Will read and comment by tomorrow morning. Watch this space

gov.uk/guidance/claim…

This presumably reflects the extension of the lockdown period announced yesterday.

gov.uk/guidance/work-…

Clearer warning about fraud (fair enough). But I hope HMRC will take a pragmatic approach to genuine mistakes - it’s complicated.

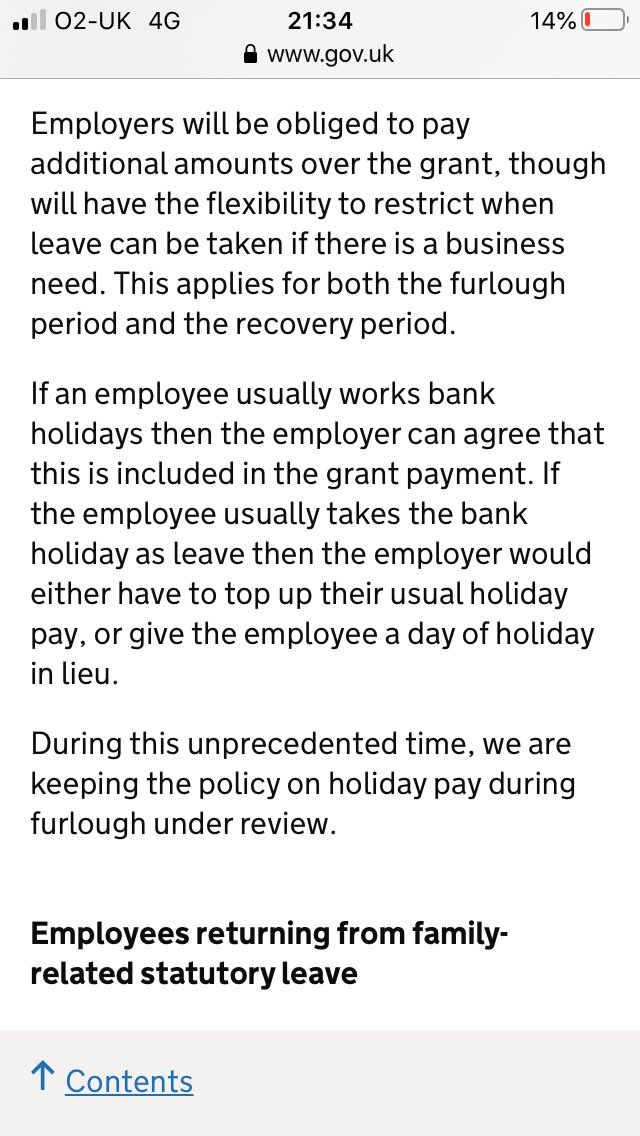

An employee who becomes sick while on furlough must get at least SSP.

In practice may be rare for agency/umbrella to agree to furlough?

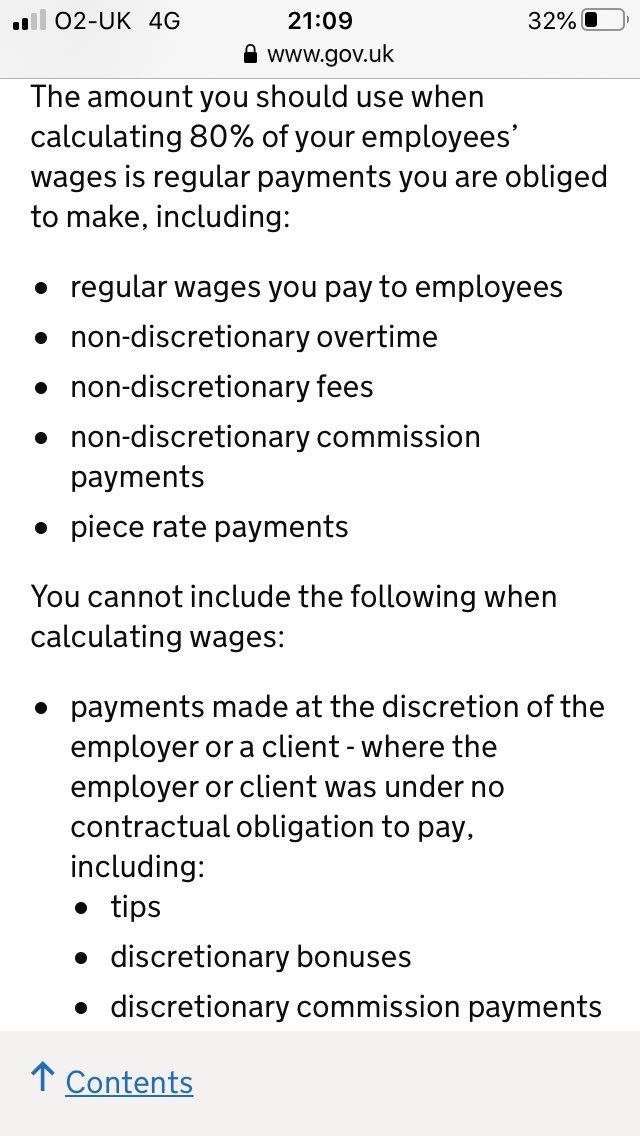

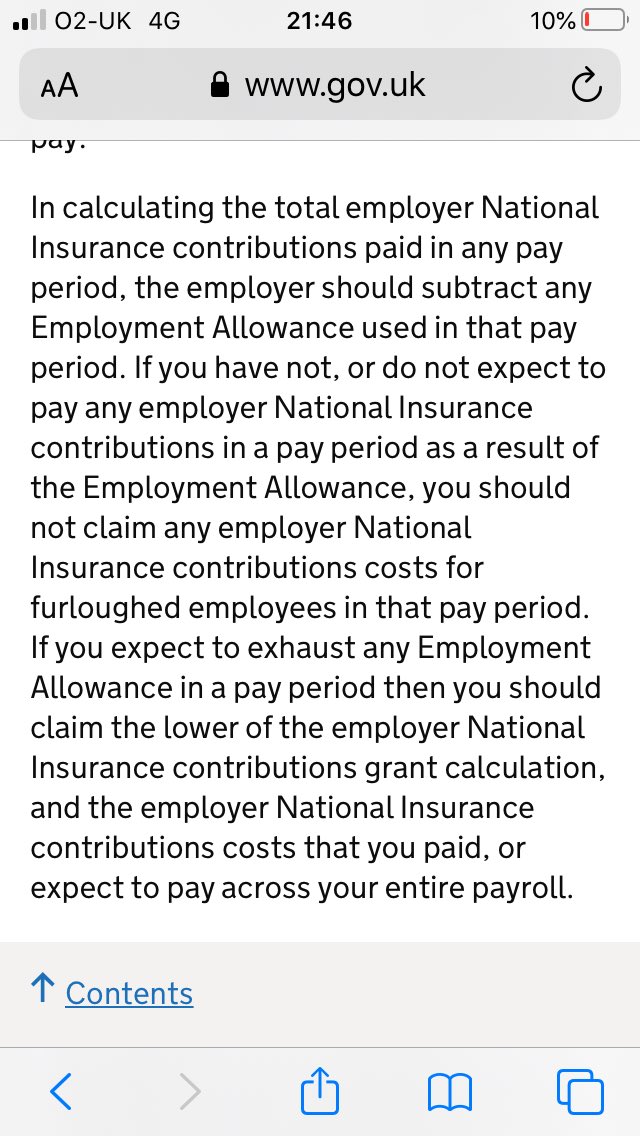

This guidance brings together all the computational aspects, and now includes several worked examples.

I can see future disputes over this - how likely was it that employees would be kept on/made redundant?