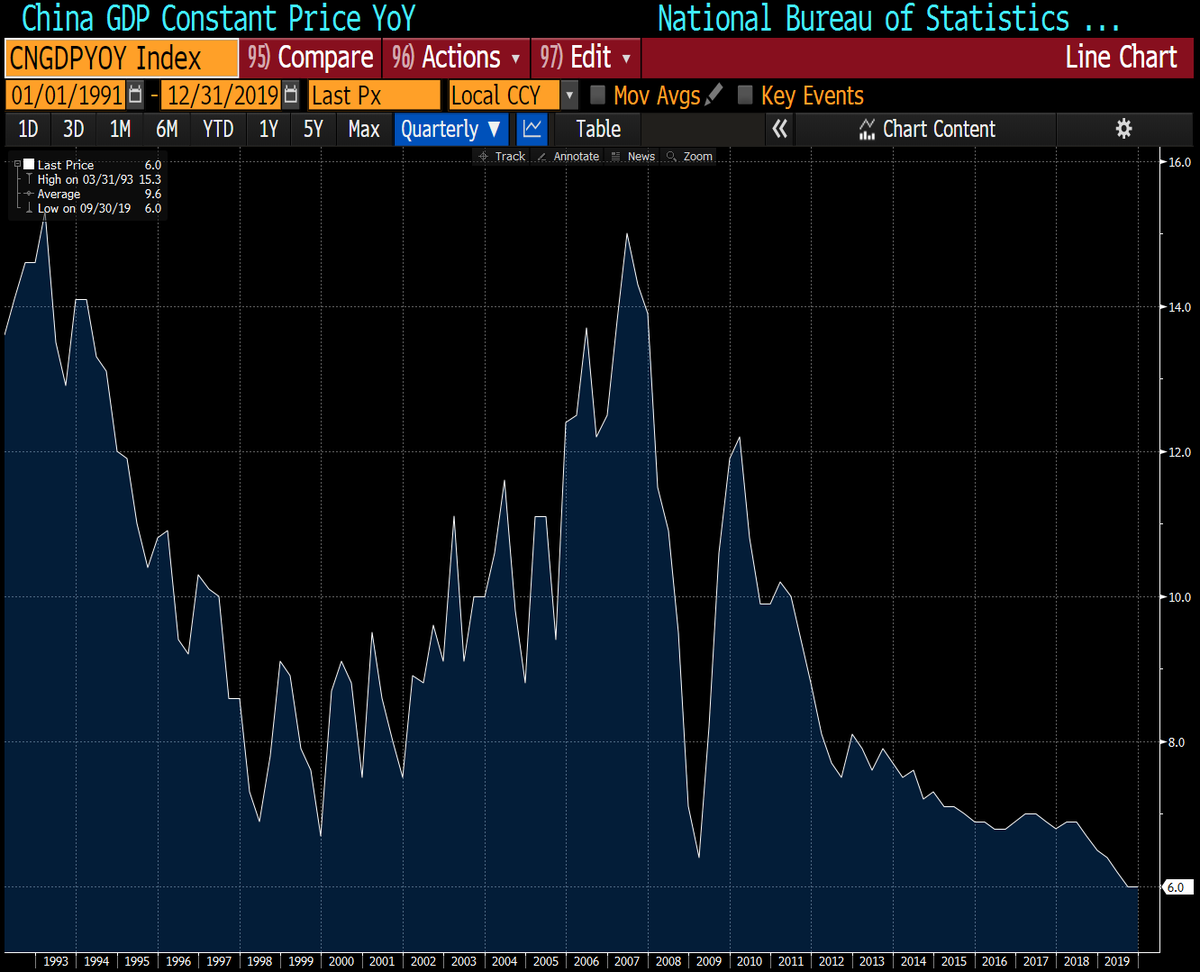

So this deflation problem isn’t simply fixed just bc of $ printing.

So how can we get inflation up to combat deflation? Only one way here: if monetary channel is broken, we have to use fiscal channel.

But main pt of this oversimplified econ thread is that hyperinflation has a bunch of hurdles to cross before it’s possible.

Deep changes afoot, we’re truly crossing the rubicon as we speak...