Business Owner ; Ex - BofA Banker ; IIM Calcutta ('07Batch)

Passionate about Investing; Student of History

How to get URL link on X (Twitter) App

2/N

2/N

Without adjustments the index on 31st Dec trading at PE of 43x / PB of 3.7x / Div Yield of 1.2%. Assuming a normal curve there represents following percentiles 100% (PE), 87% (PB) , 77% (Div Yield)

Without adjustments the index on 31st Dec trading at PE of 43x / PB of 3.7x / Div Yield of 1.2%. Assuming a normal curve there represents following percentiles 100% (PE), 87% (PB) , 77% (Div Yield)

2/N

2/N

2/N

2/N

2/N

2/N

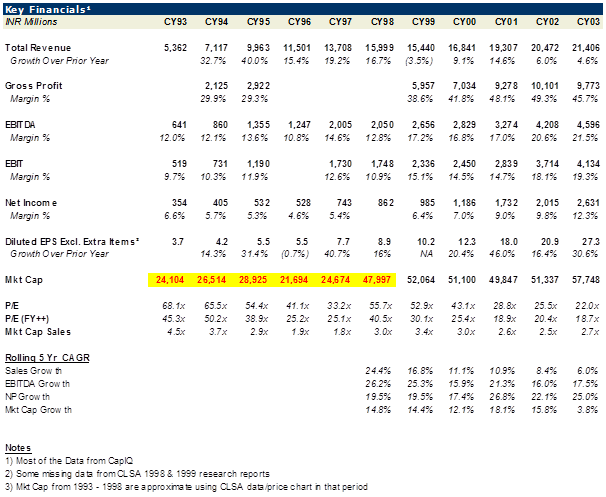

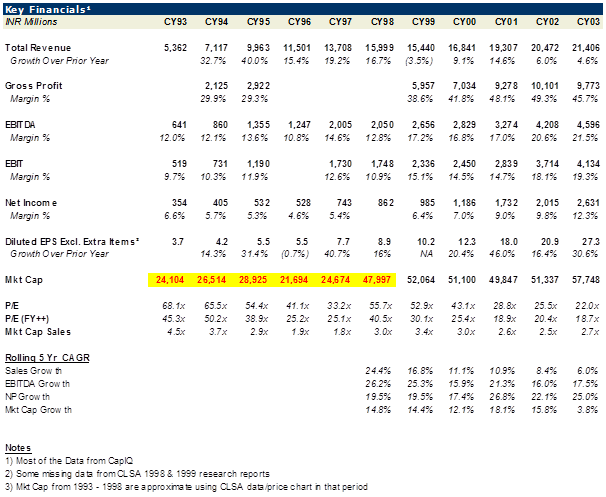

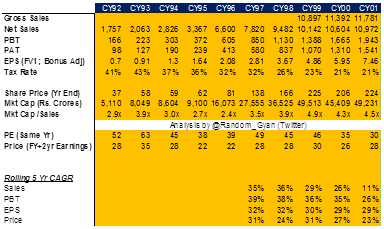

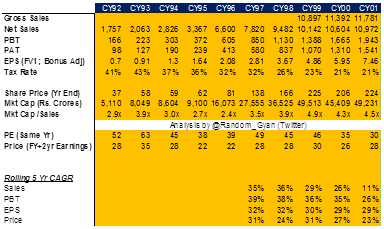

