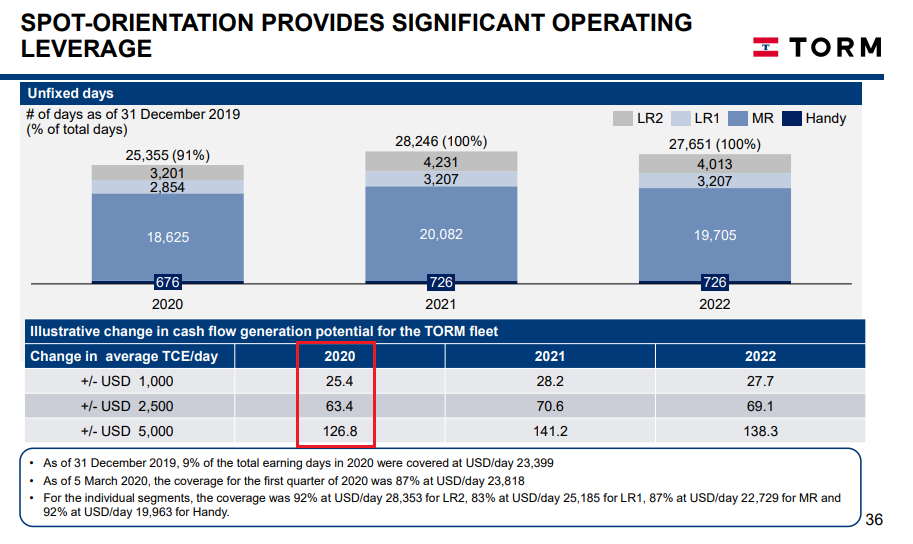

The ideas aren't original but the source may be unfamiliar - a Danish company called Torm, it's a product tanker company and I'm long: we're both talking our book.

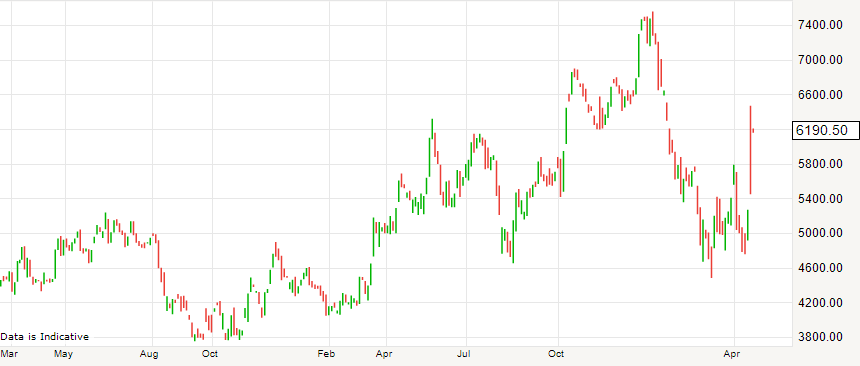

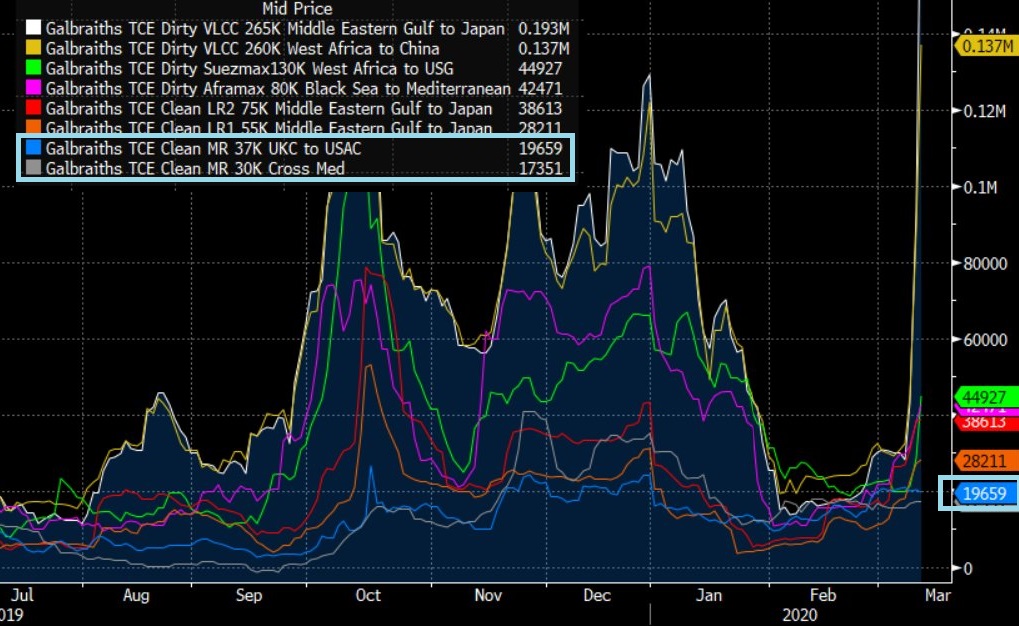

Yes, it may be a short lived spike; I've been critical of shipping holders before wondering why the stocks don't work: the blue line tells you why.

Now the facts have changed: it's a hockey stick.

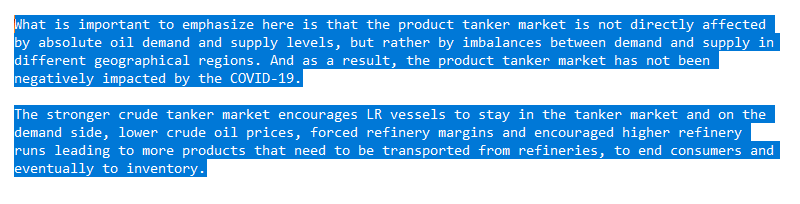

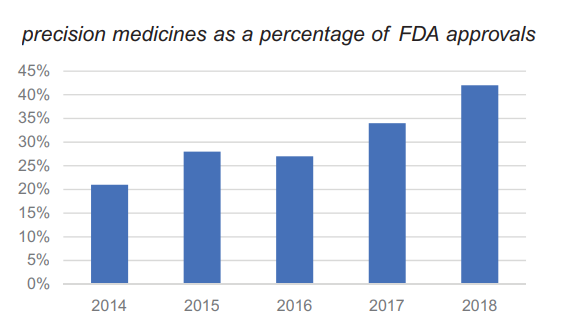

If you're interested, I'll mention why I think product rather than crude is the play here.