In 1934 Ben Graham and later in 1973 Buffet said

“In the short run, the market is a voting machine but in the long run it is a weighing machine”

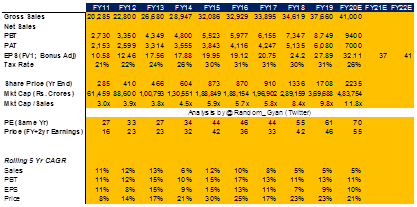

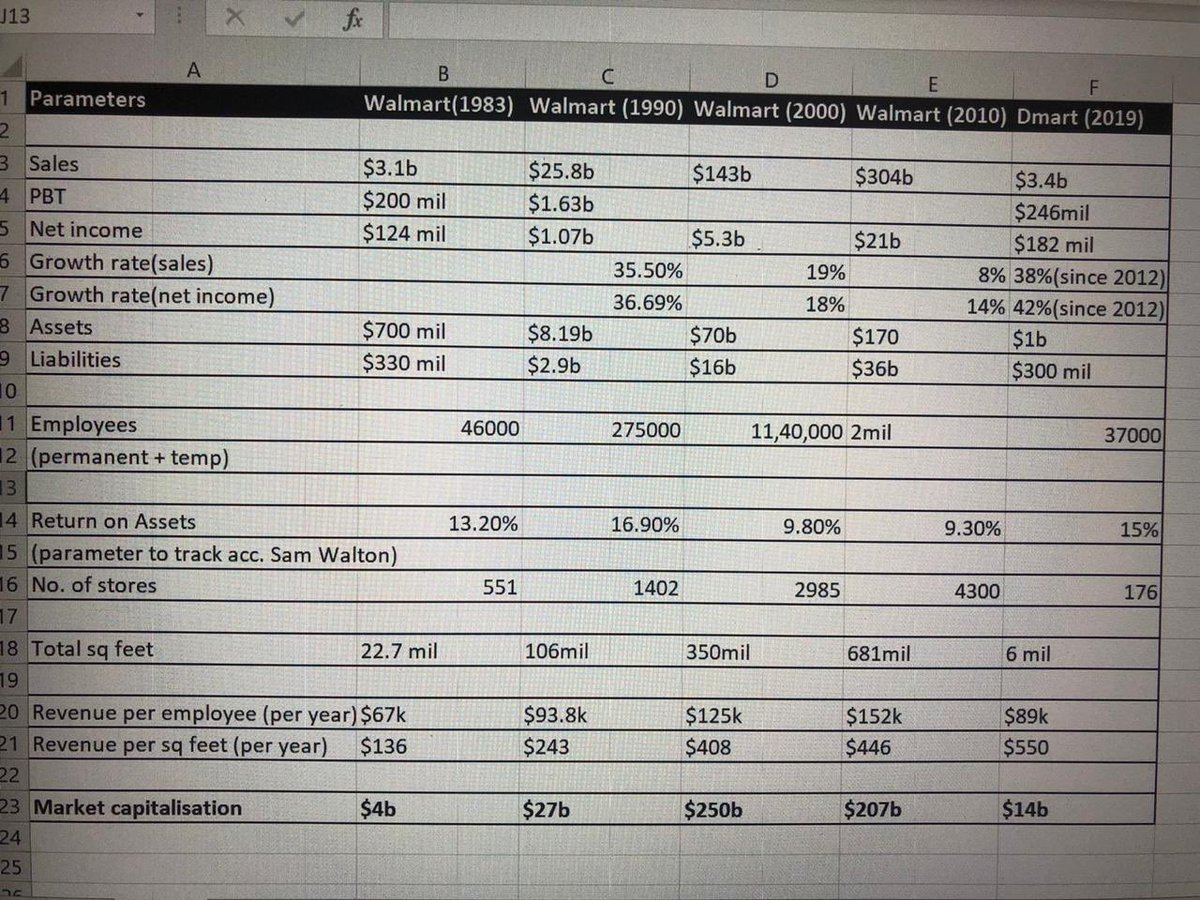

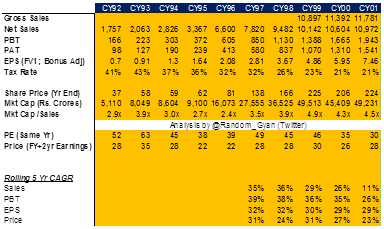

With that lens, my analysis on #HUL Valuations over 27 yrs

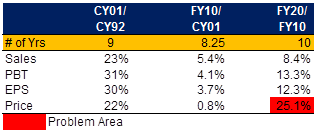

Rapid Growth (’92 to ‘01) – Sales 23%; EPS 30% Price 22% CAGR

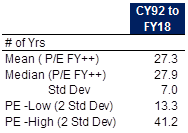

It means ~95% time #HUL P/E (14-41x). Currently it is >3 Std dev (or <0.5% times). 40x (FY++)= 1650/-

Mind you even then it will be at the higher end of the range.

Just to capture how remarkable has been the P/E expansion over the last 2 years, see the below graph.

Likely that #HUL gets back to this band over the next few yrs unless of course “This time is different” (rarely is). Trigger(GSK selling?)

Now let’s analyse the stock demand and supply. Post GSK merger, free float increases from 33-40% thereby increasing supply by 20%.

Lets analyse who have been recent buyers,

•Blind Index fund on rebalancing

•Momentum Traders

•“Quality at any price” funds

•Retail (Unfortunately)

•Mutual funds looking to hide from Covid19

When selling starts happening,

•Index fund will sell

•Momentum traders will exit.

•Mutual funds will follow

•Retail will be last to exit

•Smart Money will wait for 30-35x earnings before making an allocation

Requesting retail investors to be first to exit

To quote James Montier of GMO fame –

“Valuation as the closest thing to the law of gravity that we have in finance, as well as the primary determinant of long-term returns”

“This time is never different”

@dmuthuk

@contrarianEPS

@ayushmitt

@unseenvalue

@abhymurarka