Other big items are litigation & trading.

Who the hell knows what could happen? It’s pretty clear that the bulk of the shitstorm is in the past anyway. But if you’re interested, the dozen or so pages in the AR are always a nice read.

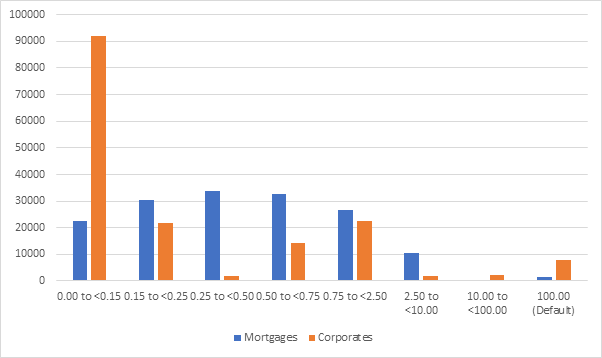

The general approach to credit risk modelling at banks is summarized in this slide from the SSM (2018 ST results)

But the day they use it, that 35€ exposure instantly becomes 100€.

I think you can see the risk there.

1) Linear algebra is great.

2) 10.4% is still a lot of capital. Before the GFC banks had CET1 of 4% or even less, and everybody was happy!

3) this is somehow a stress test, I have been conservative and my assumptions are probably a bit harsh. The real world should remain above that – possibly well above that. DB says it’ll stay above 12.5%.