that measures how much price moved up or down from previous bar. The daily rate of change captures the trend. When we make it absolute, captures volatility.