1) Original thesis busted

+I misjudged moat

+Outside forces matter more than I thought

+Mgmt can't execute

+Legal ruling

+Brand deterioration

+Deworseifcation

+Being disrupted

+If I can't trust the numbers/management, I'm out

+Big acquisitions destroy value / distract management

+Relative size is important. $3 BB company buys $3 BB company = big deal. $100 BB company buys $3 BB company = not a big deal.

Ex: AOL buys Time Warner. I'd sell AOL

+Company successfully achieves the mission

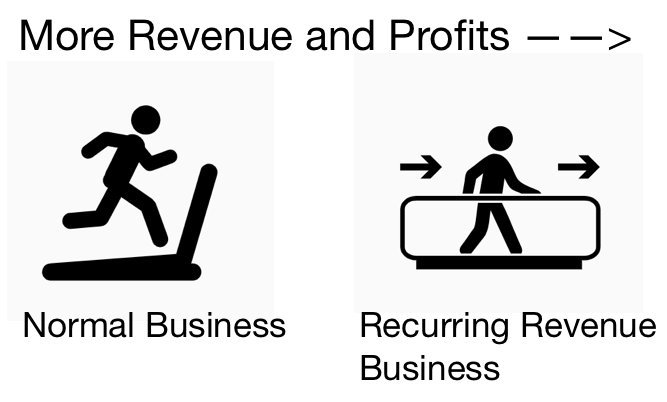

+Organic rev growth falls below ~5%

+Profit growth falls below ~10%

+Too big too succeed

+Other opportunities for cash I like more

+Glassdoor ratings plunge

+Mass management exodus

+Leadership transition doesn't work out

+High valuation AND high market cap when compared to how big I think the company can get

+Personal threshold 15% for amazing, low-risk business ($MA / $AMZN) and 10% for amazing, high-risk business ($TSLA)

+No longer want to follow the company

+If my company gets bought out and acquisition has a high likelihood of going through, I sell. I don't arbitrage.

+Major purchase/expense (car / home remodel / taxes )

+Sell a loser I've lost confidence in to lower tax bill