Here's are cheat codes to the most burning questions [THREAD]

La Casa de Papel (Money Heist for the unrefined) has created this monster. There’s nobody with a machine printing bank notes.

What they are doing is stimulating the economy by increasing liquidity.

The government is a broke boi so they issue loans (treasuries) to the market. The Federal Reserve (“Fed”) is the central bank of the US (not a restaurant).

The Fed gives banks cash in exchange for buying these treasuries. It’s an “asset swap”

Money supply starts to increase once banks lend out this cash.

QE works best when interest rates are close to zero. Why? Banks are incentivized to extend more loans to make more money because interest rates are so low

You’re fucked. Can happen when banks don’t have enough capital

It’s unlikely since large corporates are vampires that suck on every bit of liquidity during a crisis. So they will usually draw down on short term and revolving facilities

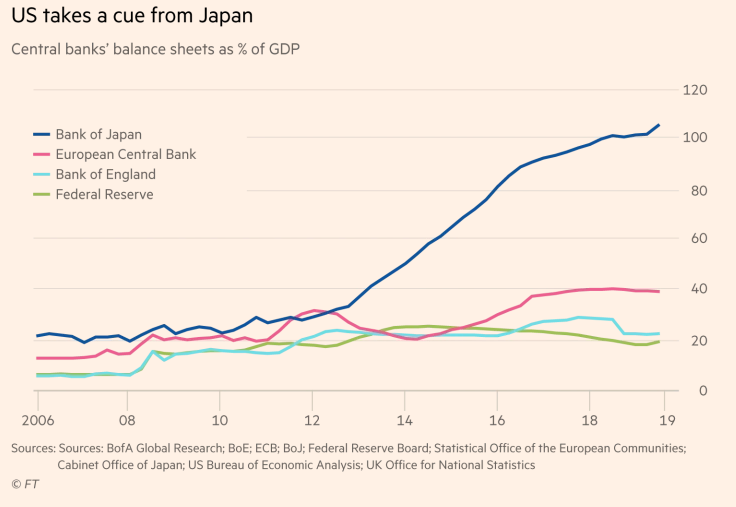

It sits on their balance sheet. This balance sheet balloons faster than someone on “My 600lb Life”.

The Fed balance sheet is expected to reach $9tn by the end of the year.

100%, yes.

It becomes a nightmare to unwind. The Bank of Japan is holding over 100% of its entire GDP on its balance sheet. Here's a chart from @FT showing how bloated central bank balance sheets are.

Yes, they are. The SARB is buying back treasuries with the intention of providing liquidity.

(This GIF accurately shows what SARB stimulus looks like compared to Fed stimulus)

You could, if you wanted an apocalypse. You’re going from exchanging cash for assets to exchanging cash for nothing. Basically, this will devalue the currency below the last season of Game of Thrones. Worthless!!

The IMF loan is at near zero interest (there could be some minor facilitation and admin costs). The one benefit is the increased scrutiny. The SA government have repeatedly lost credibility.

You’re really not going to get much for SOEs, probably worth less than a barrel of May WTI oil.

Weren’t those were negative?

Exactly…

Firstly, the IMF loan is not R500bn (it’s closer to R80bn). The issue isn’t “hyperinflation” since inflation right now is at 4.1%. The IMF loan works MUCH better since it’s a capital direct injection.

Relying entirely on a treasury repurchase programme and buying up bonds in a market with thin volumes... and then still waiting months for it to reach the man on the street is a poor game plan.

The IMF loan would also be cheaper.

One reason Uncle Cyril opted for child support grants – is it’s the quickest way to get money to people.

Right now people need cash, pushing out tax liabilities, giving payment holidays on mortgages - all of it helps.