That moment when you realize a widely-respected, billionaire hedge-fund manager (@RayDalio) writing a book on the subject of "money" and #credebt, appears to have no idea what "money" is...

#Quanta

linkedin.com/pulse/money-cr…

#Quanta

linkedin.com/pulse/money-cr…

This reminds me of that embarrassing exchange whereupon faux "nobel"-prize winning economist @paulkrugman (vs. @ProfSteveKeen) revealed his errant belief that the private commercial banking system comprised "intermediaries" of loanable funds.

LOL!

opendemocracy.net/en/opendemocra…

LOL!

opendemocracy.net/en/opendemocra…

C/

While it will be clear to some readers @RayDalio is referring to US Gov Debt Obligations when writing of the Reserve "Currency" holdings of foreign Govs. But he does a disservice to most by perpetuating the myth of "money" printing foisted on us by the private bank Cartel...

While it will be clear to some readers @RayDalio is referring to US Gov Debt Obligations when writing of the Reserve "Currency" holdings of foreign Govs. But he does a disservice to most by perpetuating the myth of "money" printing foisted on us by the private bank Cartel...

D/

By drawing an improper distinction between the different sides of the same coin (credit=debt=#Credebt="money") and not making CLEAR today's "money" IS DEBT, the answer to "what is money?" becomes further clouded, not made more transparent...

By drawing an improper distinction between the different sides of the same coin (credit=debt=#Credebt="money") and not making CLEAR today's "money" IS DEBT, the answer to "what is money?" becomes further clouded, not made more transparent...

Jane/Joe Six-Pack have NO interaction w/ FED Reserves other than the minuscule component of the "money" supply represented by Federal Reserve Notes (cash) and a few coins issued by Treasury. To the man on the street, "money" is bank credebt in his demand "deposit" accounts...

F/

Yes—the big guns settle their obligations among each other by the delivery of Gov debt securities & especially FED reserves from bank to bank. But is there a thing in this world the delivery of which will permanently extinguish debt in aggregate? Why does the debt ALWAYS grow?

Yes—the big guns settle their obligations among each other by the delivery of Gov debt securities & especially FED reserves from bank to bank. But is there a thing in this world the delivery of which will permanently extinguish debt in aggregate? Why does the debt ALWAYS grow?

G/

@RayDalio resorts to the tired & worn method of defining "money" via its functions. But consider whether one of the functions of "money", now LOST, is not to function as the the permanent extinguisher of a debt? And if (checkbook) "Dollars" are "money", whence do they arise?

@RayDalio resorts to the tired & worn method of defining "money" via its functions. But consider whether one of the functions of "money", now LOST, is not to function as the the permanent extinguisher of a debt? And if (checkbook) "Dollars" are "money", whence do they arise?