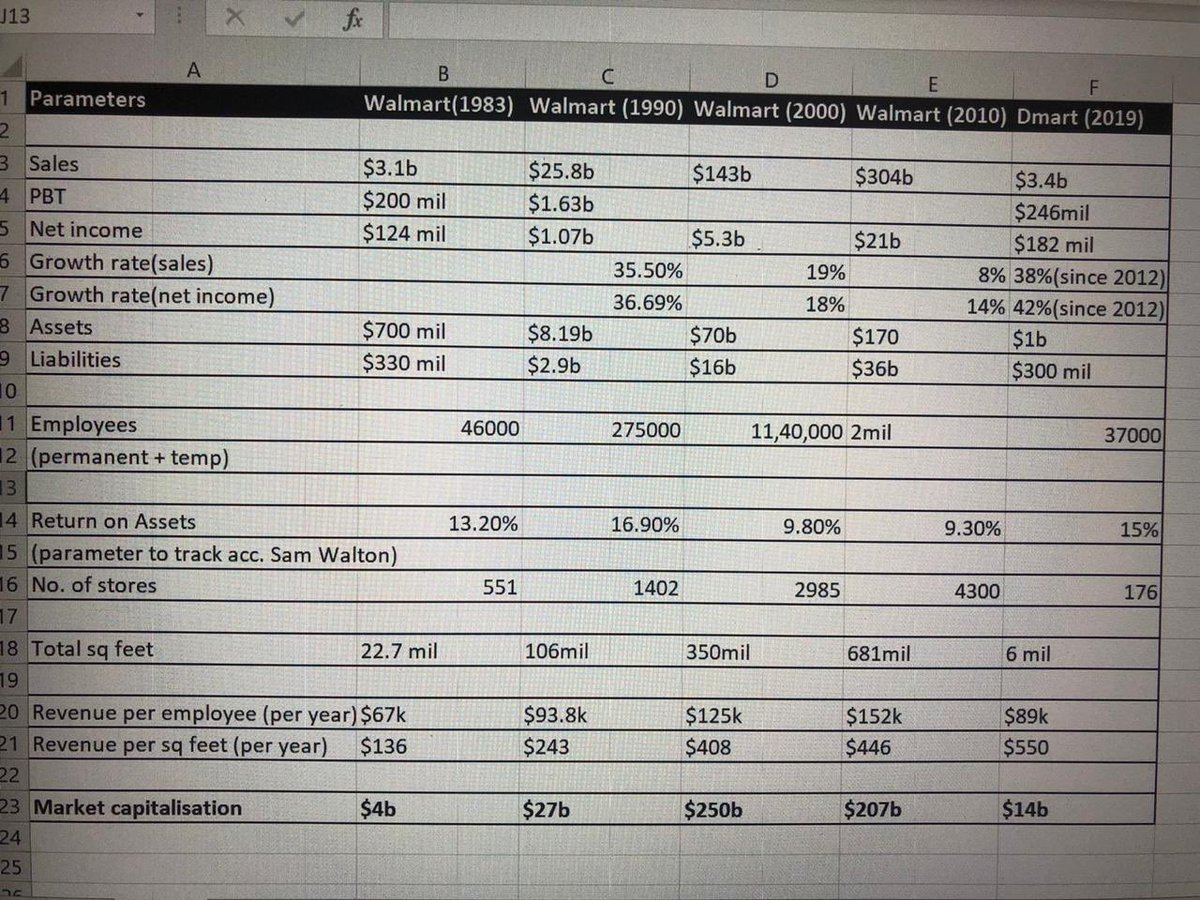

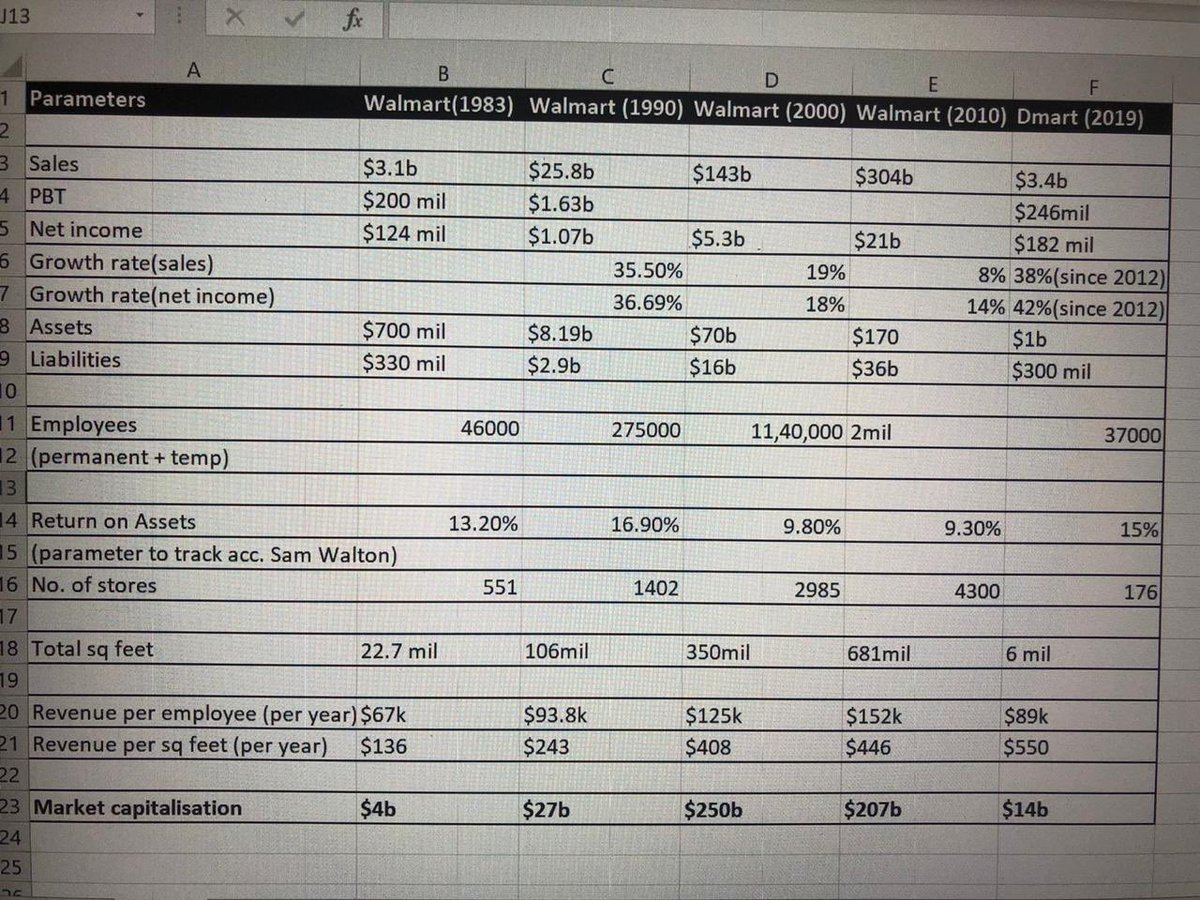

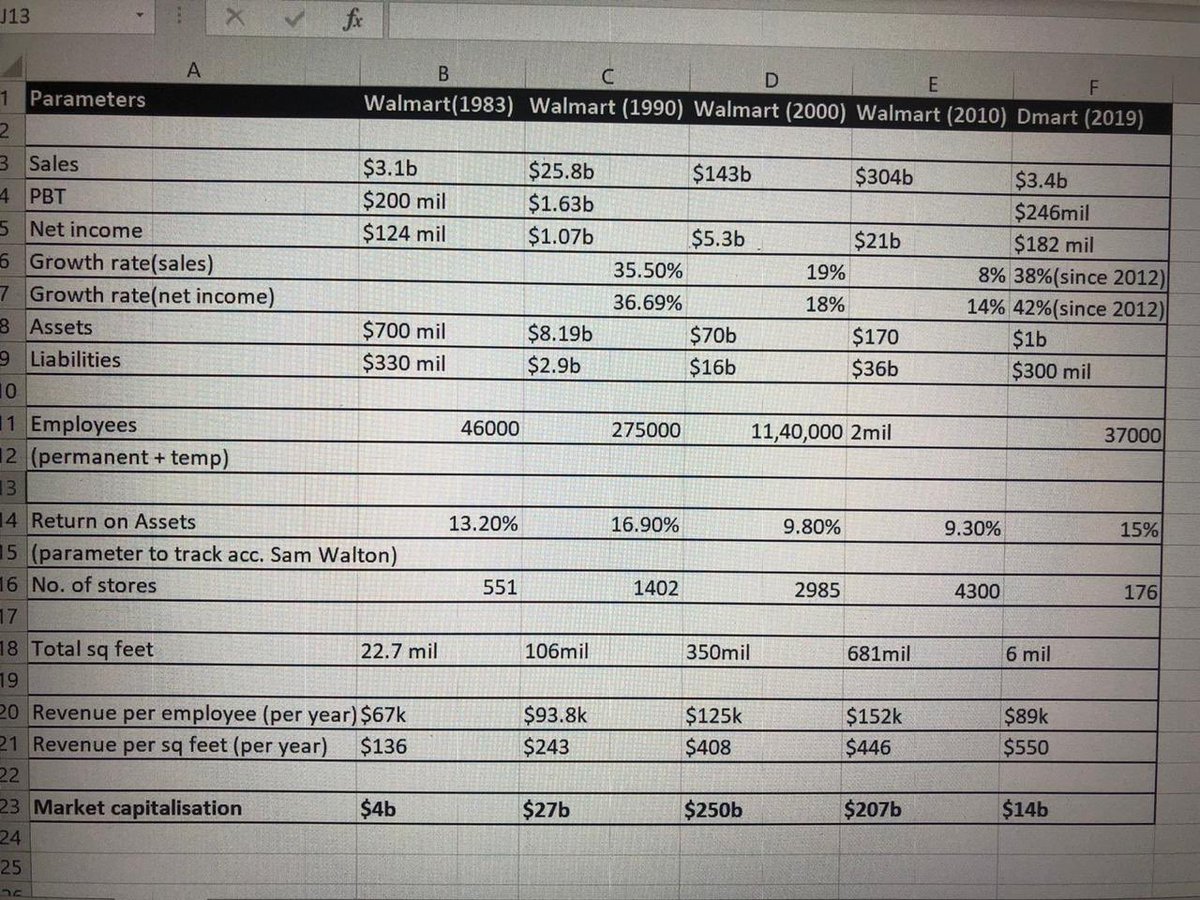

Dmart Investors - Assuming next 27 yrs is as good as walmart the returns will be 10.5% CAGR. Assuming 2x walmart CAGR is 13.4%

Dmart Investors - Assuming next 27 yrs is as good as walmart the returns will be 10.5% CAGR. Assuming 2x walmart CAGR is 13.4%

2/N

2/N