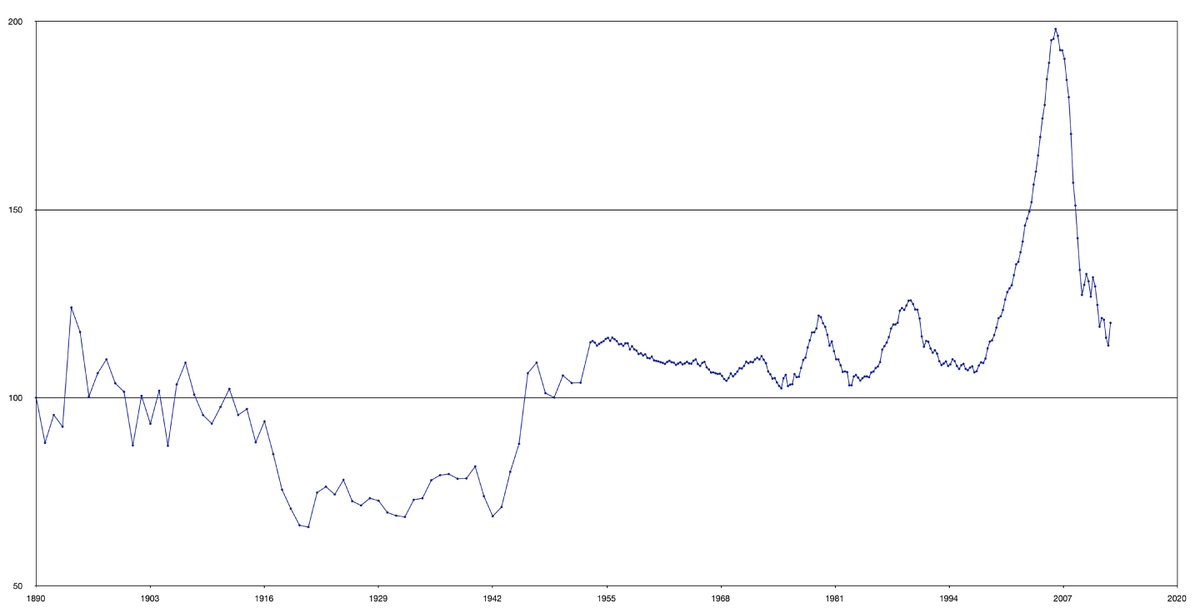

Here's Case-Shiller home price 1890-now on real basis (1890 = 100). Despite bubbles, note there's really little real gain.

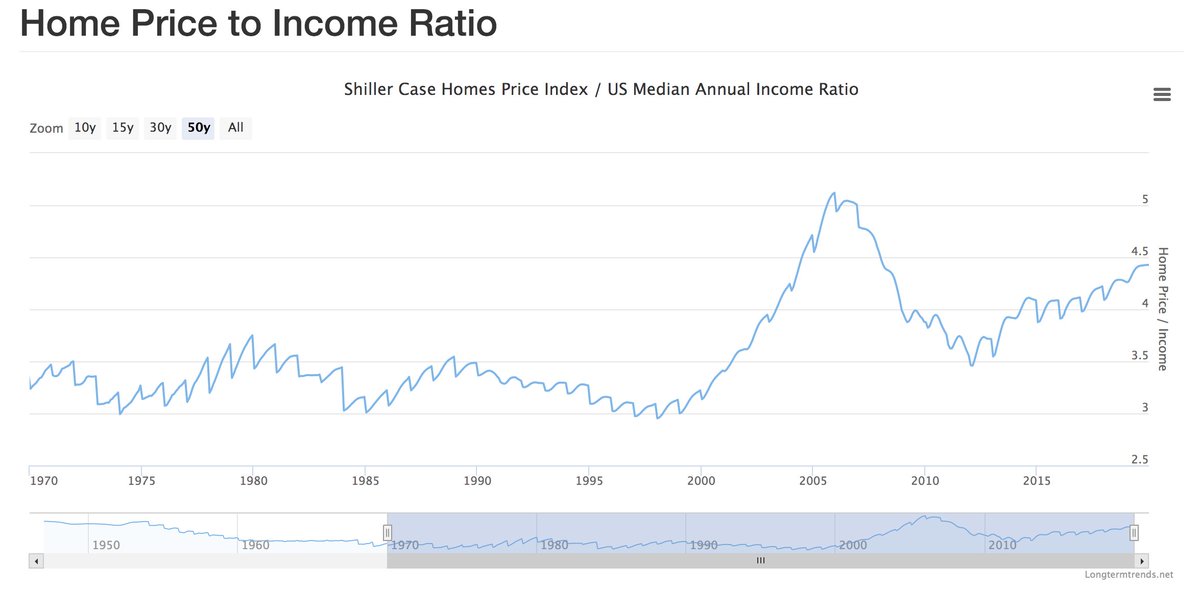

Pre-Covid housing is prolly overpriced by 20%.

Across the board de-risking of credit.

ie: Not many.

Beneath the surface, market volume has absolutely tanked. Which means we're not seeing *real prices* yet

Bc at some point, gravity will hit. Housing simply can't outrun unemployment, deflation & depression.

e.g.: Combine millennial UBI w Fed mortgages & you give Boomers way to safely exit/pass on their biggest financial albatross)

Life is beautiful.

apple.news/AQErrQPXcTGaNR…

bloomberg.com/news/articles/…