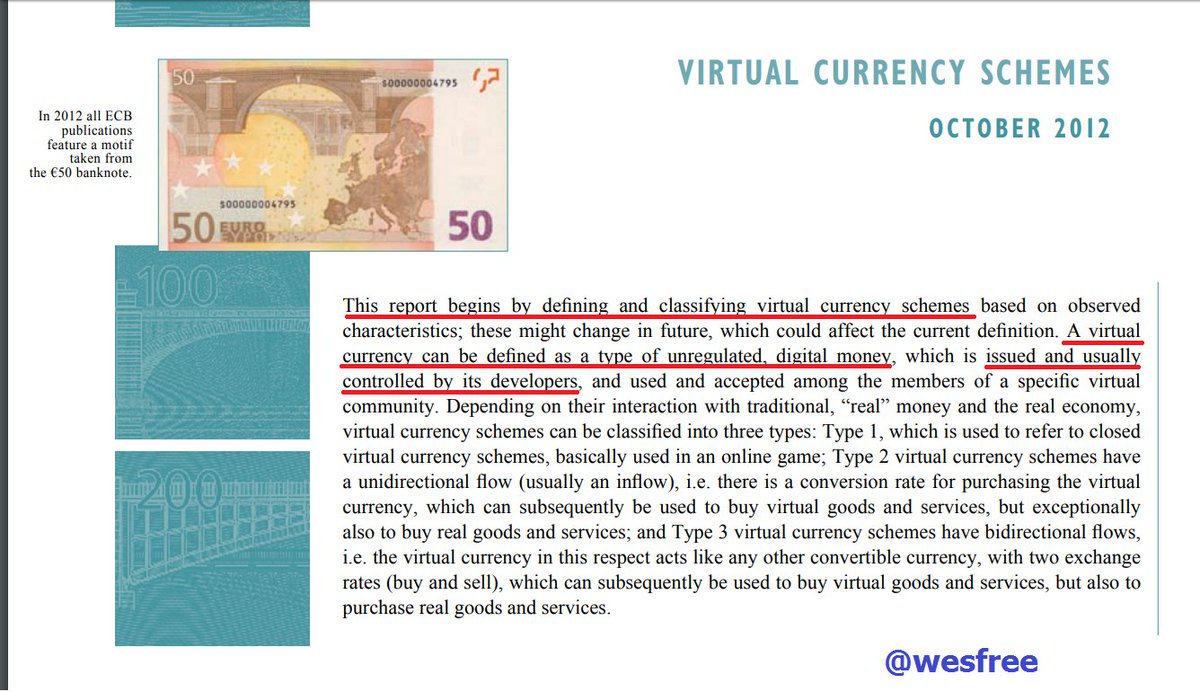

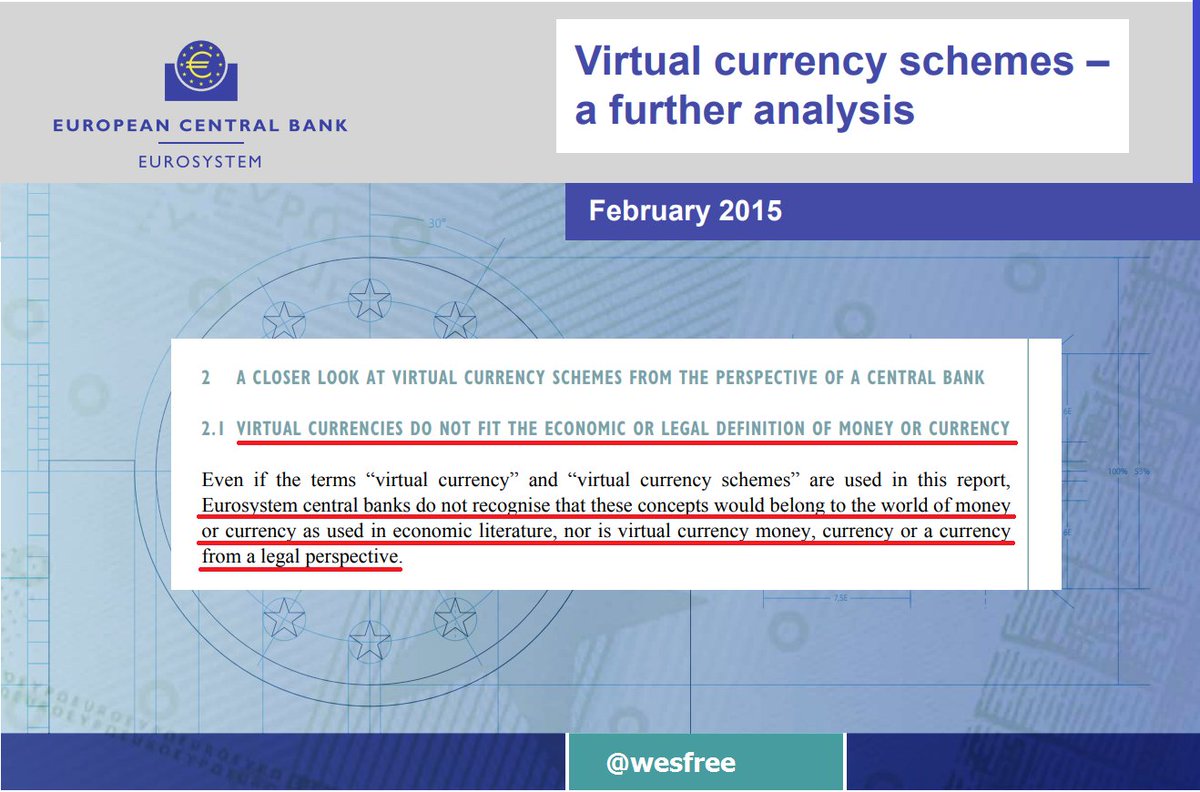

It's non-controversial, given the admissions of nearly all the world's major Central Banks, the vast majority of "money" is NOT "printed" by Gov, but rather 𝙚𝙭-𝙣𝙞𝙝𝙞𝙡𝙤 private commercial bank-credits created in the process of issuing a loan against collateral security.

I/

@RayDalio confirms that which should be seriously examined: Why do all the world's monetary systems continually gyrate between increasingly severe monetary crises? Must these minor and major expansions and contractions always occur? Is there a better way?

@RayDalio confirms that which should be seriously examined: Why do all the world's monetary systems continually gyrate between increasingly severe monetary crises? Must these minor and major expansions and contractions always occur? Is there a better way?

J/

The 1944 Bretton Woods agreement fell apart in 1968 when the "Money-of-Account" definition of the $ (London Gold Pool) was removed with NO REPLACEMENT. The "Dollar" became undefined and ADRIFT ever since. Energy is the real story!

The 1944 Bretton Woods agreement fell apart in 1968 when the "Money-of-Account" definition of the $ (London Gold Pool) was removed with NO REPLACEMENT. The "Dollar" became undefined and ADRIFT ever since. Energy is the real story!

https://twitter.com/wesfree/status/1083455713429602304

K/

Since that time, we've seen the "price" of a barrel of oil gyrate as high as $155 to NEGATIVE recently. Question: is an elastic band a good expression of length? Must the Unit of Account and the Medium of Exchange be the same thing?

twitter.com/i/events/87919…

Since that time, we've seen the "price" of a barrel of oil gyrate as high as $155 to NEGATIVE recently. Question: is an elastic band a good expression of length? Must the Unit of Account and the Medium of Exchange be the same thing?

twitter.com/i/events/87919…

L/

Our Post-BW debt-based monetary system suffers from a fatal flaw: it must continually expand or it implodes. A FED metric that puts this in perspective is called Total Credit Market Debt Outstanding. This is "money" today. And that little "squiggle" in 2008 explains the GFC!

Our Post-BW debt-based monetary system suffers from a fatal flaw: it must continually expand or it implodes. A FED metric that puts this in perspective is called Total Credit Market Debt Outstanding. This is "money" today. And that little "squiggle" in 2008 explains the GFC!

What was done to stop the implosion of private debt ("money") bank-credit in the GFC? The Gov incurred deficits (DEBT) & FED pumped its debts into the asset markets (QE) creating ANOTHER bubble. And here we are today, with a similar dilemma. Debt is imploding (deflation)...

N/

What if there WAS a way to separate these distortionary credit cycles fm their ruinous effects on the mechanism of price? What if there WAS a permanent "money" ($), the delivery of which WOULD result in the permanent extinguishment of a debt?

#quanta

twitter.com/i/events/93823…

What if there WAS a way to separate these distortionary credit cycles fm their ruinous effects on the mechanism of price? What if there WAS a permanent "money" ($), the delivery of which WOULD result in the permanent extinguishment of a debt?

#quanta

twitter.com/i/events/93823…

O/

@RayDalio & I agree on the impending cycle implosion. My focus is on fostering mechanisms by which we, humanity, may separate ourselves from this vicious cycle. Ray has kindly taken the trouble to educate you about the cycle trajectory to assist your economic survival. Bravo!

@RayDalio & I agree on the impending cycle implosion. My focus is on fostering mechanisms by which we, humanity, may separate ourselves from this vicious cycle. Ray has kindly taken the trouble to educate you about the cycle trajectory to assist your economic survival. Bravo!

• • •

Missing some Tweet in this thread? You can try to

force a refresh